A Deep Dive into Sei: The Blockchain Built for Decentralized Exchanges

The rise of orderbook DEXs on Cosmos and Sei's role in the ecosystem

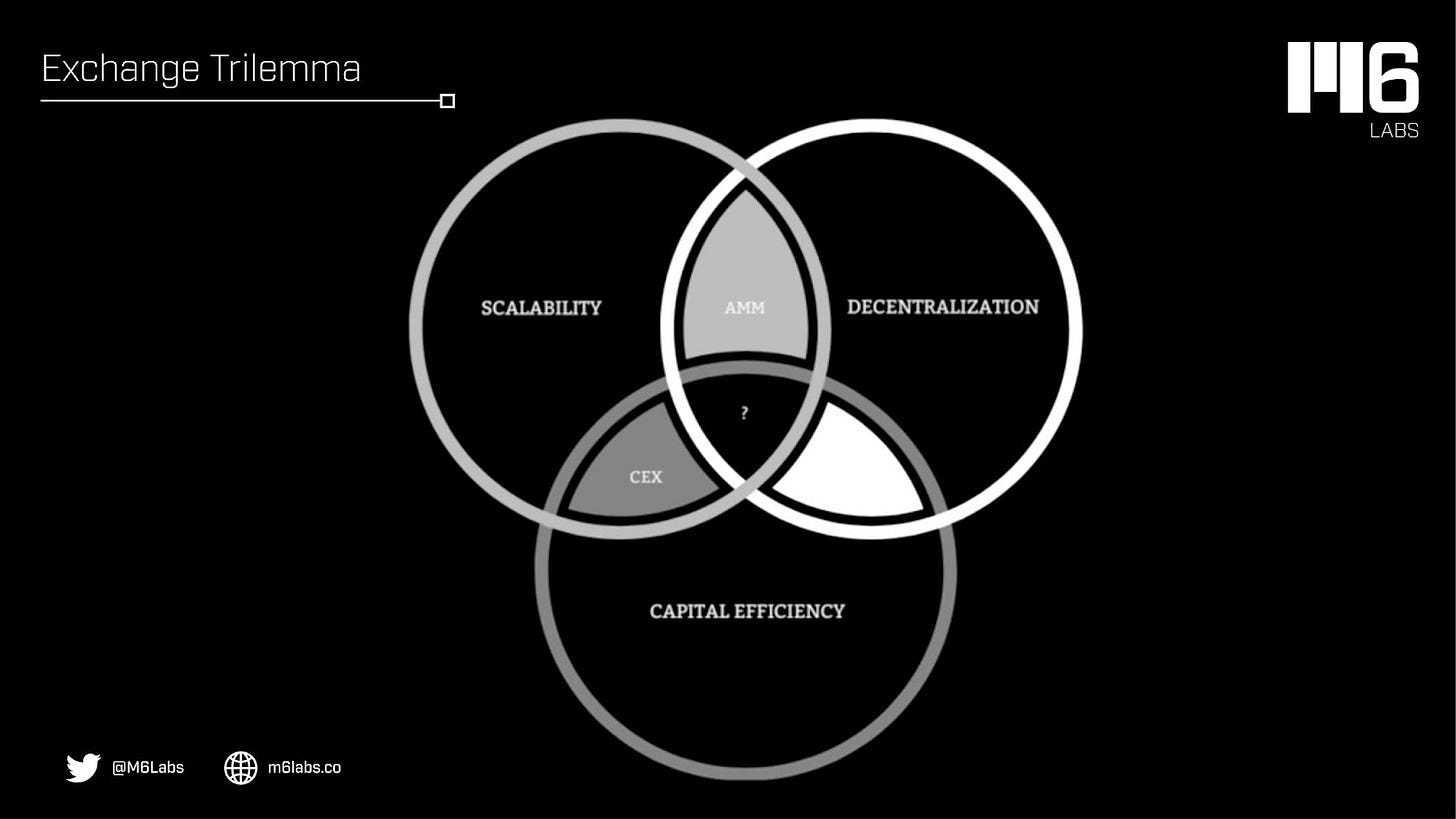

Rise of the Exchange Trilemma

It is now abundantly clear that opaque systems with poor leadership communication can quickly spiral out of control in the wake of last year's GameStop crisis and the subsequent 3AC and FTX problems. In the decentralized finance sector, a lack of transparency has left many people feeling helpless and frustrated.

Let’s understand the Trilemma

The three essential elements of the trilemma—decentralization, scalability, and capital efficiency—can currently only be offered by two exchanges.

The ability of an exchange to manage high trading volumes without experiencing performance problems is referred to as scalability.

Scalability is crucial for exchanges competing globally because it allows them to handle many trades simultaneously with minimal latency. Since centralized exchanges (CEXs) have more control over their infrastructure and can handle high volumes of trade, they are typically more scalable than decentralized ones.

On the other hand, decentralization describes the extent to which an exchange can function without having a single control point. It asks if users can trust a single entity. The management of trades can be distributed across several nodes, making decentralized exchanges (DEXs) better than centralized ones. Since no one person or organization can shut them down, they are more resistant to manipulation or censorship.

The ability of an exchange to maximize the return on investment for its users is referred to as capital efficiency. Users want to maximize their returns on their investments, so this is crucial for centralized and decentralized exchanges.

Solving the Trilemma with Sei

For the past few years, the blockchain industry has been looking for a way to solve the "trilemma" of achieving scalability, security, and decentralization. However, iterating on exchange mechanisms has yet to yield a solution. Although the underlying infrastructure has been modified, the trilemma's solution will require a complete overhaul.

Sei acts as the foundation for the upcoming financial system to support capital markets, beginning with exchanges. For this reason, Sei is the quickest chain to finality because it was the first Layer 1 explicitly designed for trading and optimizing each stack layer to give exchanges an unfair advantage.

The majority of L1s are either general-purpose or app-specific. Sei creates a sector-specific L1 that opens up a new design area in between. More than 100 teams from Solana, Polkadot, Terra, and NEAR are currently building on top of Sei as it enters the mainnet. Multicoin, Delphi, Tangent, and several market makers, like Hudson River Trading and GSR, support the team.

What is Sei ?

Sei is a Layer 1 chain created to serve as the DEX chain for new decentralized exchanges (DEXs) in the DeFi, NFT, and gaming industries. It was created using the Cosmos SDK and is industry-specific and trading-oriented.

Unlike app-specific blockchains (like dYdX or Osmosis) of the Cosmos ecosystem that build a blockchain for just one application, Sei is a blockchain for multiple applications that are all contained within a sector – DEX applications.

Sei aims to achieve its objectives by using performance, security, and interoperability improvements.

The Team

The Sei team, founded by Jeffrey Feng and Jayendra Jog, includes people with backgrounds in tech and trading firms like Goldman Sachs, Robinhood, Databricks, and Airbnb. Sei has closed a private round with "very well-known VCs," claims a source from within the team. In the upcoming weeks, specifics of the round will be made known to the public.

Sei is the first sector-specific Layer 1 blockchain.

Every aspect of the blockchain has been optimized to help exchanges run better and offer the best UX for their front and back-end users.

Native order matching engine - drives scalability of order book DEXs built on Sei

Breaking Tendermint - Sei is the fastest chain to finality at ~ 600ms

Twin-turbo consensus - improves latency and throughput

Frontrunning protection - combats malicious frontrunning that is rampant in other ecosystems

Market-based parallelization - specialized parallelization for DeFi

New categories of financial products, ranging from complex options and futures to live sports betting, can be created by combining these optimizations.

Sei would be on par with or in competition with centralized exchanges (CEXs) in executing orders, given its promise of lightning-fast transaction finality of 600ms, making it superior to the market's current DEXs.

The native order-matching engine model of the blockchain, which will replace the conventional AMM trading model, also depends on its quick throughput. Sei asserts to provide the following advantages over other general-purpose chains like Bitcoin, Ethereum, and Solana:

Sei’s Architecture

Cosmos SDK

Instead of launching as a dApp on a general-purpose blockchain, Sei built its blockchain on Cosmos, enabling them to optimize the network for speed, stability, and cost-effectiveness.

Due to its permission-based architecture, Sei can carefully select the protocols introduced to its network to maximize compatibility and avoid those that might compromise the functionality of its primary protocol.

The network uses the Tendermint BFT consensus engine and the Cosmos SDK, an open-source framework for creating PoS blockchains. The most important feature of the Cosmos SDK is the IBC protocol, which enables communication between other blockchains in the Cosmos ecosystem. This protocol allows developers to tailor their blockchains for specific use cases.

Orderbook Engine

Sei's orderbook matching engine, unlike dYdX and Injective, is entirely on-chain, making it secure and decentralized while still being able to match off-chain orderbooks' speed and efficiency.

DEXs often experience MEV issues, in which traders reorder transactions in a particular block to front-run orders. Sei prevents MEV by using the "Frequent Batch Auction" mechanism, which matches orders at a consistent clearing price in a block.

Sei has two crucial mechanisms in place to enhance performance:

Order Bundling

Sei employs order bundling on two levels. The first is that market makers can place multiple orders in a single transaction, which lowers gas prices. The second level involves using an order bundling algorithm, which combines all orders for a particular market (like ATOM) into a single, smart contract execution, requiring only one VM to be initialized and boosting throughput.

Parallelism

Orders are typically executed in order on a typical blockchain. To improve performance, Sei has implemented a parallel order-matching system that enables order-matching procedures for various markets (trading pairs) to run concurrently.

For example, if two different market makers submit 10 orders each, the market makers' ten orders are combined into a single transaction. The order matching engine then combines all 20 orders into a single transaction and uses one smart contract call to execute the transaction in parallel, depending on the market it is in.

These improvements have significantly reduced Sei's block times.

How does Sei work?

The Sei blockchain solves the following:

General-purpose chains like Ethereum do not optimize for specific use cases like decentralized exchanges, which hinders their development.

It is not possible to build an order book model exchange on a general-purpose chain because it is too congested.

General-purpose L1s are too slow and cannot offer the trading experience that centralized exchanges offer.

According to Sei, DeFi can be divided into two groups: protocols with an app chain, such as Osmosis, or protocols built on general-purpose chains, like Ethereum (OSMO). Sei aims to be a sector-specific chain that maximizes decentralized exchanges, occupying the sweet spot between the two.

This is made possible technically by several innovations.

Sei provides front-running prevention by regularly conducting batch auctions to carry out orders. One of the significant issues with DEXes is that orders either need to be processed on-chain, which overloads most blockchains, or they are processed on-chain on a fast blockchain at the expense of either decentralization or security (the Blockchain Trilemma). Sei aggregates orders at the end of the block and executes them all at once rather than executing them one at a time, preventing front-running.

Sei also uses native price oracles, which minimize external dependencies while offering trustworthy data feeds.

It uses single-block order execution, which is different from other DEXes.

Sei handles the placement and execution of an order in a single transaction instead of doing so in two.

Additionally, it bundles orders on various levels, enabling market makers and professional traders to reduce gas expenses.

This enables Sei to compete with its value pitch for a "decentralized NASDAQ."

Most decentralized exchanges implement an Automated Market Maker (AMM) for users to trade against to address the issues mentioned above. However, that solution has yet to impress the market, as Centralized Exchanges (CEXes) still control more than 90% of the trading volume. Sei claims that its technological foundation makes a Centralized Limit Order Book (CLOB) model possible, which is more similar to how traditional centralized exchanges operate.

The Sei Token and Sei Airdrop

The Sei protocol has not yet announced a Sei token or an airdrop while it is still in its incentivized testnet stage called "Seinami."

Ecosystem Overview

Despite being in testnet, Sei has already onboarded several protocols onto the network.

Cosmostation is the interchain validator, allowing users streamlined access to the interchain world!

Pharaoh is a decentralized exchange that revolves around the trading of synthetic assets, which are digital assets pegged to real-world assets, such as equities, commodities, and forex.

Axelar Network is a proof-of-stake-based cross-chain communication protocol. It will make it possible to execute, message, and bridge between various IBC chains.

Apollo Farm is the multi-sig manager for Cosmos, claiming to be the easiest way to secure, manage and govern a wallet with multiple members.

KYVE allows data providers to standardize, validate, and permanently store blockchain data streams. It creates backups of existing data and leverages data storage solutions like Arweave to provide scalable and immutable data backup solutions.

Andromeda is the first on-chain operating system connecting various protocols and services across the Cosmos ecosystem!

UXD is a fully collateralized decentralized stablecoin backed by derivatives to provide a stable, capital-efficient, decentralized stablecoin.

Deployed initially on Solana, it is the first Cosmos-native stablecoin integration.

Alpha Venture DAO is a builders’ DAO that explores and innovates at the fringes of web 3 and drives value to web 3 users with alpha!

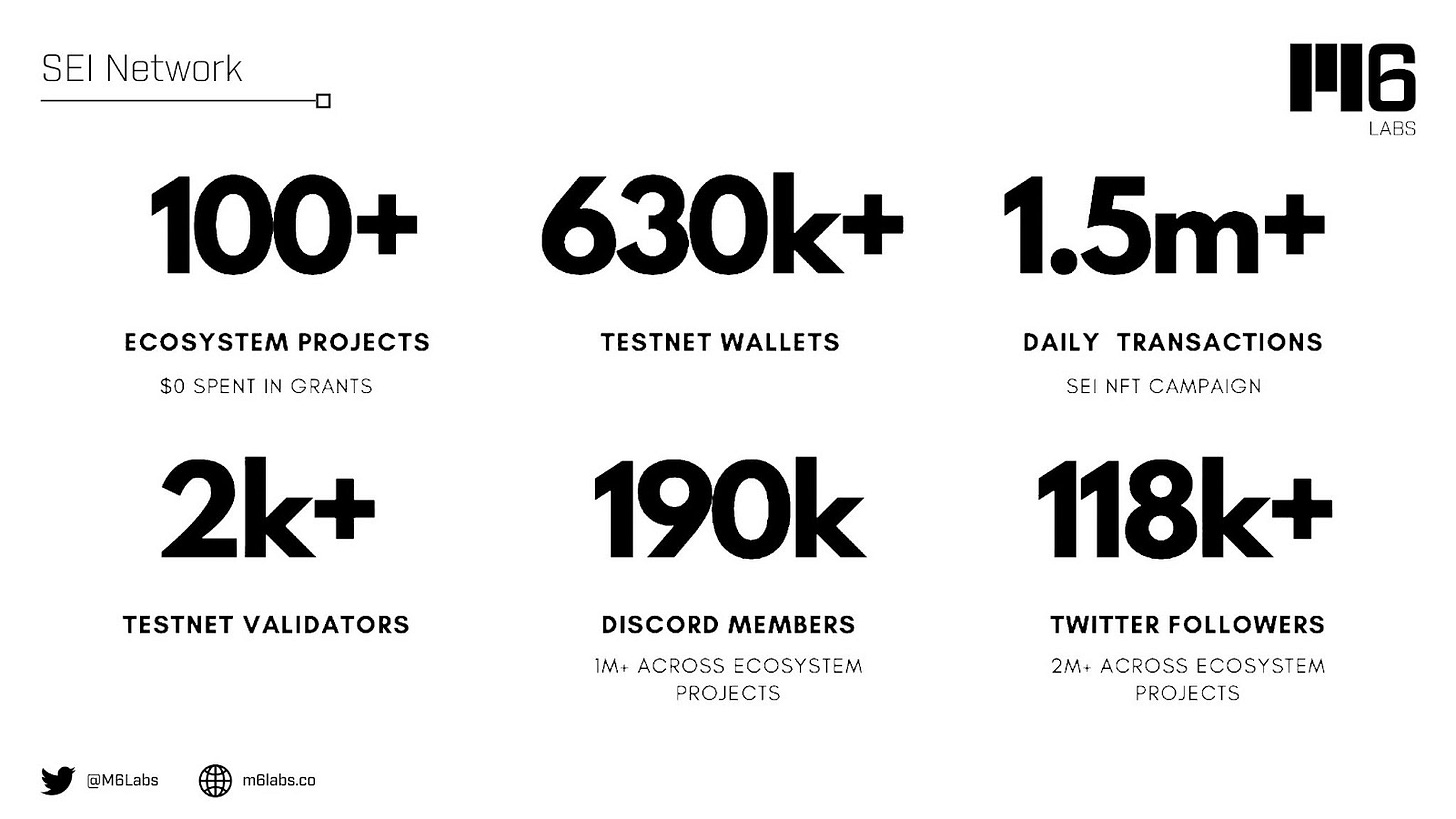

SEI December Statistics

Final Thoughts

Sei joins the growing trend of orderbook DEXs on Cosmos with its orderbook infrastructure. In contrast to the DeFi community on Ethereum, Cosmos developers are avoiding the AMM DEX trend in favor of creating decentralized trading platforms that resemble centralized crypto and TradFi exchanges.

Additionally, Sei should be able to establish orderbook liquidity upon launch, thanks to what appears to be strong backing and agreements with market makers. In addition to Vortex and Pharaoh, which focus on developing synthetic trading platforms and perpetuals, there is room for growth in the Sei ecosystem.

Subscribe to receive our daily brief, extended weekly newsletter, and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.