Acala Brings Its Stablecoin to the Polkadot Multi-chain

Polkadot is building bridges to other chains to unleash DeFi, but volatility/liquidity are still challenges. Is Acala the remedy?

Polkadot is building bridges to other chains to fully unleash DeFi, but volatility and liquidity are still challenges. Can Acala’s stablecoin bring stability to DeFi markets?

The significant swings in cryptocurrencies during the market downturn over the last few weeks have proven stablecoins to be a safe haven for DeFi investors, but not all stables performed well.

Since 2020, the amount locked in DeFi has soared from $601 million to $239 billion as large institutional investors accelerate their entry into decentralized financial services.

The biggest driver of the growth in DeFi is the arrival of new blockchains with faster and lower-cost transaction speeds and, critically, interoperability. Two years ago, some of the best of this new breed of blockchains, Polkadot, Solana, NEAR, and Polygon, did not appear in the top 20 of CoinMarketCap, and most were not even in the rankings yet.

Cross-chain transactions are unleashing the true potential of DeFi. A real game-changer is the ability of these Layer 1 chains to interoperate. Layer 2 bridges used to transfer data and assets across blockchains started going live only a year ago. The amount locked in bridges has already reached over $33 billion.

But no different from fiat markets, anyone doing business or trading in markets in different currencies is exposed to high volatility and exchange risk. Consider that the world has 164 official fiat currencies, whereas as of March 2022, over 10,000 active cryptocurrencies were in circulation.

Without a doubt, this confluence of cryptocurrencies is a recipe for high volatility. An analogy could be drawn to markets opening up to free trade. Initially, these liberated markets exhibit higher volatility as they open up to the free flow of goods and services, and more cross-currency exchanges occur. Over the longer term, they experience less exchange rate volatility.

But cryptocurrencies are a much more open and fluid market than economies controlled by central banks and one in which individuals can control and print the currency. Users of decentralized financial services can mint tokens, NFTs, and other assets. Moreover, these assets can be composable backing a loan, for example, cross-collateralized with different vaults and cryptocurrencies, or a valuable NFT game item assembled from an assortment of NFTs and attributes.

Stablecoins

The stablecoin has come to the rescue of crypto price swings. This programmable money has been a powerful driver of growth and innovation in the decentralized finance markets. The ability to peg value to fiat, crypto, or a commodity like gold provides much-needed valuation stability in services such as payments and lending.

Algorithmic stablecoins are putting some modern twists on the stablecoin. Like the basic stablecoin, the aim is to maintain a stable price close to or equal to the price of its peg, a 1:1 ratio to the US dollar, for example. Instead of collateral, code is used to maintain parity: minting and burning the stablecoin and a reserve currency. These coins are typically backed by a reserve token and a basket of collateral tokens to maintain stability and incentivize market arbitrageurs to narrow any price discrepancies.

The DeFi Stablecoin Boom

As stablecoins become a vital tool for bringing stability to crypto markets, many blockchains and DeFi platforms are introducing their own stablecoins.

Stablecoins reduce the frequency and size of price swings by:

Reducing volatility

Providing liquidity

The stablecoin may sound like a dull but safe financial instrument like a bond, with low volatility and predictable returns. This dull coin is underpinning a vibrant and rapidly growing market in decentralized financial services. In borrowing, for example, stablecoins provide stability to collateralized assets and lower risk. Lower-risk loans can charge lower premiums and stimulate more borrowing. By reducing volatility and adding liquidity, stablecoins enable investors to pursue higher-yielding investment strategies at lower risk.

But we are only beginning to see what stablecoins are capable of.

If financial engineers were getting bored creating derivatives instruments on Wall Street, they have quickly risen to the growing demand in the DeFi markets to add bells and whistles to improve stablecoins.

A significant innovation was DAI’s introduction of vaults that anyone could open to collateralize a stablecoin, truly decentralizing the stablecoin. But stablecoins quickly became a victim of their own success. The demand from DeFi protocols for the first stablecoin backed by a collateral debt position (CDP) often outstrips the supply of investors seeking to gain leveraged exposure to ETH and ERC-20 assets, leaving the Maker Foundation searching for new ways to incentivize users to collateralize Dai.

Fortunately, quants have been busy building a better stablecoin, but the recent turmoil in the cryptocurrency markets has exposed some design flaws.

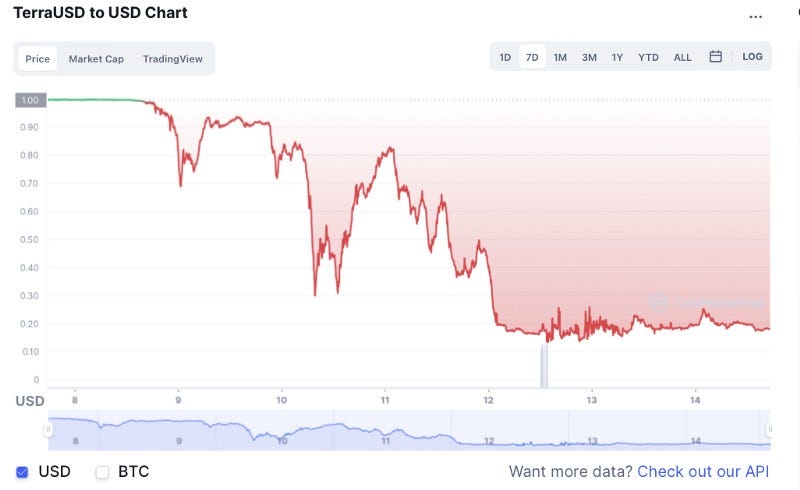

TerraUSD ($UST) was considered a pioneer of the algorithmic stablecoin when it launched in 2020 with no assets backing it. The coin was designed to be infinitely scalable by burning $1 of the reserve asset ($LUNA) for every one TerraUSD minted. This smart stablecoin operates interchain to support the growing demand for cross-chain DeFi. However, the third-largest stablecoin by market cap recently saw its peg become unhinged. To recap, large whales sold off 285 million in $UST on Curve while the shorts came out and drove the price of LUNA, the $UST reserve currency, down.

Ubiquity has released the first polymorphic stablecoin, the Ubiquity Algorithmic Dollar (uAD). The polymorphic architecture provides the flexibility to upgrade the stabilization mechanisms by continuously optimizing stability incentives to ensure the uAD maintains its peg to the United States dollar. The aim is to become the first stablecoin of crypto gaming, providing a scalable and secure digital currency for metaverses.

NEAR Protocol, the blockchain decentralizing music and other creative industries, has launched the $USN, a stablecoin not issued on leverage but backed 100% by $NEAR + stables in the reserve fund, $USN plus other stables. $NEAR is not burned but staked to the reserve fund. Any holder can mint 1 $USN against $1 and earn 10% APY.

Unfortunately, the situation has worsened for TerraUSD in recent weeks. The formerly high-flying algorithmic stablecoin is being blamed for the May crypto market downturn, placing its algorithmic stablecoin model in the spotlight. Initially, the programmable money seemed to be doing its job. The depeg took the currency down to 0.987 before rebounding to 0.995 but failed to keep the market’s confidence, and investors began to withdraw their money from TerraUST in hordes. The trigger for the initial withdrawals has been pinpointed to $UST withdrawals on Terra DeFi protocol Anchor.

By May 15th, the currency had fallen below 0.18 USD, despite several attempts of Terra’s governance to calm the market by halting trading in $UST two times.

A Bloody Sunday for TerraUSD

Interestingly, a few days before the big TerraUSD short, its creator Do Kwon announced the possibility of backing the popular stablecoin with collateral assets to create a hybrid collateralized algorithmic stablecoin. No doubt, there is room to build a better stablecoin, and recent market activity is part of that process. If there is a weakness in a stablecoin, the short sellers will eventually find it.

The Acala Stablecoin

The newly launched Acala Dollar (ACD) is well-positioned to emerge as a model of a hybrid algo-collateralized stablecoin. The market is taking notice of ACD because Acala is positioned to be a leading DeFi hub on the popular Polkadot multi-chain.

Polkadot was an early mover in introducing the concept of a multi-chain ecosystem in which all chains could intercommunicate and exchange data and assets. The Layer 0 blockchain allows other blockchains called parachains to run in parallel with its main Relay Chain while sharing in its security. Polkadot’s parallelism also delivers a real performance feat. Imagine five high-speed blockchains running in parallel. The potential aggregate speed could leave the fastest fiber optic cables used by big institutional investors in the dust.

The market has placed a lot of faith in this multi-chain, which already has over 200 DApps and a market cap of $11.3 billion — number 14 on CoinMarketCap.

Acala has a critical first-mover advantage on Polkadot as the first parachain. Acala is the first live parachain on the Polkadot network; a coveted spot gained after winning the November 2021 parachain auction. When it launched the aUSD in February, the team intended to become the default stablecoin of Polkadot and its canary network Kusama. Acala has already partnered with nine of the largest parachains in the Polkadot multi-chain network.

Acala has two cryptocurrencies. Acala’s native token, $ACA, is a utility token and governance token. aUSD is a multi collateral stablecoin currently accepting DOT and LCDOT as collateral assets. Acala offers a suite of DeFi features, including a DEX, swap market, stablecoin, and oracles, which include:

Honzon Protocol — Borrowing: Deposit any asset as collateral to borrow aUSD

Homo — Liquid Staking: Stake $DOT, earn rewards, and receive LDOT. LDOT can be deposited as collateral to mint aUSD and participate in other DeFi protocols.

The Acala Dollar is pegged to the US dollar and can be minted at https://apps.acala.network/vault/.

The borrower of aUSD deposits the collateral into the collateral debt position (CDP) mechanism, which is overcollateralized in that the collateral exceeds the value of the debt.

Once the aUSD is repaid, the CDP is unlocked, and the collateral is released.

A stability fee is charged for opening a CDP.

LPs who provide liquidity to aUSD stablecoin pair on Acala Swap receive part of the stability fee.

The ACA Dollar can be collateralized by Acala’s native token ACA, the Polkadot native currency DOT, and LDOT, the liquidity staking token on Acala.

DApp developers no longer have to choose between the most popular chain Ethereum, where 57% of dApps still build, and the next-gen chains like Acala. Developers can build fully compatible EVM DApps on the Acala EVM.

To encourage companies to develop use cases for the Acala dollar aUSD stablecoin, Acala is launching a $250 million DeFi-focused fund on Polkadot, the aUSD Ecosystem Fund.

With over 30 venture capital firms backing the fund — including Hypersphere, Pantera, Jump Crypto, and CoinDesk’s owner, Digital Currency Group.