Assessing the Damage and Casualties: FTX/Alameda Fallout

💊 Daily Bullets 💊 Wednesday, November 9th

Can you believe the writers of this show? What a timeline.. and now Bitcoin has hit a new yearly low of below $17k as we tally the fallout from this historic fall from grace.

This FTX implosion will have so many repercussions. Faith and trust has been shaken, U.S. regulators are watching and the FTX/Binance deal has already begun to draw concerns of antitrust retaliation - a merger would account for an 80% share of the global crypto market. Then there’s the scenario where Binance backs out of the deal for FTX and no one else acquires it.. Users would likely face a long road and only be able to recoup a fraction of their funds.

Uncertainty currently reigns supreme. Not to mention tomorrow’s CPI which is expected to increase by 0.6% for October, to a year-over-year change of 7.9% and usually offers volatility. Crypto is in for some hard roads. Stay safe.

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Tl;dr:

Tallying the FTX damage:

Tether, Coinbase, Circle, Genesis, Crypto.com, Cumberland, Deribit, Solana Labs limited exposure

Multicoin Capital has 10% of fund's AUM stuck on FTX

Galaxy Digital has a $76.8M exposure to FTX

Wintermute has funds stuck on FTX but within its risk tolerances

Amber Group has no exposure to Alameda or FTT but 10% of capital on FTX

Most of FTX legal and compliance teams have quit

$1B of SOL, 13% of supply, will soon be unlocked and released onto the market

Huobi and Tron DAO to exchange Tron tokens at 1:1 if FTX withdrawals fail

Binance + other exchanges to introduce Merkle-tree proof of reserves for full transparency

FTX CEO lost an estimated $14.6B dollars – nearly 94% of his net worth

FTX.us and Binance.us are two separate companies and are not currently impacted by the deal

Binance tops up Secure Asset Fund for Users (SAFU) to an equivalent of $1B

SBF’s priority crypto bill ‘dead’ after FTX sells to Binance

Solend is facing the risk of accruing bad debt

Meta cuts 11,000 jobs, 13% of its workforce

ETH tuns deflationary 55 days after The Merge

Metamask users can now bridge across multiple blockchain networks using MetaMask Bridges

STEPN partners with ASICS and Solana

Kim Kardashian and boxer Floyd Mayweather set to win EthereumMax lawsuit

U.S. Treasury Department updates Tornado Cash sanctions over North Korea nuclear weapons

Now for a more expanded and detailed look at the day…

⛓ Crypto News:

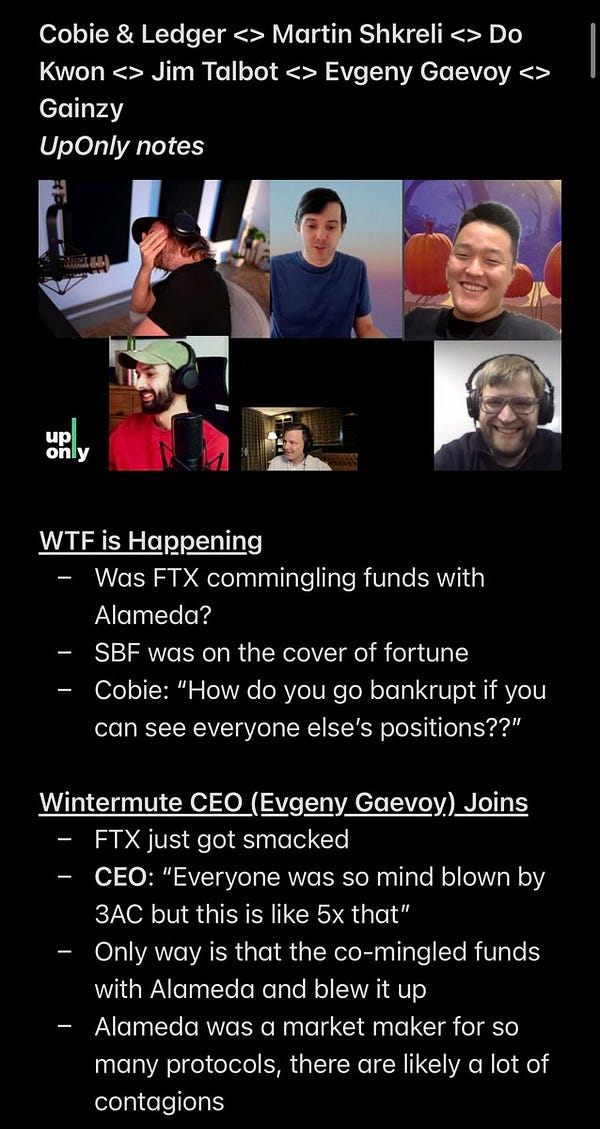

As the crypto industry looks for further contagion from FTX, Tether CTO Paolo Ardoino said the world's largest stablecoin issuer has no exposure to FTX or its sister firm Alameda Research after the crypto exchange was forced into a merger with rival Binance. Coinbase CEO also reaffirmed that they don’t have 'any material exposure' to the FTX/Aladema. Circle, Genesis, Crypto.com, Cumberland, Deribit, Solana Labs also distance themselves from FTX crisis. Galaxy Digital has a $76.8M exposure to FTX, of which $47.5M is currently in the withdrawal process. Crypto market maker Wintermute has funds stuck on FTX, but that they are within its risk tolerances. Multicoin Capital, one of the top crypto-focused venture capital firms, is significantly impacted with 10% of its fund's AUM stuck on the exchange. Amber Group has no exposure to Alameda or FTT, but it has been an active trading participant on FTX and less than 10% of total trading capital is tied up in the exchange

BlockFi, which was set to potentially be acquired by FTX, says it is an independent entity following Binance’s acquisition announcement and that their products are currently fully functional

The prices of coins associated with SBF - known as “Sam coins” - such as Solana, FTT and Serum have dropped far more than the rest of the market. In its second-largest token unlock, Solana tokens worth nearly $1B, 13% of the coin’s circulating supply, will be unlocked

Meta cuts 11,000 jobs, 13% of its workforce

Ether officially turned deflationary 55 days after The Merge

Copper, an institution-grade crypto infrastructure provider, has $500M of insurance for digital assets in cold storage. The cover uses a panel of specialty insurer Canopius-led insurers and was arranged by Aon, a professional services firm

The Middle East, Africa & Asia Crypto & Blockchain Association (MEAACBA) has been launched within Abu Dhabi’s free economic zone that aims to further the development of blockchain and crypto ecosystems

👨⚖️ Economic/Government/Regulatory:

Binance-FTX deal may attract antitrust regulators’ attention. The combined company would have a more than 80% share of the global crypto market

Sam Bankman-Fried’s priority crypto bill ‘dead’ after FTX sells to Binance

Kim Kardashian and boxer Floyd Mayweather are set to win a lawsuit accusing them of scamming investors with the obscure cryptocurrency EthereumMax

The U.S. Treasury Department updated its sanctions on Ethereum coin mixer Tornado Cash, citing its role in North Korea’s nuclear weapons program

💸 Exchange News:

How an FTX buyout benefits Binance. A timeline of events. In the hours before it secured rescue financing from its rival Binance, the crypto exchange FTX sought a bailout of more than $1B from Silicon Valley and Wall Street billionaires

FTX.us and Binance.us are two separate companies and are not currently impacted by the deal. FTX.us’s withdrawals are and have been live, are fully backed 1:1, and operating normally

Huobi and Tron DAO promise to exchange Tron tokens (TRX, BTT, JST, SUN, HT) at 1:1 if FTX withdrawals fail

Crypto.com suspends deposits and withdrawals of USDC and USDT on the Solana blockchain

Singapore’s state investor Temasek is engaging with FTX in its capacity as a shareholder in the wake of Binance’s bailout plan

Sam Bankman-Fried no longer ranks in the top 500 on Bloomberg’s billionaire index - estimated 94% plummet in his personal, an estimated $14.6B

Binance will soon introduce Merkle-tree proof of reserves, in the interest of full transparency - says the industry can’t simply say, "Trust me, bro." Justin Sun/Huobi Bitget also said that they will publish reserve certificates. OKX also plans to publish the auditable merkle tree proof-of-reserves or POF in the coming weeks (within 30 days)

Binance has topped up its Secure Asset Fund for Users (SAFU) to an equivalent of $1B

Cathie Wood's Ark Invest buys another $21.4M in Coinbase stock

🏦 DeFi News:

Solend is facing the risk of accruing bad debt due to a large lending position that’s now underwater - the large loan is being liquidated slowly due to network congestion

Metamask users can now bridge across multiple blockchain networks using MetaMask Bridges, which aggregates different blockchain bridges in one place

🖼 NFT/Gaming/Metaverse News:

Binance has agreed to purchase FTX however the deal on FTX’s many NFT and gaming initiatives remains unclear

STEPN partners with ASICS and Solana, pioneering a new era of Web3 fitness - launch of the new ASICS X SOLANA UI Collection featuring custom-made GT-2000 running shoes includes a token gated experience

💰 Fundraises:

Japanese mobile operator NTT Docomo plans to invest up to ¥600B ($4.1B) over several years to focus on web3 technology

Blockchain-based intelligence company TRM Labs announced a $70M expansion to its Series B funding round, bringing the total raised to $130M. Led by Thoma Bravo, with Goldman Sachs and previous TRM investors PayPal Ventures, Amex Ventures and Citi Ventures participating

Crypto payments firm Ramp has raised $70M in Series B funding as its valuation increases to at least $450M co-led by the investment arm of Abu Dhabi-based sovereign wealth fund Mudabala Capital and venture firm Korelya Capital

Fordefi, a financial technology and software company, raised an $18M seed round for the public launch of its institutional MPC wallet built for transacting on dApps. Led by Lightspeed Venture Partners, including Electric Capital, Alameda Research, Jump Crypto, Castle Island, Pantera Capital, Illuminate Financial, PayPal Alumni Fund, Nima Capital, Digital Currency Group, Defiance Capital and StarkWare

👶 Early Stage Projects:

GammaSwap litepaper

What’s your take on today’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

📊 Data:

TL;DR: According to Arkham Intelligence, FTX has dropped to $1.6B in total balance. This comes after it topped at $22B last September and was up until the recent liquidity crunch ranging in the $7B-$8B region.

We can also see a huge spike in their losses, rivaling the market nuke last May

Then there’s Alameda Research - Also taken a big hit recently. Only $100M left…

What is the Data telling you? See anything that sticks out to you?

🎓 Research/Reads:

Why did FTX sell to Binance? What other obstacles are there? What are the implications for the future? - source

Nansen’s on-chain metrics suggest several reasons why FTX decided to sell itself to Binance - source

WuBlockchain - CEX Data Report in Oct.: Spot Volume Steady, Futures Volume Down Sharply - source

Andre Cronje - Learn from my mistakes - source

Messari - State of Boba Network Q3 2022 - source

Have you seen our institutional-quality research?

🌍 Crypto Twitterverse:

Diving into the FTX/Binance saga through the lens of crypto twitter…

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.