Avalanche In-Depth Analysis

The TVL and market cap may be experiencing significant declines, but on the other hand, it also provides an immense opportunity for growth

Is $AVAX on your radar during the #crypto bear market?

Want to know if the @avalancheavax network is in good health?

Here is an in-depth analysis of the $AVAX ecosystem and why you should be paying attention:

MEGA THREAD 🧵📊👇

Before we get started... Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox:

Done? Now let's dive in!

1/

For starters, #Avalanche is a Proof of Stake network operating on its own Consensus model known as the Snowman consensus model

Its unique consensus model allows Avalanche to process a large number of transactions at a lower cost

Avalanche also has a finality of ~1 sec

2/

However, the key distinguishing feature of Avalanche is SUBNETS

Subnets are mini-blockchains that make up the Avalanche ecosystem

Theoretically, as more and more sovereign subnets spin up within the network, subnets enable the Avalanche network to scale indefinitely

3/

Subnets also allow Apps to have their own token for gas fees

This reduces transaction fees when the network gets congested since subnets do not compete with each other

Subnets also allow dApps to be sovereign by allowing them to set their own rules for the network

4/

Subnets are a strong value proposition for the Avalanche network due to their sovereignty, low transaction fees, scalability, and low finality

$AVAX is one of the top tokens with the strongest tokenomics:

• $AVAX has a capped supply of 720M

5/

• 360M $AVAX tokens were minted at launch while the rest of the 360M will be released over time

• 100% of the transaction fees are burned. This reduces the circulating supply of $AVAX thus increasing the value of the $AVAX token

• The $AVAX staking reward is ~10%

6/

The robust infrastructure of the Avalanche network has attracted interest from institutions, developers, and users

However, in order to assess the network's health, we as investors must be aware of the quantitative and qualitative analysis underpinning Avalanche

7/

Quantitative Analysis of the Avalanche network:

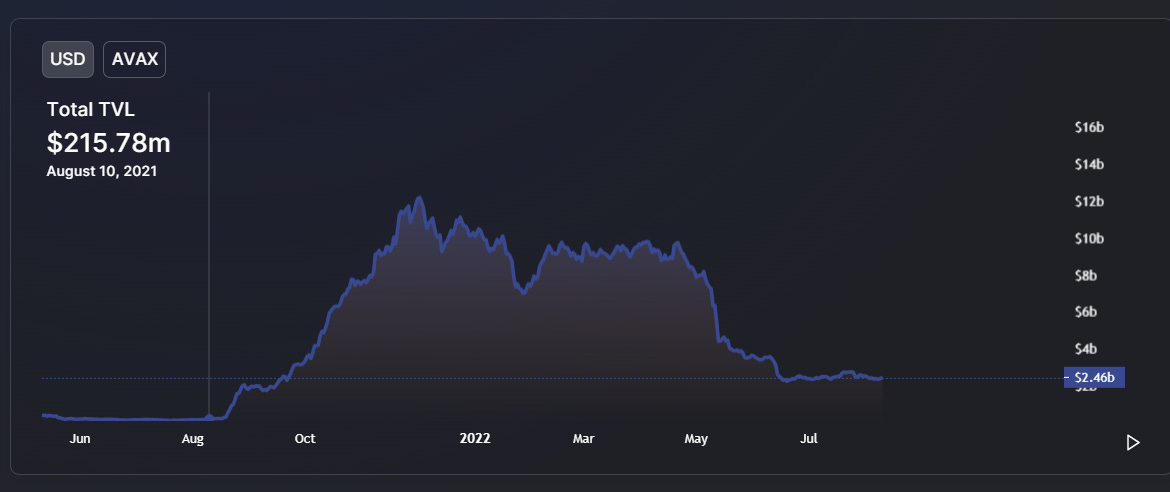

1. TOTAL VALUE LOCKED:

The Total Value of the tokens locked in the Avalanche network decreased from ~$12B to ~$2.5B

Because TVL is a function of market price, as the #crypto market fell in value, so did the TVL

8/

However, one interesting element of the current TVL value is that it is still higher than it was before the bull run

This could imply that all speculative value has been lost, and the network's value is close to its intrinsic value in its current state

9/

2. MARKET CAPITALIZATION:

The market capitalization of $AVAX fell from $30 billion to $7 billion, wiping out 81% of the value of the Avalanche network

Market cap = Circulating supply * Token price

The market cap only reflects the effect of $AVAX 's price decline

10/

As a result, one cannot effectively conclude the health of a network using a variable that is highly correlated with market price

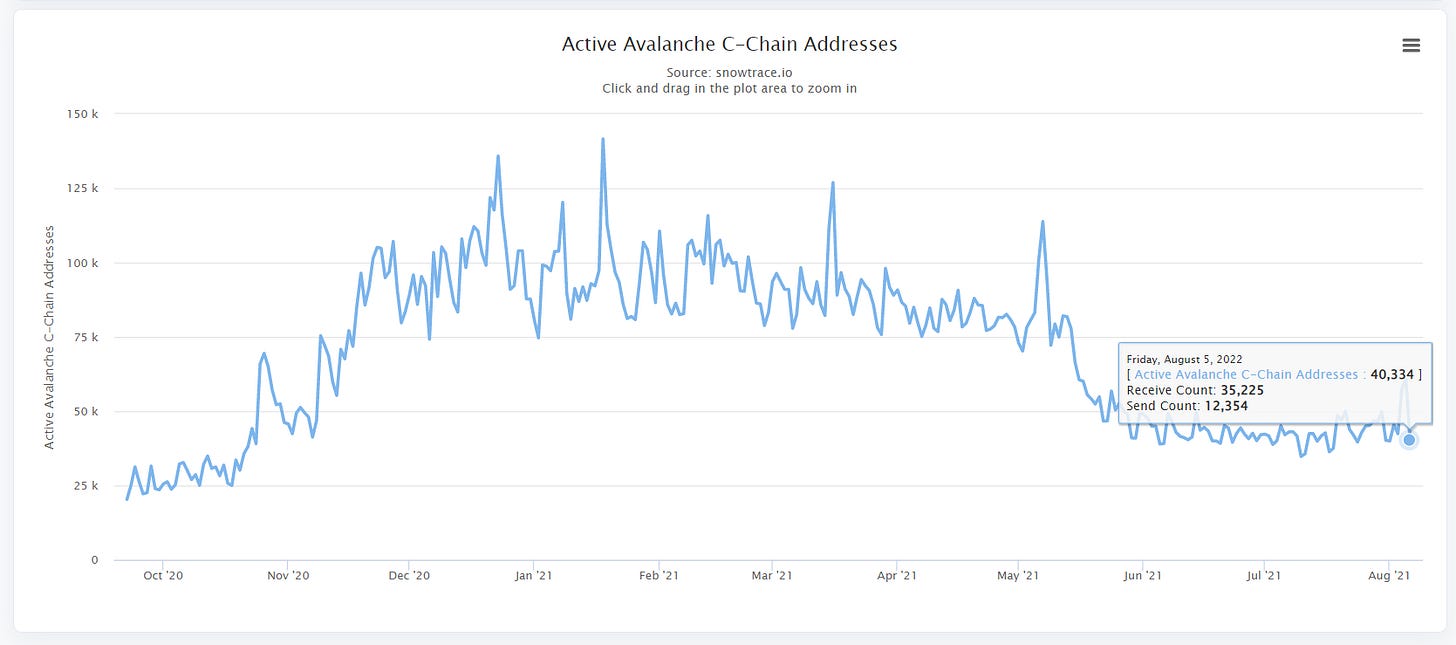

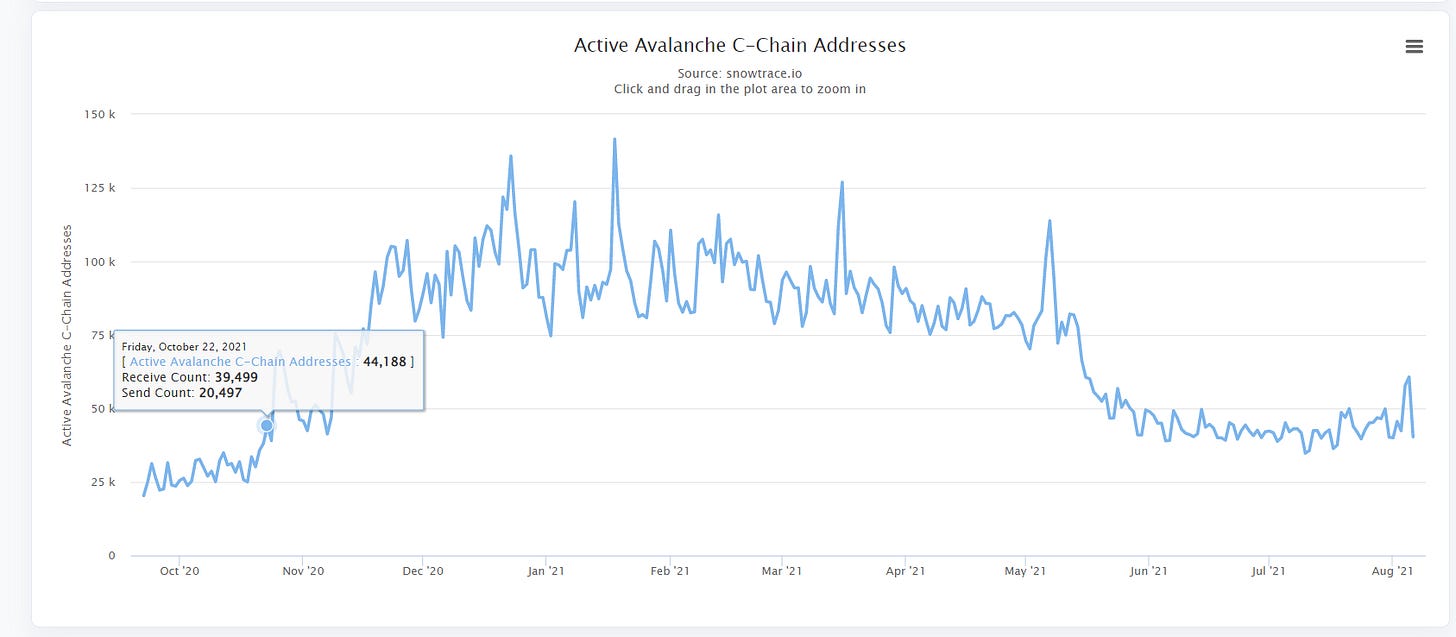

3. DAILY ACTIVE C-CHAIN ADDRESSES:

The active C-chain Avalanche addresses fell from ~130k to ~40k

11/

The decrease in active C-chain addresses could be explained due to the bearish market sentiment

It indicates that the vast majority of the funds are either HODLing or playing it safe by avoiding riskier protocols

12/

But what's more interesting here is that the active C-chain addresses are still the same as it was before the huge 2021 bull run

This demonstrates that the network's current state is free of "speculative interest" and that there is "organic utility" within the network

13/

4. DAILY C-CHAIN TRANSACTIONS:

Daily C-chain transactions plummeted from ~1.2M to ~190k a day

One plausible explanation is that daily C-chain transactions follow the same pattern as daily active C-chain address activity

14/

But, a stronger reason for this could be the launch of subnets for #GameFi developments

Major #P2E games moved outside the C-chain to launch their own subnets, such as @PlayCrabada, @DefiKingdoms

This reduced the transaction activity "ONLY" within the C-chain

15/

Collectively speaking, the Avalanche network is still generating more than $1M txns a day since subnets are also considered a part of the network

Avalanche txn fees also decreased as a result of the shift in transaction volume from the C-Chain to the individual subnets

16/

5. TOTAL REVENUE:

Total Revenue is the measure of total transaction fees paid by the users

The decrease in C-chain transactions, combined with the drop in transaction fees, reduced the protocol's revenue from $25 million to $130,000

17/

The Total Revenue is not a good measure of the Avalanche network

Here's why:

Total Revenue is a function of (Transaction fees) + (# of transactions)

18/

Given that the Avalanche network aims to reduce gas fees with the help of subnets, one can simply draw the conclusion that their overall revenue will plateau over time

And the daily C-chain transactions are primarily dependent on market sentiment

19/

You cannot judge the Avalanche network's health in a bear market since the Total Revenue is a function of market volatility and not the Avalanche network

Thus, the total revenue of the Avalanche network is going to plateau or decline due to the bearish market sentiment

20/

6. MONTHLY ACTIVE USERS:

Bear markets typically drive out a lot of speculators, leaving only those that actually USE the network

When speculators leave the network, the number of active users in a bear market falls in comparison to ATH user activity

21/

With the onset of the bear market, the Avalanche network's monthly active users fell from ~800k to ~150k

However, the same active users have still remained within the network from last year, which indicates that the network is still being used in an effective way

22/

This indicates the network is healthy at its current state b/c it means that users are sticking around for actual utility reasons & not for speculative reasons

7. UNIQUE CONTRACTS DEPLOYED:

The measure of unique smart contracts deployed within the Avalanche network

23/

Unique contracts deployed on the Avalanche network have been growing exponentially since the start of 2021, from ~100 unique contracts to ~200k

The increasing number of unique contracts suggests developers are building within the ecosystem despite the bear market FUD

24/

This demonstrates that Avalanche has a robust network architecture even in a bear market for developers to build dApps

8. UNIQUE CONTRACT DEPLOYERS:

It is the measure of unique developer activity within the Avalanche network

25/

The growth of a network shouldn't depend on a small set of developers who build the entire network

The network must have a diversified group of developers so that it can continue to expand even if a set of validators leaves the network

26/

The number of unique contract deployers within the Avalanche ecosystem has also been growing exponentially from ~30 unique contract deployers to ~1.7M

The ecosystem is no longer dependent on a major developer. As a result, making it resilient to single points of failure

27/

9. VALIDATOR COUNT:

Decentralization is primarily reliant on the number of validators present in a network

The Avalanche network's validator set has been steadily expanding from ~600 to ~1200 since the start of 2021

28/

Having more validators within the network makes it far more difficult to attack the network

This proves that Avalanche is highly secure and resilient to attacks in its current state

10. NAKAMOTO COEFFICIENT:

It is used to measure the decentralization of the network

29/

The coefficient represents the minimum number of validators needed to compromise the security of the network

Avalanche has one of the highest Nakamoto coefficients amongst its competitors

This demonstrates that Avalanche is one of the most decentralized Layer 1 networks

30/

QUALITATIVE ANALYSIS:

Many protocols are being phased out as a result of a lack of reserve funds during the bear market

But the bear market has not affected Avalanche's development and incentive programs

The following are the most recent important events and programs:

31/

• Avalanche launched a $290M incentive program called "Avalanche Multiverse" to focus on accelerating the adoption and growth of Subnets.

It is focused on supporting new ecosystems including blockchain-enabled gaming, DeFi, NFTs, and institutional use cases

32/

• Avalanche released a beta version of the Core wallet. Core is a high-powered, non-custodial wallet engineered specifically for apps on Avalanche, including subnets.

Users can also directly access the #AvalancheBridge with its native bridging functionality

33/

• A major gaming subnet was deployed on the Avalanche network.

@swimmer_network is a dedicated gaming blockchain built as an independent subnet. It also has its own gas token: $TUS

• The first native Avalanche insurance protocol, @ProjectDegis, was launched

34/

• Avalanche also launched its native borrowing protocol: @YetiFinance

• Avalanche launched its native bridge called the "Avalanche Bridge". The Avalanche Bridge allows users to bridge assets like $BTC & $ETH to the Avalanche network

35/

VERDICT:

While all of the Crypto market is down bad, Avalanche continues to build and expand its ecosystem

The TVL and market cap may be experiencing significant declines, but on the other hand, it also provides an immense opportunity for growth

36/

The network continues to maintain a robust infrastructure despite the FUD, as seen by the rising developer activity and deployed contracts

It is also one of the most decentralized Layer 1s while scaling itself with the help of subnets

37/

It is quite evident from the data that the network is in a healthy state and that it has organic utility

Subscribe to receive our daily brief, extended weekly newsletter, and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.