Daily Bullets 💊: Did Celsius Doxx You? New Tools Allowing This

💊 Daily Bullets 💊 Monday, October 10th

Another week of crabby and sideways markets with Bitcoin still cucked in the $19k-$20k region. Reminder: Thursday the 13th we have another CPI print. Something interesting to keep in mind, tools have already begun to be made to link wallets associated with the recent Celsius legal filings doxx and this type of analytics will probably only continue to increase over time - highlighting the need for privacy and caution with whom you KYC with. Also, we’re already seeing the beginning of the eventual Layer 3 narrative with Matter Labs’ L3 prototype - Pathfinder.

Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

⛓ Crypto News:

Circle's USDC market cap drops below $50B for first time since Terra's collapse - taken a hit since Binance's decision to consolidate order books and Circle's decision to freeze addresses associated with Tornado Cash

Using data pulled from Celsius bankruptcy filing, a new tool now shows exactly how much different users lost following Celsius' collapse

Huobi will sell a majority stake to Hong Kong-based investment company About Capital Management. Tron founder Justin Sun has denied reports that say he has bought Huobi’s majority stake adding that he is only an advisor to Huobi

FTX V2 will go live on Nov. 21, featuring an improved matching engine aimed at addressing complaints - whole new order matcher, lower latency API pathways

Matter Labs will launch a public testnet for an Ethereum Layer 3 scaling prototype called Pathfinder in Q1 2023

Polygon zkEVM public testnet - Aave and Uniswap, along with other projects, will be among the first projects to deploy on the zkEVM testnet

The Luna Foundation Guard, citing mounting legal pressure and threats as a reason to forestall repayment efforts with no current timeline to establish payments

Binance may spend more than $1B on acquisitions and investments this year despite what may be a prolonged crypto winter

The Markets in Crypto-Assets legislation passed the European Parliament after a two-year long debate and drafting process

Stephane Gosselin, co-founder of Flashbots, last month resigned from the MEV service following disagreements with the team over censorship

A California jury indicated a man for allegedly using crypto channels to launder more than $5M in drug trafficking proceeds

London-based blockchain firm Fnality, in conjunction with the Bank of England, is delaying the launch of its Sterling Fnality Payment System to Q3 of 2023. The system was expected to launch this month

dYdX hires former ConsenSys director as foundation CEO

CPOOL staking is live

Ethereum development company Nethermind has “transpiled and compiled” Uniswap v3 on “Warp” - a project designed to allow Ethereum users to swap tokens on the more scalable StarkNet

The chief operating officer for the Helium Foundation, Scott Sigel has claimed there is “no basis” for Binance to delist Helium Network Token (HNT)

Token holders of DeFi project Yam Finance are debating whether to dissolve the project’s treasury and distribute the funds among token holders in an attempt to salvage what’s left of the project

South Korean blockchain investment firm Blockwater Technologies defaulted on a $3.4M BUSD DeFi loan from TrueFi lending protocol

The Graph has announced its 2023 roadmap with plans to move the entire Graph protocol to Arbitrum

Privacy-focused crypto and payments firm MobileCoin, in collaboration with stablecoin platform Reserve, has launched a new stablecoin - Electronic Dollars (eUSD)

On the 4th of October, ~$1.1M was stolen from Sovryn, a “DeFi” protocol on the controversial “Bitcoin smart contract network”, RSK

The hacker that exploited cross-bridge DeFi platform Transit Finance for $28.9M has transferred 2,500 BNB tokens ($686,000) to Tornado Cash, agreed to return 10,000 BNB ($2.74M) to victims - in addition to $18.9M that was returned last week

Polkadot Ecosystem Weekly Digest. October 3 - 9

ParaSwap DAO governance forum calls for a new rewards system called social escrow where users earn rewards by performing actions deemed positive for the protocol vs current system where users who stake their tokens earn a portion of the fees generated

Perpetual futures beta (powered by zksync) is live on 1KX Protocol

MES Protocol Mainnet launch on Nov 7

SLAMM: A Unified Model for Cross-Chain Liquidity - Whitepaper

QuickSwap Lend is live

Reserve Protocol deploying on Monday Oct 10th, concurrently with launch event

Introducing Thala Labs - building an over-collateralized, decentralized stablecoin, first for the Aptos blockchain

Introducing the DeFi superapp built on Injective: Project X

Introducing Vyper OTC, the first ever trustless OTC platform

Introducing Dappnet - resists capture, a permissionless application network

Squads - announcing Mesh - a new program built specifically with institutions and DAOs in mind

Introducing Metaplex Creator Studio - create, sell and manage NFT projects with no-code tools

Numoen, the world's first permissionless options exchange live on Celo Mainnet

Taiko whitepaper - describes Ethereum-equivalent ZK-Rollup

What’s your take on today’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

📊 Data:

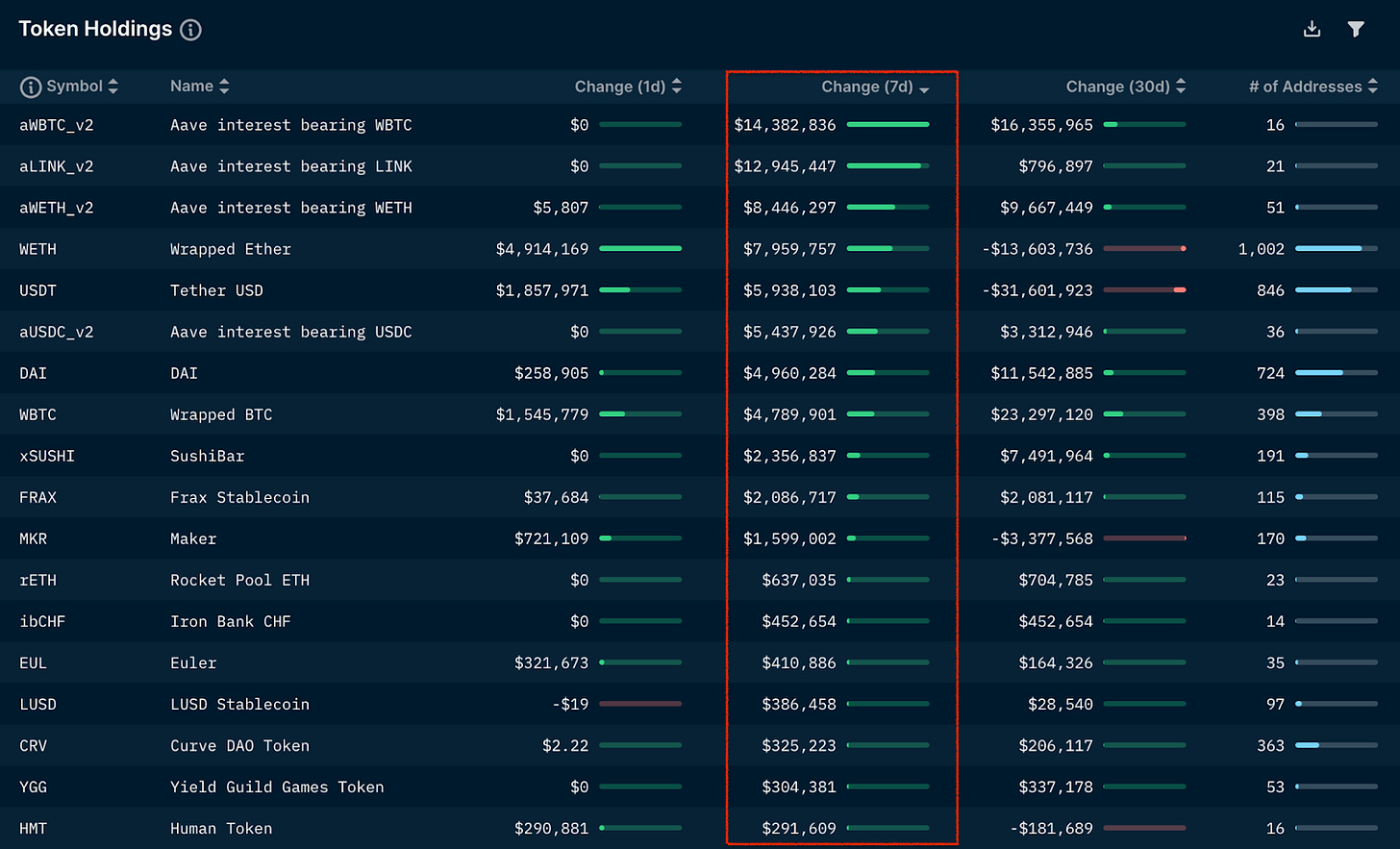

TL;DR: On the daily, we’re seeing low amounts of money flow into WETH, USDT and WBTC and light outflow from USDC. Weekly medium inflow mainly into Aave derivatives - WBTC, LINK, WETH, USDC as well as WETH and USDT. Continuing to see considerably more weekly outflow from USDC. DEEPOBJECTS.ai NFT project highest volume of the day. The ETH on exchanges has been going down since it spiked just before the Merge.

Nansen Smart Money Holdings Token Inflow and Outflows: Tracking what the whales are up to...

- Inflow (1D): WETH ($4.9M), USDT ($1.8M), WBTC ($1.5M), MKR ($721k), EUL ($321k)

- Outflow (1D): USDC ($2.1M), AXS ($215k), aSTETH ($104k), RAI ($51k), BADGER ($46k)

Weekly:

- Inflow (7D): aWBTC ($14.3M), aLINK ($12.9M), aWETH ($8.4M), WETH ($7.9M), USDT ($5.9M)

- Outflow (7D): USDC ($144M), APE ($6.5M), aSTETH ($4.5M), LDO ($1.2M), SAND ($1.2M)

Nansen NFT Hot Contracts:

DEEPOBJECTS.ai: 599 ETH

CloneX: 448 ETH

MAYC: 338 ETH

BAYC: 328 ETH

Otherdeed: 253 ETH

What is the Data telling you? See anything that sticks out to you?

🎓 Research:

a16z - Virtual Society, Blockchains, and The Metaverse - source

The DeFi Edge - Some trends for Quarter 4 - source

Studied 50+ startups on TikTok and here’s what we found - source

Token Cap Table Allocation - Why Founders Are Misallocating Tokens to VCs? - source

a16z youtube - A deep dive into basics of consensus, from the ground up - source

Vitalik - Arithmetic hash based alternatives to KZG for proto-danksharding (EIP-4844) - source

Messari - State of Polkadot Q3 2022 - source

How to use DeFillama Raises for your crypto research - source

Q3 2022 | Metaverse Virtual Real Estate Report - source

Bankless Token Ratings | October 2022 - source

Hyperapps: a primitive for a new internet - source

Have you seen our institutional-quality research?

🖼 NFTs/Metaverse News:

NFT company Dapper Labs is blocking crypto accounts with Russian ties because of new EU sanctions on Russia

Meta leadership has placed their metaverse VR platform, Horizon Worlds, on a “quality lockdown” through the end of the year due to persistent bugs

X2Y2 launches P2P NFT loan function - users can use NFTs as collateral to borrow ETH from other lenders. The current NFT whitelist only includes BAYC, Azuki, Doodles, Otherdeed for Otherside

Zapper: You can now explore NFTs on Optimism

Manifold Gallery - zero fee marketplace for creators

🌍 Crypto Twitterverse:

📈 Fundraises:

Sovryn raises $5.4M to expand its global financial operating system

DeFi startup Arch raises $5M to become the 'BlackRock of web3'

Waterfall raises $4M seed round led by Electric Capital and Pantera Capital to build an NFT trading and pricing protocol

Bond Protocol raises $2.5M to make it easier for crypto protocols to utilize treasury diversification and protocol-owned liquidity

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!

Momentum 6 offers research, analysis, and coverage of the fast-paced Crypto space.

The Crypto space never sleeps. Each day is filled with an overwhelming amount of information spread across various sources.

This newsletter offers a Crypto-native perspective and a one-stop shop for everything you need to stay updated on the daily goings on in the Crypto world.

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.