ETH Dump Post Shanghai?

Battle of the L2s - Matic vs Optimistic Rollups, The California DMV Meets…Tezos

Daily Bullets - Monday, January 30th

Tough weekend for short term traders. Bitcoin and ETH are finding it hard to move past resistance levels as Wednesday’s FOMC inches closer. CME shows a 99.9% probability of raising interest rates by 25bps, so this is one of those cases where things really should be “priced in.” Today we’re looking at:

ETH Dump Post Shanghai?

What’s a Matic With You

The California DMV Meets…Tezos

Set your reminders for this week’s Crypto Illuminati Twitter Spaces featuring industry experts.

ETH Dump Post Shanghai?

Key details: March will enable withdrawals of 17.2M ETH staked or deposited in the Beacon Chain since December 2020. Only 43,200 ETH can be unstaked per day, however, the total staking reward of the past two years, ~ 1M ETH (1% of free-floating ETH), can be withdrawn instantly.

Significance: Are market participants undergoing defensive positioning ahead of the Shanghai upgrade? The market is worried that the unlocked ETH will be instantly liquidated into the market, pushing prices lower.

Analysis: Buy the rumor, sell the news has been a tried and proven strategy during the last year. Almost every event, narrative and catalyst for a coin locally topped once said event arrived. We even saw this with the Ethereum Merge. Lots of hype built up until the actual event hit. Then boom - prices sunk lower. It’s entirely possible that we may see a repeat of this action in March once the Shanghai upgrade hits. A more optimistic viewpoint says that market participants who were worried about staking their ETH without withdrawals enabled will finally have the ease of mind to stake resulting in less available ETH on the market to sell. Do you take the trader focused cynical viewpoint or the optimistic one?

What’s a Matic With You?

Key details: Pricewise, Polygon’s MATIC has been a strong performer during the bear market. They also have an upcoming catalyst in the form of their zkEVM update, which has been teased with an official date and will launch “soon” according to Polygon co-founder Sandeep Nailwal.

Analysis: Polygon has had a very successful year in making large partnerships with big names such as Nike, Starbucks, Meta, Disney, Reddit, etc. Polygon really does have one of the best business development teams in crypto. It is front and center when it comes to name brand recognition in the L2 space. On the other hand, Optimistic rollups such as Arbitrum and Optimism have been 2 of the best known up and coming players. Now, Steven Goldfeder, the co-founder of Offchain Labs, who’s building Arbitrum, fired some shots in the Optimistic Rollup vs ZK rollup battle. He’s still bullish on Arbitrum's technology winning.

Significance: This year may be setting up to be the year of L2s. Who will “win” the battle? ZKs or Optimistic rollups? Will the technology prevail or will the name with bigger brand recognition steal the show? It’s important to remember how vital narratives and stories are in crypto.

The California DMV Meets…Tezos?

Key details: The California DMV is teaming up with Tezos blockchain for digitizing car titles and transfers. In partnership with blockchain software firm, Oxhead Alpha, the DMV aims to modernize its record-keeping and reduce the potential for fraudulent activities from car sellers. The agency hopes to have the system up and running within the next three months. The next step will be the introduction of digital wallets for non-fungible token car titles, with the DMV overseeing the transactions.

Significance: Example of transaction fraud: car sellers hide key information about the vehicle’s condition to offload a bad car onto unsuspecting buyers. While faulty vehicles have a special designation on their titles in California, sellers can move the car over to another state and hide the faulty designations with relative ease. This move by the California DMV is expected to be followed by other state agencies as the state continues to explore opportunities for integrating blockchain technology. With a focus on efficiency, transparency, and security.

Analysis: It’s always interesting to see examples of governments team up with blockchain projects and specifically which chains they ultimately choose. Most crypto natives most likely stick to transacting on the Ethereum blockchain with more NFT focused users perhaps choosing Solana. However, to choose Tezos? Seems a bit random and out of nowhere. Why did the government officials really choose Tezos? They claim it was due to the combination of responsible consensus, on-chain governance and institutional grade security. In reality, it was most likely due to the relationships between the people working on the respective teams. This is a great case that highlights that it’s not always the technology that is the ultimate factor in a project’s success but other more subjective metrics such as business relationships.

Daily Bullets

Mastercard and Binance are launching a prepaid card in Brazil

DOJ claims SBF tried to influence witness testimony and asks for communications ban

The Sorare NFT soccer trading card game has partnered with the Premier League on a multi-year licensing agreement

Yuga Labs co-founder Wylie Aronow disclosed that he was diagnosed with congestive heart failure and is taking a leave of absence

Fantom plans to introduce version 2 of its fUSD stablecoin to provide a more predictable and budget-friendly system for builders, partners, and users, developers

Dedicated World Mobile Chain will bridge Cardano, Cosmos ecosystems

Uniswap dev team won the web3 dev gaming competition, 0xMonaco: Battle of Titans beating out Ledger, Polygon, NEAR, Yield Guild Games, Chainlink, OKX and Bybit

Coinbase Wallet will now show transaction previews for transactions, in a way that should help prevent NFT scams

Avalanche Park X Ed Balloon Concert Series to Launch in DTLA in February with Emerging NFT Artists

Crypto tax unicorn CoinTracker laid off about a fifth of its staff due to market conditions

The Floki Inu community successfully voted to burn 4.2 trillion FLOKI tokens worth over $100M on a cross-chain bridge and reduce transactional tax

Post Weekend Coin Movements

Looks like market participants are getting greedier as prices move up. This score has more than doubled from where it was 30 days ago.

Some were hopeful that the weekend would bring about a pump and continued runups of hot movers such as Aptos, Matic and Fantom. Instead we got more ranging. Opening up the week we see:

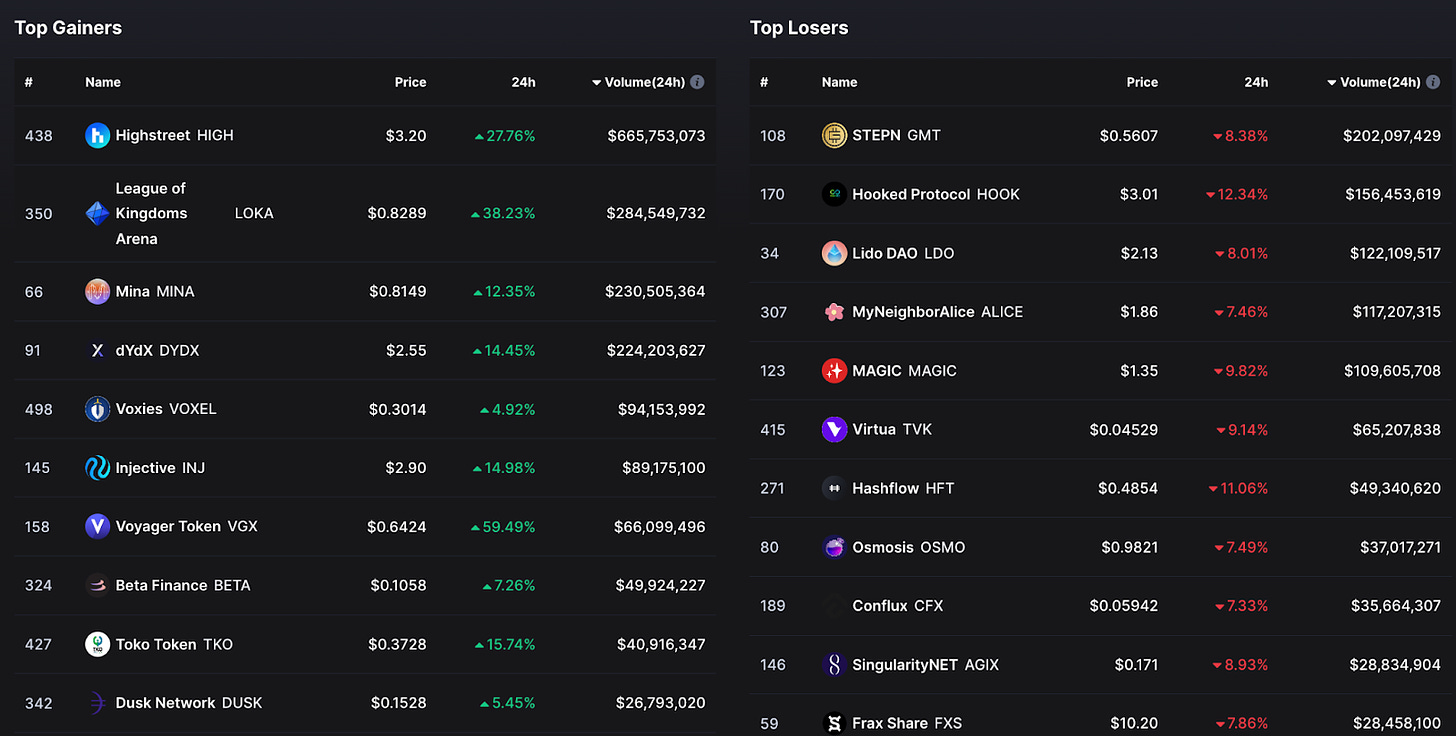

Gainers: dYdX delayed the token unlocks for investors to the end of this year instead of February. Voyager also up big - most likely some news coming

Losers: Last week’s runners such as GMT, HOOK, LIDO, MAGIC, AGIX all taking a breather

The Market’s reaction to FOMC on Wednesday should be very telling for how the tone will be set for the next several days/weeks.

Research/Reads

Better Policy Can Turn NFTs Into an Intellectual Property Powerhouse - source

Potential implications of treating all NFTs as financial assets

Introducing Hyperspace - a new type of a supercomputer - source

Powered by a browser-based blockchain, and how it has changed the world of computing

CSR - Redefining Developer Incentives - source

A new mechanism to incentivize the development of public goods

Not Companies, Not DAOs But a Third More Secret Thing - source

Why crypto protocols are unlike both companies and DAOs and why understanding this difference is crucial

Narrative Trading #1: Introduction - How To Find Alpha & Research - source

Short series on how to trade narratives

Gud Tutorial

If you’re a trader then check out this tutorial on utilizing orderflow. Coinalyze is powerful resource.

We hope you find this issue engaging and enlightening. As always, we welcome your feedback and suggestions for future issues.

GOOD