Everything You Need To Know About Concordium — The Compliant Enterprise Blockchain

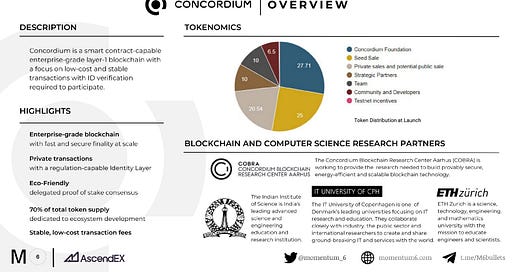

Smart contract-capable enterprise-grade layer-1 blockchain with a with focus on low cost and stable transactions with ID-verification.

EDUCATIONAL RESEARCH REPORT. Not financial advice. This educational research report was prepared in partnership with Momentum 6 and AscendEx. Concordium will be listed on AscendEx on April 8, 2022, at 13:00 UTC.

More enterprises are exploring the new generation of high-performance blockchains. They no longer have to compromise on features such as scalability and transaction speed to transact permissionlessly and frictionlessly at a low cost on peer-to-peer networks. They still, however, have to compromise on data privacy and anonymity to comply with regulatory oversight.

Data privacy, security, and governance are synonymous with trust. Most enterprises acknowledge that blockchain technology is the infrastructure of the future economy, but without trust, as economists warn us, economic activity and value creation decline. Businesses must trust that their transactions will be private, that their counterparties are creditworthy, and that the regulatory landscape will not shift and make their business model unviable.

This is the privacy paradox: How does a blockchain retain its pseudo-anonymity and anonymity while meeting regulatory and enterprise compliance requirements for user identification? Concordium has solved this dilemma by building a blockchain with an identification layer at the protocol level with advanced privacy algorithms to maintain anonymity, but with a privacy revoker function available to regulators who can essentially override privacy protocols to identify bad actors and illegal transactions.

No doubt, the privacy revocation feature is controversial with cryptographic privacy purists, but for businesses, Concordium’s “regulated decentralized finance” model could be a small trade-off to operate on the blockchain while maintaining the highest privacy protection on the market and ensuring regulatory compliance.

This article provides a deep dive into the technology underpinning the privacy-preserving and regulatory compliant blockchain and explores why Concordium is a state-of-the-science blockchain for the future economy.

What Is Concordium?

Concordium is a blockchain built for businesses unique in meeting the business imperatives of confidentiality and accountability when transacting globally. The blockchain is the first to provide Layer 1 identification at the protocol level to verify participants’ identities and support regulatory compliance. These features are delivered on a high-performance enterprise-grade blockchain that addresses the major impediments to global adoption of the blockchain, including:

low and stable transaction costs to provide businesses with predictability

limitless scalability so companies can grow without constraints

transaction finality to reduce transaction and price risk

interoperability, with the benefits of built-in identification

Concordium’s novel regulated decentralized finance solution is the work of its research team comprised of some of the world’s leading cryptographic and blockchain researchers. Research Center Leader Professor Jesper Buus Nielsen and his colleagues have played a key role in solving the holy grail of cryptography and secure computation. The Swiss-Danish research team based in Zug, Switzerland’s Crypto Valley, is among the most cited contributors to blockchain scholarly research, including pioneering foundational work in zero-knowledge proofs, multiparty computations, and Merkle-Damgård constructions (the cryptographic hash function that supports the fast, secure processing of data on all blockchains).

How Does Concordium Work?

Blockchain and DApp developers face a balancing act in a distributed data-centric world as regulators become more concerned about malicious actors hiding behind and penetrating cryptographic privacy walls. Although the current generation of high-performance blockchains is designed for usability and more use cases, designing for privacy has been challenging. This privacy hurdle has slowed one of the early and great aims of the blockchain, to provide universal digital identities. Concordium makes digital ID sharing possible across applications by providing built-in user identification at the blockchain layer of its interoperable blockchain while meeting current and future regulatory requirements.

What is a Zero-Knowledge Proof (ZKP)?

Behind the privacy solution is a tiny privacy algorithm called zero-knowledge proofs (ZKPs), widely adopted by blockchain infrastructure and applications. ZKPs make it possible to confirm information like personal ID, transaction data, and credentials without actually revealing the data inputs. Today’s ZKPs owe their existence to the early groundbreaking work in secure computation and knowledge proofs conducted by Concordium ID protocol lead Professor Ivan Damgaard and CTO Torben Pryds Pedersen, Ph.D.

At the same time, this popular privacy solution keeps regulators up at night because it can prohibit them from monitoring the reams of data flowing from decentralized sources. Regulators need access to data to monitor and enforce anti-money laundering, tax evasion, terrorism financing, and the rise in cyber fraud.

What is an Anonymity Revoker?

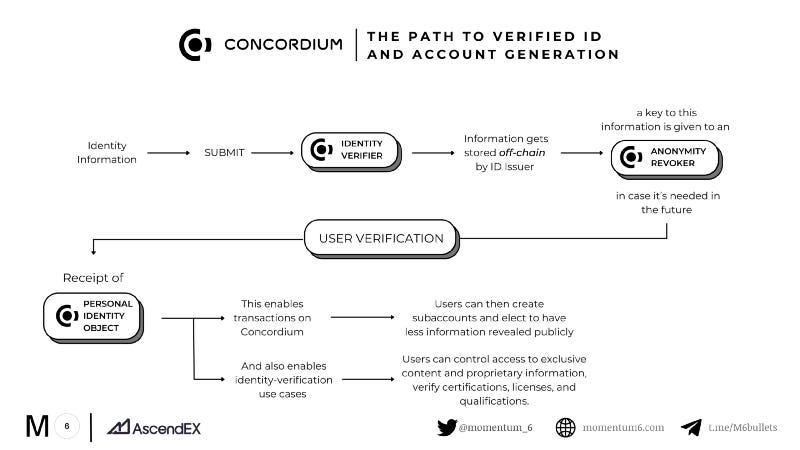

Concordium’s solution is an identity disclosure mechanism that can be triggered by a regulator called anonymity, or privacy, revoker. Each Concordium account can be traced back to its originator (individual or business) through an identity object issued by a third-party ID issuer. Regulators must obtain a court order to demand an anonymity revoker to decrypt the user identity.

Key Features of the Concordium Blockchain

At the heart of Concordium is a large research team of over three dozen scientists and technologists and leading blockchain research partners. Their work has culminated in a number of advanced blockchain features for the Concordium enterprise-grade blockchain, including:

Identity layer that balances privacy with regulatory compliance — Each Concordium user creates a Concordium ID by obtaining a Verified Concordium Identity from a trusted third-party Identity Issuer. Issuers provide off-chain verification of identity and other attributes that can be added, such as credentials and affiliations. ZKPs are used to keep data private and off-chain. Identities are private at the protocol layer with ID accountability, allowing regulators to revoke privacy to monitor and enforce regulatory compliance. If actors are acting suspiciously, identification can be enabled at the request of regulators through the Anonymity Revoker.

Private transactions — Zero-Knowledge Proofs & ID are two core technologies of the Concordium built-in identity layer. ZKPs encrypt information so that parties can verify the information without the data being revealed. ZKPs ensure user data privacy on-chain without revealing the cryptographic keys of the Identity Object. Instead, the trusted Identity Issuer vouches for particular attributes without revealing the underlying data.

Fast and real finalization — Fast finality is a major advance in the current block-by-block processing of blockchain transactions. The Concordium Platform consensus model uses the more resource-efficient proof-of-stake (PoS) consensus mechanism based on a two-layer consensus design, combining a Nakamoto-style consensus (NSC) blockchain and finality layer. On this Nakomoto-style PoS network, transactions are immediately and immutably verified instead of waiting for an entire block to be validated. The Concordium finalization approach eliminates the risk that a block will be rolled back, efficiently adding blocks using NSC while the finalization layer ensures blocks are quickly and securely declared final. The protocol is secure as long as honest bakers hold more than 50% of the stake of all bakers.

Low and stable transaction fees — From supply chain networks to gaming and NFT platforms on the blockchain, highly volatile Ethereum prices have led to highly unpredictable business forecasting and slow and even abandoned adoption for many blockchain businesses. To allow firms to develop and operate viable business models, Concordium has developed a stabilized transaction fee mechanism anchored to the Euro to keep the price, and thus operating costs, low and predictable. The transaction fee is initially set at 1 Eurocent until the end of year 2 and thereafter decreases as the transaction per minute increases.

Scalability — Sharding provides limitless capacity by automatically running shards in parallel to avoid network constraints as data capacity increases. Typically, each node has to process all transactions and execute all smart contracts in a node network. Sharding divides the network into smaller parts called shards, essentially independent blockchains that run many transactions in parallel. The Concordium blockchain also uses Intershards to support cross-communication among smart contracts and private shards to keep shard transactions private from the control chain.

The ID-centric blockchain has made substantial commitments to continue to support leading blockchain research and the development community. Seventy percent of the distribution of the Concordium native token CCD (Con+Cor+Dium) is allocated to developers and enterprise partners. The Concordium Foundation has allocated $100 million to developer grants and endowments.

Concordium Technology

The research arm of the Concordium Blockchain, the Concordium Blockchain Research Center Aarhus, or COBRA, is a leading global research center for cryptography and blockchain technology. They have developed Concordium’s key technology, on-chain encryption linking blockchain accounts to an off-chain identity. This is achieved at the protocol level through the following features:

Concordium’s public, permissionless blockchain, enables businesses to manage counterparty risk and comply with regulations.

User identity, for example an individual or a business, stored off-chain securely and remains private but may be revealed to authorities following a court order via established legal channels.

User option to keep transactions private but with ID accountability.

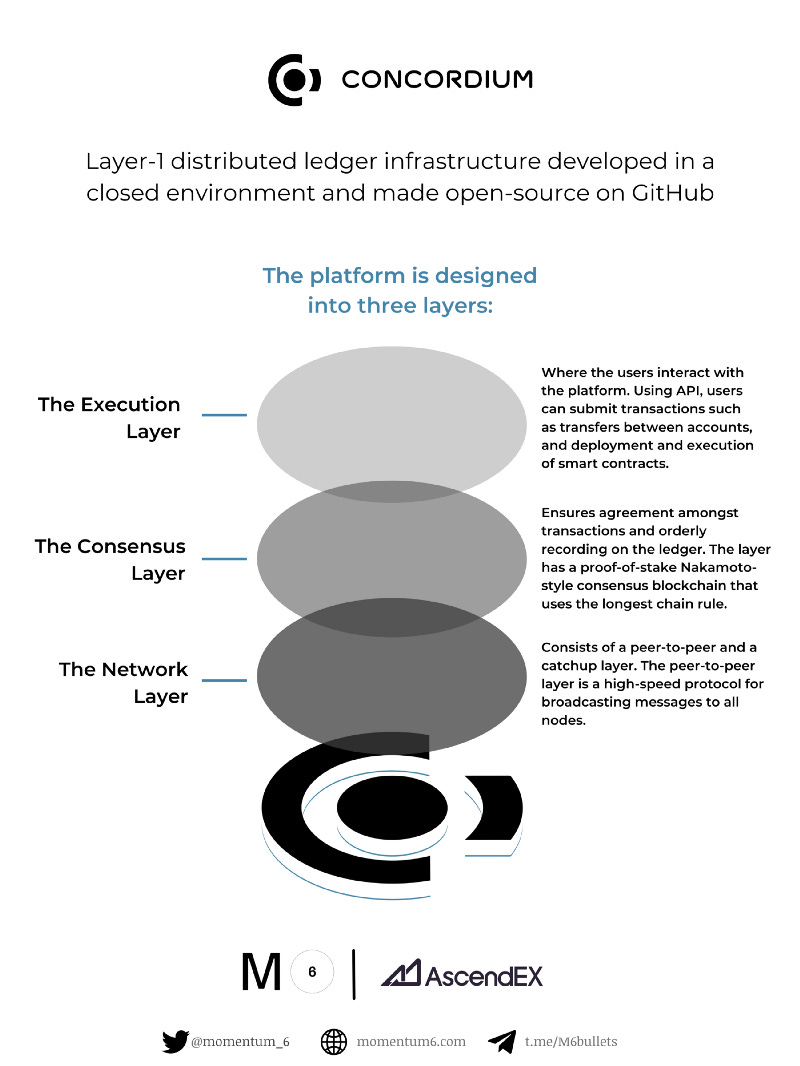

Concordium delivers the privacy-preserving, regulatory compliant blockchain with enterprise-grade performance through some noteworthy innovations in blockchain architecture.

Two-Layer Consensus

Concordium provides businesses with fast, secure, and reliable transactions through a 2-Layer Consensus Mechanism combining a Nakamoto-style Blockchain with an innovative finalization layer. When compared to the Nakamoto blockchain, the dual blockchain provides speed without sacrificing security by:

• Declaring blocks as final faster as long as corruption of the total stake is below 1⁄3

• Delivering the same security guarantees even when corruption is between 1⁄3 and 1⁄2.

Two actors carry out consensus:

Bakers — participate in lotteries to win the right to produce a block in exchange for a share of the gas fees collected, with the probability of winning tied to the amount of $CCD the Baker has staked.

Finalizers — finalization is run by a finalization committee whose members are call finalizers. For finalization to work properly, honest finalizers need to hold more than 2⁄3 of the total stake among all finalizers. The finalization committee consists of bakers with at least 0.1% of the total stake, ensuring that there are at most 1,000 finalizers in the committee and that all nodes with a substantial stake can participate.

Scale With Sharding

Concordium Sharding uses both the Control Chain and fast Finalization layer to ensure that supply capacity always surpasses the demand with very high reliability. As traffic increases, additional shards are automatically started. This prevents a lack of capacity from becoming a determinant in transaction pricing.

Interoperable

Interoperability means businesses can create substantial value from Concordium blockchain’s innovative features, namely, users can use the built-in identification to lower counterparty risk when interacting with other blockchains. Concordium is developing a novel approach that uses sharding, specifically intershard signaling, to allow users to send short authenticated messages to other chains without operating from the Concordium Platform.

On Concordium’s flexible, open development platform, expect to see the core built-in identification technology quickly adapt and evolve to meet more privacy needs of the enterprise blockchain market. The platform was designed to support the development of new consensus protocols and algorithms. This adaptability, for example, will make it easy to customize and add new privacy attributes. Concordium currently supports several types of zero-knowledge proofs, Classic Sigma protocols proving identity, and Bulletproofs to confirm a value within a range. Next, the research team plans to add SNARKs, which can process larger snippets of information faster in a smaller package.

Team

Lars Seier Christensen

CHAIRMAN

Lars Seier Christensen is Chairman of the Swiss non-profit Concordium Foundation. With over 30 years of experience across the banking and financial sector, Seier Christensen is a global pioneer in FX and derivatives trading, having co-founded the online trading and investment platform Saxo Bank in 1992. He served as co-CEO of Saxo Bank for more than 20 years. The bank grew to 1,500 employees across 150 locations serving customers in 170 countries during that time. SaxoTrader, the bank’s flagship online trading offering, was launched in 1998 and was one of the first online FX trading platforms. Seier Christensen is also the founder of Seier Capital, a private equity and venture capital firm specializing in investments in angel, seed, and A-round stage companies.

Lone Fønss Schrøder

CHIEF EXECUTIVE OFFICER

Lone Fønss Schrøder is CEO of Concordium. With extensive executive experience ranging from large-cap companies in aviation, biotech, retail, automotive, oil & gas, and shipping to banks and capital markets, Fønss Schrøder is also co-founder of the bank-fintech company Cashworks, Vice Chairman of Volvo Cars, and a Director at IKEA. She spent 22 years at A.P. Moller-Maersk — the world’s largest shipping company — and in 2005, was appointed President of Wallenius Lines, a leading provider of transport solutions and terminal facilities for the automotive industry.

Kåre Kjelstrøm

CHIEF TECHNOLOGY OFFICER

Kåre joins Concordium from a hyper-growth American pre-IPO startup where he managed the Core Infrastructure group, built the organization across 15 timezones, and created high-performance teams. Previously, he was a manager at Uber running Core Storage, building highly scalable distributed ledger and storage solutions, initially from Denmark and later from Toronto, Canada. As a co-founder of the consulting company Silverbullet, Kåre helped drive the digital transformation of the Danish Public Sector with a focus on PKI secured service-to-service communication.

Tokenomics

The Concordium tokenomics model prioritizes the rewarding of Developers and Enterprise Partners with the Concordium native token CCD (Con+Cor+Dium). More than 70 percent of the token issuance is allocated to people building on the ecosystem. The initial token mint of 10 billion $CCD has a targeted long-term growth rate of 2 percent per annum. The growth rate is linked to the transactions per second processed, falling from the current 10 percent to 6 percent at 1.7 TPS, eventually declining to 2 percent at 33.3 TPS.

Income is generated from:

Payment for Newly Minted $CCD — For each new block baked, more $CCD is minted. Bakers create blocks in exchange for a percent of the transaction fees. A lottery determines the right to create the next block, and the probability of winning is determined by the number of $CCD staked in each baker’s Baker account. New $CCD is distributed among the Concordium Foundation (10%), Baking Reward Account (85%), and Finalization Reward Account (5%).

Transaction Fees — Transaction fees paid by blockchain users in $CCD are linked to the Euro to provide users stability and predictability. Of the fees paid into the GAS account, 90% is allocated to rewarding bakers, and the remaining 10 percent is paid to the Foundation.

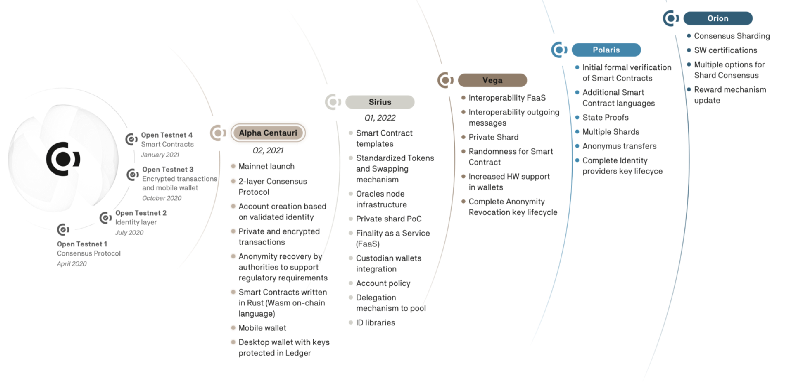

Roadmap

Concordium has met its significant milestones to date in its epoch Roadmap to launch the first enterprise-grade, regulated decentralized finance blockchain. Following four testnets, the mainnet launched in June 2021. Going forward, exciting add-ons are ahead, including the sharding beta for scalability and bi-directional bridge for interoperability, which developers should be able to explore in the continuously running public, open Mainnet testnet.

A major focus is on expanding the development environment so more applications can build on the Concordium ecosystem and adding additional smart contract languages, compilers, and automated backend infrastructure for DApp development. As mentioned, developers are being incentivized with $100 million in rewards.

The Future ID-Centric Blockchain

Since the Concordium mainnet launched in June 2021, diverse business sectors, from NFTs to self-driving cars, have supported regulated decentralized finance by making official their intention to build on Concordium. By the end of the year, over 200 nodes were operating, with 2,000 to 3,000 accounts registering per day, positioning the blockchain as a leader in the enterprise blockchain market.

Concordium will not be a go-to blockchain for dark web activities. In the same way unregulated brokerage firms eschew regulated regimes like the United States, some DeFi applications will choose not to have a presence on this blockchain. Put another way, bad actors are less likely to use the Concordium blockchain, which lowers the risk of doing business for other users on the blockchain. Similarly, other blockchains in B2B transactions with the Concordium blockchain can rest assured that every account on the network is linked to a real ID that third-party verifiers have validated. This provides business identities with a cryptographic seal of approval in the global business community. And crucially, decentralized applications wanting to future-proof their businesses can ensure their decentralized enterprises comply with regulatory compliance jurisdictions around the globe.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained here constitutes a solicitation, recommendation, endorsement, or offer by me or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.