Another day in our wacky little crypto bubble and more revelations and bombs continue to drop. Most egregious is that in a NY Times interview, Alameda CEO, Caroline Ellison admitted that Alameda used FTX customer funds to make payments after the market crash earlier in June.

Alameda dug itself into a hole and even though FTX and Alameda were supposed to be separate entities, this basically amounts to admitting to fraud. Also, we’re finding out 4 years after the fact that Gate was hacked by North Korea for $230M and never disclosed it..

Something needs to change in the industry. Transparency is meant to be one of the core pillars of crypto and we’ve seen far too many examples this year of how this space is far from transparent

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

FTX Saga Timeline Week 2

FTX owes totaling close to $9.0B outstanding

Alameda CEO said Alameda used FTX customer funds to make payments after market crash

SBF gives interview to the NY Times - says he’s been getting sleep and playing video games

FTX hacker swapped DAI for ETH - now the 36th largest holder of ETH

FTX hacker potentially doxxed by using KYC’d Kraken account to send TRX for gas fees

FTX may have more than one million creditors

Gate was hacked by North Korean hackers on April 1, 2018 for $230M without disclosing

Nansen released an overview of exchanges’ on-chain asset holdings and portfolios

Between 25% and 40% of crypto hedge funds had some level of direct exposure to FTX or FTT

OKX announced $100M to support projects with liquidity issues and to migrate from Solana

FTX’s new CEO all-hands meeting - plans to reorganize and seeks support from staff

Alameda Research may have frontrun FTX listings

Sino Global Capital revealed that mid-seven figures in assets held in custody on FTX

NBA team The Golden State Warriors ending its $10M sponsorship agreement with FTX

Turkish law enforcement investigating FTX's local arm

Liquid Exchange, acquired by FTX, will stop withdrawals due to the Chapter 11 filing by FTX

Electric Capital unaffected by FTX - only $125K stuck on exchange

Celestia project treasury unaffected. FTX invested into Celestia’s most recent fundraising round

Approved provisional liquidators to oversee FTX Digital Markets Ltd.’s assets

Binance, BitMEX and KuCoin have delisted FTX Token pairs

Nigerian crypto startup Nestcoin’s operational funds stuck on FTX

Crypto lending platform Salt halts withdrawals and deposits, citing FTX collapse

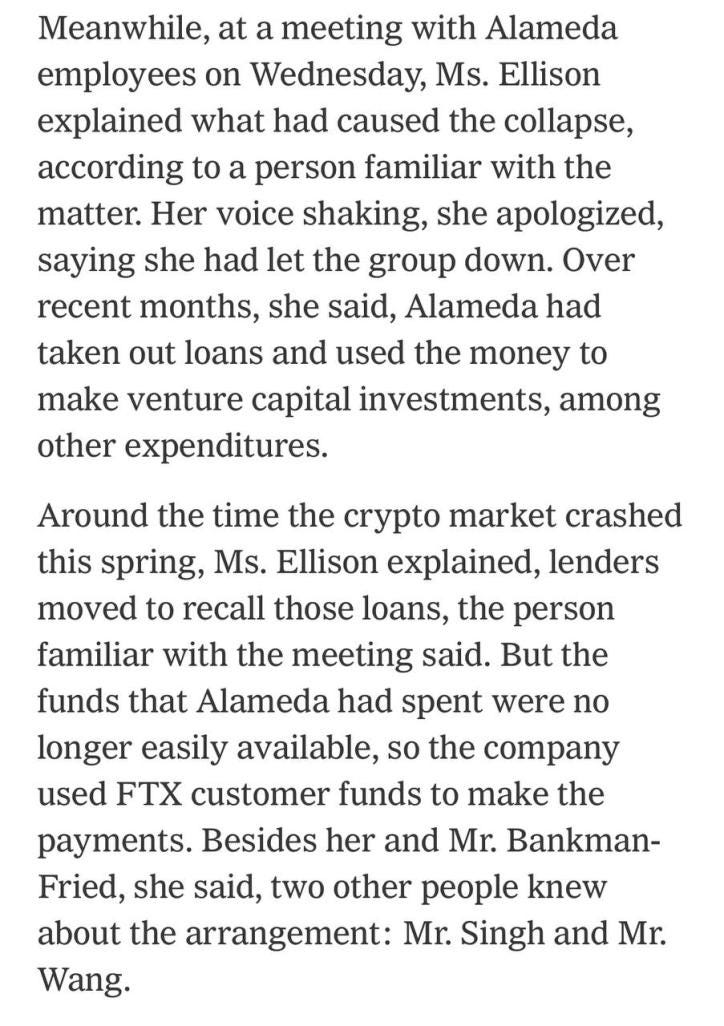

Basically a confession from Alameda CEO:

Now for a more expanded and detailed look at the day.

Crypto News:

Circle $USDC adds support for Apple Pay

Cathie Wood's Ark Invest added over $2.8M worth of GBTC shares. GBTC’s discount is currently -39.81%

The Cosmos community voted against the latest ATOM 2.0 proposal, which aims to revamp the ecosystem’s native ATOM token. Voter turnout for the proposal reached 73.41%

Hardware wallet manufacturers Ledger and Trezor both reported a huge spike in sales as consumers rushed to self-custody solutions to safeguard their digital assets

Crypto Oasis will be the official regional partner for Decipher 22, the annual Algorand ecosystem conference

Economic/Government/Regulatory:

The European Union is considering a ban that would prevent banks and crypto providers from dealing with privacy coins such as zcash, moner, dash and others

The New York Federal Reserve and a group of private banking firms are developing a DLT-based digital dollar pilot

Exchange News:

FTX owes more than $5.0B USD, $1.41B BTC, $800M Tether and $670M ETH, along with loans to BlockFi, Genesis and LayerZero totaling close to $9.0B outstanding

Alameda CEO said around the time the crypto market crashed, lenders moved to recall loans but the funds that Alameda had spent were no longer easily available, so the company used FTX customer funds to make the payments

Blockchain analytics firm Nansen released an overview of major cryptocurrency exchanges’ onchain asset holdings and portfolios in the wake of FTX’s collapse

Between 25% and 40% of crypto hedge funds had some level of direct exposure to FTX or FTT. The losses may be over $1B and possibly as much as $5B

FTX hacker tried sending USDT on the Tron blockchain multiple times unsuccessfully because they didn’t have enough TRX to pay for transaction fees. So the looter used their verified personal account on Kraken to send 500 TRX to the compromised wallet address to cover the gas fees. This is how they linked their KYC

SBF gives interview to the New York Times - says he’s been getting sleep and playing video games

FTX’s new CEO held an all-hands meeting to discuss the exchange group’s future after its bankruptcy filing - plans to reorganize and seeks support from staff

Alameda Research used prior knowledge of tokens that were scheduled to be listed on FTX to buy them ahead of the public announcements and then sold them for a profit

Sino Global Capital revealed that mid-seven figures in assets held in custody on FTX

FTX may have more than one million creditors

The FTX drainer address swapped DAI for ETH, swapped BNB on BSC and bridged to Ethereum. The address is now the 36th largest holder of ETH

NBA team The Golden State Warriors is set to pause all FTX-related promotions, ending its $10M sponsorship agreement

Turkish law enforcement investigating FTX's local arm

OKX announced $100M to support projects with liquidity issues and to migrate from the Solana

Gate was hacked by North Korean hackers on April 1, 2018 for $230M without disclosing

Liquid Exchange, a licensed Japanese exchange acquired by FTX, announced that it will stop withdrawals due to the Chapter 11 filing by FTX

Electric Capital unaffected by FTX - only $125K stuck on FTX exchange that was used to help a portfolio company

Celestia project treasury is unaffected by the FTX fallout. FTX Ventures made a small investment into Celestia’s most recent fundraising round

The Supreme Court of the Bahamas approved provisional liquidators to oversee FTX Digital Markets Ltd.’s assets

Binance, BitMEX and KuCoin have delisted FTX Token pairs

Nigerian crypto startup Nestcoin’s operational funds stuck on FTX. Raised $6.5M from investors including Alameda earlier in the year

DeFi News:

Solana DeFi sees almost $700M in value wiped out on FTX fallout

Trust Wallet launches browser extension

The 1inch Router v5 is released

NFT/Gaming/Metaverse News:

Adidas included its BAYC character named Indigo Herz in a recent World Cup promotional trailer including football stars Lionel Messi and Karim Benzema

The floor price of BAYC has dropped by more than 20% in the past week

PlayStation has been working on NFTs and blockchain technology, Sony patent reveals

Cristiano Ronaldo partners with Binance to launch his first NFT collection

Yuga Labs plans to donate CryptoPunks NFTs to modern art museums around the world

A one-of-a-kind NFT of the Birkenstocks sandals worn by Apple co-founder Steve Jobs at various times during his life has sold for $218,750 at an auction

Bangalore International Airport in India launched Metaport, a metaverse airport built on the Polygon blockchain

Fundraises:

Yakoa, a California-based NFT fraud detection startup, has raised $4.8M in a seed funding round. Brevan Howard Digital, Volt Capital and Collab+Currency co-led the round

Binance Labs made a $4M strategic investment in Ultimate Champions, a free-to-play fantasy sports platform that will be deployed on the BNB Chain

Web3 gaming monetization platform PlayEmber raised $2.3M in a pre-seed round led by Shima Capital. Investors in the round also include Big Brain Holdings, Hyperithm, Warburg Serres, Lyrik Ventures and Huobi Ventures

Early Stage Projects:

Daylight is out of closed beta - wallet has special abilities you don't know about, and Daylight uncovers them for you: mints, airdrops, unlocks, votes, etc

What’s your take on today’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Data:

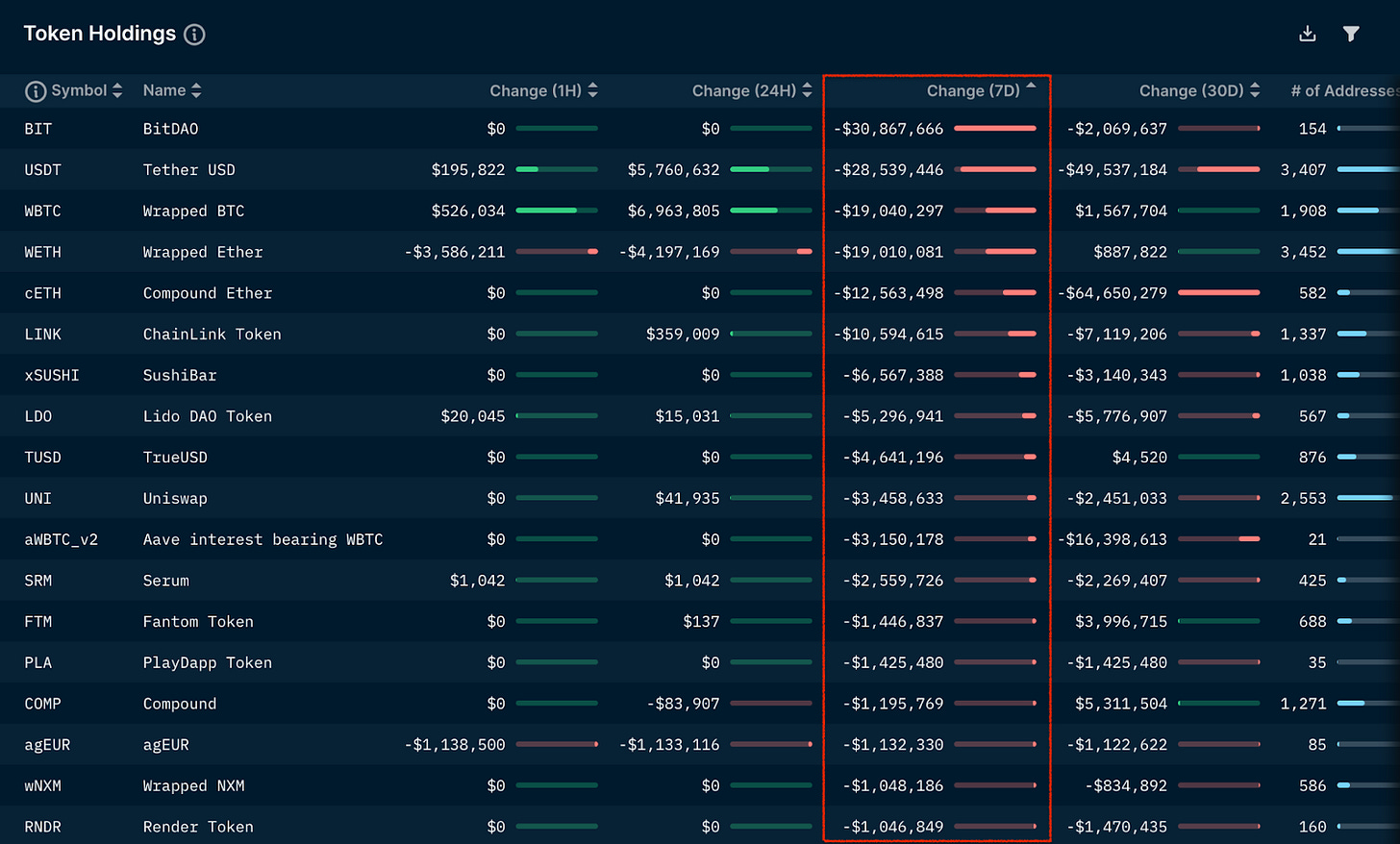

TL;DR: Nansen smart money seems to be moving into BUSD, WBTC and USDT today and moving out of USDC and WETH. On the weekly, money is moving primarily into BUSD followed by DAI and moving out of BIT, USDT, WBTC and WETH. There has also been a spike in the volume of BAYC.

Nansen Smart Money Holdings Token Inflow and Outflows: Tracking what the whales are up to...

- Inflow (1D):

- Outflow (1D):

Weekly:

- Inflow (7D):

- Outflow (7D):

Nansen NFT Hot Contracts:

What is the Data telling you? See anything that sticks out to you?

Research/Reads:

Fantom: Consensus practically explained - source

The Merge series: Rewards - source

Midterm Miracle - Macro Update: How the Market Reacts to Elections - source

Crypto Wallets: The Drivers of Mass Adoption - source

In summary: What is the real reason for the collapse of the FTX empire? - source

Have you seen our institutional-quality research?

Crypto Twitterverse:

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.