Genesis Down & Gemini Issues - Dominoes Keep Tipping

Daily Bullets: Wednesday, November 16th

Today's prominent casualty of the day: Genesis

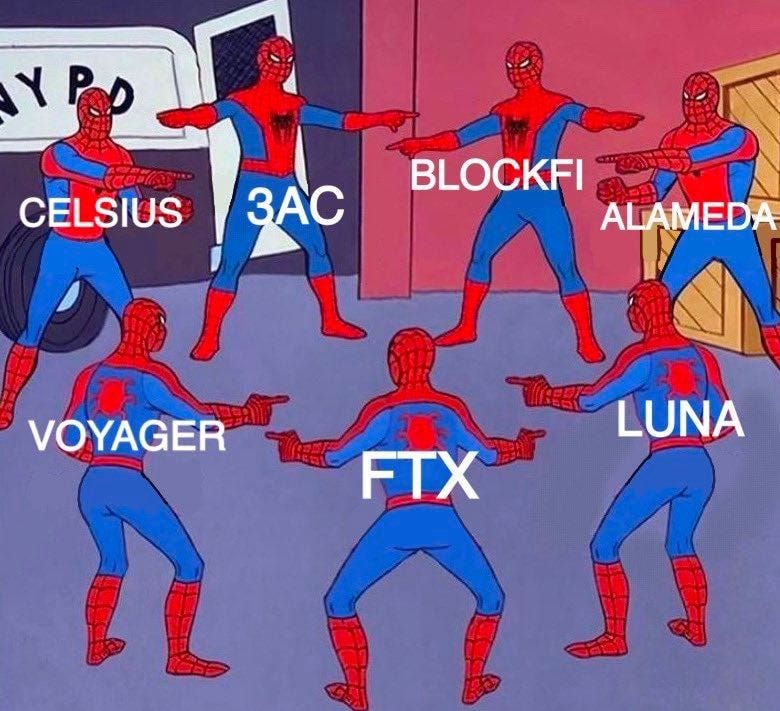

The fallout from the FTX Saga continues and dominoes continue to fall. This will be a recurring theme over the next weeks and months due to the deeply interconnected Crypto landscape. Everyone was lending and borrowing from each other.

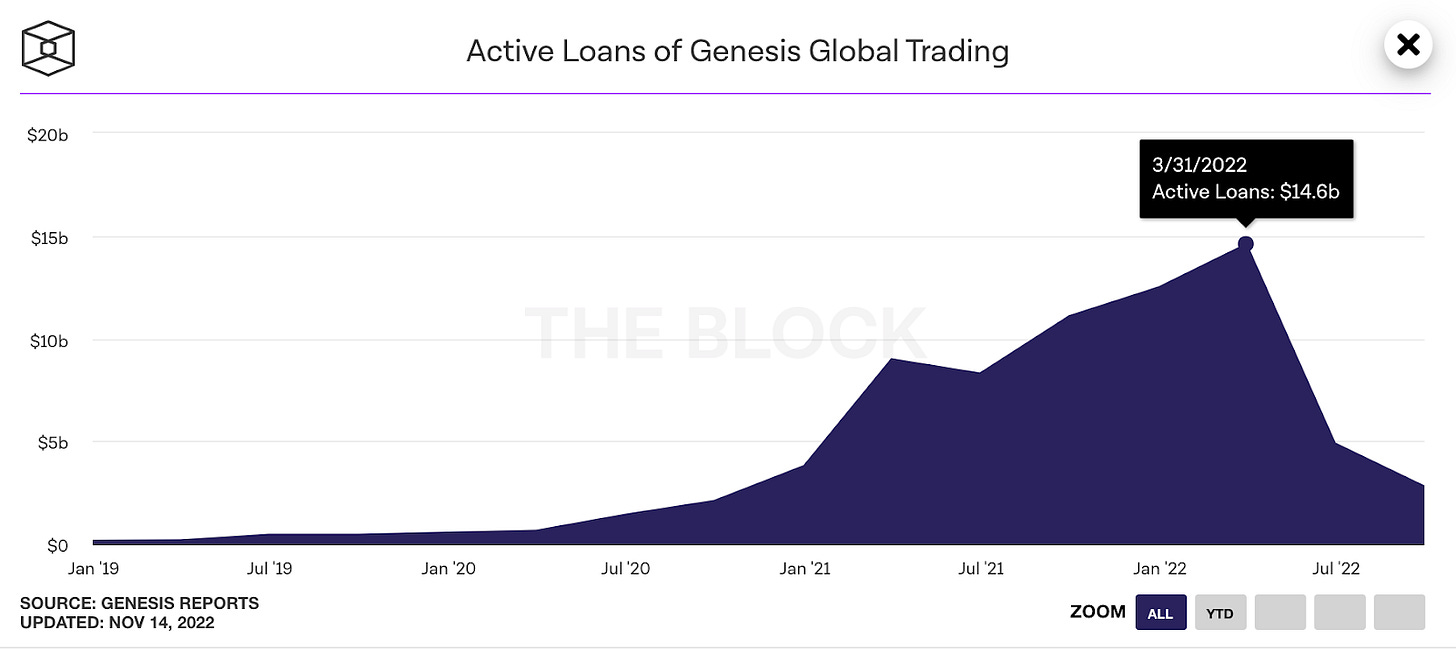

It was previously reported that Genesis had ~ $175M in locked funds on FTX however it didn't impact their market-making activities. Then they received $140M equity infusion from parent company DCG. Currently has $2.8B in active loans. Down from peak $14.6B back in late March

The news also trickles over to Gemini Earn which is unable to meet customer redemptions. Blockfi is also considering filing for bankruptcy..

We're working on a complete casualty report from the fallout so keep an eye out for that. We'll unfortunately see more casualties emerge

Rumors also continue to circulate: SBF extradited? Upcoming congress meeting? Plus Celebrities getting sued. Everyone distancing themselves. Crazy times.

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

FTX Saga Timeline Week 2 continued:

US reportedly considering SBF extradition for questioning

SBF sued in U.S. court for yield-bearing crypto accounts which allegedly violated Florida law

The U.S. House Financial Services Committee will hold a hearing into FTX next month

BlockFi considering filing for Chapter 11 bankruptcy protection and preparing for job cuts

Lending arm of Genesis is temporarily suspending redemptions and new loan originations

Gemini Earn unable to meet customer redemptions due to Genesis unit pausing withdrawals

Crypto exchange Gemini reports broad outage, says client funds secure

Grayscale products are operating "business as usual" and operations have not been impacted

Crypto lender Ledn has no exposure to Genesis and is fully operational

Market maker B2C2 offered to purchase loans from Genesis

Bahamas-based subsidiary FTX Digital Markets filed for Chapter 15 bankruptcy protection

Bankrupt crypto lender Celsius Network had $12M in outstanding loans to Alameda Research

Temasek, Sequoia Capital and SoftBank writing off hundreds of millions they invested into FTX

Tom Brady, Gisele Bundchen, Steph Curry, Larry David class action lawsuit for FTX promo

Esports club Team SoloMid (TSM) suspended its 10-year, $210M sponsorship deal with FTX

Binance has taken over all of FTX futures market share

DeFi prime brokerage service Oxygen had FTX act as custodian for over 95% of coin supply

Investing platform Bnk To The Future terminated it’s intent to buy Salt Lending

Politicians, regulators and athletes are attempting to distance themselves from FTX and SBF

Australian financial regulator suspended FTX Australia's financial services license

Now for a more expanded and detailed look at the day…

Crypto News:

Luna Foundation Guard spent $2.8B defending UST peg

CoinGecko New Feature: Exchange's Proof of Reserves

StarkNet Token deployed on Ethereum Mainnet. Tokens held by StarkWare shareholders, employees and independent partner software developers are locked for 4 years. Distribution mechanism not yet established

Economic/Government/Regulatory:

U.S. SEC delays decision on ARK 21Shares spot Bitcoin ETF to Jan. 27

South Korean authorities raid Terraform Labs co-founder Daniel Shin’s company. Also summoned Shin as part of another investigation into the selling of pre-issuance Luna tokens

Exchange News:

US reportedly considering SBF extradition for questioning

SBF sued in U.S. court by investors alleging the company’s yield-bearing crypto accounts violated Florida law

The U.S. House Financial Services Committee will hold a hearing into FTX next month

The lending arm of crypto investment bank Genesis Global Trading is temporarily suspending redemptions and new loan originations in the wake of FTX’s collapse. Served an institutional client base and had $2.8B in total active loans as of the end of the third quarter of 2022

Prominent crypto market maker B2C2 has offered to purchase loans from the suddenly-struggling crypto financial firm Genesis

Grayscale said that its products are operating "business as usual" and operations have not been impacted by "recent events" after Genesis Global Capital halted withdrawals

Gemini Earn unable to meet customer redemptions due to Genesis unit pausing withdrawals

Canadian crypto lender Ledn has no exposure to Genesis Global Capital and is fully operational - Genesis was Ledn's primary lending partner at the start of its operations

FTX Digital Markets, the Bahamas-based subsidiary of collapsed crypto exchange FTX, filed for Chapter 15 bankruptcy protection

Crypto lending platform BlockFi is considering filing for Chapter 11 bankruptcy protection and preparing for job cuts after FTX collapse

Bankrupt crypto lender Celsius Network had $12M in outstanding loans to Alameda Research

FTX investors including Temasek, Sequoia Capital and SoftBank are writing off hundreds of millions of dollars they invested into FTX

Celebrities who promoted troubled crypto exchange FTX are facing a class action lawsuit for promoting unregistered securities. Tom Brady, Gisele Bundchen, Steph Curry and Larry David are among those named in the lawsuit

Binance has taken over all of FTX futures market share

DeFi prime brokerage service Oxygen, which Alameda and Multicoin once led a $40M investment, said FTX Group acted as custodian for over 95% of the overall supply of its tokens

Online investing platform Bnk To The Future terminated its non-binding letter of intent to buy Salt Lending due to FTX collapse

Esports club Team SoloMid (TSM) suspended its 10-year, $210M sponsorship deal with FTX

Politicians, regulators and athletes are attempting to distance themselves from FTX and SBF

The Australian Securities and Investments Commission suspended FTX Australia's financial services license in the country until May 15, 2023

Binance secured permission from regulators in Abu Dhabi to operate as a crypto custodian for institutional clients

Proof of reserves for Bitfinex - holds: 204338.17967717 BTC, 2018.5 L-BTC (Liquid), ~1000 BTC on LN, 1225600 ETH

Coinbase CEO Brian Armstrong sells more than $1.6M in shares

Coinbase & Coinbase Exchange will list Lido DAO (LDO)

Bitget, a Singapore-based crypto derivatives exchange, has launched operations in Brazil

DeFi News:

Circle estimate that up to $3.0B of the $8.3B decline in USDC in Circulation from June 30, 2022 to September 30, 2022 was driven by the auto conversion by Binance of USDC to BUSD

New users of Uniswap’s Web App reached a 2022 high

MetaMask and Laconic launch MobyMask light client - a new initiative from the MetaMask team to help proactively protect users from phishing, uses a dynamic web of trust for sourcing phishing reporters

Trader Joe - Liquidity Book: Launch Day Plan

Introducing yBribe. Yearn’s new bribe platform for Curve gauge voting

Aave is live on Aztec. The leading open source protocol for non-custodial liquidity markets, now with full privacy and 12x lower gas fees

Maker Teleport - A MakerDAO infrastructure for teleporting DAI across the multi-chain space without losing security or scalability

A call to Build Smarter Self-Custody - Safe commits $1,000,000 in grants for teams building better alternatives to custodial solutions

NFT/Gaming/Metaverse News:

Binance to include OpenSea NFTs on Binance NFT Marketplace

SolChicks NFT project lost up to $20M of treasury funds due to the UST implosion in May 2022 and decided not to inform the community

Fundraises:

Matter Labs has raised $200M in a Series C round to launch first-party projects built by Matter Labs, grow its team, and fund other ecosystem projects built by external teams led by Blockchain Capital and Dragonfly with participation from LightSpeed Venture Partners, Variant, and Andreessen Horowitz

JUMBO, one of the foremost DEXs on NEAR, raised $3.5M in fundraising round - Leading Investors: Pantera Capital, Huobi Ventures. Participating: D21 Ventures, Big Brain Holdings, Dweb3 Capital, Fundamental Labs, MetaWeb.

Thallo raises $2.5M for next generation carbon credit exchange powered by blockchain

Early Stage Projects:

Announcing “Beta-2”: Fuel's Second Public Testnet - brings cross-chain bridging

What’s your take on today’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Data:

Genesis last week said it had ~ $175M in locked funds in an FTX trading account however it didn't impact market-making activities and they received $140M equity infusion from parent company DCG. Currently $2.8B in active loans down from peak $14.6B back in late March

The entity being tracked by Arkham Intelligence shows that their account balance topped in late December at $4.5B and is currently ~ $244M with their largest holding beings ETH and USDC

Looking at their profit and loss, it looks like they slipped into the red starting in May

What is the Data telling you? See anything that sticks out to you?

Research/Reads:

Binance's CZ lists six requirements for safe exchanges - source

Coinbase - The long winter gets longer - source

Luna Foundation Guard (LFG ) - Technical Audit Report - source

Taking A Long Term View Of Web3 - source

Understanding the Tax Implications of NFTs, Staking and Yield Farming - source

A look at the future innovation direction of fan tokens under the World Cup Upsurge - source

Binance Responses to the Chair of the Treasury Select Committee on questions to Binance at the crypto asset industry hearing on 14 November 2022 - source

The Other Side Of The Trade: QCP Capital - source

Have you seen our institutional-quality research?

Crypto Twitterverse:

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.