Thread 🧵: Grayscale "Bear Markets in Perspective" Summary

Here's a brief summary of the report in short and easy-to-understand Tweets

Grayscale recently published a lengthy Bear Market report: Bear Markets in Perspective

We read the whole report so that you don't have to!

Here's a brief summary of the report in short and easy-to-understand Tweets:

👇🧵

1/

Born out of the 2008 economic recession, crypto has grown from an idea in a nine-page white paper to a trillion-dollar industry

Understanding where we are in this market cycle offers a perspective to deal with the uncertainty that clouds the crypto markets in a bear market

2/

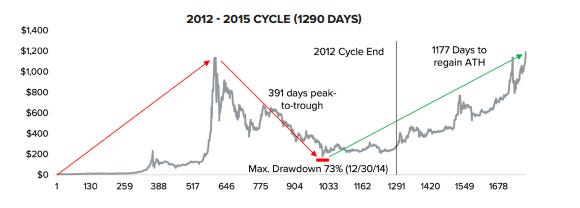

The previous market cycle's length, time to peak and trough, and recovery time to ATH may suggest that the current market may resemble previous cycles

3/

1. Crypto Market Cycles:

• Identifying Crypto Cycles:

Crypto market cycles have mostly mirrored the ebb and flow of traditional markets

Crypto market cycles usually last ~4 years or ~1,275 days

4/

While there are several methods to identify crypto market cycles, they quantitatively define a cycle when the "Realized Price" moves below the "Market Price" using Bitcoin prices as a proxy

Realized Price = Realized Market Cap / Current Supply

5/

Realized Market Cap - The sum of all assets at their purchase price

Current Supply - Market Capitalization of the asset

Realized price provides a measure of how many positions are in or out of profit

6/

A Realized Price below Market Price implies that most assets are held above the price they were bought

Conversely, a Realized Price above Market Price implies that most assets are held below the price they were bought

7/

When most assets are held above the price they were bought, the market begins to transition out of a bear market and into a new cycle

As of June 13, 2022, the Realized Price of $BTC crossed below the Market Price, signaling that we may have officially entered a bear market

8/

These points in the market cycle could present some of the best opportunities to buy

Just 21 days into this zone, we may see another ~250 days of high-value buying opportunities when compared to previous cycles

9/

• Market Cycles by the Numbers:

#Crypto market cycles have been taking longer to peak each time

The time taken to peak each time increases approximately by 180 days for each subsequent cycle

10/

Time taken to peak:

2012 - 603 days to peak

2016 - 786 days to peak

2020 - 952 days to peak

Time taken from peak to trough:

2012 - 391 days to fall 73%

2016 - 364 days to fall 84%

Cycle end time:

2012 - 1290 days

2016 - 1257 days

11/

2020 cycle: ~1200 days

Time taken from peak to trough: 222 days to fall 72%

So, we may see another 5-6 months of downward price movement

Est. 2020 Cycle End: There could be another ~4 months left in this cycle until the Realized Price crosses back above the Market Price

12/

2. A Brief History of Crypto Market Cycles:

• 2012 - 2015: Hack Era + Beginnings of Ethereum

In 2012, Bitcoin’s primary use was online purchases of goods from websites like the Silk Road

The crypto market consisted almost exclusively of Bitcoin

13/

The major theme of this cycle was the proliferation of new crypto exchanges and wallets

During this period the market experienced a lot of setbacks like the closure of the Silk Road, China banning Bitcoin, the Mt. Gox hack of 850,000 Bitcoin & other crypto exchange hacks

14/

The price of #Bitcoin dropped ~80% in the year following the peak on December 16, 2013

Due to price decline, a lot of players left the market while those who remained continued to build & innovate

#Ethereum is the most significant of them all

15/

Ethereum introduced the power of "smart contracts," which allowed the creation of dApps

• 2016 - 2019: ICO Experimentation Era & the Birth of DeFi

Sentiment in the crypto market continued to improve, as Ethereum brought more programmability to crypto

16/

Initial Coin Offerings (ICOs) gained immense popularity both as fundraising tools and scamming mechanisms during this period

Many retail users bought tokens to support visions that would never be filled

The crypto exchange BitMEX also launched perpetual swaps (perps)

17/

Leveraged trading on worthless ICO tokens only exacerbated the frenzied price action

Macro drivers, like QT and trade disputes, caused the total crypto market cap to fall from $700B to $100B

However, most of the major dApps were launched during this period Ex: $AAVE, $UNI

18/

• 2020 - Present: Leverage, Institutions, & DeFi Battle-testing

The 2020 market cycle is a story of leverage

The launch of perpetual swaps and CME Bitcoin futures enticed investors to use more leverage in the markets

19/

The market unwound after hitting an initial price peak of $64.8k due to high leverage from perps and other derivatives

Towards the end of summer 2021, was the period where the leverage was largely in the hands of #CeFi firms and hedge funds

20/

#DeFi yields range anywhere from 5% to 20%

CeFi platforms offered users around 3-8% APY and used the deposits to capture the difference

When the FED started raising interest rates, prices began to fall for the second time from ATH, liquidating a lot of CeFi's positions

21/

As prices began to drop:

$UST collapsed, which wiped out over $35 billion

stETH: $ETH peg broke down to <.95

Institutional firms became insolvent

CeFi platforms filed for bankruptcy

Despite tough market conditions, the major DeFi protocols continued to operate properly

22/

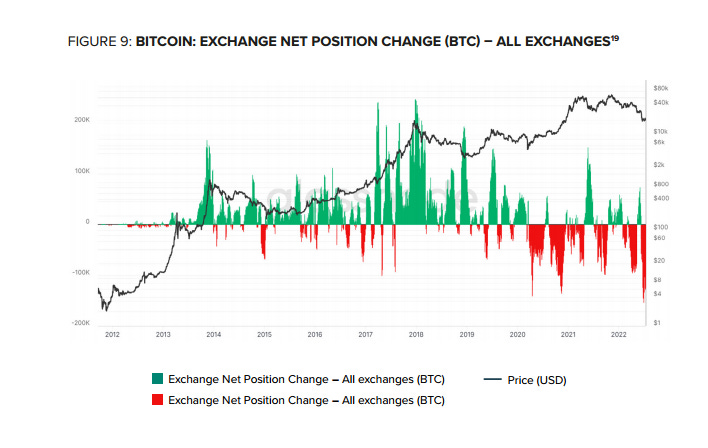

3. What’s Happening On-chain?

The amount of Bitcoin on centralized exchanges experienced the largest outflow on record in June 2022

This signals that investors may be wary of keeping funds with centralized lenders who may be experiencing liquidity issues

23/

The number of wallet addresses holding .001-1 BTC also reached new ATHs

This is interesting b/c smaller investors have historically decreased their positions sizes in times of uncertainty

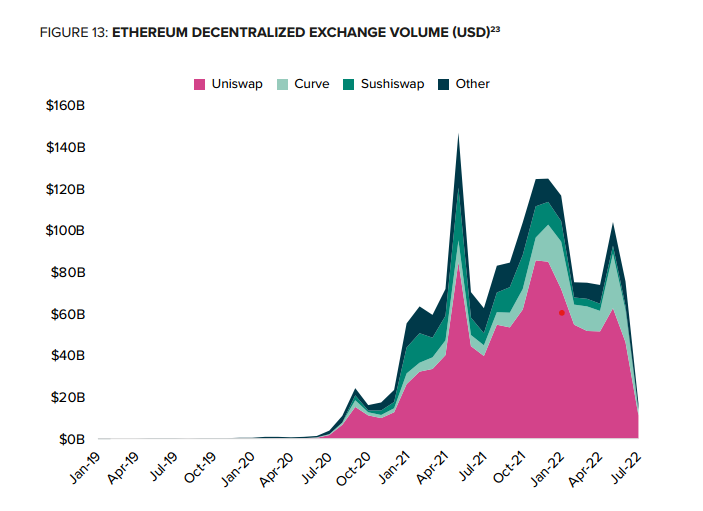

Monthly DEX volume has also remained stable amidst volatile market conditions

24/

In June 2021, #DEXs were handling a few billion dollars in volume

As of June 2022, DEXs like @Uniswap did approximately $75 billion in trading volume

#Metaverse is also one of the fastest growing crypto sectors with more than 230 assets valued at over $11 billion

25/

4. What's next?

Crypto has enabled users to truly own digital assets without personally operating the physical hardware it lives on

The bad news of 80% drawdowns can be viewed as good news for investors with a long enough time horizon

26/

Every market cycle that the crypto market has gone through has left the ecosystem stronger than the previous ones

This market cycle has provided us with battled-tested DeFi protocols, innovations in scaling solutions, a growing metaverse industry, and more!

Here's the original report: https://grayscale.com/wp-content/uploads/2022/07/Bear-Markets-in-Perspective-FINAL-Designed.pdf