Harmony Grant Spotlight: InsurAce

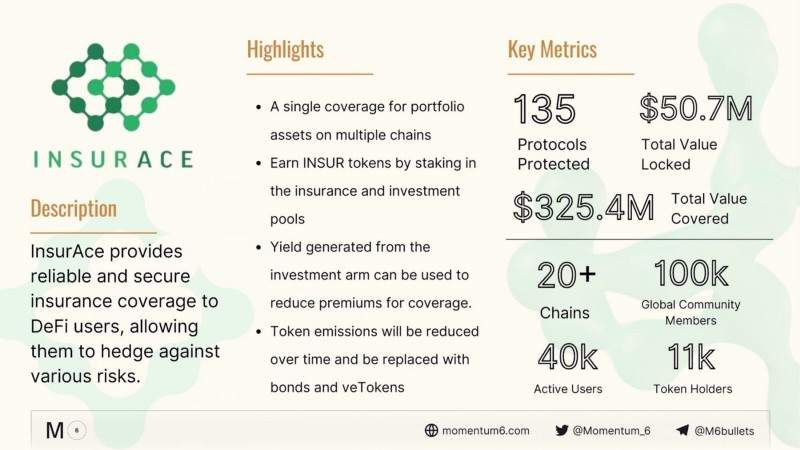

The protocol offers decentralized finance users secure, robust, and reliable insurance services to secure their assets against various…

Overview

DeFi is called the Legos of Finance as it allows ordinary people to use smart contracts to create a new world of financial products. Decentralized finance (DeFi) has changed how people transact in the modern world.

According to DeFiPulse, the total value locked (TVL) in DeFi is about $80.67B. The sad news is that the growing interest in DeFi has also attracted hackers who have made off with substantial sums of money.

According to a report by Yahoo Finance, unlike in 2021, when hackers were using online scams and fraud to steal from investors, in 2022, they are focusing on DeFi exploits, and investors have lost about $1.22 billion in the first three months of 2022.

InsurAce is a decentralized multi-chain decentralized finance insurance platform. The protocol offers decentralized finance users secure, robust, and reliable insurance services to secure their assets against various risks.

InsurAce is the industry’s first platform to offer cross-chain portfolio-based covers. However, it is not the pioneer insurer in the DeFi space. The creators of InsurAce identified the following challenges with the pioneer insurance:

Product accessibility limitations. Lack of protection diversity, limited cover capacity, KYC-based membership, and high premiums are some of the accessibility limitations of the current insurers.

Capital inefficiency. Unsustainable investment returns and low reserve utilization reflect capital inefficiency in existing protocols.

Lack of underlying risk management. Claim assessment risk, operation, cybersecurity risk of insurance protocols, concentration, credit, and market risks are risks that most existing protocols do not manage effectively.

What InsurAce offers

“0” Premium. InsurAce has pricing and portfolio-based product models to optimize cover cost combined with a sustainable return on investment to achieve ultra-low premium close to zero. Portfolio-based covers mean that users can select multiple protocols running on different chains and consolidate them under one cover. Other insurance protocols require you to take an insurance cover for every asset held on a different chain.

SCR Mining. Investors, insurers, and the insured can participate in SCR (Solvency Capital Requirement) mining to earn INSUR tokens by staking them in the insurance and investment pools.

Enriched product-line. InsurAce comes with portfolio-based product design, cross-chain protocol coverage, and wallet-based accessibility (no KYC), providing flexibility and accessibility to insurance protection to end-users.

How InsurAce works

InsurAce has two functional arms, the investment, and insurance arm, just like traditional insurance firms. The investment arm maintains all the investment pools that generate carry to attract investors with risk appetites and subsidize claims. On the other hand, the insurance arm maintains all the reserve pools, maintaining the solvency for claim coverage based on risk exposure. The free capital in the insurance capital pool can be pooled into the investment pool and gain higher yields.

Yields from the investment arm will complement the premium on the insurance side and reduce the customers’ cover costs. The interoperability of these two arms allows InsurAce to provide “0” premium insurance and considerable investment returns.

$INSUR

InsurAce has an ERC20 token; $INSUR is capped at 100M tokens. It is the governance token for incentivizing users across the platform. The current benefits of the token are:

Grants users voting rights in areas such as proposal voting and claim assessment,

Users are eligible for fees generated by the platform through governance participation,

Get mining incentives for providing capital to the investment products and insurance pool,

Ecosystem and community incentives.

How to buy InsurAce

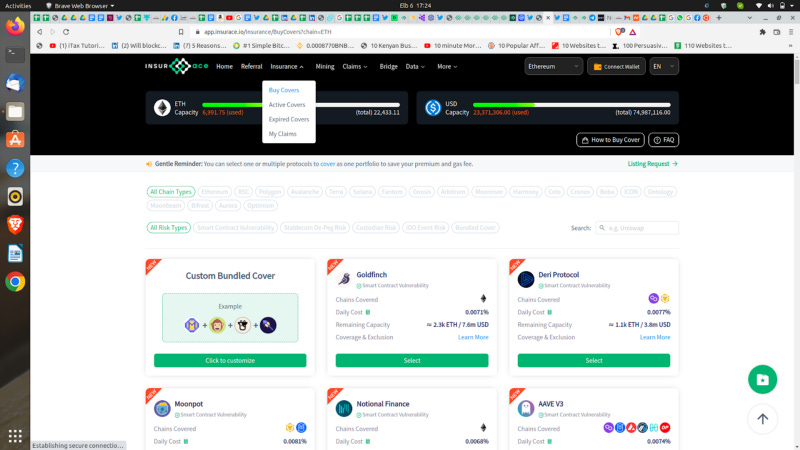

Go to InsurAce.io, locate the Insurance page, and click on “buy covers.”

2. Choose your chain and then connect your wallet.

3. Find and search for the protocols you want to be covered. Select the protocols that are open (with a green ‘select’ button)

4. If coverage for a protocol is sold out, you can switch your network from Ethereum to either Polygon, Avalanche, or BSC and buy coverage there. Funds on Ethereum will be covered as long as it is the same wallet.

5. Choose the amount you want to be covered, the days of coverage, pay the premium, and confirm.

Claim Assessment process

A cover holder who loses assets can file a claim. The claim will undergo several steps: investigation, voting, and payout. The claimant must provide all the necessary documentation/ evidence in the claim document.

Roadmap

InsurAce V2

The platform has had an exciting journey since the launch of the InsurAce V1 mainnet in 2021. However, as the DeFi space continues to grow, the creation of InsurAce V2 was needed. Even though V1 has achieved a lot, it faced many challenges:

Insufficient cover capacity,

Misaligned token incentives,

Demand for broader offerings,

Seamless and wider access for users.

V2 seeks to address these challenges with revised tokenomics, the release of innovative new insurance products, increased insurance capacity & capital efficiency, and continued expansion across multiple chains.

2022 Q1

The products lined up for this period are Multi-chain Insurance Aggregators, dynamic pricing, cover cancellation, a new data reporting system, and Public API access.

Capital aggregation is essential as the capital pools are separated across different chains. Capital staked on the BSC network can only be used to underwrite for covers purchased on Ethereum. However, any capital can be used for risk underwriting after the aggregation, irrespective of the chain.

2022 Q2

This will be the season of tokenomics enhancements. V1 was introduced in the era of liquidity mining. So far, $INSUR has been used to reward cover buyers, risk underwriters, partners, and the community.

However, liquidity mining has left $INSUR with few use-cases. V2 will readjust the tokenomics by bonding L1 and stablecoin assets to protect underwriting users. Thus, an intermediary layer will exist to protect staked capital whenever an insurance event occurs.

The role of token emissions in token distribution will be reduced over time in favor of sustainable approaches, such as bonding. The veTOKEN model will also be introduced where stakers of $INSUR will be awarded $veINSUR, and the longer they stake $INSUR, the higher the $veINSUR rewards.

2022 Q3

InsurAce will introduce new insurance product offerings, an insurance marketplace, and an investment arm. A revamped investment arm will introduce investment strategies for stablecoins and native tokens (e.g., $ETH, $BNB, $MATIC, $AVAX) to optimize risk-reward from technological security and traditional investment lenses.

Some of the new product offerings lined up are Wallet Insurance, NFT Insurance, and Rug Pull Insurance. The Insurance Marketplace will enable users to create customized bundles and insurance markets for protocols that don’t exist on the InsurAce platform.

Team

Oliver Xie, Founder. Oliver is a Web 3 thinker, believer, and creator. Before founding InsurAce, Oliver created MTR Labs, a Web 3 company that is still operational. He also worked for APEX, Asia Pacific Exchange, in various capacities such as Chief Technology Officer, Digital Research Lead, and Senior Information Technology Specialist.

Segun Ashaolu, Community Manager. Segun is a Social Media and Project Manager. He has an engineering background, having pursued Information Technology from the Ladoke Akintola University of Technology.

Dan Thomson, Head of Marketing and Business Development. Dan is a crypto expert, adventurer, and philosopher. He is also the Chief Marketing Officer of MTR Labs. Before InsurAce, Dan worked as a partner at Rock Crypto Fund, Director at RESTEK EU LTD, and the Managing Director of Supernatural Restaurants & Juice Bars International.

Grants and Funding

Development Grant from Harmony

InsurAce was among the 13 projects that received grants from Harmony Protocol in February 2022. Harmony has a $300M ecosystem fund, out of which $20M is set aside for 100 ports. Projects applying for grants for porting must have achieved their market fit, and InsurAce had already achieved that within nine operating months. The money is split into two parts; where the first portion is to help InsurAce port to the mainnet, while the second bit will allow InsurAce to integrate into five other projects.

Development Grant from NEAR

The Near Grants Program has been running for over 12 months. The program has set aside $250 million for DeFi projects that are likely to add value to their community and ecosystem. The grant will help InsurAce deploy on NEAR.

$3M in a Funding Round Led by Alameda & HashKey

InsurAce completed a funding round in the first quarter of 2022, where it raised $3M. This funding round was also boosted by the project’s $1M seed round investors such as ParaFi Capital, DeFiance Capital, Signum Capital, and Hashed.

Other institutional investors in this round include; LongHash Ventures, HashGlobal, Factorial Ventures, ImToken Ventures, Tembusu Partners, Maple Leaf Capital, and Wang Qiao and Kerman Kohli as angel investors. The funds will enhance technology platforms, talent recruitment, community building, PR, and marketing.

Wrapping Up

The InsurAce platform has been growing steadily since the Ethereum mainnet launch in April 2021. So far, the platform has 40k+ total users and 11k+ token holders. The platform also has over 100k+ global community members and has secured over 60 partnerships.