LayerZero Bridge Drama

Secret Network Drama Not a Secret & Elon Musk Moves Markets

Daily Bullets - Tuesday, January 31st

The market seems to have some uncertainty going into tomorrow’s FOMC despite the outcome (25 bps) being essentially priced in. Most of the recent major gainers such as Aptos continue cooling off. If you took advantage of the Sudoswap hype several months ago and provided liquidity, or are an 0xmon NFT holder, or xmon token holder, check your $Sudo airdrop eligibility here! Today we’re exploring some of the recent drama going on around LayerZero/Nomad and Secret Network plus the idiosyncratic way Elon still moves Dogecoin.

Layer Zero Drama Explained

Secret Network Drama Not a Secret

Elon Musk Keeps Moving Markets

Set your reminders for this week’s Crypto Illuminati Twitter Spaces featuring industry experts.

Layer Zero Drama Explained

Quick Take: Did Nomad target LayerZero to derail a coveted Bridge partnership?

Shots Fired: James Prestwich, founder of cross-chain bridging service Nomad, alleged that LayerZero can bypass security controls in order to pass data between blockchains without anyone’s permission!

Return fire: Bryan Pellegrino, a co-founder of LayerZero, fired back that the project does have backdoor-like capabilities but denied the platform has ever tried to hide them and has been open about its security practices and gave the developers the ability to set parameters barring LayerZero from special access privileges

Insight: The drama started just before Uniswap voted on whether to partner with LayerZero when choosing a bridge provider. The lead contenders in the vote were LayerZero and Wormhole. Nomad on the other hand has been out of commission as a result of last summer’s hack. In the end, whatever the actual intentions were, Wormhole won the Uniswap vote to become the single crypto bridge provider for the proposed Uniswap v3 deployment on BNB Chain. Naturally this also has its own controversy with some arguing against the use of a single bridge provider. The big question: would one competitor stir up drama ahead of an important event to derail the competition? Absolutely. All is fair is love, war and crypto. Stay frosty out there.

Read more here

Secret Network Drama Not a Secret

Key details: Several validators, including Smart Stake, Kingnodes, Azul Collection, and Domerium Labs, have stopped their services on privacy-focused Secret Network. Smart Stake halting services primarily due to issues with the network's core technology and a problematic firmware upgrade. Potentially other unreported financial irregularities, such as an open loan to Alameda and founder receiving funds.

Reasoning: Secret Foundation’s founder, Tor Bair made an undisclosed sale of foundation funds and directed $2M to himself as a dividend. Bair claimed that the withdrawn tokens were owed to him as part of his vesting schedule.

Significance: The departure of these validators could be concerning for the survival of the network as well as this is another case highlighting how transparency is a meme in crypto. Crypto touts itself as being able to solve problems found in traditional finance and business with the openness and transparency of the blockchain however time and time again we see that this hardly ever plays out. Most of the time we have no idea what is really happening until after the fact. Secret is down 92.91% from its all time high.

Read more here

Elon Musk Keeps Moving Markets

What Happened? Twitter CEO Elon Musk is reportedly building Twitter’s payment system with the option to accommodate crypto payments in the future and this resulted in the price of DOGE rising due to speculation about the token being supported on the platform in the future.

Significance: Crypto is an attention economy! Those who are able to hold the attention of the masses are powerful and Elon Musk is one of those personalities. We can see this in how his public moves are gauged and reacted to by the market depending on whether it is positive or negative. Good news sends Doge soaring and bad news sends it dumping. This is hallmark behavior of the crypto market (and financial markets in general) where news based catalysts move markets. Is it right for one person to have so much influence over a major coin’s price? No, but due to the global casino environment that is crypto, we can regularly witness this behavior time and time again for various projects based on news around people associated with the project.

Daily Bullets

Zhejiang, the first public withdrawal test network prepared for the ETH Shanghai upgrade, will be launched at 23:00 on February 1

VC firm Pantera Capital’s liquid token fund lost 80% in 2022 & is rotating back into altcoins from Bitcoin and ETH for the first time since spring

Uniswap DAO voted to select a single crypto bridge provider, Wormhole, for the proposed Uniswap v3 deployment on BNB Chain

Djed, a decentralized stablecoin pegged to the US dollar, launched on the Cardano blockchain after being in development for over a year

Sandbox’s SAND token unlock scheduled for Feb. 14 - releasing 12% of the token’s supply, equivalent to around $273M to seed and strategic investors

Osprey accused Grayscale of conducting “false and misleading advertising” for the Grayscale Bitcoin Trust since late 2020

Defunct crypto lender BlockFi has earned court approval to sell its remaining assets

Digital payments firm Strike is expanding its international money transfer service that runs on Bitcoin’s Lightning Network to the Philippines

Alameda Research is suing Voyager Digital for $445.8M, seeking to recover loan repayments it made after Voyager filed for bankruptcy protection

Celsius misled its investors – and on occasion used new customer funds to pay for other customers’ withdrawals

The Pyth Oracle Network launched price feeds on Arbitrum, which previously only had Chainlink oracles available on its network

Structured finance and administration platform Intain launched an Avalanche subnet for issuing and trading asset-backed securities on-chain

Ordinals launches NFTs on Bitcoin sparking controversy from maxis

Blur is now using Seaport to get around OpenSea's marketplace blocklist

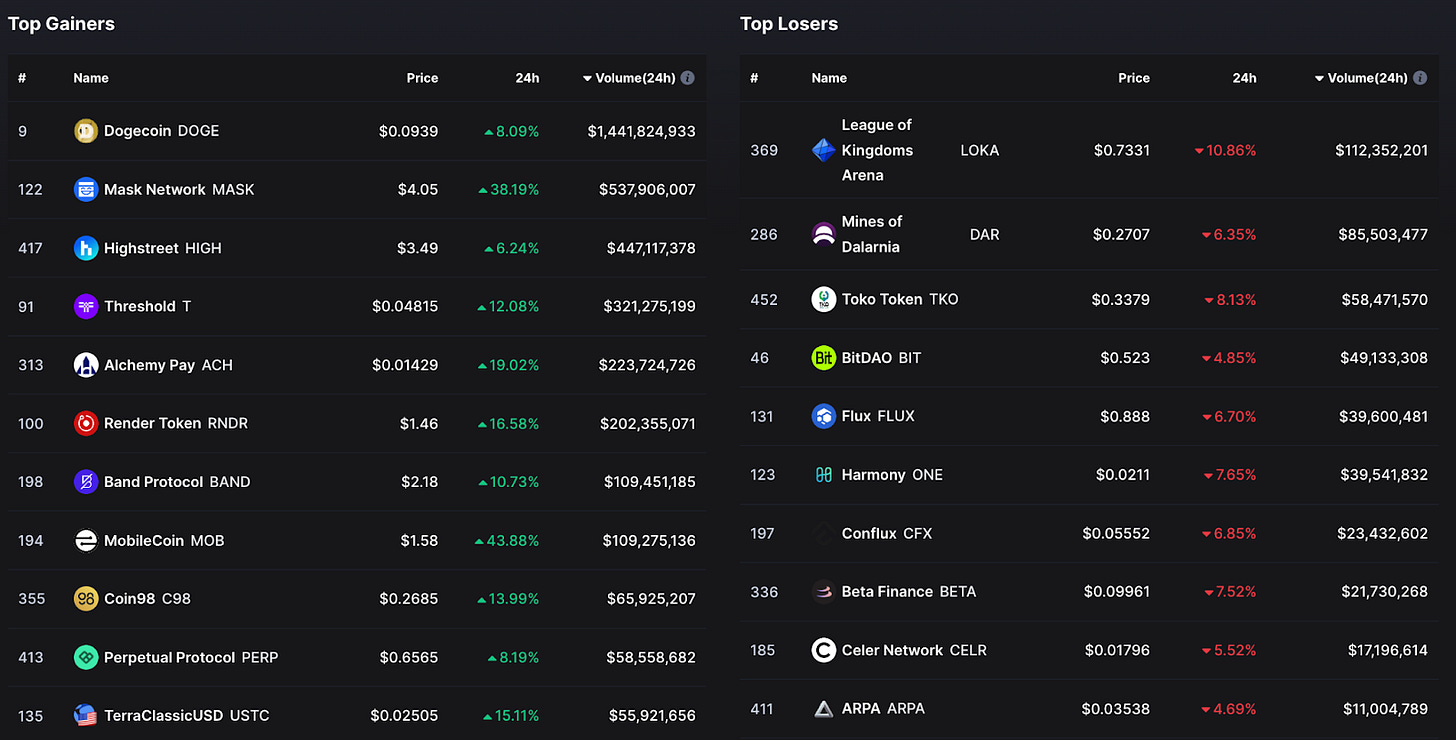

Market Gainers & Losers - Why They Moving?

Gainers: We can see DOGE and MASK leading on the gainers side piggy backing off Elon/Twitter news. That man has such an idiosyncratic way of moving markets. Also, not viewable on this picture due to lower volume but still up ~ 33% is Layer 1 blockchain Everscale after Abu Dhabi-based Venom Ventures Fund made a $5M strategic investment

Losers: Conflux is giving back the gains it made last week on news of a partnership with the Chinese instagram. The market giveth and the market taketh away.

Research/Reads

Glassnode - Short Squeezes and Spot Demand - source

Bitcoin markets have seen the strongest monthly price performance since Oct-2021

Crypto 101: What is the blockchain trilemma? - source

maximizing one outcome can only be achieved by sacrificing another

Conclusion of Discussion Paper on Crypto-assets and Stablecoins - source

Report from Hong Kong Monetary Authority

The Cost of Intelligence: Proving Machine Learning Inference with Zero-Knowledge - source

If rollups using zkproofs to scale compute while preserving cryptographic security, could we do the same for AI?

Commerce In The Fluid Web - source

Evolution of the web from Web 1.0 to Web 3.0

The Value of Nontoxic Orderflow to the Uniswap Protocol - source

How it can be incentivized

Bonus: Did Jump Trading Dump Lido on You?

Important due to LDO being one of the primary LSD tokens in the spotlight ahead of the Ethereum Shanghai upgrade

We hope you found this issue engaging and enlightening. As always, we welcome your feedback and suggestions for future issues.