M6 Weekly Alpha Leak 🚰 Crypto May Be Down But Big Brands Are Leading The “Adoption” Charge

Week of September 17-23, 2022

Markets reacted poorly to this week’s FOMC :/ - indicating risk assets are in for some more pain. But it’s ok! Let’s look past all that and forward at some instances of what may be considered “Crypto Adoption??” You be the judge.

TL;DR:

Macro Recap: What You Need to Know

Is This What Metaverse “Adoption” Looks Like?

Top Bullets: Draft legislation around stablecoins/MiCA, SEC charges crypto influencer, Ian Balina, for promoting unregistered ICO's, Market making firm Wintermute hacked for $160M, Nasdaq to launch an institutional crypto custody service, Binance integrates BUSD on Avalanche and Polygon, China and Iran CBDC trials, Nova Labs agreement with T-Mobile to cover 5G on Helium Network which is moving to Solana

Scammy Sh*t: Revolut data breach of over 50,000 customers, U.S and South Korea target tax avoiders

Data Highlights: This week, most Smart Money is flowing into ETH derivatives and out of USDC and DAI. DeFi TVL: $54B - abysmally low, Top Protocols and Top Blockchains DeFi TVL also a sea of red. ENS, Synthetix, GMX, Lido and X2Y2 have been maintaining decent protocol revenue on the 180D trend despite the bear. NFT Sales: over the past month, Ethereum: down 29%, Solana: up 97%

DeFi Highlights: GMX $500,000 loophole exploit, Coin98 introduces CUSD, a fully-backed decentralized stablecoin, MakerDAO to add GnosisDAO token as collateral for DAI, Tribe DAO will finally repay victims of the $80M Rari hack, Celsius revival plan may include issuing tradable wrapped assets to customers, Uniswap Foundation $1.8M in first round of grants

NFT/Metaverse Highlights: NFT Day was September 20, OpenSea supports Arbitrum, Azuki $30M raise, Zilliqa to launch web3 games console in early 2023, OpenSea upgrades NFT drops with 'immersive minting experience'

Before we get started...Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox.

Done? Now let's dive in!

⛓ Crypto Highlights of the Week ⛓

Macro Recap: What You Need to Know

The US Federal Reserve raised rates by 75 basis points to continue battling inflation

The Fed’s stance is strict about staying the course to reach their target rate of 2% inflation

2 more FOMCs left this year with with an expected 100-125 bps in combined hikes

Could that mean a 75, 50 split or ? Will have to wait and see

Next important macro date will be the September CPI data released on October 13

Is This What Metaverse “Adoption” Looks Like?

So, now that we have that out of the way, let’s turn our attention to the future and the question of what will that long anticipated “Crypto Adoption” actually look like? Crypto people try soooo hard to make the Metaverse a thing and push this narrative about the functionality of NFTs, real world use cases and how crypto/blockchain gaming will be the future. Will it actually be tho? Given how massive and culturally ingrained gaming and entertainment is in popular culture, it stands to reason that this sector is a strong candidate by which crypto can enter the mainstream.

We’ve already seen countless examples of big brands, companies, and celebrities trying to capitalize on the Crypto/NFT craze. However we absolutely can’t forget that traditional gamers despise NFTs and most regular people don’t have a more favorable view of crypto either. So if we ever wish to move beyond our little speculative bubble, we have to look for signs of meaningful adoption. For clues as to how that journey is going, let’s look at some of these recent moves by big players in the traditional non-crypto world. Will these approaches bear any fruit or are these just more doomed money grabs?

MoonPay, Universal Studios and Hypermint partnered to create an NFT-based “Halloween Horror Nights” scavenger hunt at Universal Theme Parks. Park guests will need little to no crypto knowledge to claim these NFTs. Seven types of NFTs can be found in both the Orlando and Hollywood Universal Parks with those who collect all seven receiving a “gold medal NFT,” which is “eventually going to do something”

Autograph, the NFT company co-founded by Tom Brady, will create official PGA Tour collectibles with the help of Tiger Woods. The platform will launch in early 2023 and offer potential real-world perks for fans. Sports fans encompass a huge market

Bandai Namco, Sega and Square Enix are not just jumping on the crypto gaming bandwagon - they have a long-term vision for blockchain-based gaming. They are initially looking at developing brand new blockchain games instead of integrating blockchain tech with their current gaming franchises such as Tekken, Pac-Man, Sonic the Hedgehog and the Final Fantasy franchise

Metaverse firm, MyMetaverse, implements NFTs into its Minecraft and GTA 5 servers, despite Minecraft creator Mojang Studios being against the integration of NFTs. They do this without violating the game's guidelines by not having any pay-to-win NFTs and making their best NFTs free to earn. NFTs also have an interoperability aspect and can be used in their other games - by reading the user's wallet, seeing that they own the NFT and providing them different benefits such as in Minecraft this NFT is a sword, in GTA the NFT is a car and in Infinity Realms, the NFT is a house. Run on Efinity, a Polkadot parachain developed by Enjin

Web3 software firm Chain has entered into a four-year marketing deal with Kraft Sports + Entertainment to serve as the “official blockchain and Web3 sponsor” for the New England Patriots, New England Revolution, Gillette Stadium, and Patriot Place to develop what it calls “state-of-the-art Web3 experiences.”

Funko will sell DC Universe-branded comic books at Walmart with linked NFTs, which can be redeemed and minted on the WAX blockchain. Each book cover will be available as a physical item with a digital counterpart, otherwise known as a “phygital.” Luxury goods company Prada and sportswear firm Puma both have sold physical goods with digital counterparts as well

Italian soccer club AC Milan is diving deeper into crypto with a new collection of NFTs from Solana-based esports franchise MonkeyLeague. Fans mint Rossoneri-branded wearables and give them access to game tournaments, such as football players playtesting the game

Hasbro is rebooting the Starting Lineup sports toy line, which were a hit in the ‘80s and ‘90s, with new figures that include NFT trading cards on the Panini blockchain with NBA stars like LeBron James and Stephen Curry. Cost: $50 toys that include NFT cards with various rarity levels

Long Story Short: Big names and brands are doing their darndest to make NFTs a thing irl! Only time will tell if users will actually be interested, because without users - none of this is ever going anywhere.

This Week’s Top Daily Bullets 💊

Draft legislation to create a U.S. federal framework around stablecoins would temporarily ban issuing a stablecoin without approval from appropriate regulators and could be punishable by up to five years in prison and a $1M fine - similar to TerraUSD. The European Union has similarly finalized the full text of its landmark Markets in Crypto Assets legislation

Why this matters: We are seeing continued fallout from the Terra collapse. A lot of people got hurt and lost money and now regulators are using that as ammo to push new types of legislation. We can only hope they don’t overstep

SEC charges crypto influencer, Ian Balina, for promoting unregistered ICO's. In the civil complaint, the SEC suggested that it believes the U.S. government has jurisdiction over all Ethereum transactions because transactions were “validated by a network of nodes on the Ethereum blockchain, which are clustered more densely in the United States than in any other country.”

Why this matters: The United States government is trying to sneakily pass this type of legislation and it sets a dangerous precedent. Crypto is intended to be decentralized but the SEC is trying to classify activity on Ethereum as akin to that on an American securities exchange

Crypto market making firm Wintermute has been hacked for $160M but the firm remains solvent. 90 different assets were affected via a 'Vanity address' bug with Profanity tool despite recent 1inch warning. Wintermute offers hacker 10% bounty on funds taken

Why this matters: Market makers are the backbone of every crypto exchange, ICO, dApp and many token listings and when market markers fail, liquidity dries up and there is nothing worse for tradable assets than spreads growing wider

Nasdaq is preparing to launch an institutional crypto custody service pending regulatory approval

Why this matters: This is a big step towards getting institutional investors into the crypto space if it’s done through a more official mediary

Binance has completed the integration of BUSD on the Avalanche and Polygon networks with deposits and withdrawals now open on both networks

Why this matters: Another development in the ongoing saga on BUSD - following on the news of Binance making it the primary stablecoin on their platform.

The People's Bank of China plans to extend the trial of its e-CNY CBDC to Jiangsu, Hebei and Sichuan as well as Guangdong. Central Bank of Iran will begin the pilot launch of crypto-rial as the bank’s digital currency

Why this matters: CBDCs will eventually most likely become reality for many countries so it’s important to keep an eye out on how these trials develop

Nova Labs inks agreement with T-Mobile to cover 5G dead spots in Helium network and the Helium community approves crypto wireless network's migration to Solana

Why this matters: Everyone has an opinion on which Alt L1s will go straight to zero or survive. Solana has been gaining traction in the NFT space and making moves into the mobile phone world. Adoption of Helium has been extremely slow but do partnerships like this offer hope or just another doomed attempt?

These are just our top bullets, want more? Check out our daily newsletter:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

💰 Fundraising Highlights of the Week 💰

Scammy Sh*t 💩

Digital bank Revolut, which includes crypto trading among its services, suffered a breach which may have exposed the data of over 50,000 customers

Why this matters: You can practice airtight security but when a 3rd party service leaks your data and information, there’s not much you can do about it

Korean tax authorities seize $185M worth of crypto from tax evaders since 2021. The U.S. IRS also has been granted the power to issue a "John Doe" summons to M.Y. Safra Bank, allowing them to obtain data on customers of the bank's partner SFOX, a crypto prime broke to seek crypto tax evaders

Why this matters: The authorities seized the delinquents’ accounts or assets based on information received from the cryptocurrency exchanges to pressure them to pay taxes. Could we see this behavior coming soon from other governments? Tax avoiders in shambles

📊 Crypto Market Data Highlights of the Week 📊

TL:DR:

This week, most Smart Money is flowing into ETH derivatives and out of USDC and DAI

DeFi TVL: $54B - abysmally low, Top Protocols and Top Blockchains TVL also a sea of red

Protocol Revenue: ENS, Synthetix, GMX, Lido and X2Y2 have been maintaining decent revenue despite the bear on the 180D trend

NFT Sales: over the past month: Ethereum: down 29%, Solana: up 97%

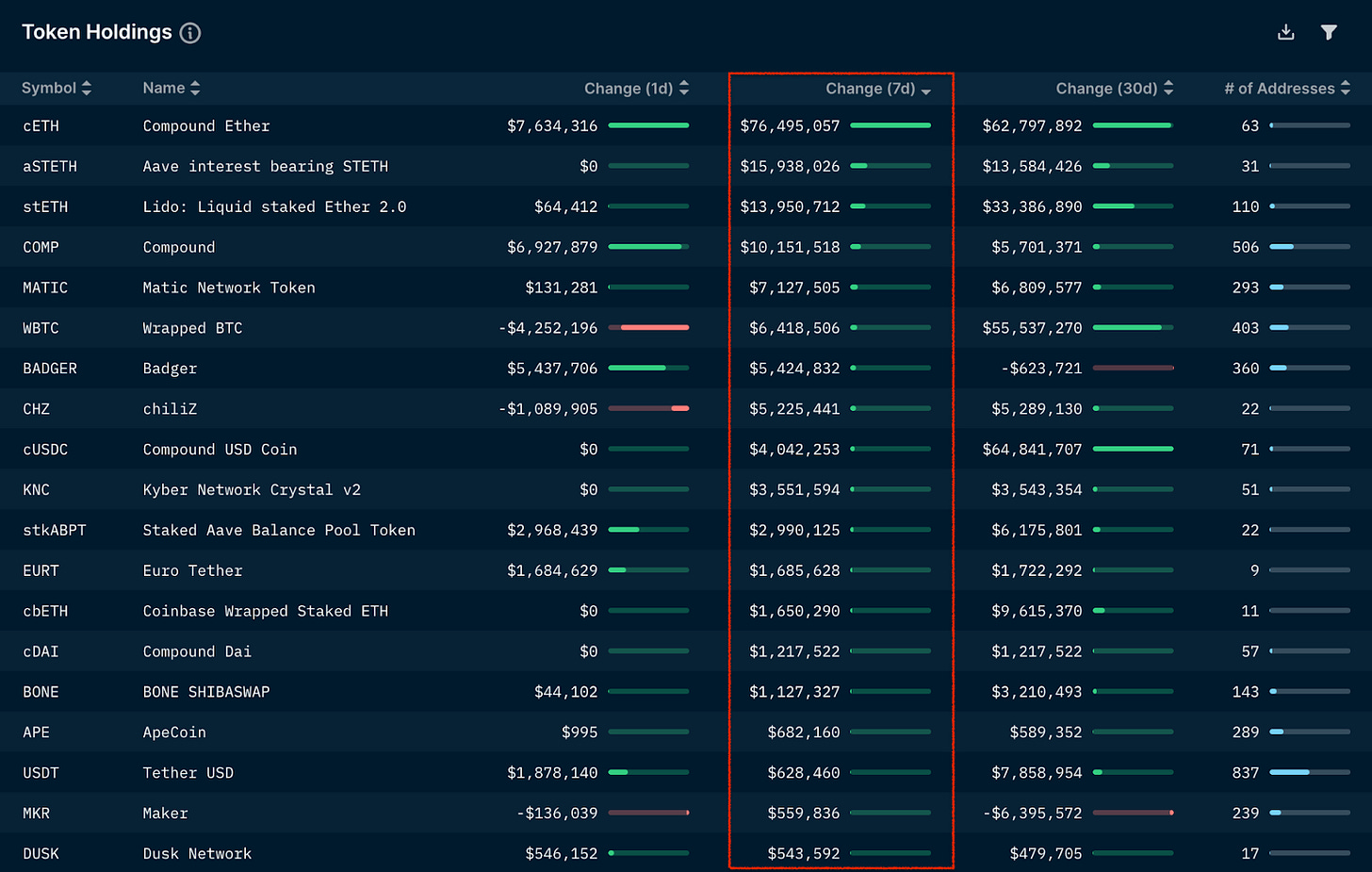

Nansen Smart Money Token Inflow and Outflows:

Weekly:

Largest Smart Money Inflows this week: most money is flowing into ETH derivatives

Largest Smart Money Outflows this week: Money flowing out of USDC and DAI

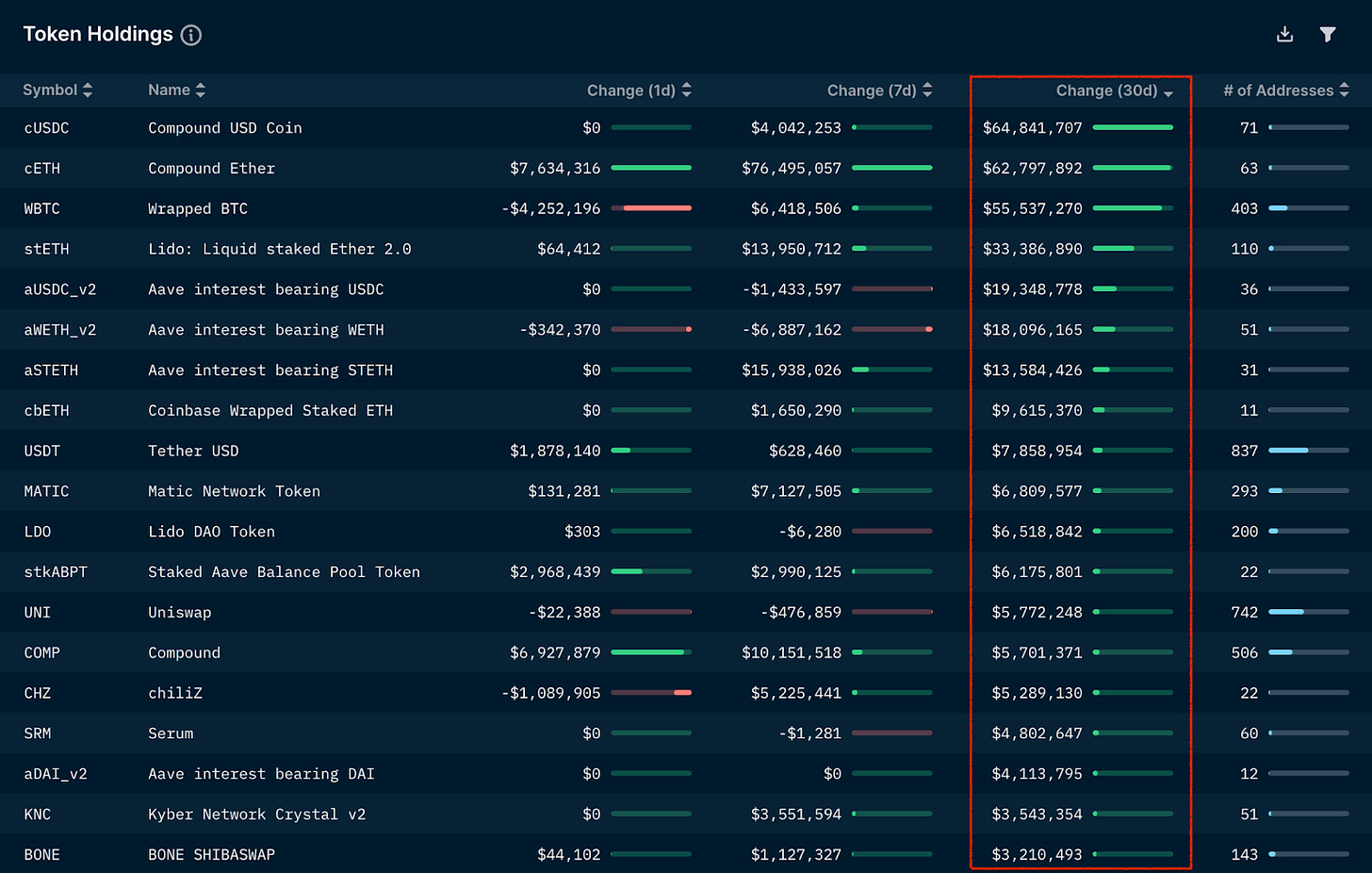

Monthly:

Largest Smart Money Inflows this month: All some variation of USDC, ETH, WBTC. Messy and hard to tell anything from this. Market too iffy.

Largest Smart Money Outflows this month: USDC and WETH clearly the largest outflows

Nansen Hot NFT Contracts:

Highest Volume NFT collections of the past week: Top 5 are all blue chips except this random Legendary Dancing Seahorse.. Just came out of nowhere. Overall, volumes are still low

🏦 DeFi Highlights of the Week 🏦

A trader deployed millions of dollars to manipulate the prices of AVAX on GMX, profiting $500,000 by utilizing a strategy that exploited a basic loophole. GMX developers are reviewing the loophole and in the meantime capped open interest at $2M for AVAX on their exchange with a solution to be expected in two weeks

Why this matters: GMX is one of the most popular DEXes and for such a basic loophole to be exploited shows how little most market participants know about the underlying mechanisms

Coin98 (C98) introduces CUSD, a fully-backed decentralized stablecoin that aims to become a cross-chain unit of account that fulfills the demand for cross-chain liquidity in DeFi

Why this matters: The stablecoin wars continue. As the world of multi-chain expands, it drives up the demand for moving assets among different chains by a large margin; however, the major issue of fragmented liquidity also arises. Need to have a unit of account that measures the value of all the cross-chain liquidity pools

MakerDAO governance votes yes to adding GnosisDAO token as collateral for DAI

Why this matters: GnosisDAO reportedly plans to create 30M DAI using GNO from its $972M treasury as collateral. DAI is the main stablecoin on Gnosis chain - an EVM-compatible blockchain created by Gnosis. It is also used to pay transaction fees on the chain

Following several rounds of voting and governance proposals, Tribe DAO confirmed that it would repay victims of the Rari hack

Why this matters: It's been a long road for victims. After voting to make victims of the $80M hack whole back in May, the community is finally making good on its proposal

Celsius revival plan proposal may include issuing tradable wrapped assets to customers

Why this matters: Customers can redeem their wrapped tokens or wait for a larger payout when additional revenue hits such as from incoming mining, staked ETH revenue and other coins that may become liquid. Celsius entered Chapter 11 proceedings in July and has since been winding its way through the bankruptcy process with customers hoping for a return of their assets

Uniswap Foundation has announced $1.8M in its first round of grants to 14 recipients working on various projects

Why this matters: Some criticized this proposal as being a way to funnel money to insiders and friends but for better or worse it’s here and they vary in size and scope, and are spread across three categories: Protocol Growth, Community Growth, Governance Stewardship

🏢 NFT/Metaverse Highlights of the Week 🏢

This week saw the celebration of the NFT Day. September 20, 2017, is the day Dapper Labs Chief Technical Officer, Dete Shirley, published ERC-721, which is the standard from which NFTs are built

Why this matters: NFTs helped to kickstart a revolution. Up until now we’ve only seen PFP NFTs for the most part but plenty of people are working on adding utility and real world use cases. Let’s see where we are at in another year!

OpenSea will soon support Arbitrum - offering trading of NFTs on their gas-free layer-2 protocol

Why this matters: Step in building the goal of a web3 future where people have access to the NFTs they want on the chains they prefer. One interesting thing to note is that IMX was supposed to be supported as well but it’s been over a year with no news

Chiru Labs, the Los Angeles-based creator of the Azuki NFT collection, plans to raise at least $30M in a Series A funding round

Why this matters: Last week, Doodles raised $54M from VCs at a $704M valuation. Moonbirds has raised $50M. All following in the footsteps of Bored Ape Yacht Club creator Yuga Labs, which raised $450M in March at a $4B valuation. What are they planning?

Layer-1 blockchain Zilliqa to launch web3 games console in early 2023

Why this matters: An important point here is how the console aims to have web3 capabilities including a crypto wallet and mining integrated but to hide the complexity of Web3 from the end-user. Normal users are highly unlikely to ever be actually interested in how anything actually works. They just want to use it and enjoy the experience.

OpenSea upgrades NFT drops with 'immersive minting experience' - new UX means creators will be able to launch their collections with dedicated drop pages and greater discoverability

Why this matters: The move comes amid a period of change for NFT marketplaces and service providers, as companies look to offer something different from their competitors amid a prolonged bear market. OpenSea has long dominated as a host for NFT drops and sales, however challengers offering multi-chain options and ways to bypass royalties have gained traction in recent months

The crypto space is a wild and fast paced, evolving landscape - however one filled with recurring themes and trends. The point of this newsletter is to highlight the story of crypto - as it's told over time. The board, the players, and the game itself. Follow along as we catalog and organize the chaos.

Subscribe to receive our daily brief and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!