Weekly Alpha Leak 🚰 Ugh, The Merge is So Last Week - What’s Next?

Week of September 10 - 16, 2022

Finally the Merge is behind us, bit of a nothingburger, eh? What do we have to look forward to now? Crypto people are always ready with another narrative in their pocket. Let’s explore what they’re trying to push next.

TL;DR:

Et hirium Merge Finally Over With - What’s Next?

Potential Upcoming Narratives: Cosmos and appchains, Aptos vs Sui will be the new Solana?, Real Yield, Arbitrum/L2, Zks, New Stablecoins, Memes: APE staking event, Bone - Shibarium Launch

Top Daily Bullets: Do Kwon arrest warrant, MicroStrategy $500M potential bitcoin buy, New EDX Markets crypto exchange, Wintermute becomes Tron’s market maker, BNB Chain partnering with Google Cloud, Huobi delisting 7 privacy coins, Coinbase politics endeavors

Scammy Sh*t: India's unfreezes exchange’s bank accounts, Coinbase insider trading guilty plea, Razzlekhan needs to access wallets for taxes, Italian class-action lawsuit against Binance for outages, Chicago Crypto Capital prosecuted for illegal token sale to investors

Data Highlights: Nansen Smart Money is stabling up, Huge influx of ETH onto exchanges just before the Merge

DeFi Highlights: Celsius custodial services revival, Near to support USDT, Maker doubled debt ceiling for stETH to reduce centralized USDC reliance, Compound crypto-backed loans for institutional clients, Ribbon Lend, Thai SEC to ban crypto lending

NFT/Metaverse Highlights: Starbucks NFT loyalty program on Polygon, Fortnite’s Epic Games first NFT game on its store, Magic Eden MetaShield to protect NFT creator royalties, NFT mints on Solana popping off, Singapore's biggest bank to acquire land in The Sandbox, Rarible partners with Immutable, Grammy award-winning producers working with Bored Ape NFT band, South Korean jail sentence for sexual offender in metaverse, web3 fashion brands at NY Fall Fashion Week

Before we get started...Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox.

Done? Now let's dive in!

⛓ Crypto Highlights of the Week ⛓

Et hirium Merge Finally Over With - What’s Next?

The Merge has officially occurred marking Ethereum’s transition from proof-of-work to proof-of-stake! This was a historic event in Crypto history that comes with a variety of changes for Ethereum - with a popular selling point being it reduces worldwide electricity consumption by 0.2%! Wow! Now all the previous miners need to decide what to do with all their expensive mining equipment. Lots of trading speculation has occurred lately regarding PoW tokens such as Ethereum Classic and Ravencoin but the influx of miners causes the networks to rise in block difficulty and at current market conditions and energy costs, it’s difficult for GPU miners to turn a profit and it’s estimated that as many as 20% to 30% of miners have shut down operations altogether.

Truthfully though, the Merge passed by without too much excitement or noise for market participants. Some people expected a pump, some people expected a dump and what we ended up seeing in the immediate aftermath was a tiny bit of volatility but generally more flat and ranging price action, followed by a move down in price since. However, considering we’ve been in a bear market all year - it comes off as feeling like just another day. Overall it kinda feels like it was all just a nothingburger or perhaps many are just too desensitized at this point. From a technical and development standpoint this was a big deal, however the majority of people truthfully only care about the financial aspect - and price going down is not what most people want. With a heavy macroeconomic environment, a recent CPI annual rate of 8.3%, vs 8.1 percent expected and the Fed pushing hawkish monetary policy to battle this inflation in the upcoming months - we’re probably in for some more bear market blues. Can we call The Merge a sell the news event? Or is it just part of the bear market? Remember there are more future upgrades to come, known as The Surge, Verge, Purge and Splurge.

Potential Upcoming Narratives:

Segueing into what most people probably care about most - what’s next? You care about making monies - be honest! The Merge was the biggest narrative and catalyst we’ve had over the past several months, and now that it’s over, everyone’s attention is turning towards the big question, what’s next!? Most likely it’ll be more bear market tings. But fret not! There’s still opportunities during the bear so let’s take a look at what Crypto Twitter has their eyes set on next. Warning! We have been and continue to be in a bear market so all investments are risky - especially these. Take everything with a pinch of salt. Timeframes are also important as some of these may be quick plays/trades and not part of a longer term thesis.

Overview: mfers are always ready with the what’s next

Cosmos and appchains: The appchain thesis has been around for a while and fresh off the recent support of Delphi, ATOM has certainly been catching a bid. It’s promising to see strength in a shitty market so this one is worth keeping an eye on. ATOM’s price has historically been cucked so will it be different this time?

Aptos vs Sui will be the new Solana?: Some people are looking at Solana and expecting big things once the market turns around - then there’s another train of thought that sees attention shifting towards new shiny toys like Aptos and Sui. Which will it be? Will we see the previous playbook as before or will it be different this time?

Real Yield: This is honestly a good one. A move towards protocols that are operating like actual businesses and accruing value to token holders makes healthy sense for the crypto space. We’ve seen enough vaporware and inflationary token models. A move in the direction of common sense would be welcome but will the market agree?

Arbitrum/L2: The upcoming Arbitrum airdrop has been highly anticipated. How will the token launch go? Recent airdrops and token launches have followed a fairly similar pattern: initial pump, dump, consolidation and pump again followed by a cool off - consider the Optimism chart. Will the L2 narrative be different this time?

ZKs: bit of a race among these contenders to see who will be the first to market. Who will win?

New Stablecoins - Curve, Aave - oh, everyone and their grandmother is apparently coming out with their own stablecoin. The regulatory environment is also likely to tighten from here on out so how will stablecoins fare? Who will win the stablecoin war?

APE Staking Event: Yuga Labs is investing buttloads of money in the Bored Ape Yacht Club brand and APE. Building a metaverse, doing interesting things with their IP rights and seemingly trying to keep the ship afloat. Will the upcoming staking event serve as a catalyst to push price up?

Bone - Shibarium Launch: This is your healthy dose of meme. The premise here is simple - The Shib brand is massive and speculation over plans to launch an L2 EVM based chain called: Shibarium sent the BONE token ripping in recent weeks though it has begun to cool. The premise is simple - these people have been betting on degeneracy and that retail apes will be drawn to the chain once it opens. Looking at a similar competitor, Dogechain, for an idea of how this will play out eventually. Rough…

Other narratives that have cooled off: Sudoswap and Xmon now that the snapshot has been completed for the Sudo airdrop, Manifold and its MEV narrative, DigiDaigaku ran hot on news of a Limit Break’s $200M VC raise and has considerably cooled since, ETH merge related plays also seemingly cooling off.

Things that have been cooked for a while now: Gamefi, DAOs, Privacy

Conclusion: Crypto people are dying for something to make money on and looking for anything that can catch attention, hype and a bid during this bear market. These can be risky and the lifespan for narratives during the bear can be pretty short lived..

This Week’s Top Daily Bullets 💊

A South Korean court issued an arrest warrant for Do Kwon, CEO of Terraform Labs, and two other employees and prosecutors apply to revoke their passports

Why this matters: A lot of people lost billions of dollars during the Luna collapse and now legal action is being taken. Was there malice behind Terra or simply bad design? Will future founders be responsible for the course their projects take as well as if they fail?

A new filing shows MicroStrategy could sell up to $500M in class A common stock to buy more bitcoin

Why this matters: Saylor the absolute mad lad! One of the biggest bitcoin bulls out - is he a genius or idiot?

Financial heavyweights Charles Schwab, Citadel Securities, and Fidelity Investments, and others announced the start of crypto exchange EDX Markets

Why this matters: This is an interesting step towards mainstream adoption - opening up avenues for traditional investors and institutions. Let’s just call it what it is - this is for the boomers

Wintermute is now the Tron ecosystem’s official market maker, helping the crypto project’s native TRX token improve liquidity across various exchanges

Why this matters: Justin Tron is an absolute hustler and Wintermute is huge. The grind never stops for Tron - can we expect more things from the Tron ecosystem?

BNB Chain is partnering with Google Cloud, aiming to support the growth of early-stage Web3 and blockchain startups

Why this matters: Google isn’t exactly known for being decentralized… - moves like this are in the opposite direction of the ethos of crypto but you could argue that most people don’t actually care about decentralization at the end of the day. Maybe the sweet spot will be somewhere in the middle

Huobi to delist 7 privacy coins, citing regulatory pressures - Dash (DSH), Decred (DCR), Firo (FIRO), Monero (XMR), Verge (XVG), Zcash (ZEC) and Horizen (ZEN)

Why this matters: This ties into the recent Tornado Cash sanctions. Governments and regulators are definitely not ok with regular people having privacy. They’ll use whatever scary argument they can such as terrorism, tax evasion, money laundering, illicit activity, etc etc to try and limit this tech. The future of privacy coins such as these is shaky - even though most people want some sort of privacy features

Coinbase users can evaluate lawmakers’ crypto bona fides, register to vote and discover political events on the exchange’s app

Why this matters: So Coinbase is stepping into the political arena now? Trying to be more than just an exchange - inevitably this can become a tool to try and influence political opinion

These are just our top bullets, want more? Check out our daily newsletter:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Scammy Sh*t 💩

India's ED regulator has "unfrozen" the business bank account of crypto exchange WazirX more than a month after it was frozen by the agency for "illegal loan apps" scam investigation

Why this matters: The world is a big stage and there’s so many different governments out there with different views on crypto - India has a massive population and it’s important to pay attention to their crypto stance

Ex-Coinbase manager's brother pleads guilty in first crypto insider trading case

Why this matters: As the first insider trading case - this will be setting precedents and one of the main issues is that an asset needs to be classified as a security for it to count as insider trading. So will this become legal precedent then?

Heather Morgan, a.k.a. "Razzlekhan," has asked the court to clarify pre-trial conditions to allow her to access her crypto wallets to assess her tax burdens

Why this matters: As one of the largest hacks in history, this case will also be setting history and the woman herself is such a meme. This is an interesting case to follow along with. Will the courts let her do her taxes? There are expectations that the courts will want to make an example out of her

A group of Italian and international investors brought a class-action lawsuit against Binance seeking damages for losses sustained during multiple exchange outages in 2021

Why this matters: Will this succeed? Can we recoup damages due to shitty exchange experiences? Everyone probably has a story of how an exchange screwed them…

Chicago Crypto Capital, its owner and two salesmen are being prosecuted for their illegal sale of BXY tokens to investors from August 2018 to September 2019

Why this matters: What a fascinating and scammy time this was. There are probably a lot more people out there who did highly sketchy things - will they ever face repercussions?

📊 Crypto Market Data Highlights of the Week 📊

Nansen: Smart Money Percentage in Stables:

This is an interesting metric to pay attention to. The percentage of Smart Money holdings that are currently in stables. The more in stables people are - the more unsure they feel about the market and the less stabled up they are, the more risky they’re feeling. We just saw a large spike in people stabling up..

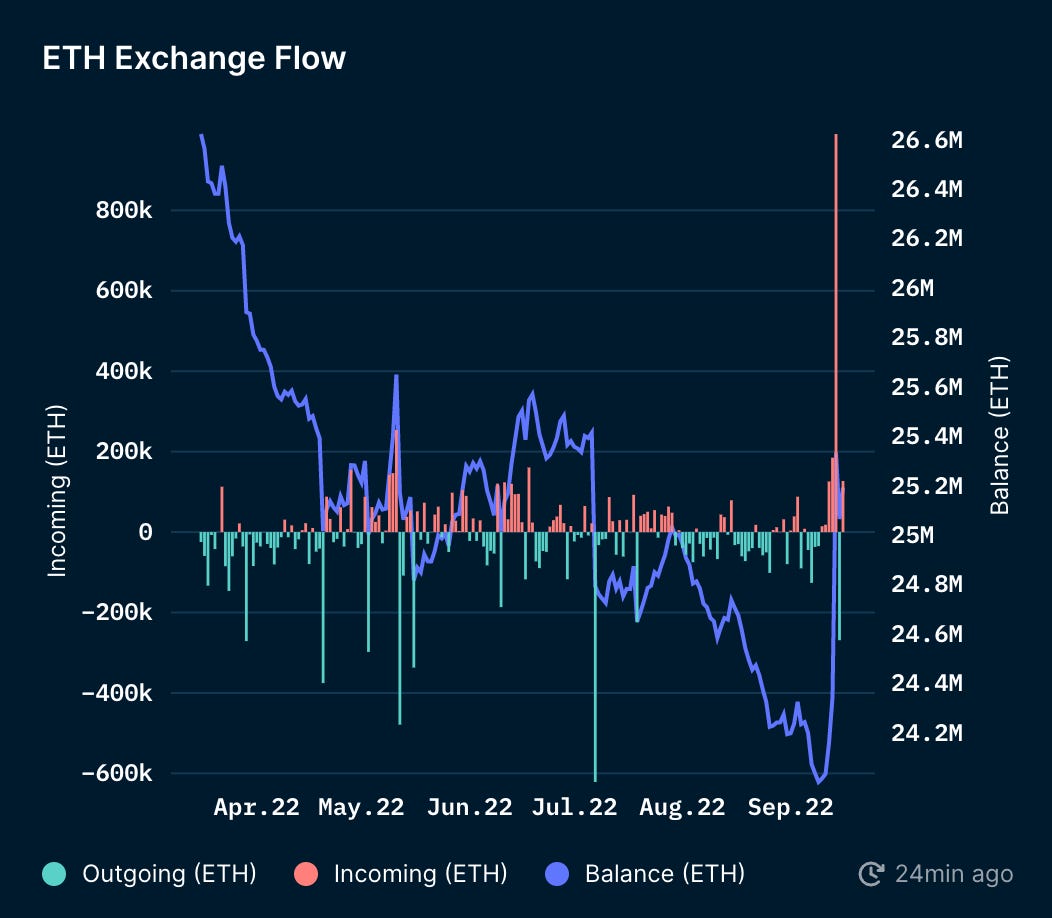

ETH on Exchanges

Huge influx of ETH onto exchanges just before the Merge was likely sold off

Nansen Smart Money Token Inflow and Outflows:

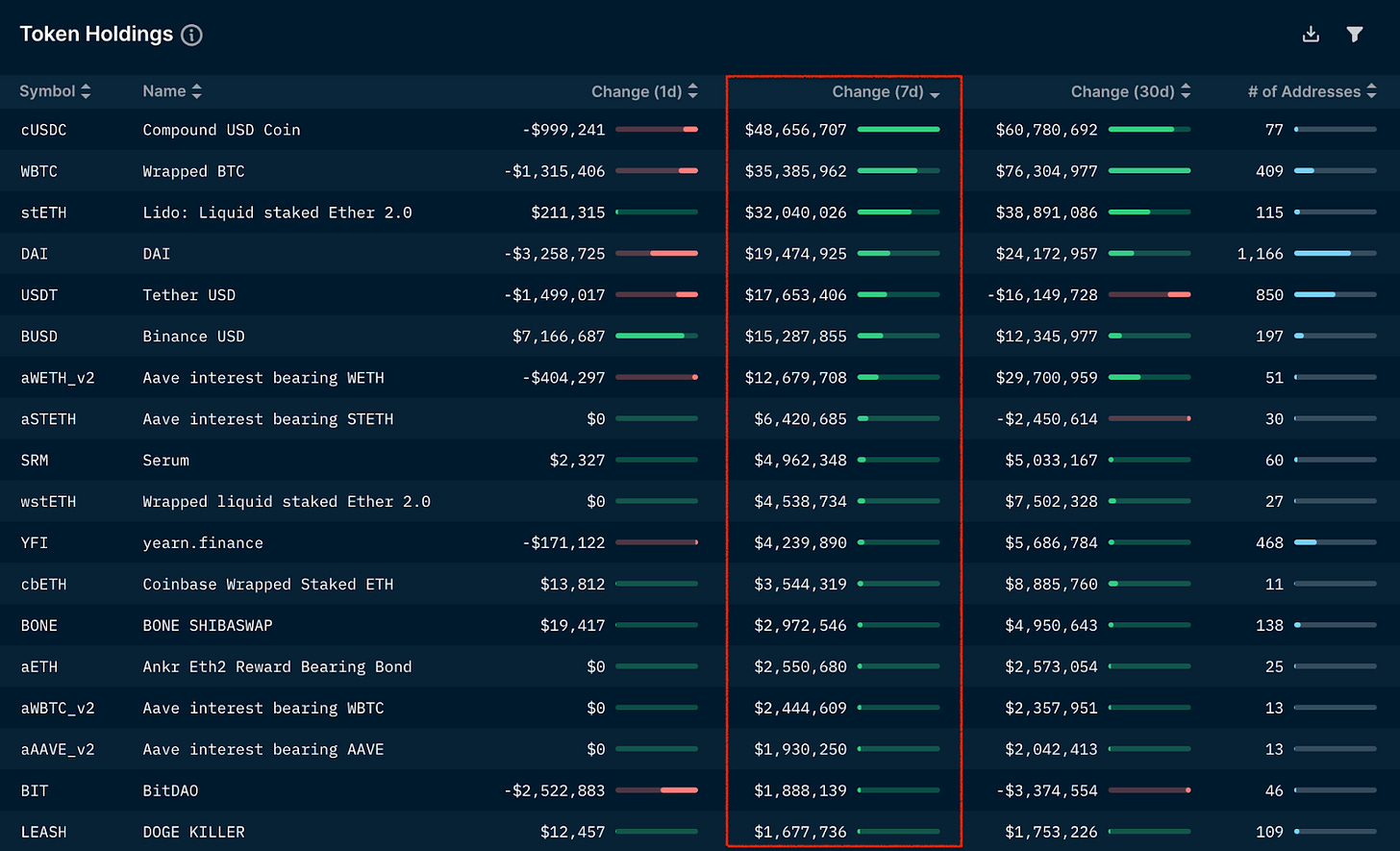

Weekly:

Largest Smart Money Inflows this week: Compound USDC, WBTC, stETH, DAI, USDT, DAI. To sum it up, lots of money flowing into stables

Largest Smart Money Outflows this week: Money is mostly flowing out of USDC and WETH. The money leaving ETH is something we can see obviously in the recent ETH selloff but the flow out of USDC is interesting to see. Money is flowing into the other stables instead.

Monthly:

Largest Smart Money Inflows this month: WBTC, cUSDC, stETH, aWETH and DAI. So now that the Merge is over, it seems like Bitcoin is getting a bit more love

Largest Smart Money Outflows this month: So it seems smart money doesn’t want to be holding USDC..

Nansen Hot NFT Contracts:

Highest Volume NFT collections of the past week: Eyes on Renga which saw the highest volume as well as a 356% increase in floor price over the last week

Highest Volume NFT collections of the past month: Led by blue chips such as BAYC, ENS and Otherdeed. DigiDaigaku stands out for having seen a 996% increase in floor over the past month

🏦 DeFi Highlights of the Week 🏦

Celsius CEO Alex Mashinsky is pushing for a revival of the firm around custodial services

Why this matters: The ironic thing here is that there’s lots of people who haven’t been able to get their funds off Celsius since all the trouble started and so they’re already sorta doing a custodial service - just involuntary lol

Near has become the 13th blockchain to support Tether's USDT stablecoin. Near moves ahead with phase one of four-step plan sharding upgrade. Near is forming a working group to set standards for self-governance

Why this matters: There’s a whole war happening over which will become the dominant stablecoin - USDC, USDT or something else. Near also has lots of funding and backing but very little demand for anything built on it so far. Will integrating USDT help at all?

Lending platform Maker doubled the debt ceiling of its stETH vault this week as it looks to reduce its reliance on centralized stablecoins such as USDC

Why this matters: Another side of the stablecoin wars. Some people like that USDC is regulated and backed by a centralized entity and others don’t. Who will eventually win?

Compound Treasury debuts crypto-backed loans for institutional clients - borrowers will be able to put up crypto collateral to secure loans from Compound Treasury at a 6% interest rate

Why this matters: Another attempt at institutional adoption - gonna keep an eye on the demand for this

Announcing Ribbon Lend - Ribbon's expansion into the credit market

Why this matters: Need to see what the response is to gauge the health of the DeFi sector. Interest has largely been low in DeFi this whole year

Thai SEC intends to ban crypto lending in the country

Why this matters: Many governments out there have similar anti-Crypto/DeFi views. Could other countries follow suit? What would that mean for DeFi?

🏢 NFT/Metaverse Highlights of the Week 🏢

Starbucks Odyssey to offer NFT-based loyalty program built on Polygon

Why this matters: Polygon has a golden business development team and has pumped out so many big name partnerships this year. The HUGE question - will any of this lead to adoption or users? None of this works without demand and Starbucks sure does have a loyal following

Fortnite creator Epic Games releases first NFT game on its store

Why this matters: If this can capture even a fraction of the market share that Fornite has.. Fortnite is yuuge. Gotta keep an eye on established brands to see if they’re able to successful crossover

Magic Eden launches MetaShield to protect NFT creator royalties. It identifies NFTs listed/traded on marketplaces that bypass creator royalties

Why this matters: Another war that we saw instances of with Sudoswap as well are creator royalties. Some in the NFT community feel adamant that creators deserve a cut of all future sales for all time and others feel that that isn’t right. You’ve got protocols that circumvent royalties such as Sudoswap and this is a move to counter that

NFT mints on Solana have surged to an all-time high despite an overall tepid NFT market

Why this matters: It was originally attributed to the y00ts mint but this metric hints that retail and NFT participants are keeping the Solana ecosystem alive - will Solana have another run when the market turns?

Singapore's biggest bank DBS to acquire land in The Sandbox metaverse

Why this matters: Lot’s of big “professional” names have entered the metaverse by buying land or doing things like opening up offices in the metaverse - but what does that even mean? What good will a receptionist and lobby in the metaverse do for anyone?

NFT marketplace Rarible partners with Immutable to broaden its gaming NFT offerings

Why this matters: NFT assets for Gods Unchained, Guild of Guardians, Illuvium and other blockchain-based games can be purchased on Rarible - but does that matter if no one is interested in buying them? There needs to be demand!

A pair of Grammy award-winning producers tied to hit acts from Beyoncé to Justin Timberlake are helping to create music for a NFT band made up of Bored Apes

Why this matters: lol - this one is silly but they sure are pushing this one hard. Shows, musical groups based on Ape characters. They’re at least allocating proper resources in their efforts by using grammy award-winning producers

South Korean authorities have sentenced a man to four years in prison for collecting sexual content of underaged victims he met in the metaverse

Why this matters: New technology, old problems. Creepers in the metaverse. Will girls be receiving unsolicited dick pics in the metaverse soon?

Web3 native fashion brands hit the runway in real life at NY Fall Fashion Week

Why this matters: digital fashion sounds dumb but still keeping an eye on it. Gotta keep an eye on all the narratives

The crypto space is a wild and fast paced, evolving landscape - however one filled with recurring themes and trends. The point of this newsletter is to highlight the story of crypto - as it's told over time. The board, the players, and the game itself. Follow along as we catalog and organize the chaos.

Subscribe to receive our daily brief and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!

And I think it's the main news of not this week only, it lasts for quite a long time already. US does everything in order to remove all the crypto as far as possible. That's not true. And everyone are presenting it like all the privacy coins are dying already and couldn't be traded anymore. It all depends on the level of privacy you've chosen from the very beginning. As Crypton CRP from Utopia p2p https://u.is/ feels pretty nice despite all. Maybe that's all because of the decentralization and own blockchain. Anyway, it's not a disaster.