M6 Weekly Alpha Leak 🚰 What Do the CEOs Know!?!?!?

Week of September 24-30, 2022

What do you know, we had another week of bear market vibes 🤷♂️ Question of the week: is the timing relevant with the current exodus of Crypto CEOs we’ve seen?

TL;DR:

Crypto CEOs Stepping Down - Suspicious or Coincidence?

Atom 2.0 Upgrade

Western Gamers Hate NFTs - Is the East the Path to Success?

Top Bullets: Circle intends to make USDC available on Arbitrum, Cosmos, NEAR, Optimism and Polkadot, Facebook and Instagram users can now share and cross-post digital collectibles, Ribbon Finance new crypto options exchange Aevo, Chainlink to launch staking and new economic model, FTX won the auction for bankrupt lender Voyager Digital, BlackRock launches an ETF in Europe with blockchain and crypto company exposure

Data Highlights: In the past month: Ethereum sales: down 34%, Solana sales: up 113%. Largest Smart Money Inflows this week into stablecoins followed by ETH derivative products. Largest Smart Money Outflows this week from wrapped BTC followed by Rocket Pool, Compound and Tether. Largest Smart Money Inflows this month into Compound products for ETH, USDC and DAI. Largest Smart Money Outflows this month from USDC, followed by Rocket Pool and wrapped ETH

DeFi Highlights: Interbank messaging service SWIFT partners with Chainlink Labs, Institutions can now borrow from Compound Treasury, California issued a cease and desist against crypto lender Nexo, Nexo acquires a stake in a US chartered bank, Launch of PancakeSwap StableSwap, Polkadot latest roadmap, Bancor proposes burning 1 million BNT, Umee creating an institutional lending DAO called UDX

NFT/Metaverse Highlights: Disney hiring for 'aggressive' NFT and DeFi plans, Apple to impose a 30% commission on NFTs, QQL Mint Pass earned $17M on mint launch, Mythical Games’ Blankos first metaverse game launched on the Epic Games Store, Warner Music Group partnered with OpenSea, Walmart launches two new metaverse experiences in Roblox, OpenSea lists NFTs from Optimism, Pixelmon new leadership and development plans

Government, Regulatory and Legal Highlights: Bank of England's bond market intervention raises hopes for Fed pivot, Pentagon contracts with Inca Digital for a security-focused digital asset mapping tool, CFTC’s Ooki DAO legal action, Australian, French, Caribbean, Israel, Norway and Sweden CBDC plans, 23% of Ethereum blocks are complying with U.S. sanctions, SEC charges crypto firm Hydrogen Technology, California accuses 11 of violating securities laws, Veritaseum sues Coinbase for $350M alleging patent infringement

Scammy Sh*t Highlights: BlockSec debunked allegations $160M Wintermute hack was an inside job, South Korea to freeze $67M Bitcoin tied to Terra's Do Kwon, MEV bot gained profits worth $1M then got rekt, Stanford University proposal to freeze illicit crypto gains

Before we get started...Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox.

Done? Now let's dive in!

⛓ Crypto Highlights of the Week ⛓

Crypto CEOs Stepping Down - Suspicious or Coincidence?

So, lots of eyes have picked up on this as well but what’s up with the mass exodus of Crypto CEOs in such a short time span? This week we saw Celsius Network CEO Alex Mashinsky submit his letter of resignation and that can be attributed to the legal issues the company is facing. We also saw that Brett Harrison is stepping down as President of FTX US and over the next few months he’ll be transferring responsibilities and moving into an advisory role at the company in a move similar to Sam Trabucco - the co-CEO of Alameda Research. Zach Dexter will be the next to head FTX US as the exchange moves from Chicago to Miami. Also recently we saw Jesse Powell the CEO of Kraken leave.

Everyone can state their personal reasons for why they’d want to step down from such demanding roles and while they may be valid, it can’t help but beg the question, are all these people stepping down at the bottom of the market or is this something people do when they know difficult times are yet to come?

With the upcoming and inevitable regulation this space is bound to experience in the next few years - could they just be happy to cash out and walk away? The rest of us are in for the ride.

Atom 2.0 Upgrade

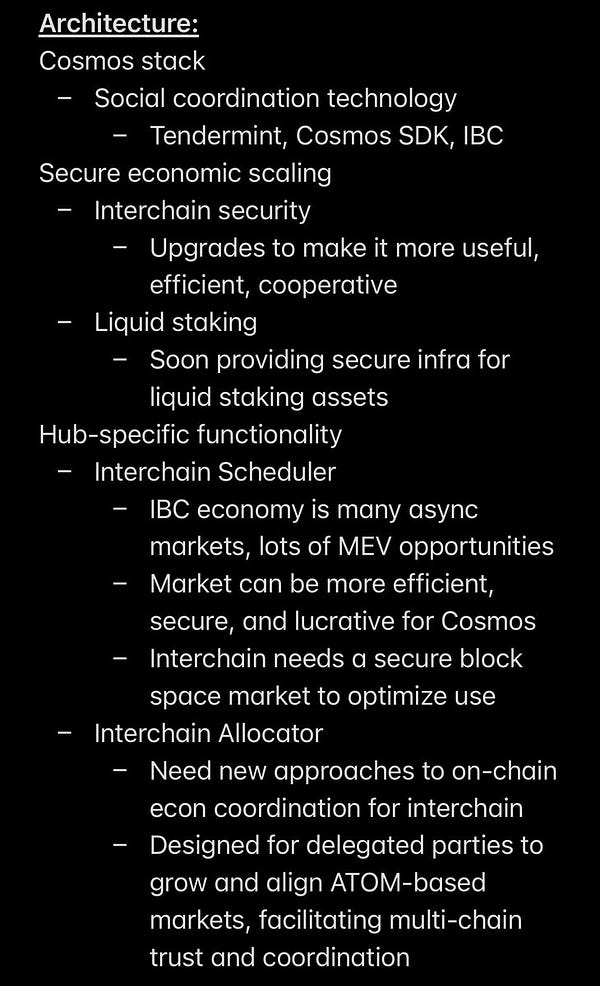

First of all, an oversimplified recap - Cosmos brands itself as the internet of blockchains - and it’s basically an interoperability protocol that allows different blockchains to seamlessly communicate and transfer information with each other over what they call the IBC. Then there’s the Cosmos SDK that allows developers to easily spin up a blockchain used by networks not connected to the IBC like Binance Smart Chain and THORchain.

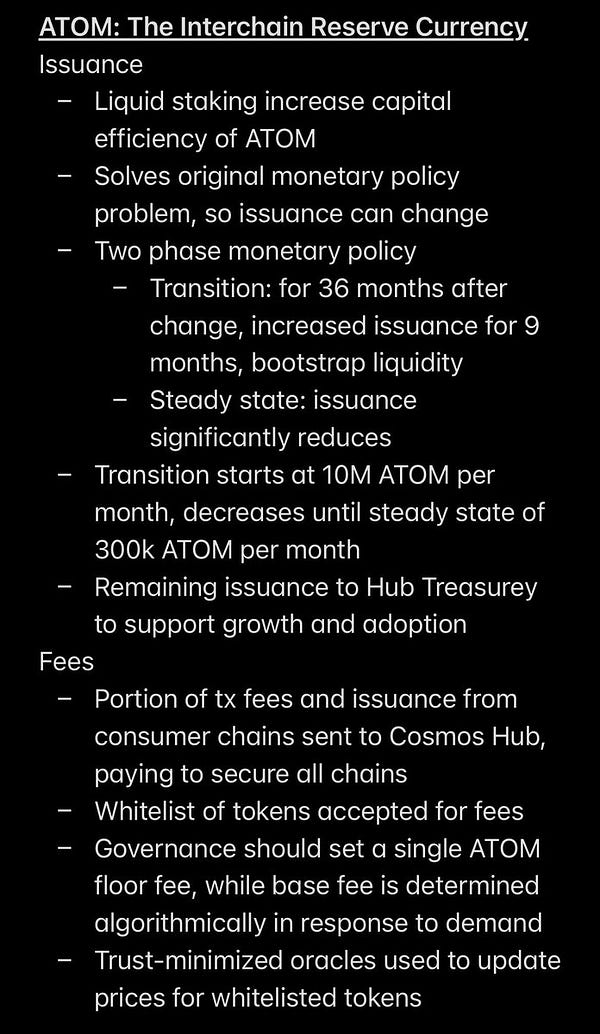

Then there’s the Cosmos Hub which was the first blockchain on the Cosmos Network and it’s intended to facilitate the growth of the Cosmos ecosystem and the native ATOM token. One major problem that ATOM has been previously criticized for is not accruing value from the growth of the Cosmos ecosystem. So in came the proposed solution - Interchain Security and ATOM 2.0

Running a blockchain is expensive, difficult and requires a lot of maintenance. Interchain security aims to solve this problem by allowing approved networks to rent security from the Cosmos Hub by paying fees and tokens to validators and ATOM stakers. The revamped tokenomics for ATOM revealed during the Cosmoverse convention aims to solve the issue of infinite inflation and to incentivize more people to stake. It’s essentially an upgraded value proposition and value accrual mechanism between reducing inflation and allowing for greater liquidity.

Big picture is to provide a better way for ATOM to accrue value than the current airdrop method.

Sounds neat! But let’s be honest - most people care about price. It should’ve been a bullish catalyst, right? Not in this market... ‘Twas another buy the rumor, sell the news event - similar to the Merge. We saw a recent run up and sell off into the Cosmoverse conference where these upgrades were announced. The long term impact of these upgrades are yet to be seen but for now, the price ain’t blasting off towards the Cosmos.

Western Gamers Hate NFTs - Is the East the Path to Success?

Now this is a fascinating topic. There is a consensus out there that “traditional gamers” hate NFTs and crypto - we can see examples of this from the backlash against major gamemakers such as Ubisoft attempting to integrate NFTs into their games. Such resistance from this player base makes mass adoption and progress difficult. Where does this hate come from and is it warranted? That’s up for debate but on the other side of the world - Asian gamers may not share these same views as their western counterparts and may be the key to success for blockchain gaming.

Animoca Brands co-founder Yat Siu thinks that GameFi has the biggest opportunity for growth in Asia, as gamers there “don’t hold the same vitriol toward NFTs as they do in the West.” He attributes this to differing views in the West vs. East on Capitalism and the reflective views that gamers end up holding towards in-game economics, play-to-earn and in general intertwining finance into their favorite games. Whatever the reason - it’s undeniable that there is a strong base of gamers and entertainment consumers coming from countries such as Vietnam, Korea and the Philippines where play-to-earn games were very popular during the last bull run.

While play-to-earn models are unsustainable and long term not the path to success, the welcoming attitude and mindset of the player base to incorporating these new technologies into their gaming experiences should make this an especially important part of the world to keep an eye on as the market is more likely to be accepting of these emerging trends.

💊 This Week’s Top Daily Bullets 💊

Circle intends to make USDC available on five additional blockchain ecosystems including - Arbitrum, Cosmos, NEAR, Optimism and Polkadot by end of 2022 to 2023 and also launching a cross-chain transfer protocol to support USDC interoperability. USDC has been involved in many positive and negative stories lately such as Binance “delisting” it and claims of being overly centralized

Everyone on Facebook and Instagram in the US can now connect their wallets and share their digital collectibles and cross-post digital collectibles that they own across both Facebook and Instagram. Meta (Facebook) has lost a ton of money on its metaverse plans so far but these social media sites encompass a large portion of internet users so their response to such efforts will be telling. Will we see another failure such as twitter integrating NFTs?

Ribbon Finance announced their crypto options exchange Aevo - new order-book based DEX built on a custom EVM rollup to launch before the end of the year. The state of DeFi has been ded for a while but the options game is an interesting sector which has yet to truly realize its potential

Chainlink CEO Sergey Nazarov unveiled plans to launch staking in December, plus a new economic model for the Web3 services platform. Chainlink - an integral part of the crypto ecosystem which delivers real world data feeds to blockchains but has struggled with its price performance. Highlights a trend of everyone realizing protocols needs to be economically sustainable

FTX has won the auction for bankrupt lender Voyager Digital and its assets with a bid of about $1.4B. While many big entities have been dropping like flies during the crypto downturn, FTX and SBF have been busy amassing power

Pantera CEO Dan Morehead highlighted the potential growth and value of DeFi, Web3 functionality, NFTs and metaverse applications in his opening keynote speech at Token2049 in Singapore. Some could say that it’s his job to be bullish on their investments but VCs left and right are sticking to their long term theses

BlackRock, the world’s largest asset manager, launches an ETF in Europe with blockchain and crypto company exposure. The index has 75% exposure to companies with primary business related to blockchain, including crypto miners and exchanges, and 25% exposure to companies supporting the blockchain ecosystem

These are just our top bullets, want more? Check out our daily newsletter:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

💰 Fundraising Highlights of the Week 💰

📊 Crypto Market Data Highlights of the Week 📊

In the past month:

Ethereum sales: down 34%

Solana sales: up 113%

Nansen Smart Money Token Inflow and Outflows:

Largest Smart Money Inflows this week: Top money flowing into stablecoins followed by ETH products

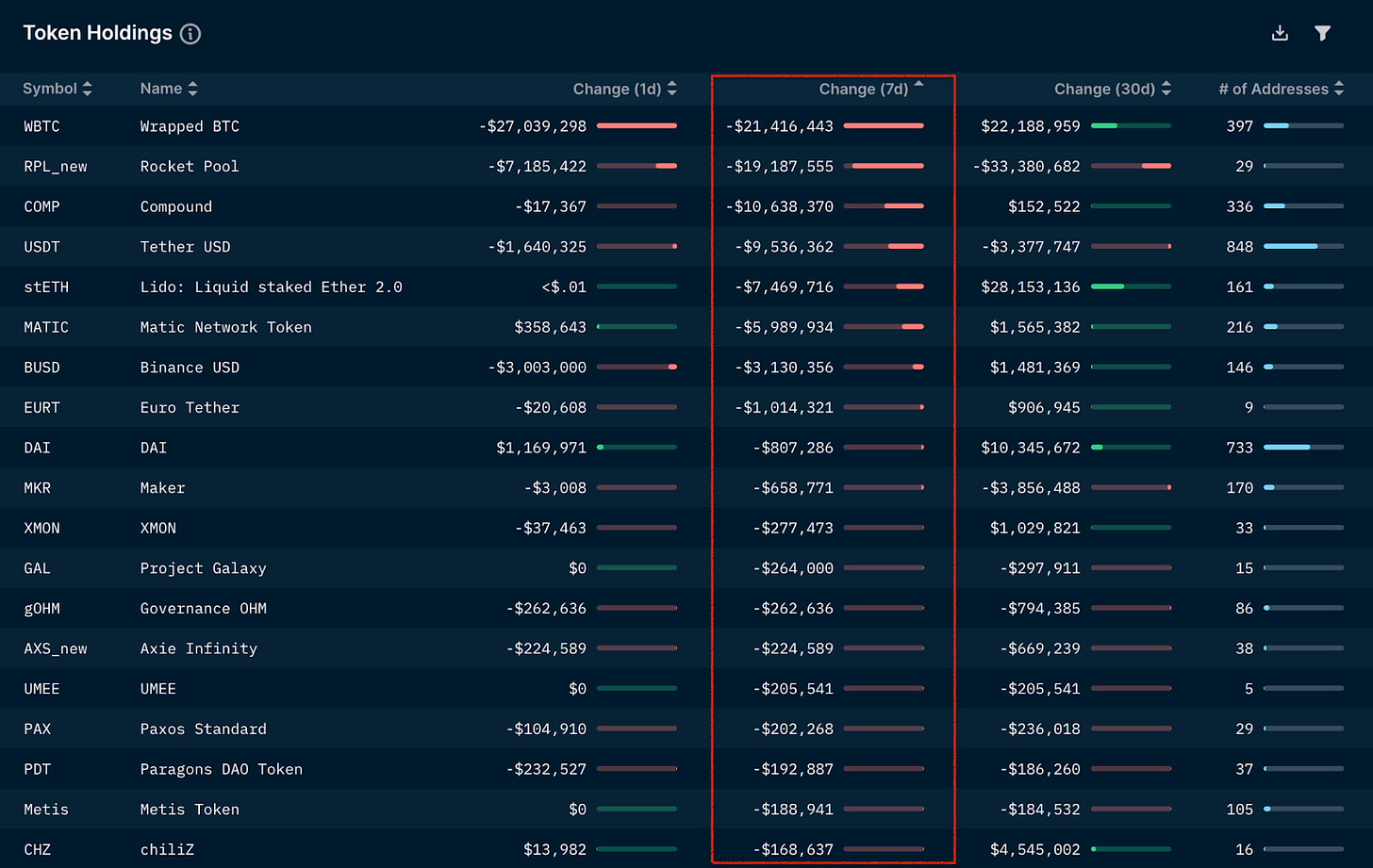

Largest Smart Money Outflows this week: Biggest outflow is from wrapped BTC followed by Rocket Pool, Compound and Tether

Largest Smart Money Inflows this month: Top 3 biggest inflows are into Compound products - ETH, USDC and DAI

Largest Smart Money Outflows this month: Biggest outflow was from USDC, followed by Rocket Pool and wrapped ETH

🏦 DeFi Highlights of the Week 🏦

DeFi has been a ghostland this entire bear market. TVL has tried up - no one else talking about yield farming strategies anymore, the days of high APY farms are behind us. Yet we still see weekly developments from protocols aiming to improve their economics, implement new and improved mechanics and overall enhance liquidity in the space. Another common trend we’ve seen is protocols attempting to reach out and bridge the gap between traditional institutions and crypto natives - a move that may be necessary with the wave of upcoming regulation that we’ll inevitably see in the next few years.

Interbank messaging service SWIFT has linked up with Chainlink Labs on a cross-chain interoperability proof-of-concept project

To meet the growing demand for liquidity, institutions can now borrow from Compound Treasury, using digital assets as collateral

8 states, including California's Department of Financial Protection and Innovation issued a cease and desist against crypto lender Nexo over its crypto interest-bearing accounts

Nexo acquires a stake in the holding company that owns Summit National Bank, a US chartered bank, to expand its financial product offerings in the United States

Launch of PancakeSwap StableSwap – offers lower slippage & fees for stable pair trades

Polkadot latest roadmap includes: Asynchronous Backing, Parathreads/Next-Generation Scheduling, XCMv3, FRAME: Weights V2, Governance Overhaul, Collectives Parachain, Nomination Pools & Fast Unstake, Staking Dashboard, Disputes Slashing

Bancor proposes burning 1 million BNT tokens to support prices

Cross-chain DeFi protocol Umee is stepping into TradFi by creating an institutional lending DAO, called UDX, to help facilitate the transition of bond markets into DeFi lending

🏢 NFT/Metaverse Highlights of the Week 🏢

Crypto gaming, Metaverse, NFTs - you can basically bundle all of this together since the future of this sector hasn’t quite been figured out yet but this is probably the highest potential area in crypto. The potential market for gaming and entertainment is massive and if builders and teams can properly implement this tech into gaming, in a way that makes sense and isn’t rejected by the market - then this area will boom. The problem is that introducing this new technology to the masses has been slow so we pay attention to moves that aim to familiarize users with NFTs and gauge the reaction. General interest in NFTs have waned considerably throughout the course of this year. Nonetheless, there’s still plenty of developments pushing this sector forward

Disney hiring transaction lawyer for 'aggressive' NFT and DeFi plans

NFT app developers backlash at a decision by Apple to impose a 30% commission on NFTs sold through apps on its marketplace, putting NFT purchases in the same boat as regular in-app purchases and similar to that imposed by Android’s app store Google Play

Fidenza creator's new NFT project, QQL Mint Pass, earned $17M on mint launch - decided to blacklist royalty-free NFT platform X2Y2 in the ongoing controversy over royalties

Mythical Games’ Blankos is the first metaverse game to be launched on the Epic Games Store

Warner Music Group partnered with OpenSea to help engage music fans through NFT drops

Walmart has joined the list of companies seeking new ways to market their brands via the metaverse with the launch of two new experiences in Roblox. Will let users take part in several new experiences and games, collect in-game coins and tokens, prizes and “verch” (virtual merch)

OpenSea lists NFTs from Layer 2 scaling network Optimism - brings the platform's supported blockchains to six

Pixelmon, a Web3 game project that raised $70M from primary NFT sales and was ridiculed for its abysmally bad art, has announced new leadership and development plans

NFTs will spawn the next Marvel or Disney, says Solana Founder - a juggernaut IP could emerge from the current crop of NFT projects

Illuvium’s co-founder wants to build a series of blockchain games connected to each other, forming an ecosystem of interconnected titles which share NFTs - the interoperable blockchain game (IBG)

👨⚖️ Government, Regulatory and Legal Highlights of the Week 👨⚖️

Ah, everyone’s favorite topic - regulation. Like it or hate it - it will be here before you know it so best to pay attention to the developments as they happen so you’re prepared. The U.S government and Pentagon is continuing its push to build the framework they need to monitor on-chain activity for enforcing sanctions as well as figure out the legal standing of DAOs. We also see the push by many different countries to develop their own central bank digital currencies.

Bank of England's bond market intervention raises hopes for Fed pivot

Pentagon contracts with Inca Digital for a security-focused digital asset mapping tool

CFTC’s Ooki DAO legal action shatters illusion of regulator-proof protocol - raises still-unanswered questions about who is culpable when a DAO commits a crime

Australian CBDC pilot test for eAUD to commence mid-2023

French Central Bank CBDC projects aim to manage defi liquidity, settle tokenized assets

Central Banks of Israel, Norway and Sweden team up to explore retail CBDC

The Caribbean is pioneering CBDCs with mixed results amid banking difficulties

At least 23% of Ethereum blocks are complying with U.S. sanctions due to the use of a service called Flashbots

SEC charges crypto firm Hydrogen Technology with market manipulation and selling unregistered securities in the form of its Hydro token from which it profited $2M

California regulator accuses 11 of violating securities laws, operating like Ponzi schemes

Blockchain firm, Veritaseum, sues Coinbase for $350M alleging patent infringement and potentially unlawfully used the patent to facilitate crypto payments, trading, and staking services

💩 Scammy Sh*t Highlights of the Week💩

Blockchain security firm BlockSec debunked a conspiracy theory alleging the $160M Wintermute hack was an inside job, noting that the evidence used for allegations is “not convincing enough”

South Korean authorities look to freeze $67M Bitcoin tied to Terra's Do Kwon

A MEV bot gained profits worth $1M via an arbitrage opportunity however authorized a malicious transaction that drained the funds an hour later

Stanford University recently put forward a new proposal to freeze illicit crypto gains, called ERC-20R and ERC-721R, allowing a short window after a transaction to challenge the theft and possibly recover

The crypto space is a wild and fast paced, evolving landscape - however one filled with recurring themes and trends. The point of this newsletter is to highlight the story of crypto - as it's told over time. The board, the players, and the game itself. Follow along as we catalog and organize the chaos.

Subscribe to receive our daily brief and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!