Macro Mondays 🌍: More Powell Pain or Pivot?

🌍 Macro Mondays by Michael 🌍 Monday, September 19th

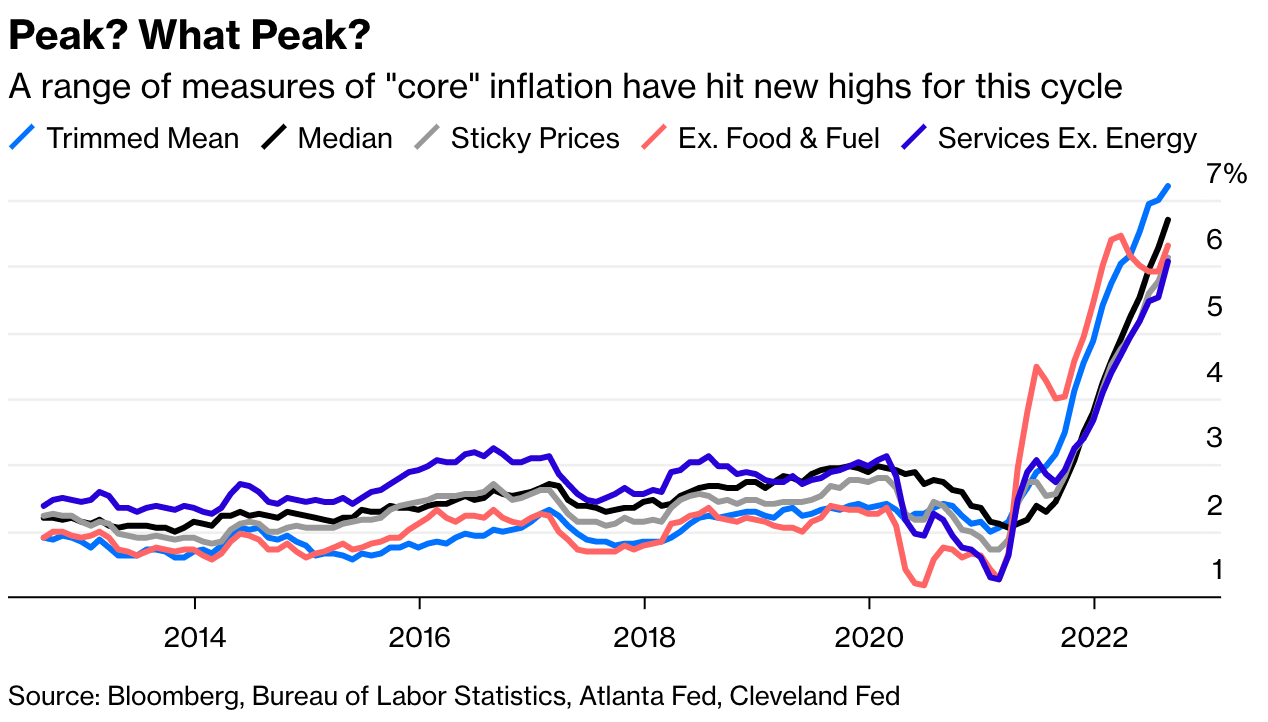

Stonks have gotten crushed. This latest round of pain has been driven by the disappointing August CPI print, which the market has taken as an indication that the Fed will not pivot anytime soon. While year-over-year inflation decreased slightly in August, headline inflation rose 0.1% and “core” inflation rose 0.6% month-over-month.

Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Most upsetting to markets was the unexpected rise in core inflation. MoM Core inflation initially dipped to 0.31% in July but jumped up to 0.57% in August, a level not seen in three decades.

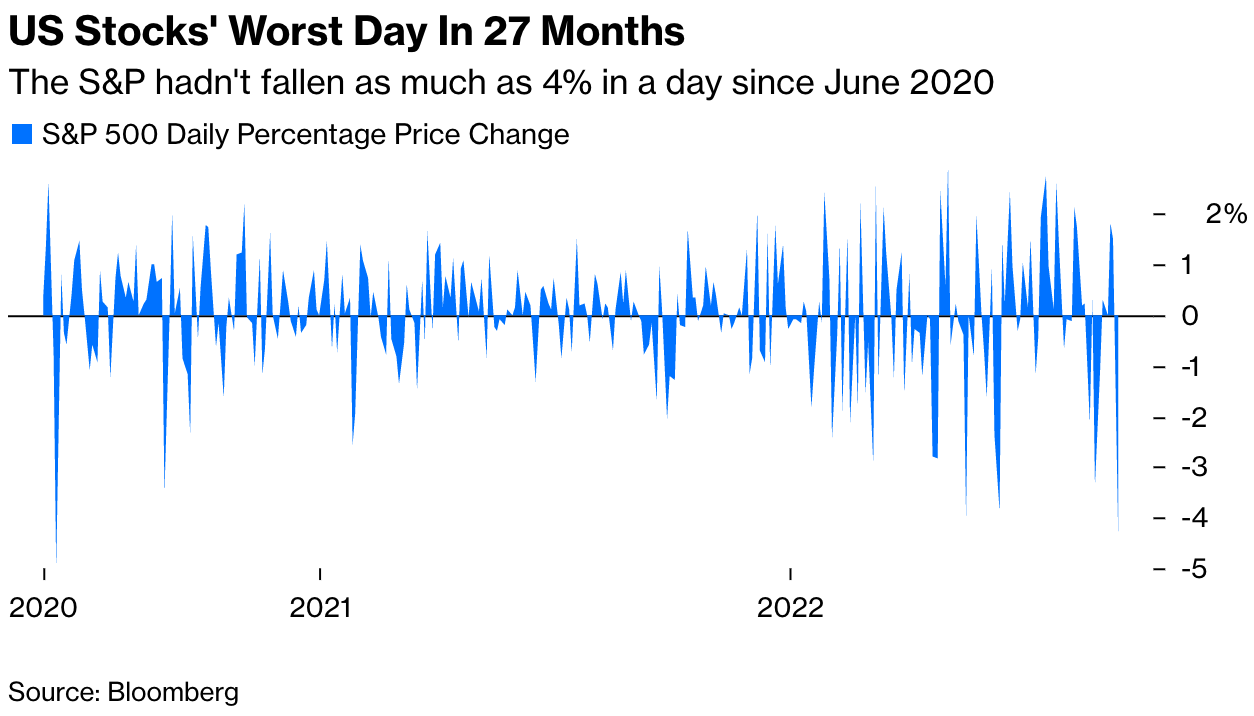

This latest print caught many investors offside, as evidenced by the painful decline in global stonk indices on the day of the print (9/13). As Shakespeare once said: “expectation is the root of all heartache.”

The question now is how hawkish Jerome Powell will be during his FOMC presser on Wednesday. The market currently expects a 75bp hike, but traders will be listening for any dovish hints of a future pivot.

During Powell’s last public address – the Jackson Hole speech in August – where he doubled down on the Fed’s hawkish stance. The WSJ reported today that leading up to J-Hole, Fed officials “thought investors were misreading their intentions given the need to slow the economy to combat high inflation.” To correct this misperception, Powell actually scrapped his original address and instead delivered unusually brief remarks with a simple message – the Fed would accept a recession as the price of fighting inflation. R.I.P. soft landing…

One Fed official, governor Christopher Waller, suggested this month the central bank would be comfortable with the jobless rate rising to around 5%, from its current 3.7%. That magnitude of increase has never occurred outside a recession. “If unemployment were to stay under, say, 5%, I think we could really be aggressive on inflation,” Waller said. After it goes above 5%, the Fed will face “obvious pressure to start making tradeoffs” between employment and inflation.

The Fed has pointed to continued low unemployment as proof that the labor market (and broader economy) remains robust and able to digest additional rate hikes and QT. At this current juncture, the Fed is more worried about employments than ETFs. Until the unemployment rate weakens, the Fed will continue to use it as proof of the underlying strength in the economy, justirfying additional rate hikes.

However, one area of the economy that could complicate the Fed’s hawkish stance is the housing market.

The National Association of Home Buyers/Wells Fargo gauge decreased for a ninth straight month. Homebuilder sentiment has fallen every month this year, the longest stretch of declines since 1985.

Declining sentiment is driven mostly by soaring mortgage rates, which makes financing a new home more expensive, dampening demand for homebuilder’s services.

This year’s rapid rise in borrowing costs has slammed the brakes on the US housing market and led to calls for an imminent “housing recession.” The calculus going into the FOMC meeting this Wednesday is to divine which market the Fed is watching (cares about) more: labor or housing – cuz they don’t jive.

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!

Momentum 6 offers research, analysis, and coverage of the fast-paced Crypto space.

The Crypto space never sleeps. Each day is filled with an overwhelming amount of information spread across various sources.

This newsletter offers a Crypto-native perspective and a one-stop shop for everything you need to stay updated on the daily goings on in the Crypto world.

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.