NEAR Protocol Offers $1 Billion+ in DeFi Developer Incentives

Is mass adoption NEAR?

Is mass adoption NEAR?

The L1 race is heating up. Just days after we profiled NEAR Protocol last fall, the Layer 1 blockchain proving to be the one to beat in terms of performance, announced a momentous event, an $800 million fund to drive usage of the NEAR blockchain in decentralized finance (DeFi).

Watch out Vitalik, we might be $NEAR the end of $ETH dominance: An Overview of NEAR’s Ecosystem

TL;DR -medium.com

After Solana came out of seemingly nowhere two years ago to rival Ethereum to host DeFi applications, no one underestimates this even faster blockchain, especially in trading where execution speed is money. When block time and finality are considered together, NEAR has the edge with its delegated PoS, infinitely scalable dynamic sharding, and fast finality algorithm DoomSlug.

All eyes were already on this contender to see how its impressive performance metrics would translate into use cases, and now it is placing more than a billion dollars behind them. In addition to the ecosystem incentives, another $350 million was slated for a DeFi incentive program (allocated from a January 2022 private financing round). Fast grants of up to $50K are being issued to applications wanting to build on NEAR.

If that is not enough to lure developers, some prominent VC investors are also increasing their backing of NEAR. Mammoth blockchain fund ConsenSys, the creator of MetaMask Wallet, has announced a blockchain fund focused on NEAR. YCombinator has launched a DAO on NEAR, OrangeDAO, to invest in startups, which undoubtedly will benefit those in NEAR’s ecosystem.

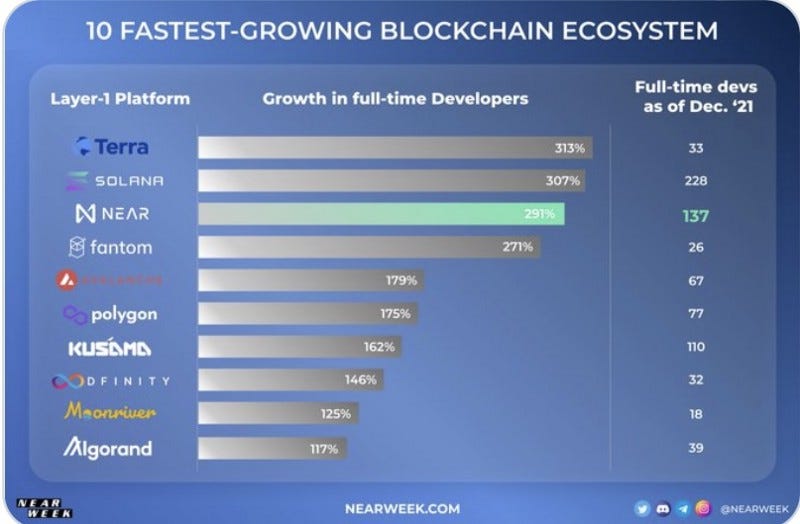

Developers are also biting. The number of full-time developers building on NEAR increased 291% in 2021 to 137, making NEAR among the top 10 fastest-growing blockchain ecosystems. All indications are that growth has accelerated since NEAR announced over a billion dollars of developer incentives.

Let’s dive deeper into who is building and what current development activity may lead to for NEAR.

NEAR Overview — Easy Access to Web 3

A few months ago, NEAR’s plans to become the main launchpad onboarding the masses to Web 3 may have seemed ambitious. Making use of its user-centric features, support from guilds and DAOs, and social community, NEAR forecasts that one billion people will be using NEAR-based applications or components in 5 years.

NEAR was purposely built around an ever-expanding community of innovators, creators, and contributors. The strategy behind this growth is to make it easy for both developers and end-users to access Web 3 on its high-performance blockchain. Over five million wallet addresses have been registered, many taking advantage of the ability to turn their address into a marketable account name, similar to an Internet address.

To this end, in recent months, NEAR has formed more partnerships with strategic advisory firms to assist startups wanting to onboard to Web 3 through NEAR’s blockchain. This includes a partnership with Web 3 solutions provider Chikai, part of digital systems builder consultancy Keyko, specializing in deployment on the NEAR blockchain, and Encode to provide education, bootcamps, and hackathons for developers building on NEAR.

NEAR Bridges to Everywhere

Considering cross-chain functionality to be fundamental to driving mass adoption over an interconnected and open Web 3, NEAR has continued building one of the most complete bridge network solutions within the blockchain ecosystem. To remove barriers to building for a multichain world, developers can build Dapps with compatibility with both Ethereum and the new generation of interoperable platforms via bridges with minimal friction.

Aurora, the ETH L2 sidechain used to transfer tokens to and from NEAR and Ethereum, has recently undergone a UX upgrade to its Rainbow Bridge 2.0. Token transfers can be made across Ethereum or various blockchains on NEAR4 without leaving the Dapp.

NEAR will need to improve transaction processing time on Rainbow to make it viable in DeFi and other applications. Any user or protocol can send assets from Ethereum to NEAR in about six minutes for about $10 on average. However, sending assets from NEAR back to Ethereum can take up to 16 hours and costs around $60.

Other networks continue to expand. The Octopus Network providing interoperability with Substate-based appchains like those in the Polkadot ecosystem is gradually adding appchains.

Notably, developers can program on NEAR in many programming languages, including Rust, Assembly, Solidity, and Substrate.

Guilds and DAOs

Recent guild and DAO community deployments prove NEAR to have a strong use case as a launchpad to Web 3 through its powerful community-building tools and cross-chain bridge networks. An unmistakable trend in social communities and Dapps deploying on NEAR is leveraging the bridges for multi-chain use cases.

SailGP, a provider of world-class sporting entertainment, has become a NEAR DAO to empower its fandom. Fans who hold tokens can take part in governing the platform. Through NFTs, users can own and manage SailGP teams and other content. SailGP plans to use NEAR’s user engagement tools and bridges to other major blockchain networks.

Other social projects have found NEAR to be an effective community-building platform. Fitness app Stepbet amassed over 250,000 users of its wallet in the first 48 hours on NEAR. In January, the Y Combinator crypto collective OrangeDAO signed up over 1,000 founders and former alumni.

The NEAR Dapps Ecosystem

For L1s, winning over the decentralized finance sector is like winning the Grand Prix. Solana has shown the DeFi sector will follow the performance. With its fast transaction speeds, the 2-year-old blockchain quickly took over Ethereum as the host of the most DeFi Dapps.

Over the last six months, the total value locked in DeFi on NEAR has almost quadrupled, from $150M to $582 million. This compares to a TVL of $5.9 billion on Solana and $100 billion on Ethereum, according to DefiLlama. The TVL of Ref Finance, the AMM where investors can access multiple pools through one contract and trade across pools through one atomic transaction, more than tripled to $250 million since January.

It is noteworthy that projects on NEAR are receiving strong investment backing, with a number raising over $5 million, including DeFi projects Ref Finance and Bastion Protocol. Other investor favorites include Flux Protocol, Octopus Network, Paras, and Aurora ($12M).

When reviewing some of the DeFi use cases on NEAR, a first impression is that the long-talked-about DeFi products are finally becoming a reality.

The Vinci NFT-backed DeFi protocol uses NFTs as collateral for various financial services among recent NEAR grant recipients. You can finally deposit your NFT game items (Axies, Decentraland land plots) and collectibles (CryptoPunks) and use them as collateral for a loan, trading perpetual contracts, or even hedging price volatility in your CryptoPunk or other NFTs.

On cross-chain DeFi marketplace Ariadne, traders can enter and exit farms on multiple blockchains (EVM or non-EVM) from one chain without dealing with bridges and their fees or slippage. Fundamental to all of these innovative DeFi services is the ability to transact across chains at very low costs on NEAR.

But the real innovation on NEAR may be the most apparent in the blockchain’s oldest use case, payments. NEAR’s fast TPS, low transaction fees, and scalability support commercial-scale payment solutions. Newly launched Dapps include no-code commercial payments on MooPay, UX-friendly POS crypto-fiat solution with instant activation on NEARPay, and automated payment stream control with fungible token support on Roketo.

We continue to see a heavy focus on user-centric Dapps empowering the user, including consumer data control social platform QSTN, decentralized identity provider Verona, and data privacy protocol HOPR (run nodes and stake to earn rewards while providing data privacy on Web 3).

A vibrant artist community is growing in comedy NFTs (NiftyComedians), Music NFTs (DAORecords), gaming NFTs, and more focused on rewarding creators where artists benefit from NFT ownership, fractional ownership, and real-time on-chain settlement of royalties.

Launch of Algorithmic Stablecoin

Last month, NEAR launched its algorithmic stablecoin, $USN.

Algorithmic stablecoin protocols are designed to smooth price volatility by issuing more coins as the price rises and buying them in the market as the price falls.

NEAR has issued a U.S.-backed stablecoin along the lines of the most popular coins $USDT, $USDC, $TUSD, or $GUSD. NEAR’s stablecoin is the $USN, newly launched on April 20th on the NEAR public testnet.

While an APR of ~20% was initially circulated, the APR announced is ~10%, which is still high enough to attract money from other stable currencies.

The $USN is not issued on leverage but is backed 100% by $NEAR + stables in the reserve fund, $USN plus other stables. $NEAR is not burned but staked to the reservoir fund. Any holder can mint 1 $USN against $1 and earn 10% APY.