Overview: DeFi Options Trading

Large institutional investors will not enter the cryptocurrency market in a meaningful way without access to this essential risk mgmt tool.

Over the last year, investor interest has been peaked by a surge in DeFi platforms selling a new financial instrument called a DeFi option. For a small options fee (premium), investors can place long (buy) or short (sell) directional bets on crypto assets without putting out the full cost of the position.

Large institutional investors will not enter the cryptocurrency market in a meaningful way without access to this essential risk management tool. With options, investors can profit whether prices rise by buying the right to buy the asset with call options, or fall by purchasing the right to sell the asset with put options at a predetermined price and date. Or they can let the option expire and only lose the options fee.

Decentralized finance is now making options more accessible to the average investor. Investors who are bullish, bearish, and love volatility can easily invest in DeFi options through decentralized options platforms. They increasingly do so through DeFi option vaults (DOV) on platforms like Ribbon and Friktion. DOVs make it easy for even retail traders to enter the market by depositing their crypto coins into the vault option strategy of their choice, not unlike choosing your favorite ETF or copy trading portfolio.

Currently, DeFi options range from covered puts and covered calls on popular crypto pairs to user-created vaults for highly customized risk coverage. The composability and interoperability of DeFi is taking structured options product innovation to a new level and improving the investor risk-reward profile.

Options Primer

Invented in the commodities markets, options would give the buyer of eggs on the Chicago Mercantile Exchange the right but not the obligation to buy a commodity at a predetermined price on or before an expiry date for a small fee called the premium.

Options are derivatives contracts (a smart contract in the case of DeFi options) whose value is dependent on that of the underlying asset. This asset could be stock, cryptocurrency, or commodities, for example.

Even though options have a more attractive risk-reward profile than many other investments, the average investor considers them too complicated to use. Since most options contracts are entered into through over-the-counter agreements, counterparty risk management can be cumbersome and costly.

On DeFi options platforms, investing in options is as easy as investing in a liquidity farming pool. Options vaults are similar to copy portfolios on investment platforms. Each vault offers a different options strategy (e.g., covered call in $ETH, put on $WBTC) executed by a smart contract and backed by a pool. The investor deposits assets to the vault’s smart contract to execute the strategy.

Either way, you will pay a premium to enter into the options contract, and if you do not exercise the option right, you only lose the premium fee.

Options can be cash-settled or physically settled. If you buy lean hogs for physical settlement in traditional markets, they could be dumped on your front lawn. More practically, investors invest in commodities in exchange for cash settlements. In DeFi options markets, payout in the platform’s token would be considered cash settlement. If you invest in $WBTC and the payout is in $WBTC, it is said to be physically settled (in the actual underlying asset).

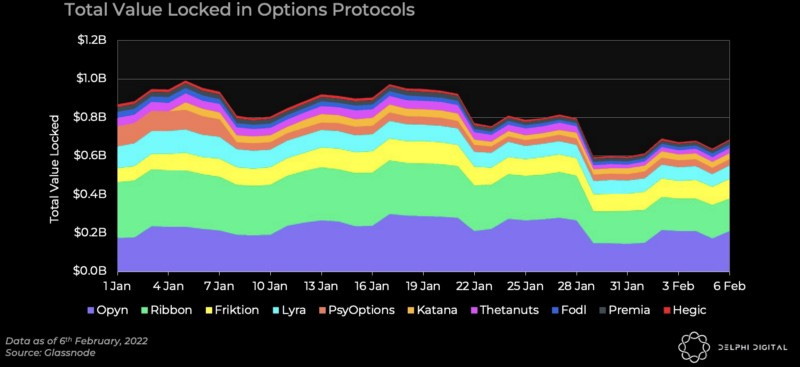

The Current State of DeFi Options

Structured derivatives products are a center of innovation in financial products. Options are a handy risk management tool in volatile markets like commodities and cryptocurrency. In 2021, the total value locked in options protocols rose from $85M to $1B. We expect this to be the calm before the storm of innovation that will lead to high growth in the coming years.

Due to the ease of use of DeFi options structuring and minting, users will increasingly be structuring their own products with a few clicks and even launching their own vault pools to promote to others.

The Good

The primary benefit of options is that hedgers and investors can reduce risk or go long or short at a much lower cost. Crypto options minted on the DeFi platforms on the blockchain provide many added benefits:

Generally higher-yielding, sellers of DeFi options can enjoy the currently high premiums.

Options, typically an inexpensive way of providing portfolio diversification, are becoming even cheaper.

Gas costs can be spread across all users in a pool.

More potential combinations of spreads and options. Though most platforms are offering up basic options contracts, options product innovation is expected to surpass that of traditional options markets.

Users will be able to create their own customized options and vaults.

Investor token holdings may be partially or fully back positions to reduce the use of leverage.

Options pools help prop up liquidity in new tokens.

The Bad

Professional options traders are volatility lovers. However, the less experienced traders may find volatile cryptocurrency markets challenging to navigate. From a pure risk management perspective, options are helpful for hedging potential losses and smoothing out returns.

Based on an analysis from a Crypto Options Quant, who performed a backtest on the ETH Covered Call Option Vault and SOL Covered Call Option Vault: You may make more money in fast-rising crypto markets simply by holding the token in your wallet instead of paying premiums to achieve lower returns through option strategies.

More sophisticated options are scarce at this stage of DeFi options market development.

Historical data on options pricing and volatility skew, key inputs into options pricing models, may be hard to find on newer tokens.

High volatility — Price forecasting is difficult if the underlying asset is volatile.

Leveraged transactions — Traders often use leverage when buying options, magnifying their potential gains or losses.

Yield payments may be delayed on some platforms. If you are reinvesting your earnings, the compound returns will partly be a function of how soon you can obtain your earnings and put them back to work in the market.

Some options trading platforms are reselling or licensing the services of another options trading platform and may charge higher fees to do so.

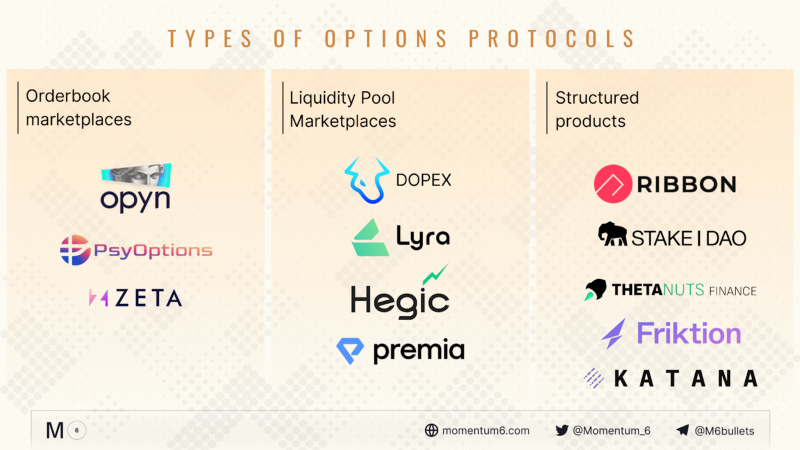

Current Projects in the DeFi Options Space

*TVL source Stelareum and DeFiLama

dYdX (TVL: $1B)

dYdX is a pioneering structured product market in the DeFi space and is still the most popular by TVL. The main current offering is perpetual options. Popular in the DeFi space, a perpetual option (XPO), considered an exotic option, has no fixed maturity or exercise date. To manage its rapid growth and add more trading pairs and derivatives products, dYdX has partnered with StarkWare on a Layer 2 protocol for cross-margined perpetuals. The StarkWare engine brings scalability, zero gas costs, lower trading fees, and smaller minimum trade sizes.

Ribbon Finance (TVL: $274.5M)

Ribbon aims to help its users add crypto options, futures, and fixed income products to their investment portfolios to improve their risk-return profile. The platform currently provides various fully collateralized options vaults allowing investors to run an options strategy automatically, and will soon offer partially collateralized options. Developers can also create structured products by combining various DeFi derivatives. A myriad of new products and features are being rolled out in Ribbon V.3, including a high yield product with downside protection combining levered vaults and spread vaults and the ability to create options vaults on most any asset with Uniswap V3 oracle support. Ribbon recently announced it would redistribute half its protocol revenue to stakers, who will be more incentivized to lock $RBN and boost the token’s value.

Opyn (TVL: $274.3M)

Opyn is another perpetual options market where traders go long or short ETH by buying and selling Squeeth (a power perpetual ETH² on the Opyn platform) based on the difference in price between an Index Price (ETH²) and the current market price (Mark Price). Investors can also invest in Automated Squeeth Strategies by depositing $ETH in the contract of their choice, gaining neutral (Crab), positive (Bull), or negative (Bear) exposure to ETH. Platform users can also build novel options strategies. Another way to go long $ETH on Opyn is to be a liquidity provider on the Uniswap V3 SWTH-ETH liquidity pool, with the option of heading the Umiswap LPs with Squeeth with almost no impermanent loss.

Friktion Labs (TVL: $129.7M)

Friktion Labs is the largest options market on the Solana blockchain, a lightning-fast chain that has outstripped Ethereum in total value locked in DeFi protocols. The long-term aim of the portfolio risk management platform is to provide DAO treasuries with portfolio management services to manage risk across cycles and create new revenue streams. These portfolios, called Circuits, are powered by Volts. Friktion Volts have quickly become popular with two currently open, Covered Calls and Cash Secured Puts, with more on the way, including a volt to harvest volatility and hedge impermanent loss while providing liquidity to top AMMs.

Dopex (TVL: $50.3M)

Dopex set out to build an options protocol that improved on the shortcomings of others. The platform offers discounted options and instant arbitrage opportunities. Some of its features include fully collateralized options, deeper liquidity enabling the purchase of swap options at any strike price, and the ability to mint synthetic swaps (indices, stocks, etc.). Liquidity providers to options pools can receive $rDPX rebates to offset risks and constantly receive $DPX rewards. New products include Curve Interest Rate Options (IRO) on the pools of the largest AMM with 500x+ leverage.

Do not confuse standard options trading with binary options, a riskier strategy being introduced to various DeFi platforms including Synthetix, Value Network, and Spectre.AI. They involve a binary bet based on whether the price is above or below a price level on the expiry date. These all-or-nothing bets are also called knockout options.

On the other end of the spectrum is highly customized DeFi options, allowing users to create markets and structured options products. Investors will be able to create custom options products that more precisely hedge risk or capture upside and trade them at low to zero cost.