Pantera Capital Says DeFi is the Future. Here’s Why They’re Wrong

Weekly Hot Take + Highlights of the Week

Weekly Alpha Leak: January 21st-27th, 2023

Pantera Capital recently put out an investor’s letter detailing how bullish they are on DeFi being the Future.

Here’s why they’re wrong.

Key Points Covered:

The Potential of DeFi

The Reality of Why DeFi Won’t Work

The Compromises That’ll Make “DeFi” Not DeFi

A Reminder of a Tale as Old as Time

An Optimistic Outlook - Plenty of Opportunity

Footprint Analytics and The Crypto Illuminati are hosting a workshop teaching how to analyze on-chain activity: Blockchain Forensics for Dummies. Check it out and participate for a chance at a USDT prize pool. Details here

The-Anti DeFi Thesis

Credit Where Credit is Due

Pantera Capital recently put out an investor’s letter where they detail how bullish they are on DeFi. This is not a new take! In fact, it is quite common among many crypto enthusiasts. They are adamant that on-chain, smart contract, protocol-based crypto is the solution to solve the tale as old as time problems of centralized entities. And you know what? That’s completely valid and admirable. Blockchain technology really does hold the potential to solve these problems. The principles and core tenets of crypto do an excellent job at selling a vision of a better and more egalitarian future. One where the individual user is able to take back control of their finances and introduce more transparency and control checks into a shadowy system. It sounds pretty appealing, so what’s the problem?

The Problem

The problem is that despite the underlying principles that are worthwhile and admirable about decentralization, crypto and blockchain, at the end of the day, DeFi is going to struggle heavily to gain mainstream adoption due to the complexity and nature of working on-chain. It's too difficult for normies in its current state and the compromises you’d need to make to get the technology normie friendly inherently shifts the state of the technology back towards centralized entities. It takes away from the original purpose. People constantly chime in at this point and say “we need to make the technology better and easier to use and we will in time.” Sounds good! But not really.

Painting a Picture

Let’s paint a picture here with an example. Imagine telling your average user - whether it be a grandparent, parent, friend, neighbor, acquaintance, etc that they will be wholeheartedly responsible for their assets. Completely. Financial sovereignty. Your keys, your crypto. The nuances of what this really entails aren’t so exciting for everyone though. If they send a transaction to the wrong address, accidentally get phished, lose their keys, a loved one dies without backup plans or simply makes any type of mistake, then their funds are GONE. No customer service, no one that you can call up or message to have the transaction reversed or help you. You sent an immutable transaction. There’s no do-overs on the blockchain. You’d be trying to convince people to place their finances in a system that’s more complicated for them and makes their lives harder. Technology has only ever made our lives more convenient and easier and that’s the trend it will continue on, Not adding more complexity and problems.

You think you’re going to get mainstream adoption from this? Imagine convincing people en masse to trust their life savings and finances into a system where they have no means of getting any type of support. How could someone help you? There’s no calling up your wallet provider and getting them to fix what you did wrong. You are the one with full and total responsibility for your assets. It’s not a bug, it’s a feature. A niche group will undoubtedly be interested in this type of control but the public on a grand scale? It’ll be a very hard sell.

A Potential Compromise - But is it Even DeFi Anymore?

Many proponents of crypto will take this opportunity to step in and say how these are problems that will be solved in time. Great! Let’s walk down that hypothetical path and explore what that may look like. Imagine that we start introducing solutions that allow users to have customer service and other means to resolve issues that will INEVITABLY arise. If a mistake is made, then they can simply contact customer service and ask for help. “I accidentally sent funds to an incorrect address… I made a mistake, can you help me get the transaction reversed? Or “I am locked out of my wallet and can’t access it. Can you help me access it?”

The most likely solution would be some sort of middleground of web2 and web3. One that blends both worlds and allows customers and users to have the type of support they have come to expect in a modern world. We are inherently going to need to always have some element of centralization involved to appeal to a wider audience who simply needs such things. We may end up solving a lot of these problems and make crypto more accessible to a user, but at that point, it really feels like we’d be moving away from the core tenets that we set out to embrace and the problems we wanted to solve. Some intermediary would still need to exist, in some form. We really just going to risk everything on something with no takebacks? The banking and finance apps we use in the future may be based on blockchain but won’t it just be a new iteration of what we currently have but with extra steps? It’s like taking a step forward and 1.5 steps back. Regular banks with blockchain built in. The same thing as before but with extra steps.

Cold Water on the Face

Let’s also take this opportunity to address the psychology of why people would be interested in using DeFi. We can have all the bright ideas in the world and revolutionary technology but all of it is for naught if nobody actually wants to use it. If you build it, they will come is simply not true. You need to convince people of an idea and why it is important to them. The crypto and DeFi space is permeated with brilliant people and built on a foundation of wanting to build a better future but the honest truth is that we're still in a space fueled by speculation. Crypto is in the business of selling hopes, dreams and visions of what the world may one day be. DeFi sounds really pretty and elegant on paper and in theory, but what we've seen in practice is speculation, corruption, greed, insider trading, and manipulation even in an area that is supposed to solve those problems. It’s inherently human. Crypto is really just another iteration of financial markets that have operated for hundreds of years. The point however is to sell a vision and dream to investors who hope they can one day sell the same hope to another poor sucker. Would people really be interested in crypto if they didn’t stand a chance at making a TON of money? Values are great and all but the only thing that will attract users to this space are powerful incentives. A billion users aren’t going to onboard for no good reason.

The Future isn’t Bleak

Despite all this “negativity”, this doesn’t mean that there isn’t hope, potential and most importantly opportunity! There are so many hard working, intelligent, driven and passionate builders and leaders filled with ideas and aspirations. There is strong synergy and support in the growing world of crypto and most importantly a TON of money inflowing to see those ideas play out and succeed. But it's important to remember that at the end of the day we're all beholden to that crucial price factor and many people won’t be interested in stepping into this sector without a big reason to.

Will DeFi be the future? Perhaps a version. One that incorporates blockchain technology but it’s hard to see “DeFi” as it was intended to be the winner. The end result that may “win” the race could look something like a crippled version of what DeFi started out to be. The limitations of onboarding and getting this tech to go mainstream will essentially compromise what crypto set out to fix. At that point, why are we still building in crypto? Won’t it just be regular banking with extra steps and new marketing? Why do tokens need to exist that will make a handful of individuals filthy rich so that the plebs can one day hope to buy those tokens from them at highly inflated prices to simply use the technology as an everyday part of life? Is that normal? For us to be here aiming to try and get filthy rich on the basis of an unsold dream?

It's a beautiful mess. An ocean wave crashing of reasons why crypto won't work and why it will. At the end of the day, this isn't a cynical look. It's a straight level admission of the state of the game from the perspective of someone who is deep down the crypto rabbit hole. Who sees things for how they are and doesn’t sugarcoat them like many of the other peddlers out there and will tell you what you need to hear, not what you want to hear.

To reiterate, this space is filled with untold potential and no shortage of people willing to work to make it happen. It won’t be easy and the endgame may not be what we think it will be but the future is the future. As for DeFi? We’ll see what happens but it probably won’t turn out the way we think. DeFi, at least the version everyone is so constantly shilling you, is not the future.

If you have an idea that is truly new and revolutionary, we’d like to talk to you.

Top Crypto Highlights of the Week

News

The U.S. SEC charged Avraham Eisenberg with orchestrating an attack on Mango Markets and draining $116M and classified the governance MNGO token as a security

Developers behind Mango Markets plan to push forward with a relaunch of the project – even as the U.S. SEC alleges the project’s native token, MNGO, is a security

Decentralized crypto exchange Mango Markets sues its exploiter Avraham Eisenberg for $47M in damages

Chainway released a "Proof of Innocence" tool for Tornado Cash users to show their funds didn't originate from illicit sources

The FBI confirmed Lazarus Group and APT38 are responsible for the $100M Harmony bridge hack last June

Wormhole exploiter converts $150M in ETH to stETH via the DEX aggregator OpenOcean to take leveraged DeFi positions

Bankrupt crypto lending firm BlockFi has $1.2B in assets tied up with bankrupt exchange FTX and Alameda Research

Electric car maker Tesla did not buy or sell any bitcoin in the fourth quarter for the second straight quarter

Celsius lawyer says Earn account customers entitled to a 'significant return'

Circle’s Cross-Chain Transfer Protocol (CCTP) will be launched soon. This infrastructure helps build more scalable, efficient, secure, and user-friendly applications based on USDC

Kevin Rose, founder of the NFT collection Moonbirds, had his wallet hacked losing an estimated $1M in NFTs

Amazon to launch an NFT program in the spring, including getting Amazon customers to play crypto games and claim free NFTs

Data shows Binance’s BUSD stablecoin losing its share of market dominance due to regulatory threats and investors’ concerns about the exchange’s fund management

Project Updates

The first set of shadow fork testing has commenced for the Ethereum Shanghai upgrade

dYdX delayed its token unlocks for investors to Dec. 1 from Feb. 3 - was set to release 150M tokens ($282M)

DeFi lending platform Aave to launch V3 on Ethereum after a successful DAO vote

Injective, a layer-1 blockchain focused on building financial applications, launched a $150M fund ecosystem initiative to boost DeFi, Cosmos adoption

Cardano-based decentralized stablecoin Djed launching next week - expected to go live on over 40 Cardano-based dApps including DEXs MuesliSwap and MinSwap

TRON announced liquidity staking and resource market

The deployment of Uniswap V3 on the BNB Chain has been approved

The final Sushi DAO vote to direct all SushiSwap trading fees to the DAO treasury has passed

NFT shop Doodles will acquire animation studio Golden Wolf and launch a new joint-venture called Active Ingredient, which will provide blockchain and AI tools for creators

Fractal, the platform for game-related NFTs developed by Twitch co-founder Justin Kan, is expanding to Polygon to boost accessibility

The Web3 Foundation, which supports the Polkadot protocol, has again presented its argument that its native DOT token is not a security

MakerDAO’s community approved a proposal to deploy up to $100M in USDC from its reserve to Yearn Finance, for a 2% annual yield

SYS will be the native coin of Syscoin's upcoming optimistic L2

Sushiswap is launching a perpetual futures exchange on the Sei Network to expand into non-Ethereum-based ecosystems

Conflux token will integrate with Little Red Book, the Chinese version of Instagram, to let users display their NFTs on the platform

Arkham Intelligence adding support for Polygon in Q1 - airdropping future token to people who participate in its private beta

.SWOOSH, Nike’s new NFT platform, is inviting users to design their own digital wearables - offering a $5,000 cash prize and a chance to collaborate on a one-of-one virtual sneaker

Sui Testnet Wave 2 is live

Treasure announces MagicSwap v2, the first AMM in crypto to support pools for ERC-20s and NFTs through a single router

Market Update

Charts to pay attention to

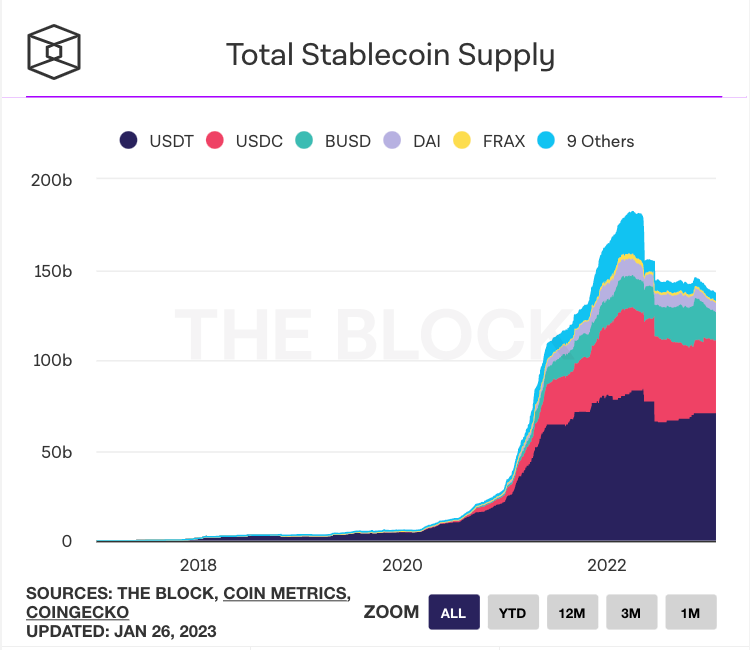

Stablecoins represent liquidity and liquidity is the lifeblood of crypto. Stablecoins continue flowing off exchanges which is the opposite of what we’d want to see if we believe the bull run is back.

Likewise we’d like to see the total stablecoin supply increase which is the opposite of what we’ve seen since April 2022.

Overview

Crypto Market Cap: Finally crossed back above $1T

Stablecoin Exchange Reserves: $27B - continues dropping. Want to see start increasing to support market moving up

Stablecoin Total Market Cap: $136B - continuing to slip downwards

DeFi TVL: $47B - slowly increasing from low of $39B

Exchange Volume: $700B for the month of January. Higher than December but still part of monthly downtrend in exchange volume

Dex Volume: $50B for January - Higher than December but also still part of monthly downtrend

NFT Volumes: Ethereum volumes and mints continue staying subdued as opposed to Solana NFT volume which has been surging

Find value in this newsletter? Help us grow. Subscribe, Like, Share, Leave Feedback, and Follow us on Twitter, Telegram, Discord, and LinkedIn.

sadly agree with what u say.

excellent essay bro

An excellent essay on DeFi and crypto! As a crypto VC for a few years, I could attest to the statements that the space is mainly speculation and filled with scams and bound-to-fail startups. On the other hand, Bitcoin remains the digital, hard, sound money with a clear value proposition to separate Money from State and to solve the problems of savings and payments. People should view Bitcoin differently from crypto, while maintaining a healthy prospect and skepticism towards the potential applications of blockchains.