Parallels Between Current TradFi Markets and Crash in 2020

There is a high degree of parallels between pre-March 2020 and the current TradFi markets

There is a high degree of parallels between pre-March 2020 and the current TradFi markets. degentrading wrote a thread for degens and advised them to panic and prepare. We summarized the key points in an illustrative thread to understand the situation.

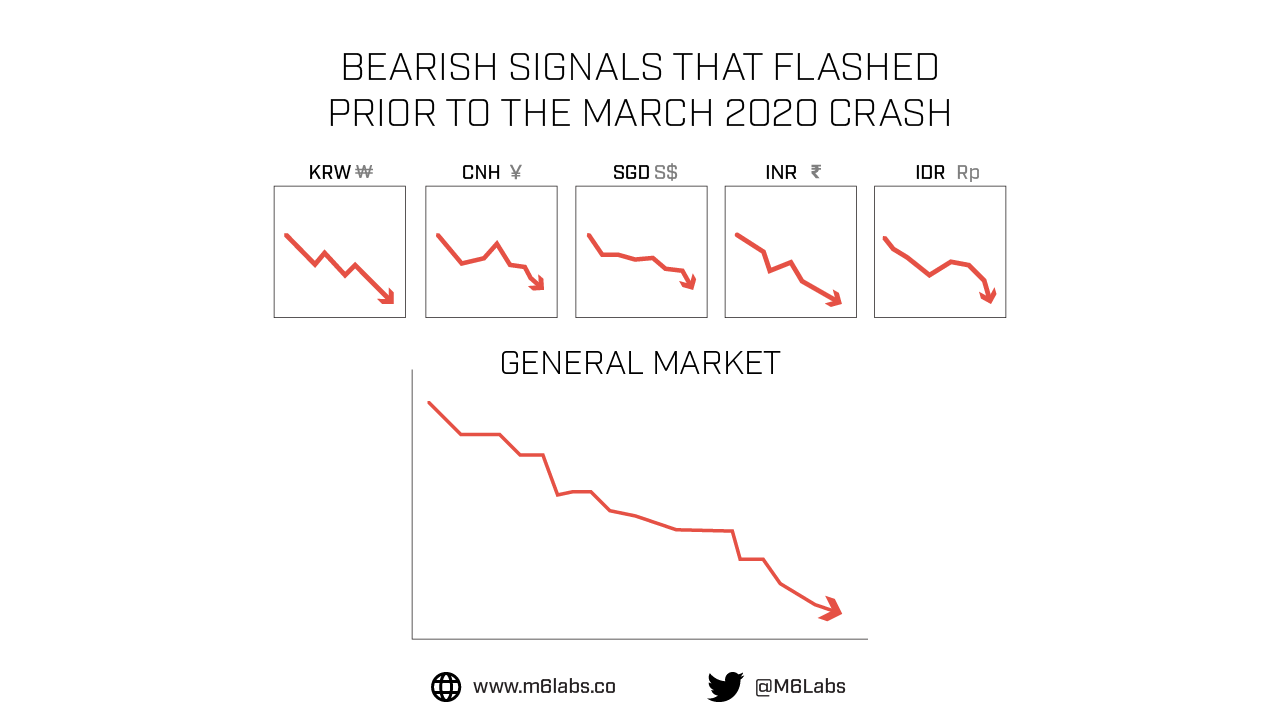

Stocks were doing just fine at the start of 2020, but there were initial signs of a crisis. Then a bearish signal flashed in an asset class that is arguably the most liquid market. Asia's emerging market currencies like KRW, SGD, CNH, INR, IDR were blowing up.

By Feb 2020, the equity markets and the world became aware of it. As a result, debt markets dried up and forex volatility was through the roof. However, up until now, Crypto was not affected by the stress. It was in March 2020 that we had a correlation event and a run on cash.

So, where's the similarity here? GBP is a major currency in the forex markets. The last time a major currency flash crashed was before the March 2020 sell-off, and it was the AUD. Similarly, on September 23rd GBP flash crashed!

The forex markets are the most liquid markets in the world. A flash crash in a major currency like GBP means that there is a grab for liquidity/run on cash. As a result, we could see a similar correlation event and a run on cash in the Crypto markets as seen in March 2020.

Additionally, macro is also flashing bearish signals. Every country is raising interest rates which further reduces the circulating money supply in the system. When there is less money circulating in the system, asset prices will inevitably go down.

Thus, a major upcoming #Crypto crash is may be likely given bearish macro conditions and also the 1B $BTC unlocked for sale from Mt. Gox. But, in a correlation event, we can't really predict the lows. However, people have the chance to buy the crash and make exponential gains!

Keep reading the original thread to learn more:

Subscribe to receive our daily brief, extended weekly newsletter, and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.