Polkadot Parachain Spotlight: Parallel Finance

A decentralized money market protocol that offers lending, borrowing, and liquid staking for any asset in the Polkadot ecosystem.

Overview

Parallel Finance is a decentralized money market protocol that offers lending, borrowing, and liquid staking for any asset in the Polkadot ecosystem.

With a market cap of over $20B, Polkadot is currently the 12th largest cryptocurrency (as of 4/24/22). For new projects to become a Polkadot parachain, they must participate in an auction to win a slot on Polkadot’s Relay Chain. This requirement poses a challenge for new projects that must crowdsource or raise enough $DOT to win an auction. Parallel Finance’s products offer services to make this process much easier and more approachable for investors. Normal crowdloan participants can be subject to significant opportunity costs when participating in crowdloans because their staked tokens are locked for the duration of the parachain lease period. Parallel solves this by offering liquid versions of tokens staked to crowdloans and network validators.

How it works

Liquid Staking

Users who participate in Polkadot’s network validation earn rewards. It even gets better as they can stake their tokens in a pool for a double earning yield. Such users will continue adding leverage as they desire as long as it fits their risk profile.

Users who stake $DOT or $KSM tokens through Parallel get $sDOT and $sKSM as the tokenized staking derivatives. The token derivatives represent the $DOT and $KSM in the pool.

Parallel Finance has a ‘leverage staking’ feature allowing users to now lend $sDOT and $sKSM to the protocol and get an added borrower on top of the staking interest. Additionally, you can use $sDOT and $sKSM as collateral for borrowing. Parallel has an algorithm that determines the best $DOT or $KSM nodes to stake on, optimizing the yields for stakers.

Auction Loans

The protocol extends its borrowing interface to auctions, where it offers competitive rates for users seeking to take advantage of the incentives provided to crowdloan participants. Users can deposit collateral for floating or fixed interest, and those pursuing can borrow from that collateral to participate in parachain auctions. This means that users earn a fixed rate on their auction loans on top of the incentives offered by the projects.

Decentralized Credit Scoring

Parallel Finance was designed to become the “DeFiPulse of credit”. For DeFi to compete with traditional finance, we need systems that can rate the quality of borrowers and the debts they acquire. The credit scoring is in place to keep in check the rogue institutional borrowers and give all the lenders a second line of defense to negotiate the payment terms of loans.

Interest Rate Swaps

Interest rate swaps are needed if DeFi is to break the glass ceiling. This functionality allows institutional investors to reduce or extend their exposure to interest rates based on their perception of the market and willingness to take risks.

A user with a fixed-rate loan can switch to a floating interest rate if they suspect that a bear market is on the way and want to take advantage of the lower interest rates.

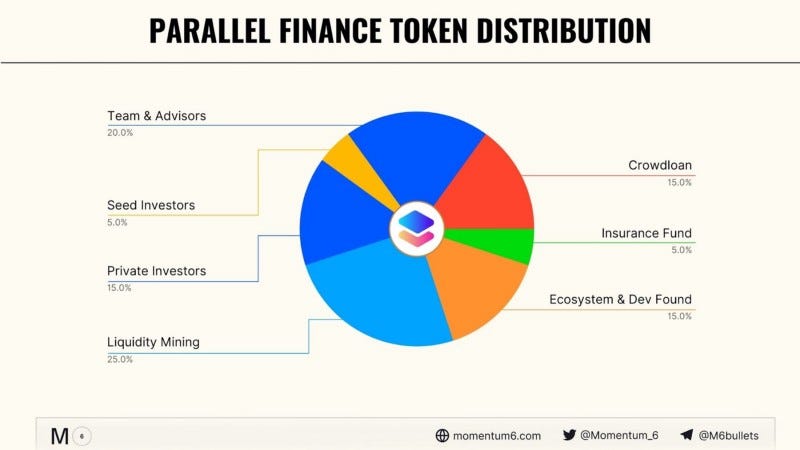

Tokenomics

$PARA is the utility token on Parallel Finance. Users can get $PARA on external exchanges or the Parallel Finance website by connecting PolkadotJS or Clover wallets. $PARA has the following uses:

Protocol governance. Parallel Finance uses a token-weighted voting system. $PARA holders can vote on various aspects of governance, such as council elections and network upgrades.

Transaction fees. Parallel Finance charges small fees for using the network. The treasury takes these fees and utilizes them for ecosystem growth.

Security Module Staking. Users who stake $KSM/$DOT through Parallel Finance can also stake $PARA in an insurance pool and hedge against the risk of staking slashes.

Network utility and incentive. Validators and collators receive $PARA to power the decentralized nodes. Crowdloan contributors and liquidity providers are rewarded with $PARA tokens.

Governance

Parallel Finance is designed to be a decentralized protocol. In the current setting, the platform has four types of stakeholders; open contributors & development team members, investors with $PARA tokens, platform users, and network maintainers. The governance process is designed to incentivize users to contribute to the development of the protocol.

Parallel started with centralized control, and complete decentralization will be a gradual process. The protocol has a governance committee tasked with collecting the staking rewards from validators, the ability to support or cancel a market, and the ability to choose new administrators.

Roadmap

Multisig Crowdloan Product

The Multisig Crowdloan Product was launched in the last quarter of 2021. The team is already releasing data on the winning projects through the Rewards page, where users can learn how the rewards are given and how to claim them.

v2 Decentralized Crowdloan

The v2 Decentralized Crowdloan is expected to be released in the first half of 2022. This feature allows users to contribute through a crowdloan pallet and receive $cKSM (for Kusama projects) and $cDOT (for Polkadot projects). At the end of the lease period, users can redeem $cDOT and $cKSM for $DOT and $KSM, respectively.

V1 Multichain Wallet

The Multichain Wallet is expected to be released in the first half of 2022. Users will now be able to transfer $KSM and $DOT from the relay chain to Parallel. This wallet also allows users to transfer $USDC and $USDT from Ethereum to Parallel.

V1 Regular AMM

The AMM is already running, and users can trade. Parallel Finance users can also remove or add liquidity from the AMM pools.

V2 AMM — Stableswap

Parallel Finance is developing Stableswap to allow users to trade stablecoins/assets, swap with low slippage, and provide liquidity to earn yield.

V2 Decentralized Liquid Staking

The Decentralized Liquid Staking feature is expected to launch in the first half of 2022. $KSM and $DOT holders will stake tokens to nominate validators and earn ~16% yield. The feature also offers more utility through $sDOT/ $sKSM, as these tokens can be used to access liquidity on the platform.

Wrapping up

DeFi is very broad, so you cannot find a project that can offer all the solutions. Parallel Finance’s competitive advantage is offering lending, staking, and borrowing under one umbrella. The parachain market is still in its early stages with an enormous untapped market, and we can only wait and see how Parallel Finance will change the DeFi space for the better.