The Fed Signals Slowing Interest Rate Hikes

Daily Bullets: Thursday, December 1st

We've entered a new month and with it, the winds appear to be changing.

Federal Reserve Chair Jerome Powell said in a speech yesterday that December would likely bring smaller interest rate hikes - resulting in a boost to markets. Investors have long been looking for a Fed pivot.

The Fed has upped interest rates by 75 bps four times in order to get inflation under control this year and a 50 bp hike would lift short-term rates to a target range to 4.25 to 4.50%.

Recall: The Fed has been consistent in stating their goal of reaching 2% inflation.

Important to note that the Fed has stressed that monetary policy is likely to stay restrictive for "some time" until real signs of progress emerge on inflation.

On the other hand, SBF continues his spree of public interviews, each highlighting how disordered FTX actually was. His lawyers must hate him.

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Daily Bullets:

The Fed likely to slow its rate increases. CME's FedWatch tool says 77% of a 50 bp increase next

SBF interview at the New York Times' DealBook Summit paints messy picture

Telegram has sold more than $50M in usernames via Fragment. Plans wallets and DEXs

Russia's Sber bank integrates Metamask into its blockchain platform

Ethereum Ropsten testnet winding down, with a full shutdown sometime between Dec. 15-31

The Graph will soon add support for the Polygon blockchain

Near Foundation loyalty points program for one of Latam’s largest processed food companies

Italy’s proposed 2023 budget plans to extend a 26% levy on capital gains to digital assets

Binance completes the Hooked Protocol subscription launchpad and will open trading

Chainlink Staking v0.1 launching on Ethereum mainnet on December 6th

Blur's second airdrop is arriving December 5th and is 10x bigger than Airdrop 1

MoonPay is rolling out a "soulbound" NFT loyalty program Dubbed the "Web3 Passport"

Timex will make 500 watches for Bored Ape Yacht Club and Mutant Ape Yacht Club holders

Now for a more expanded and detailed look at the day for those who like detail and sources:

Crypto News:

SBF apologized or admitted failure at least 12 times during his appearance at the New York Times' DealBook Summit

Telegram has sold more than $50M in usernames via Fragment, a platform that secures name ownership on the blockchain. Plans to expand beyond usernames and build a host of blockchain tools for Telegram including crypto wallets and decentralized exchanges

Russia's Sber bank integrates Metamask into its blockchain platform

The Ethereum Foundation announced that the blockchain’s Ropsten testnet has begun to wind down, with a full shutdown anticipated for sometime between Dec. 15-31

Indexing service The Graph will soon add support for the Polygon blockchain - will allow Polygon developers to find the data they need to improve the efficiency of their dApps

Numbers Protocol: ushering in a new era of digital media trust with Avalanche Subnets

The Near Foundation will be rolling out a loyalty points program for Grupo Nutresa, one of Latin America’s largest processed food companies

Economic/Government/Regulatory:

The Fed is likely to slow its rate increases in December. CME's FedWatch tool says 77% of a 50 basis point increase

Italy’s proposed 2023 budget plans to extend a 26% levy on capital gains to digital assets for profits larger than 2,000 euros

Exchange News:

Binance completes the Hooked Protocol subscription launchpad and will open trading for HOOK

Capital markets firm TP ICAP has received approval from the UK's Financial Conduct Authority (FCA) to register as a crypto asset exchange provider to institutional clients

Bitmex launched a system that will allow all depositors to self-verify their liabilities in the crypto exchange's total liability balance sheet

Broker-dealer INX has joined Binance in submitting a non-binding letter of intent to buy distressed assets from bankrupt asset manager Voyager Digital

DeFi News:

Chainlink Staking v0.1 launching on Ethereum mainnet on December 6th

Compound is set to vote to increase the supply cap for WETH supply to $194M in ether on v3 protocol

NFT/Gaming/Metaverse News:

Apple blocked Coinbase Wallet last app release until they disabled the feature of sending NFTs. Apple’s claim is that the gas fees required to send NFTs need to be paid through their In-App Purchase system, so that they can collect 30% of the gas fee

Blur's second airdrop is arriving December 5th and is 10x bigger than Airdrop 1

Crypto payments infrastructure firm MoonPay is rolling out what it calls a "soulbound" NFT loyalty program for its users - Dubbed the "Web3 Passport," the token will grant its owner access to exclusive events

Timex will make 500 watches for Bored Ape Yacht Club and Mutant Ape Yacht Club holders, decorated with their NFTs - follows a similar move by Tiffany & Co. for CryptoPunk holders

The word “metaverse” has made it through to the top 3 finalists for the Oxford Word of the Year competition. The word will go against other contenders, including “IStandWith” and “Goblin Mode”

Pudgy Penguin's 'Snowed In' collection sells out at Sotheby's for an average of $12,900 each

The first Web3 project Porsche has planned is a 7,500-piece NFT collection based on the classic Porsche 911. The NFTs are scheduled to be released in January 2023

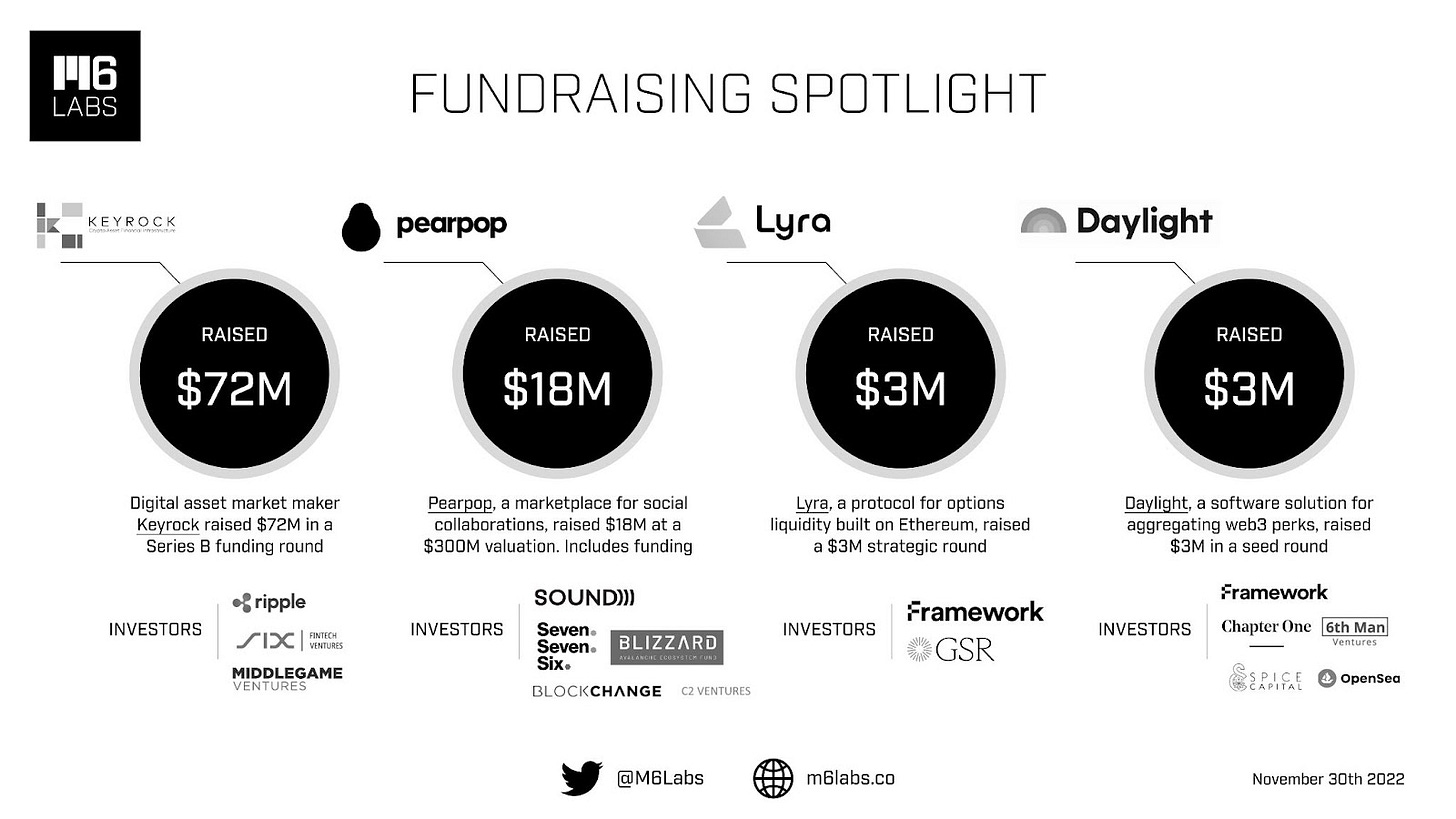

Fundraises:

Web 3 developer platform Fleek has raised $25M in a Series A round led by crypto-focused venture capital firm Polychain Capital. Other investors in the round included Protocol Labs, Arweave, Coinbase Ventures, Digital Currency Group, North Island Ventures, Distributed Global, The LAO and Argonautic Ventures

Cybersecurity startup Cyvers raised $8M in a seed round led by Elron Ventures. Other backers include Crescendo Venture Partners, Differential Ventures and HDI

Liqwid Labs, the DeFi startup building the Liqwid algorithmic lending & borrowing protocol raised $2.7M in a seed round led by cFund

UnUniFi Protocol raised $1.5M in Seed Round led by gumi Cryptos Capital to build the first Decentralized Cross-Chain NFTFi Platform / Marketplace with Auto DeFi Yield

Cypherock, a hardware wallet startup with a mission to accelerate web3 adoption, raised $1M from an array of reputed industry leaders including Consensys Mesh, Infinite Capital, Gnosis

Early Stage Projects:

AXL airdrop site is live

The Onomy Network is live

SUI Delegation Program - critical step towards decentralization & in supporting the community's participation

LensPort 2.0 has been released. LensPort is now a marketplace AND a complete Lens social app

Incentives for Aleo Testnet 3 will be activated on December 2nd

Aztec Connect has launched a stable developer testnet - Aztec Connect Testnet v1

Cedro Testnet 1.0 is here - an Omnichain Lending and Borrowing platform that unifies fragmented liquidity across multiple chains

What’s your take on today’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Data:

TL;DR: CME's FedWatch tool is predicting a 77% of a 50 bp increase in December. Will be highly reliant on upcoming inflation data.

Telegram’s TON has also been popping up a lot recently so taking a look, we can see that its ETH and BTC pair is near all time highs, while its USD pair is recovering from summer lows. Weekly active developers and commits have also seen a boost. They’ve sold $50M in usernames so far and have been busy getting their name out there.

TON Price versus USD, BTC, ETH

Developer Activity

Research/Reads:

Bankless - Is Solana Dead? - source

DeFi Options: Mapping Hype to Reality - source

Why RWAs Are Important to DeFi - source

Venture Capital Is Ripe for Disruption - A world where a billion is a drop in the bucket - source

Building Game Studios as Venture Capital Runs Dry - source

Have you seen our institutional-quality research?

Crypto Twitterverse:

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.