The Power of Liquid Staking in the Defi Ecosystem

Liquid Staking is emerging as an innovative option to solve the challenges of traditional staking.

One of the most popular financial activities in the cryptocurrency industry is undoubtedly staking. From the investor’s point of view, staking is an option to place your savings in a bank in a crypto wallet to obtain a fixed return over time.

The key difference here in the DeFi ecosystem from traditional banks is that everything happens transparently, thanks to blockchain technology.

Staking under the PoS consensus mechanism is an ecological alternative to cryptocurrency mining. Stakers help secure a blockchain network and, in exchange, participate in the rewards granted by the network during the transaction validation process.

Although it has been one of the most popular DeFi products used by many cryptocurrency enthusiasts, its lack of liquidity has been one of the significant challenges investors have faced.

For example, suppose you have ETH in your wallet and want to participate in ETH 2.0 Staking. You should consider that doing so directly implies not having an exact date when you will be able to retake possession of your ETH (illiquidity) because the Fusion Phase of the Ethereum 2.0 roadmap is still undefined.

Alternatively, Liquid Staking is emerging as an innovative option to solve the challenges of traditional staking: providing investors liquidity for their assets while generating passive income.

Simply put, Liquid Staking allows users to stake their crypto to earn low-risk interest while also keeping their funds liquid to maximize capital efficiency.

Why participate in Liquid Staking?

Liquid Staking allows token holders to stake their tokens while putting them to work in DeFi. It is the best of both worlds: Staking and DeFi, without being subject to crypto unlocking periods that in some cases can take up to 28 days.

Liquid Staking offers:

Quick access to funds: There is no need for a lengthy ‘unlink’ process from staking or exposure to penalties for early removal of staking in PoS protocols.

Derivatives strategies: It solves the DeFi cross-chain incompatibility crisis by enabling derivative assets to be used in DeFi protocols to generate revenue and staking rewards, helping to unlock liquidity locked in PoS networks estimated at some $600 billion.

Yield stacking: Through practices such as Yield Farming, users can expose themselves to yield-earning opportunities with their tokenized derivatives while trading on Liquid Staking protocols and earn returns on numerous assets simultaneously by locking up a batch of funds.

Exposure to cryptocurrency-backed loans: With Liquid Staking, investors do not need to part with their assets to solve unexpected limitations on access to funds in a fiat currency. Alternatively, investors can use their existing crypto assets to obtain a crypto-backed loan using a Liquid Staking protocol.

Low fees: Liquid Staking supports borderless finance without the high fees of financial intermediaries, making it easier to shop around for the best fees and performance.

A better risk-reward balance: Liquid Staking contributes to the overall strength of the network since the strength and security of PoS networks are directly linked to the number of locked coins. The lower risk encourages greater participation in these protocols, increasing the capital staked in PoS networks.

How Liquid Staking works

With liquid staking, we have already seen that users can earn both staking rewards and any rewards earned by using their tokens in DeFi applications.

In essence, Liquid Staking grants a representative L-token in the same proportion as the user’s original token in exchange for staking their tokens in the respective protocol.

Thus, if you stake ATOM in Persistence Protocol, you will receive a pATOM token, in a proportion equivalent to your ATOM assets, that you can freely use in any DeFi protocol.

These tokens derived from liquid staking, in Persistence, for example, represent both the main asset (ATOM) and the staking performance that continues to accumulate for helping secure the Cosmos network (in this case).

Therefore, while generating passive income with traditional staking through your ATOM, you can use the pATOM to move it into DeFi protocols and take advantage of the opportunities offered to maximize your potential rewards (e.g., yield farming, LPs, loans).

Keep in mind that you will be able to exchange the pATOM for the underlying asset at any time without waiting for penalties or discounts in the number of tokens for unlocking the staking.

Anyone can follow these few easy steps to participate in Liquid Staking:

Connect to your wallet in a Liquid Staking protocol with tokens from a proof-of-stake protocol.

Stake your tokens from a participating Layer 1 network that operates on proof-of-stake.

Upon receiving your synthetic tokens representing the underlying staked asset, you will be able to connect to any DeFi protocol to be exposed to strategies to maximize capital return.

Withdraw your rewards at any time, both for the DeFi strategies applied with your L-tokens and for your underlying staked asset that continues to earn staking rewards.

You can redeem that synthetic token to unlock access to the underlying staked assets whenever you want.

Risks to consider with Liquid Staking

Besides the benefits of Liquid Staking and the satisfaction of maximizing the capital in our wallets, we must take into consideration that there are certain risks when using derivative (or synthetic) assets in DeFi:

We should note that users are also at risk of losing a portion of their tokens should a validator go down.

Strategies used in Liquid Staking, such as Yield Farming and loans, are highly risky. Each increase in leverage in funds implies a greater risk of liquidation when the market takes a drastic turn that leads the value of the derivative asset to fall below the requirements to avoid liquidation of the collateral.

Trading and interacting with numerous Liquid Staking protocols simultaneously to maximize capital may not be profitable if you do not have the proper financial education and investment plan.

Liquid Staking on exchanges or centralized platforms can pose a risk under the motto: “no keys, no funds.”

With Liquid Participation, you can add and remove funds as you wish but typically with a lower APR compensation.

A growing potential market

According to JP Morgan, staking returns will increase to $40 billion by 2025, almost five times the current size of this market, with ETH2 as the main driver of this industry.

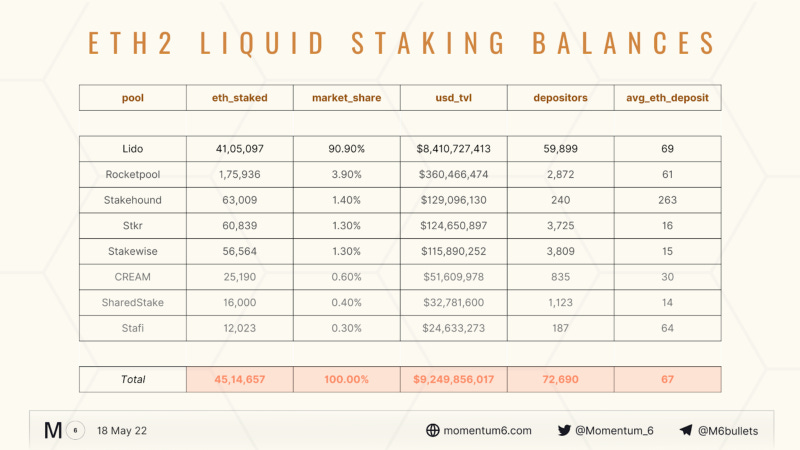

And as part of the solutions implemented for ETH2, Liquid Staking is one of the sectors experiencing rapid growth in recent months, managing to reach almost 30% of the ETH staked via pools in Liquid Staking protocols such as Lido, RocketPool, or StakeWise.

The preceding only demonstrates the growing interest in this emerging sector in the decentralized finance industry under the PoS consensus mechanism, which to date represents just over $190 billion.

As the rhetoric about climate change challenges networks under PoW consensus algorithms, further investment may flow to greener alternatives such as ETH2, thereby boosting the staking industry as JP Morgan envisions.

Therefore, once Liquid Staking platforms begin to free up staked assets for multi-chain usability significantly, they will open the door to unprecedented growth and revenue generation.

How to use liquid staking to increase DeFi yields will depend on the risk profile of each investor or average user, and on the DeFi strategies that they consider the most convenient to apply at a given time, but always with the possibility of freely moving their assets in their non-custodial wallet.

The benefits and improvements Liquid Staking brings to DeFi are a reminder that we are living at the beginning of a new era within the decentralized finance sector that supports the pure essence of the DeFi spirit: empowering users with financial tools to manage their capital and build their future without the intervention of third parties.