The State of DEXs in 2023: A Comprehensive Review

Analyzing the Post-FTX Landscape and the Future of Decentralized Exchanges

Exchanges have been an integral part of the cryptocurrency industry for years. As 2022 ends, it's time to take a closer look at the state of decentralized exchanges (DEXs). In this blog post, we'll delve into the latest statistics, trends, and challenges facing DEXs.

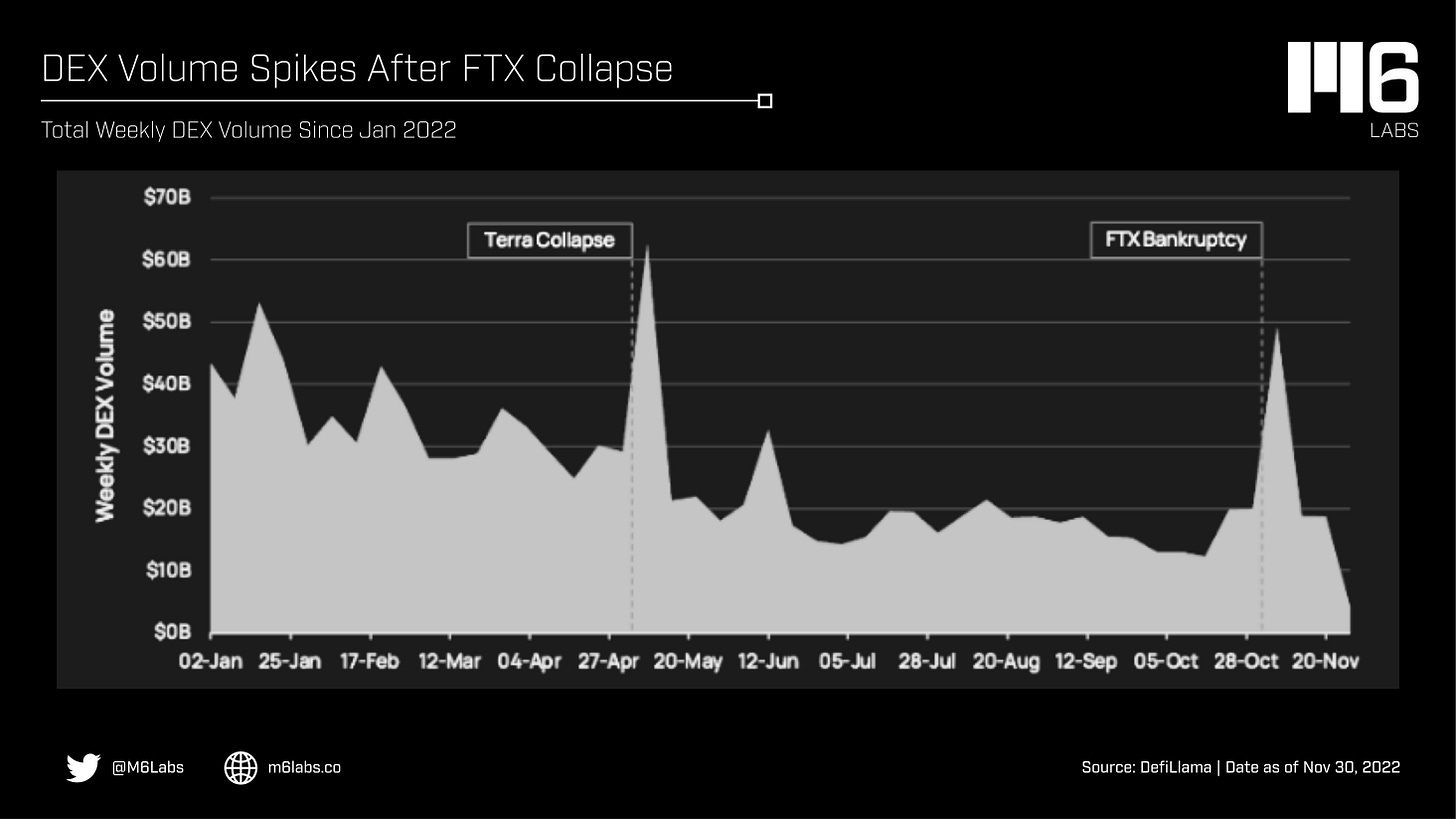

📊 DEX Volumes Spike After FTX Collapse

Weekly DEX volume across all chains increased 146% from $20B to $49.2B during the first week of November as the FTX saga unfolded. Monthly DEX volume also increased 110% from $107B in October to $50.8B in November.

DeFi isn't a miracle cure for crypto's multi-billion dollar problems. Vulnerable to hacking, fraud, draining & other abuse = significant losses. However, DEXs function in accordance with their open-source code, unlike the "black boxes" of centralized exchanges.

On-chain assets in DEXs are visible to everyone if they know where to look. While the not your keys, not your coins advice is generally given, the hypothesis is that DEX volume is set to increase post-FTX collapse as people would want self-custody of their coins while trading.

DEX volume has been decreasing.

Spikes in usage are attributed to market stress (Luna in May, Celsius in June/July, FTX in November). These catalysts still need to be stronger to change user behavior, as there are no noticeable strong trend changes.

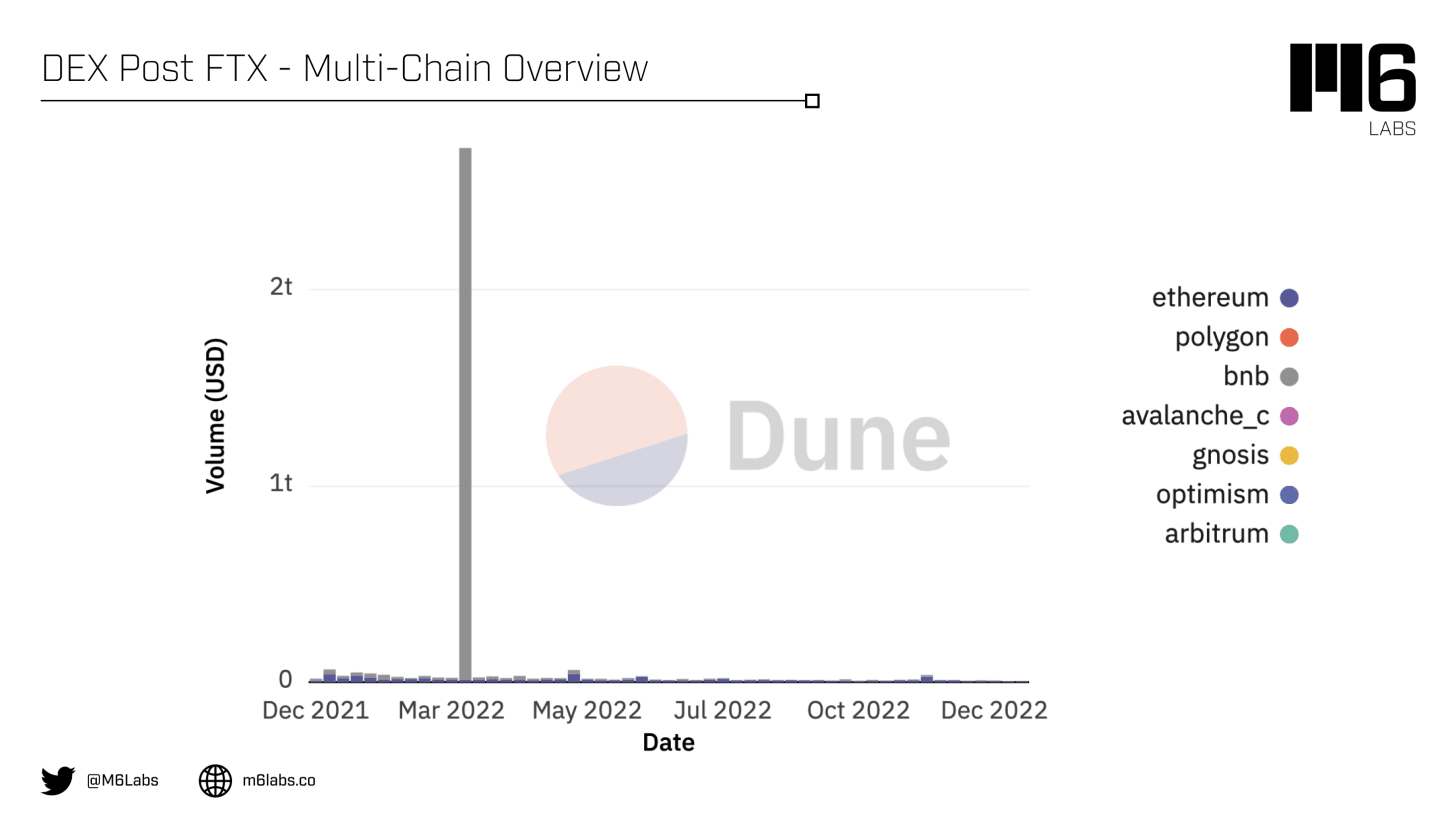

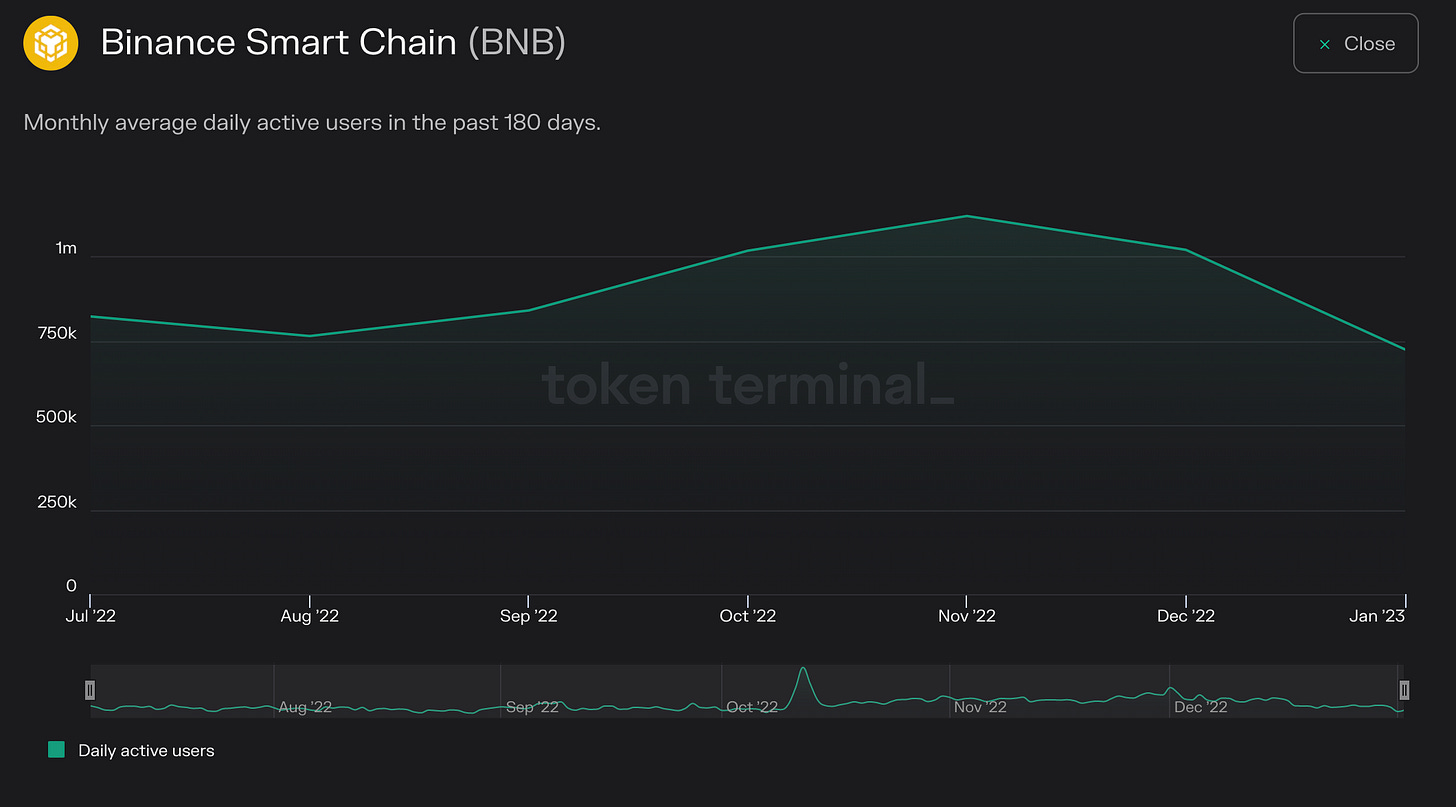

Despite being the rival exchange, Binance didn't experience a surge in users following FTX's downfall. It demonstrates that users choose more decentralized chains or go directly to the exchange.

Monthly average daily active users on BSC in the past 180 days:

Growth in Polygon market share is likely due to an increase in web2 partnerships, while Arbitrum could be due to GMX.

This tells us that DeFi is still strong. Crypto lenders are more affected than exchanges at this point.

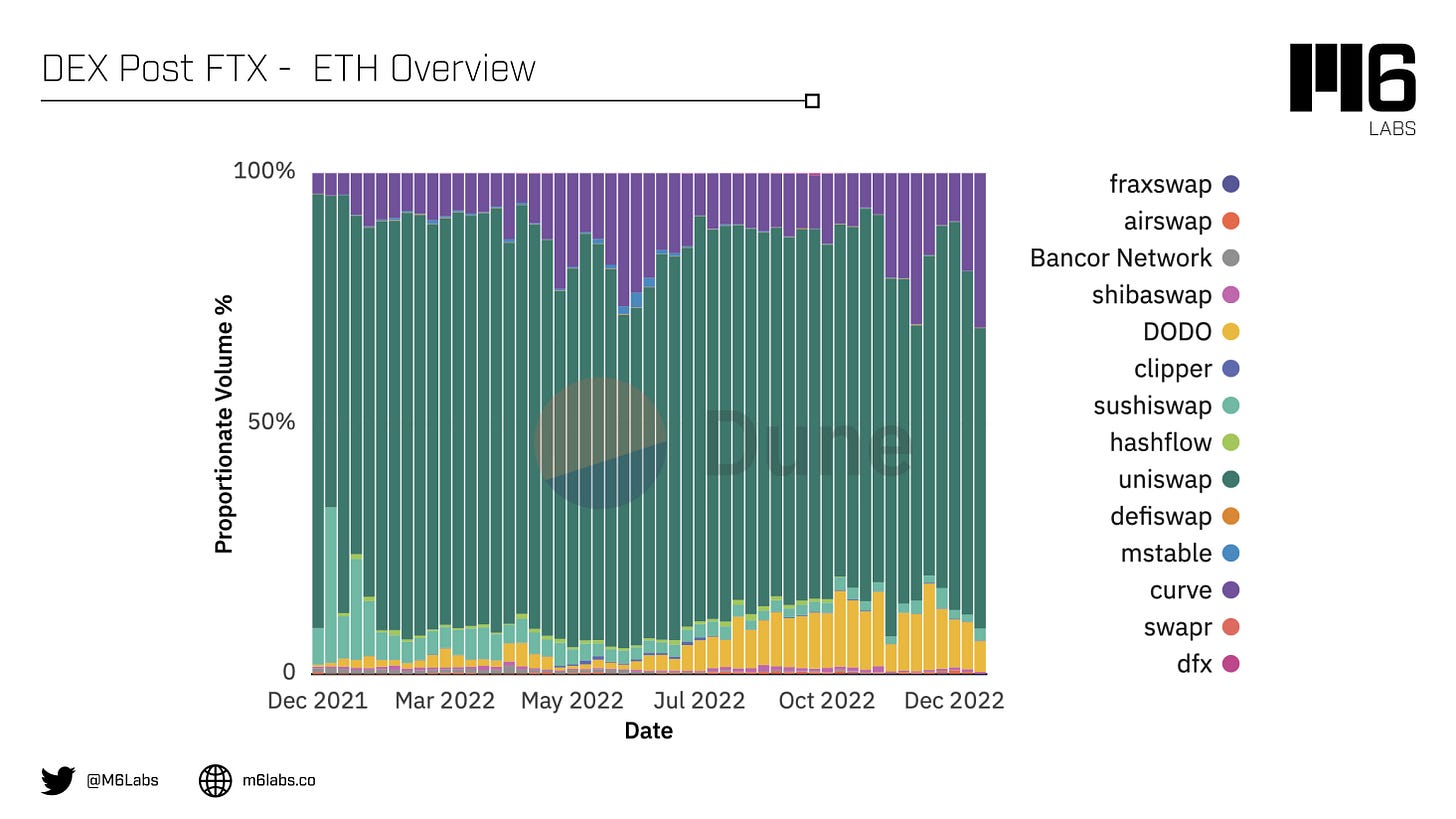

A closer look at DEXs on Ethereum:

• Generally, the spikes correlate with the overall market during market stress.

• Uniswap is king in all metrics.

• Interestingly, there is an inflection in the Txn count for DEX in Ethereum post-Celsius (in June/July).

This is in line with the overall fall in DEX volumes, active users, and transactions.

...and of-course Uniswap remains the most dominant DEX in terms of Volume post FTX (USD):

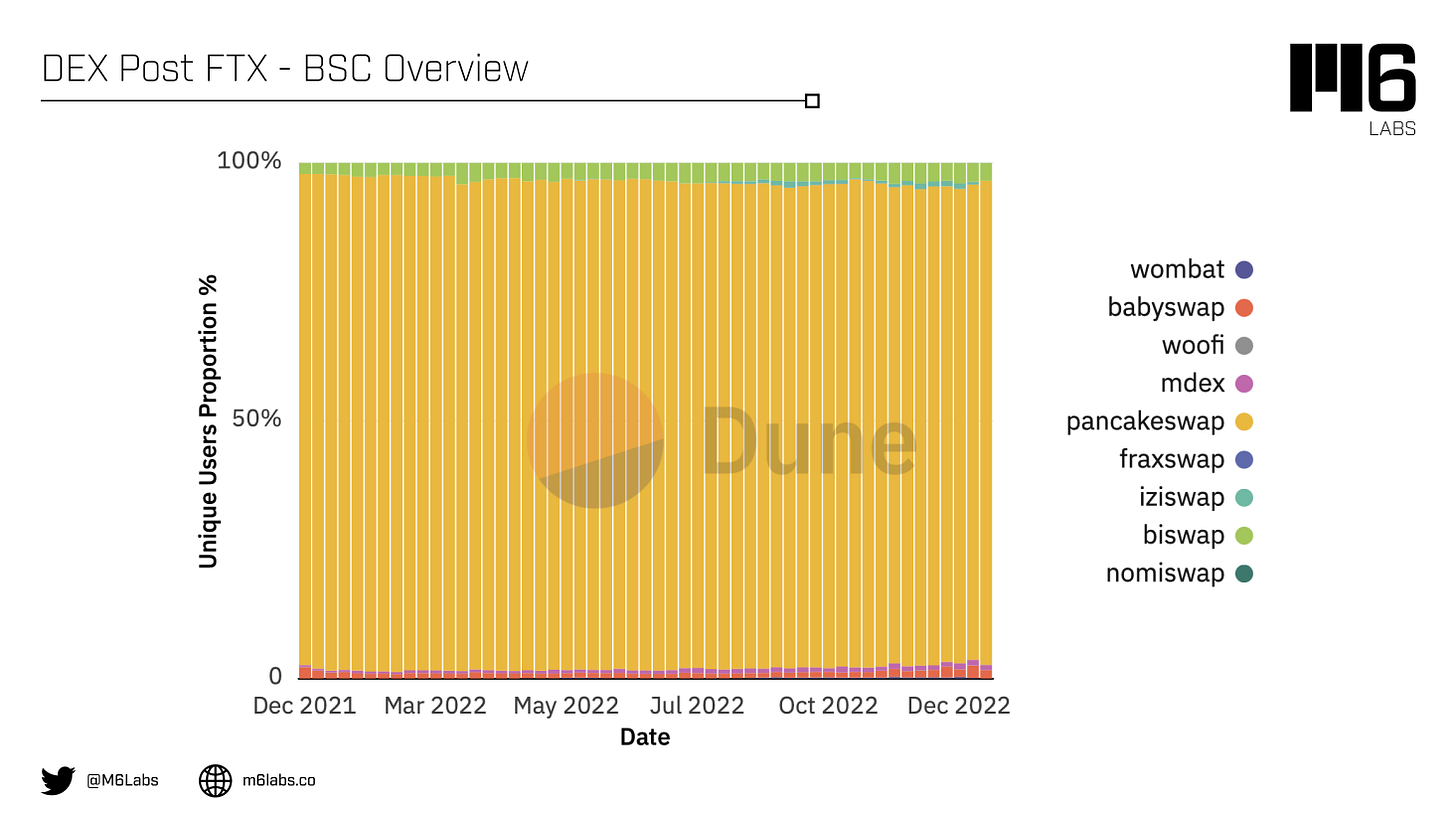

A closer look at DEXs on Binance Smart Chain:

• @PancakeSwap is king on BSC.

• Volume has tapered off a lot more aggressively as compared to Ethereum. Also, the number of DEXs needs to be more diverse.

Pancakeswap still has the most users over all other DEX on BSC:

Both users and txns counts declined in 2022

While it is true that DEXs as a whole aren’t performing as well, the fact remains that Uniswap had an uptick in all metrics, but DEXs in BSC didn't tell us that users are going to other chains for their DeFi needs.

The volume of DEXs has decreased. Catalytic events cause volume spikes, but they quickly fade over time. The consensus is that macroenvironmental factors, rather than the collapse of the FTX, affect DEXs and DeFi (bear market, NFT launches, etc.). This is evident because activity levels are increasing gradually and slowly. Fast movements are not sticky because they eventually become normal.

Despite the collapse of FTX, DeFi is still strong overall.

This demonstrates the ecosystem's resilience. The events currently unfolding and the lack of significant trend changes in DeFi are strong signs that users should go to DeFi despite being perceived as unsafe.

The user experience of decentralized exchanges is key to their success: DEXs can offer substantial benefits, but the barrier for entry is high compared to existing centralized exchange platforms. Improving usability will be essential for them to dominate the market.

Additionally, DEXs that pose as your bank may scare away cryptocurrency beginners who might prefer to take the chance of entering the market through a centralized exchange rather than through a DEX like Uniswap. A CEX still has control over the simplest method.

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.