Even the most OG crypto natives have attested that this week’s events in crypto stand out as being historic for the industry and not in a good way… Here’s the ultimate play by play timeline for how the FTX dominoes fell.

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Done? Now let's dive in!

Ultimate FTX Collapse Timeline

Wednesday, November 2nd

CoinDesk report finds that Alameda’s balance sheets are largely made of FTX’s native FTT token

Executives deny aspects of the story, saying it paints an incomplete picture but sparks rumors

Sunday, November 6th:

CEO Caroline Ellison says Alameda has $10B in assets not reported in leaked balance sheet

CZ/Binance to sell $584M worth of FTT due to recent revelations

Caroline offers to buy Binance’s FTT at $22

FUD and fears of insolvency break out even more

Monday, November 7th:

Alameda begins to sell off SOL to keep the price of FTT above $22

CZ refuses OTC deal and begins to sell FTT to purchase BNB

FTX FUD results in heavy outflows, people rush to withdraw - things start heating up

Tuesday, November 8th:

SBF attempts to calm markets by assuring investors their assets are safe

FTX pauses certain withdrawals causing panic about potential bank runs

BitDAO accuses Alameda of dumping 1% of BIT token supply. Alameda proves they didn’t

SBF tweets that FTX would be acquired by Binance. CZ confirms

Begins clearing withdrawal backlogs, resolving liquidity issues and conducting due diligence

Binance will not buy FTX after reviewing the company's financials

FTX websites go dark - uncertainty reigns

Wednesday, November 9th:

Crypto markets nuke

Tether, Coinbase, Circle, Genesis, Crypto.com, Cumberland, Deribit, Solana Labs claim limited exposure

Multicoin Capital has 10% of fund's AUM stuck on FTX

Galaxy Digital has a $76.8M exposure to FTX

Wintermute has funds stuck on FTX but within its risk tolerances

Amber Group has no exposure to Alameda or FTT but 10% of capital on FTX

Most of FTX legal and compliance teams have quit

$1B of SOL, 13% of supply, will soon be unlocked and released onto the market

Huobi and Tron DAO promises to exchange Tron tokens at 1:1 if FTX withdrawals fail

Binance + other exchanges to introduce Merkle-tree proof of reserves for full transparency

FTX CEO lost an estimated $14.6B dollars – nearly 94% of his net worth

FTX.us and Binance.us are two separate companies and are not currently impacted by the deal

Binance tops up Secure Asset Fund for Users (SAFU) to an equivalent of $1B

SBF’s priority crypto bill ‘dead’ after FTX sells to Binance

Solend is facing the risk of accruing bad debt

People selling their FTX accounts for 10-20 cents on the dollar

Thursday, November 10th

FTX would need to file for bankruptcy without a cash injection - top priority is fundraising

DoJ and SEC are working together to investigate FTX U.S

It took a grossly irresponsible amount of time before FTX closed customer deposits

SBF transferred at least $4B to Alameda after suffering losses in May and June

Alameda allegedly owes FTX about $10B

Alameda Trading is winding down

Justin Sun working with FTX to protect Tron users with funds stuck on FTX at a 1:1 ratio

Tether freezes $46M USDT on the Tron blockchain following a request from law enforcement

FTX approached U.S.-based crypto exchange Kraken about a potential rescue deal

Binance hot and cold wallets holds a total of ~ $70B

Japan's financial regulators have ordered FTX's Japan arm to suspend operations

Crypto.com, OKX and Kucoin, BitMEX providing proof of reserves & proof of liabilities

Tether begins to depeg. The Tron DAO Reserve will purchase 1B USDT to fight short sellers

Curve's 3pool imbalanced - USDT accounting for ~ 80% of the pool's liquidity

FTX begun processing withdrawals again following a more than 48-hour shutdown

SBF seeking up to $9.4B for FTX's rescue

Sequoia FTX investment now worthless ~ $213.5M in losses but fund is still in good shape

Nexo currently has net zero exposure to FTX and Alameda Research

Kraken had no exposure to Alameda Research - only holds ~ 9,000 FTT

Genesis Trading reported losses of ~ $7M

GSR will cover client losses from FTX collapse

Hodlnaut held assets worth $13.1M on FTX

El Salvador's president Nayib Bukele denies country had any funds on FTX

Friday, November 11th

SBF seeks $9.4B package for FTX rescue from Justin Sun, OKX, and Tether

Tether does not have any plans to invest or lend money to FTX/Alameda

FTX reached an official agreement with Tron to establish a special facility to allow holders of TRX, BTT, JST, SUN, and HT to swap assets from FTX 1:1 to external wallets

Genesis derivatives business currently has ~$175M in locked funds in FTX trading account however does not impact market-making activities

Crypto lender BlockFi suspended withdrawals and will not be able to operate business as usual

Bahamas regulator freezes assets of FTX

FTX’s head of institutional sales resigns. The FTX Foundation’s Future Fund team resigns

Alameda employees resign collectively after a meeting

Mechanism Capital assets stuck on FTX. Says amount is non-trivial and exploring legal options

Stripe, Deloitte, Sullivan & Cromwell among 53 FTX advisors, vendors and bankers affected

Pantera Capital has limited exposure to FTX - mainly as a shareholder through the acquisition of Blockfolio

CoinList has no material exposure to FTX, FTT, Alameda or any credit exposure to FTX

FTX had $16B in customer assets and lent more than half to Alameda

A peek into SBF's social circles reveals a leadership regime where personal and professional ties blurred

SBF invested hundreds of millions in Sequoia Capital, Paradigm, Multicoin and Altimeter, the same VC firms that backed FTX

Bahamian regulators froze the assets of FTX Digital Markets and related parties

FTX US warned its users to close their positions as it might halt trading

FTX US says assets are safe and the company will soon be entirely separate from FTX

Voyager has not transferred any assets to FTX, planned deal with FTX has not been completed

SBF sold equity in the firm at a 50% discount to employees in the spring

FTX U.S.-based employees trying to sell assets like a stock-clearing platform and naming rights to a Miami arena

California becomes the first state to officially announce an investigation into FTX

FTX NFT exchange is paused after $50M in volume due to a Bahamas account withdrawing other people’s funds bypassing balance transfer block by selling NFTs

LayerZero structured an agreement and bought out FTX, FTX Ventures and Alameda Research from all equity positions, token warrants and all other agreements between the parties

European arm FTX EU has had its license in Cyprus suspended just two months after securing it

FTX has liabilities roughly worth $8B according to ex- Head of Institutional Sales of FTX

Scaramucci’s SkyBridge exploring buying back 30% stake in equity from FTX

Crypto trading shop Folkvang has some assets on FTX but is highly liquid and solvent

Crypto services provider Matrixport's fixed affected but faces no risks of insolvency

Genesis to get $140M equity infusion from parent company DCG

FTX declares bankruptcy and CEO SBF resigns

FTX's new CEO, John J. Ray, III, was the lawyer brought on to clean up Enron

FTX withdrawals remain active

Want the same timeline but told through hilarious memes? Check this out:

⛓ Crypto Highlights of the Week ⛓

TL;DR: (for the non-FTX stuff this week)

💊 Top Bullets: US CPI print lower than expected - 7.7% YoY, 0.4% MoM, U.S. Attorney seizes $3.36B tied to Silk Road, Solana unveils Google partnership/ smartphones/Web3 store at Breakpoint, Neon Labs Solana EVM coming Dec. 12, Meta cuts 11,000 jobs, ETH turns deflationary 55 days after The Merge, Aptos partnered with Google Cloud, Middle East, Africa & Asia Crypto & Blockchain Association launches, Space and Time joins Nvidia's startup program, Shell two-year sponsor partnership with Bitcoin Magazine,

📊 Data Highlights: Bitcoin dropped to $15,563, ETH dropped to $1071, Total Crypto Market cap dropped to $850B, DeFi TVL drops to $44.5B, Stablecoins and ETH rush off exchanges, Smart Money stabled up

🏦 DeFi Highlights: Zerion in-browser web extension challenges MetaMask, GALA exploit due to GitHub public leak, Avalanche $4M in AVAX incentives for GMX, BetDEX, Solana sports betting exchange offering fee-free betting on World Cup games, Solana adding support for Euro Coin, Upcoming Solana scaling protocol Layer N, DeFi aggregator Bebop expands to Polygon, MetaMask Bridges, Curve's 3pool imbalanced, Solana 28.5M SOL re-staked, dYdX placed Solana trades in “close only” mode, Solend $6M bad debt, USDT/USDD begins to depeg, Debank Time Machine

🖼 NFT/Metaverse/Gaming Highlights: OpenSea to enforce creator royalties, LooksRare NFT Aggregator, Beeple bringing 'immersive 3D NFTs' to Solana, Mysten Labs strategic partnership with South Korean gaming company Ncsoft, WeWork co-founder Adam Neumann launching NFT project Flow3rs, Yuga Labs Co-founders suggest BAYC sales only to royalty-enforcing marketplaces, STEPN partners with ASICS and Solana, Lionel Messi joining Sorare

💸 Exchange Highlights: Huobi alleges pNetwork Gala actions were not whitehat, Bitmex launches native BMEX token trading, Binance, OKX, Crypto.com, OKX and Kucoin, BitMEX, Huobi, Bitget to introduce Merkle-tree proof of reserves, Binance Custody adds NEAR standard to infrastructure, Coinbase Germany must meet regulatory requirements, Crypto.com suspends deposits and withdrawals of USDC and USDT on Solana,

👨⚖️ Economic/Government/Regulatory Highlights: DoJ and SEC investigating FTX’s U.S., Polkadot claims to be software not a security, UK bank Santander to block payments to crypto exchanges, SEC wins suit against LBRY, Kim Kardashian and Floyd Mayweather set to win EthereumMax lawsuit, U.S. Treasury Department updates Tornado Cash sanctions due to North Korean nuclear weapons, Hong Kong to allow crypto retail ETFs, SEC subpoenas HEX, Pulsechain and PulseX influencers, SEC suing ponzi scheme Trade Coin Club, Paradigm launches Crypto Policy Council

💊This Week’s Top Daily Bullets 💊

US CPI came in lower than expectations - fell to 7.7%: 7.7% YoY, 0.4% MoM Expected: 7.9% YoY, 0.6% | MoM US CPI Core: 6.3% YoY, 0.3% MoM Expected: 6.5% YoY, 0.5% MoM

U.S. Attorney announces historic $3.36B cryptocurrency seizure and conviction in connection with Silk Road dark web fraud

Solana unveils Google partnership, smartphones, Web3 store at Breakpoint

Neon Labs plans to release its mainnet, an Ethereum virtual machine on Solana, on Dec. 12. Neon EVM will allow developers to port Ethereum-based applications on top of Solana

Meta cuts 11,000 jobs, 13% of its workforce

ETH officially turned deflationary 55 days after The Merge

The Middle East, Africa & Asia Crypto & Blockchain Association (MEAACBA) has been launched within Abu Dhabi’s free economic zone that aims to further the development of blockchain and crypto ecosystems

Layer 1 blockchain startup Aptos partnered with Google Cloud in a move that will see the search giant power some of its validator nodes, among other services

Data warehousing platform Space and Time has joined chipmaker Nvidia's startup program just over a month after raising a $20M strategic funding round backed by Microsoft’s venture arm M12

Shell, one of the world’s largest oil and gas companies, has signed a two-year partnership with Bitcoin Magazine to sponsor the 2023 and 2024 Bitcoin Conferences

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

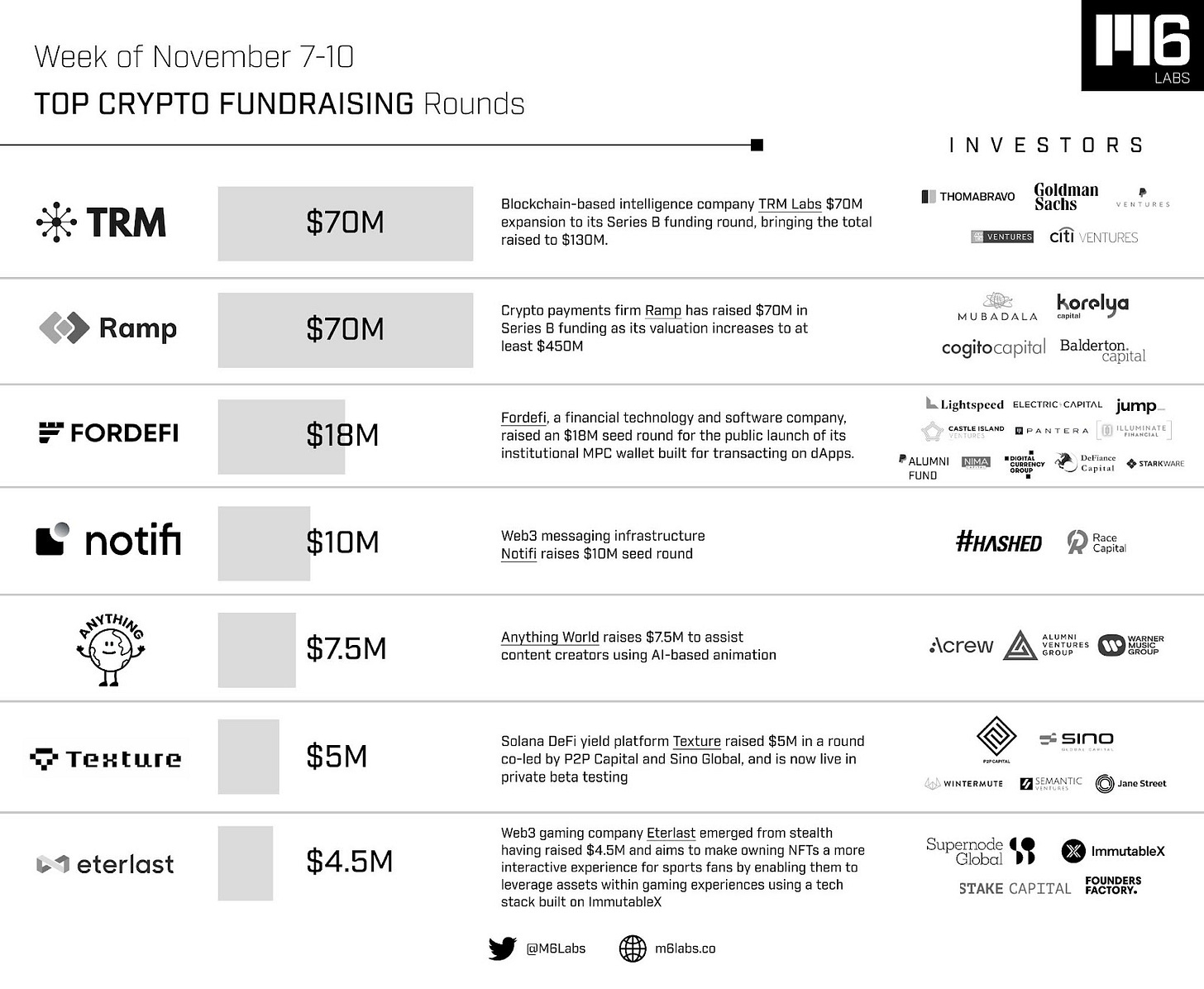

💰 Fundraising Highlights of the Week 💰

📊 Crypto Market Data Highlights of the Week 📊

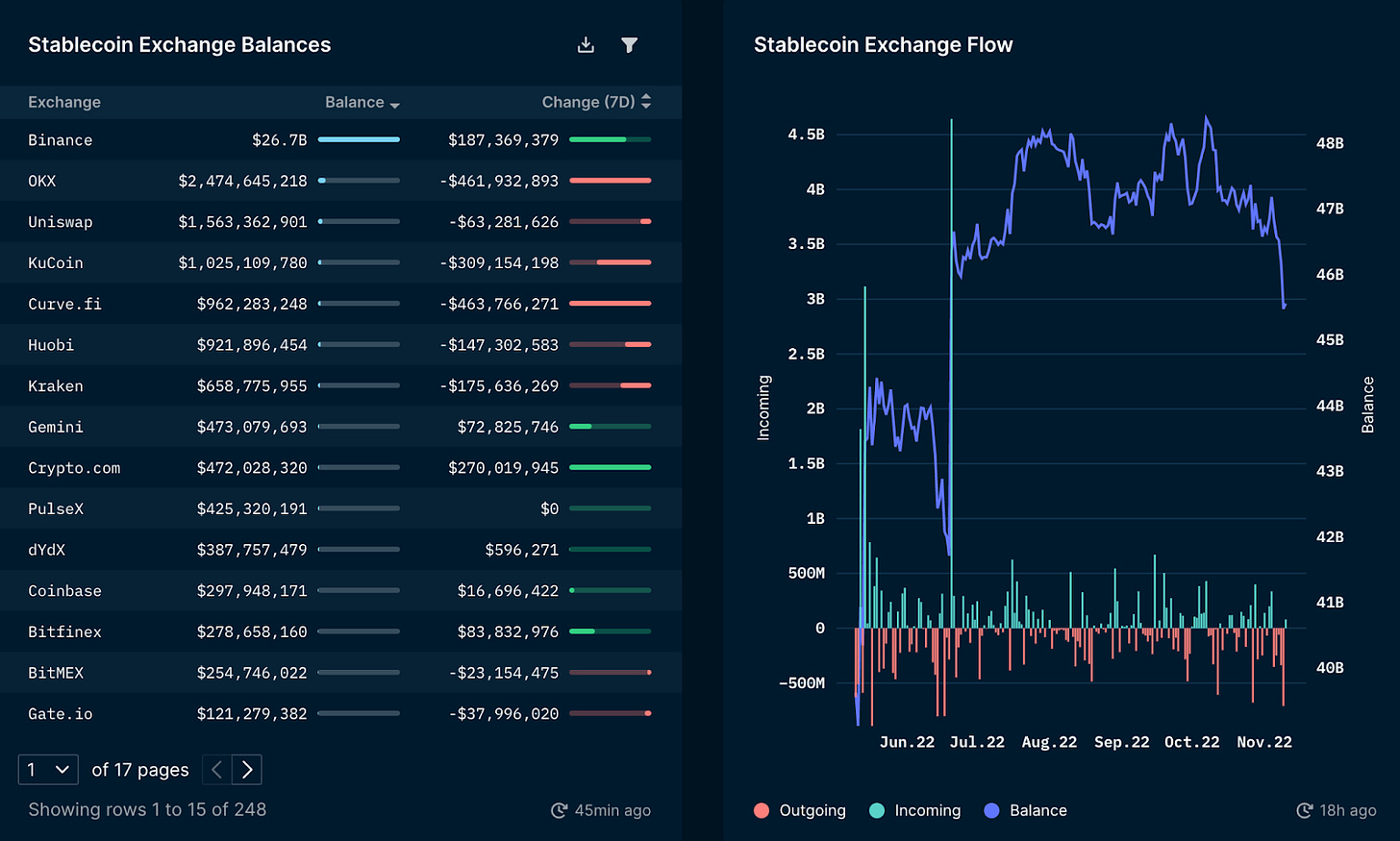

Nansen:

That big ol’ spike is smart money stabling up

Stablecoins on exchanges plummeted. Most likely from fear and uncertainty in addition to the FTX ordeal. No one wanted to be left with trapped funds

ETH on exchanges similarly nuked. Normally you’d say that people taking their crypto off exchanges is bullish because that’s less sell pressure, but in this case - trust has really been eroded. People panicked and took their crypto off exchanges. Will people really rush right back in to buy after such a mess? Seems like it would take time

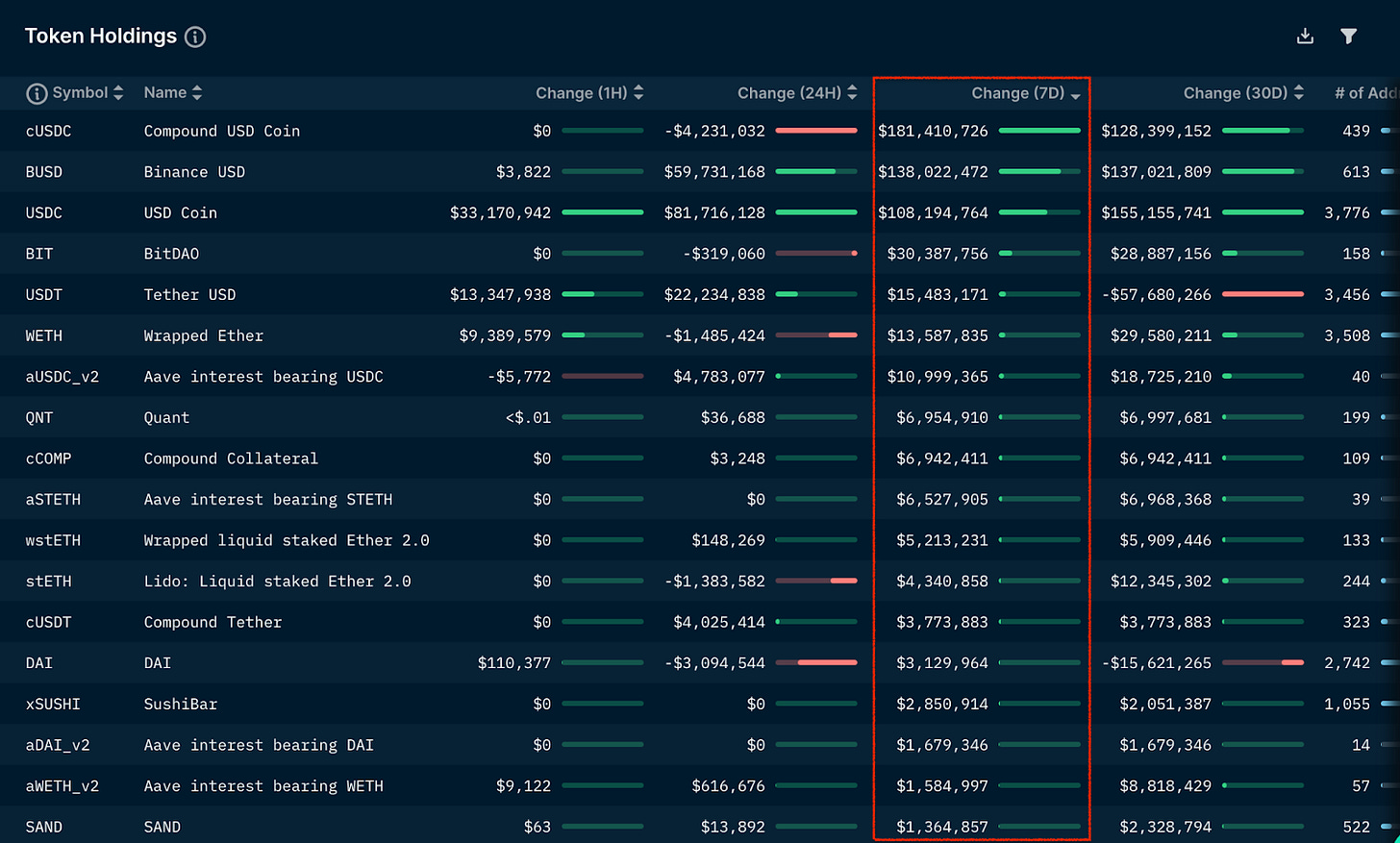

Largest Smart Money Inflows this week: smart money was stabling up it seems

Largest Smart Money Outflows this week: Maker, MIM and WBTC - however not in particularly large amounts

Exchange Flows: What is being deposited and withdrawn from exchanges

We can see cbETH, TUSD, LUNC, FTT were primarily sent to exchanges over the past week.

Understandably, people rushed to get their Stables and ETH off exchanges during all the panic.

🏦 DeFi Highlights of the Week 🏦

Crypto wallet Zerion is gearing up to launch an in-browser web extension as it prepares to take on industry leader MetaMask. The web extension is now in a closed beta and is expected to go live by the end of November

The GALA token exploit resulted from a public leak of applicable security keys on GitHub

The Avalanche Foundation is providing incentives worth $4M in AVAX tokens for the decentralized trading platform GMX, as part of the Avalanche Rush incentive program, which has the goal of growing the DeFi ecosystem on Avalanche

BetDEX, a sports betting exchange built on a blockchain, will open on Solana mainnet on Nov. 17 at the beginning of the FIFA World Cup in Qatar - offering fee-free betting on all World Cup games

Stablecoin issuer Circle announced Solana will add support for Euro Coin (EUROC), a regulated and reserve-backed stablecoin pegged to the value of the euro

A new Solana scaling protocol named Layer N that could quicken DeFi derivatives and on-chain social networks has come out of a stealth development phase ahead of a mainnet launch expected next year. FTX Ventures, Solana Ventures, Solana Foundation, and Solana co-founders Anatoly Yakovenko and Raj Gokal are investors

Wintermute-backed DeFi aggregator Bebop expands to Polygon. Bebop's unique “many-to-one” token feature lets traders swap whole portfolios for one coin in one click

Metamask users can now bridge across multiple blockchain networks using MetaMask Bridges, which aggregates different blockchain bridges in one place

Curve's 3pool, one of the most important pools for stablecoins in DeFi, is heavily imbalanced - USDT accounting for 80% of the pool's liquidity

Solana plan to unstake has now been postponed, and all 28.5M SOL have now been re-staked

dYdX placed Solana trades in “close only” mode, meaning users will only be able to close out their positions on the perpetuals exchange and not open new ones citing market volatility

Solend has accrued a bad debt of more than $6M from a large underwater position

The Tron network's algorithmic stablecoin USDD has begun to depeg - fell to as low as 96 cents

Debank - "Time Machine" - help you look back your complete portfolio details (not just the total net worth number) from any day in history

🖼 NFT/Metaverse/Gaming Highlights of the Week 🖼

OpenSea laid out the first of a suite of tools for its users, allowing creators of new NFT collections to enforce royalties on-chain. The code to which it is giving creators access restricts NFT sales to marketplaces that enforce creator fees. OpenSea will continue to enforce creator royalties on NFTs following significant pushback from the community

Coming Soon: LooksRare NFT Aggregator

The world’s biggest-selling NFT artist, Beeple, is bringing 'immersive 3D NFTs' to Solana via Metaplex and Render Network

Blockchain developer Mysten Labs has entered a strategic partnership with South Korean gaming company Ncsoft to create engaging gaming experiences, which contributed $15M to Mysten Lab’s previously announced $300M Series B round

Flowcarbon, a blockchain startup created by WeWork co-founder Adam Neumann, will launch an NFT project, Flow3rs, that uses a majority of its proceeds to buy carbon offsets

Co-founders of Yuga Labs have suggested a method to allow Bored Ape Yacht Club NFT sales only to royalty-enforcing marketplaces

STEPN partners with ASICS and Solana, pioneering a new era of Web3 fitness - launch of the new ASICS X SOLANA UI Collection featuring custom-made GT-2000 running shoes includes a token gated experience

Soccer star Lionel Messi is joining Sorare, the French NFT trading game, as an investor and brand ambassador

💸 Exchange Highlights of the Week 💸

Huobi made allegations against pNetwork, claiming that the protocol’s recent Gala actions were not a white hat move but a scheme for malicious profit and calling the activity a white hat attack was only an excuse by the pNetwork team to avoid legal consequences

Crypto exchange Bitmex is set to launch trading of its native BMEX token on Nov. 11. Rewards will be offered in the form of trading fee discounts, withdrawal fee waivers, improved staking rewards and access to new products and services

Binance, OKX, Crypto.com, OKX and Kucoin, BitMEX, Huobi, Bitget are among exchanges that will soon introduce Merkle-tree proof of reserves, in the interest of full transparency following FTX implosion

Binance Custody adds $NEAR token and NEP-141 standard to its infrastructure

Germany’s financial regulator ordered the local German Coinbase branch to comply to risk and capital requirements outlined by national banking legislation

Crypto.com suspends deposits and withdrawals of USDC and USDT on the Solana blockchain

👨⚖️ Economic/Government/Regulatory Highlights of the Week 👨⚖️

The Department of Justice (DoJ) and the Securities and Exchange Commission (SEC) are working together to investigate FTX’s U.S.

The Web3 Foundation that funds development of Polkadot said the blockchain’s token should no longer be considered a security subject to regulation by the U.S. SEC and is instead considered software

UK bank Santander is set to block real-time payments to crypto exchanges next year citing fraud

SEC wins suit against LBRY in major blow to crypto token issuance - the case has major ramifications for applications of SEC enforcement authority over projects that did not conduct ICOs

Kim Kardashian and boxer Floyd Mayweather are set to win a lawsuit accusing them of scamming investors with the obscure cryptocurrency EthereumMax

The U.S. Treasury Department updated its sanctions on Ethereum coin mixer Tornado Cash, citing its role in North Korea’s nuclear weapons program

Hong Kong’s Securities and Futures Commission looks set to allow the launch of ETFs tracking cryptocurrency futures for retail investors, citing the increasing sophistication of investor safeguards

The SEC reportedly issued a subpoena to influencers who were found promoting cryptocurrencies such as HEX, Pulsechain and PulseX

The SEC is suing Trade Coin Club, an alleged Ponzi scheme that netted 82,000 bitcoin from 2016 to 2018

Web3 venture capital firm Paradigm has launched a Crypto Policy Council - an 8-member bipartisan council that will advise Paradigm’s leadership and assist the company in “telling the story of Web3 in Washington and around the world”

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.