Thread 🧵: Is $USDC on track to flip $USDT?

We present a straightforward comparison between $USDT & $USDC

Will $USDC flip $USDT to become the leading stablecoin in the Crypto market?

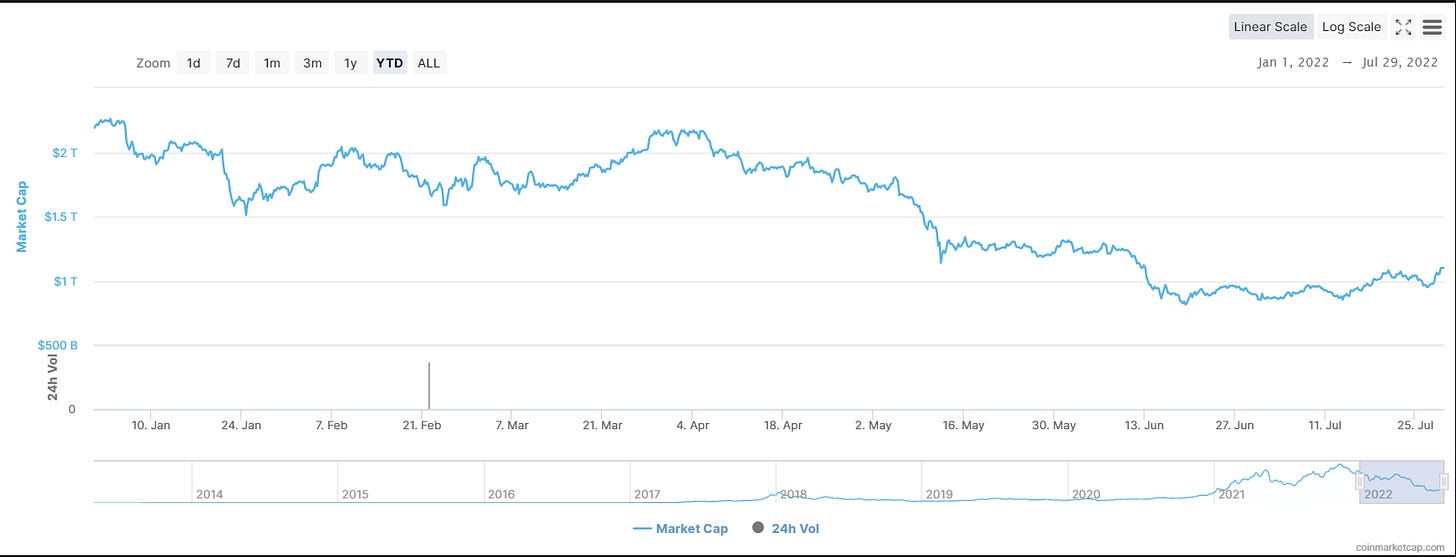

Year-to-date the market cap of $USDC has grown from $42B to $54B while the Crypto market cap fell from $3T to $1T

We present a straightforward comparison between $USDT & $USDC:

🧵👇

1/

$USDC and $USDT are both fiat-collateralized stablecoins pegged to the US dollar

Both of them have reserves in the form of fiat currencies and other assets

Reserves enable you to redeem the "digital dollars" (stablecoins) for "real dollars"

2/

The stablecoin market cap has grown from $1 billion to $180 billion at the peak of the market cycle

Given that all value is transferred digitally within the Crypto market, they have a very clear Product Market Fit for the Crypto market

3/

Ever since the entire Crypto market began plummeting, there was one coin whose market cap rose despite the FUD

And that coin is $USDC

Year-to-date, the market cap of $USDC has grown from $42B to $54B, while the Crypto market cap fell from $3T to $1T

4/

Despite the bullish performance of $USDC, $USDT has been the dominant stablecoin in the #Crypto market

As of now, the market cap of $USDT stands at ~$65B

It also has the competitive advantage of being the most liquid stablecoin with a staggering volume of $75B

5/

$USDC has a 24h volume of 'only' $9B

But that might be due to the fact that it is not being widely used in the Perpetual derivatives market

But on the flip side, the $USDT market cap fell along with the Crypto market cap from $83 billion at its peak to $65 billion

6/

Did you notice the bizarre situation here?

Why did "just" the market cap of $USDC increase while the rest of the crypto market, including the biggest #stablecoin, declined?

There may be compelling reasons for the smart money to move their funds into $USDC

Let's see why:

7/

• Why is $USDT inherently riskier than $USDC?

$USDC primarily focuses on building "TRUST" by guaranteeing users that every digital dollar of $USDC can always be exchanged 1:1 for cash. ALWAYS.

@circlepay is the issuer of $USDC & maintains the reserves for $USDC

8/

@circlepay assures that every digital dollar of $USDC on the internet is 100% backed by cash and short-dated U.S. treasuries so that it’s always redeemable 1:1 for U.S. dollars

$USDC reserves are held in leading U.S. financial institutions, like BlackRock and BNY Mellon

9/

Circle’s customers can mint/redeem $USDC instantly by opening a Circle account

~20% of the reserves are held as cash in the banks, while the rest ~80% is held as 3-month Treasury Bills

Treasury bills are one of the most liquid assets in the world, with ~$600B in volume

10/

The $USDC reserves do not contain any other high-risk, less liquid assets such as digital assets, private equities, unsecured loans, commercial papers, or assets held with third parties that are subject to lock-ups

11/

@circlepay is regulated as a "licensed money transmitter" under U.S. state law

This means Circle (as a licensed money transmitter) "cannot" simply lend its reserves to some Chinese company or use it for their own business expenditures like the way CeFi companies do

12/

But why should we believe their financial statements?

The $USDC reserve statements are audited annually by a leading global accounting firm

Circle also publishes monthly attestations of the size and composition of the USDC reserves to verify whether $USDC is 100% backed

13/

Now that we've examined $USDC, let's look at what's under the hood of $USDT:

@Tether_to is an offshore corporation that issues $USDT. This implies that it does not need to abide by US regulations

Tether works the same way as $USDC does but with one exception: RESERVES

14/

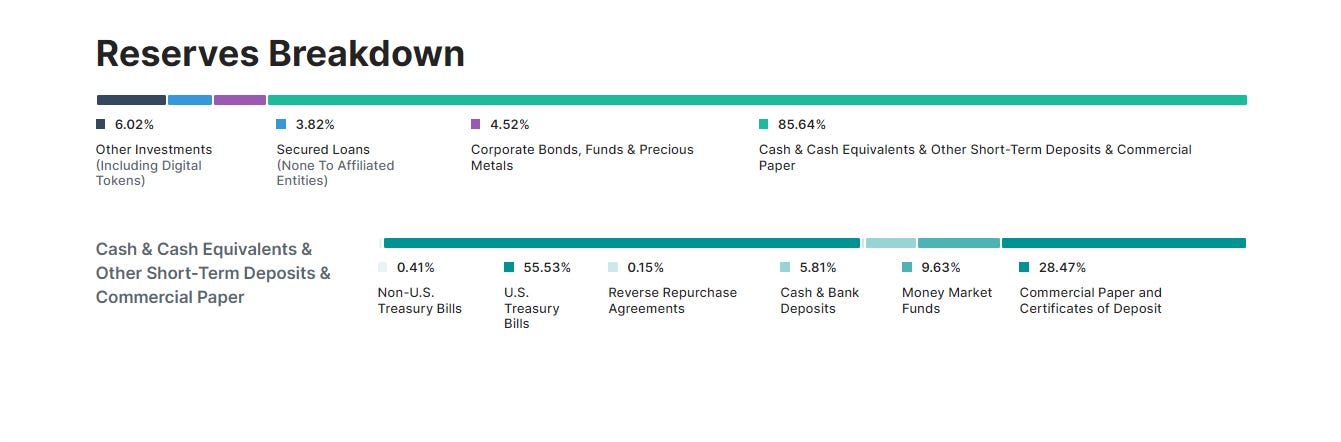

$USDT is backed 100% by Tether’s reserves similar to $USDC but with a slight difference

$USDT's reserves contain Cash, U.S treasury bills, Non-U.S treasury bills, Digital tokens, Secured loans, Precious metals, Commercial papers, Certificates of Deposit, etc.

15/

Instead of having only liquid and stable assets like $USDC, $USDT opted to diversify its reserves into risky & illiquid assets

This means that if $USDT redemptions skyrocket in a short period of time, Tether might not have enough liquid assets to meet redemptions

16/

But why would Tether hold risky assets in the reserves?

Simple. Yield.

80% of $USDC's treasury bills get interest (which is low) & 20% of them get close to zero interest

But Tether wants to hold risky assets to get those juicy yields to be a profitable company

17/

Tether also does not publish monthly attestations of their reserves, they post audits once in a while.

You will only know what assets they hold in the reserves when "they" decide to release an audit report

However, $USDC releases attestation reports every month

18/

Here are the risks involved in $USDT:

• Risky assets held in reserves

• Lack of regulation

• Sketchy business practices

• No monthly attestation reports of reserves

The "TRUST" in the $USDT is suppressed by all of these risks

19/

At the end of the day, the best fiat-backed stablecoin to hold ultimately comes from the one that finds the 'least' risky solution for these problems:

1. What assets does it hold in the reserves?

2. Can it handle high amounts of stablecoin redemptions immediately?

20/

Which one should you hold: $USDT or $USDC?

It is quite evident that $USDT carries significantly more risk than $USDC

21/

If you want a monthly report on the stablecoin issuer's reserve holdings and whether they can handle 100% of the redemptions: $USDC might be a better choice

22/

But if you are a day trader and you want a highly liquid market to transfer your dollars immediately, then $USDT might be a better choice for you

For short-term use cases, you might be better off holding $USDT while keeping your larger investments in $USDC