Thread 🧵: Real Yield, DeFi's Lifeline

The new narrative in Crypto that we need, Defi protocols have been gradually shifting their incentive models from "Inflationary Yield" to "Real Yield"

Real Yield - the new narrative in Crypto that we need

Defi protocols have been gradually shifting their incentive models from "Inflationary Yield" to "Real Yield"

Here is the underlying architecture of Real Yield and why it is FUNDAMENTALLY SUSTAINABLE over the long term:

🧵👇

Before we get started... Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox:

Done? Now let's dive in!

1/

#DeFi protocols have been operating on an unsustainable incentive model for quite a while

Many protocols that used Ponzinomics started to die with the onset of the bear market

DeFi protocols have now shifted to sustainable incentive models called "Real Yields"

2/

But, before we dive into "Real Yields," let us go back in time to understand the "Ponzi Yields" that kicked off the 2020 DeFi summer

• PONZI YIELDS OF 2020 DEFI SUMMER:

It is quite evident that the protocol with the highest liquidity attracts the most attention and users

3/

But how can a new DeFi protocol attract liquidity?

INCENTIVES!

DeFi protocols had to figure out a way to incentivize users to use their protocol and provide liquidity for their liquidity pools

Why? B/c users had no reason to lock their token in the absence of incentives

4/

So, most of the DeFi protocols decided to incentivize their users in the form of "TOKEN EMISSIONS"

Token emissions: Minting more and more new protocol tokens for users who provide liquidity or participate in the ecosystem

As more people join, more tokens are printed!

5/

This creates a positive flywheel for the protocol (in the short term) as degen #Crypto nerds flood the ecosystem in search of token incentives

The protocol that minted the maximum tokens got the maximum liquidity

This was the primary method to bootstrap initial liquidity

6/

Users can now earn 1000% APR in the form of inflationary tokens, and as a result, the protocol generates network effects

It's a Win-Win situation for both sides, right?

No. There's a catch!

Here are two major problems with this type of incentive model:

7/

1. Most protocols fail to gain ORGANIC UTILITY:

While the protocol gains network effects from token incentives, it doesn't gain a sticky user base

A sticky user base is one where people initially join the ecosystem for incentives but remain for utility-related purposes

8/

Because most protocols failed to provide utility, users' primary intention was to make a profit and sell the tokens as quickly as possible

The positive flywheel (incentives) has now become a negative flywheel, crashing the token and the protocol itself

9/

2. Supply eventually outstrips Demand:

The underlying structure of this incentive model requires the protocol to mint more tokens to gain more users

Since it costs nothing to create new tokens, the protocol aggressively mints more tokens to gain the fastest adoption

10/

The supply of tokens slowly increases with time as more users join the ecosystem

But the demand for the token will be very low since there is no organic utility for new users to buy the token

Supply>>Demand. What will happen?

The token crashes hard. Protocol dies forever

11/

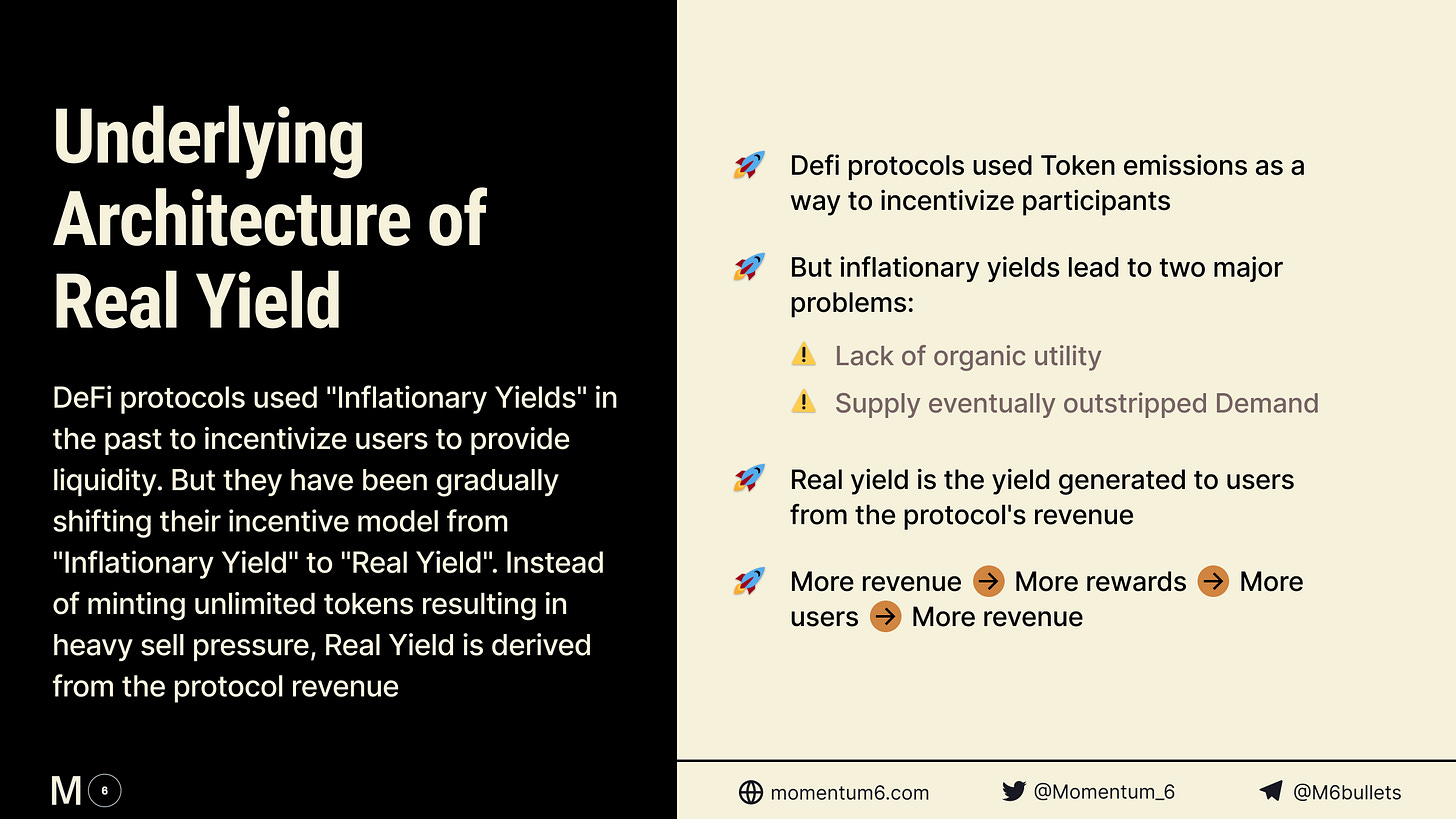

• WHAT IS REAL YIELD?

The yield generated for users from the protocol's revenue is known as the Real Yield

There is no increasing supply of tokens when more users enter the ecosystem since no new tokens are minted to incentivize people to use or hold the protocol's token

12/

Incentives are given to users in proportion to the protocol's revenue

More revenue -> More rewards -> More users -> More revenue

But how does this incentive model create a sticky user base? The Real Yield incentive model is primarily dependent on UTILITY

13/

The protocol can only pay out high rewards if it has an expanding revenue stream

An expanding revenue stream can only be achieved with an expanding user base

How can one achieve an expanding user base?

By offering actual UTILITY as a reason for users to join the network

14/

If the protocol fails to achieve either one of the criteria:

1. Increasing revenue

2. Expanding user base (with the help of organic utility)

A negative flywheel is formed:

Less revenue -> Less rewards -> Less users -> Less revenue

15/

The protocol is therefore compelled by this incentive model to develop a product with a genuine use case in a profitable way

This is a Win-Win situation for both sides!

The protocol is profitable.

Users are also getting incentivized to actually USE the protocol.

16/

Here are some major protocols that use a #Realyield incentive mechanism:

1. @LooksRare pays users who stake $LOOKS tokens with 100% of its trading fees

But users who buy and sell NFTs also earn "inflationary" $LOOKS tokens as rewards

It uses the best of both worlds!

17/

2. @GMX_IO is a Decentralized Perps Exchange that pays 30% of its platform fees to users who stake $GMX tokens

The platform fees are generated from users who pay a small fee to trade leveraged assets

Platform fees -> Rewards to users -> More users -> More platform fees

18/

The remaining 70% of @GMX_IO fees is paid out to $GLP token liquidity providers

3. @UmamiFinance that pays 20% APR in $USDC

Umami generates this yield from minting $GLP tokens to collect the majority of $GMX trading fees (not by minting more stablecoins!)

19/

Individuals are now aware of the need to look for protocols that pay from their revenue streams after the failure of major DeFi protocols that only employed an inflationary token incentive mechanism to reward people without building a useful product

20/

So, it is now more important than ever for protocols to build products with real UTILITY and real YIELDS in order to attract more users

Thus, Real yield is a sustainable long-term incentive model that benefits both users & protocols who want to use & build DeFi products

Subscribe to receive our daily brief, extended weekly newsletter, and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.