Remember one of the fundamental golden rules:

"Follow the money"

Stablecoins are the lifeblood of Crypto

Let's see where that lifeblood has been flowing in search of that covetous edge in these markets

We're analyzing stablecoins flows to keep an eye on what Smart Money has been doing with their stables.

In this article we cover:

-Stablecoin Exchange Flow

-Smart Money % Holdings in Stablecoins

-Daily On-Chain Volume

-Smart Money Balances

tl;dr:

Most recently, November saw the highest on-chain volume ever recorded, stablecoins have flown off exchanges, Smart Money continues to stay highly stabled up and their holdings of popular stables USDT, USDC and BUSD have all fallen.

First all, let's start with:

Stablecoin Exchange Flow

We can see that since November 4th, the balance of stablecoins on exchanges has plummeted.

Roughly $4B dollars worth. This coincides with the FTX collapse and scare. People rushed to get their crypto off exchanges.

Next, let's look at the Percentage of Smart Money Holdings in Stables

The idea is:

More in stables = bearish

Less in stables = bullish

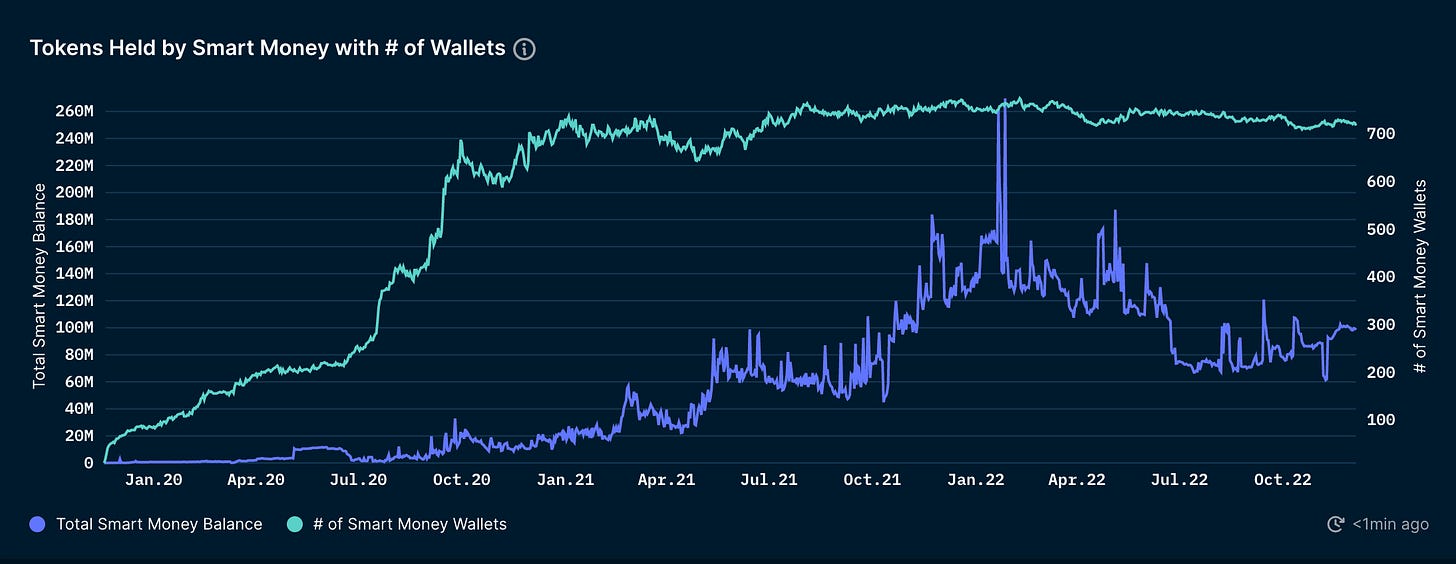

We can see that Smart Money is considerably more stabled up than they were this same time last year indicating current low risk appetite.

Looking at Stablecoin Daily On-Chain Volume:

We can see that November was the highest volume month ever with the bulk of that volume coming from USDC with $585,518,197,775 being traded on-chain.

This can likely also be attributed to the FTX scare and aftermath.

Next, we look at the historical token holdings for 4 of the most notable stables currently: $USDT, $USDC, $BUSD and $DAI.

Let's see what Smart Money prefers and what they're holding:

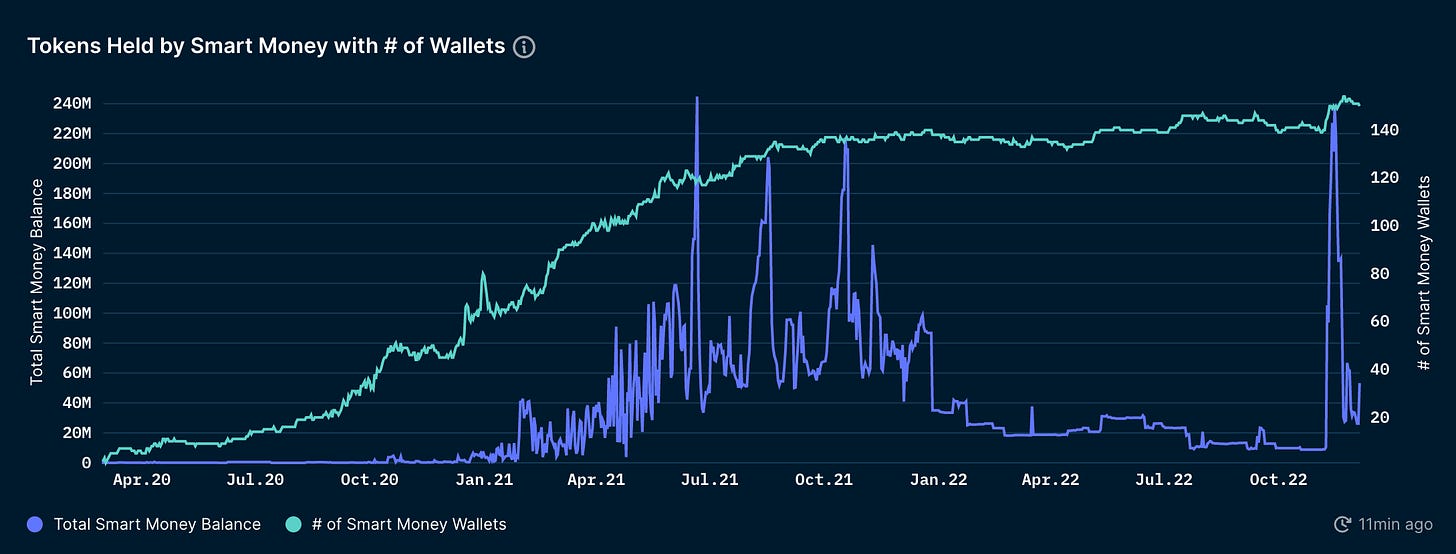

The balance of $USDT held by Smart Money has been slowly bleeding since September.

The Smart Money holdings of $USDC had been gradually increasing until September until which it fell and has been grinding downwards since.

Next, let's examine Binance's up-and-comer $BUSD, which we can see saw a massive spike in early November which has also sharply retraced.

Last, we can see that $DAI Smart Money holdings has gradually been increasing/ranging since the summer although it is still below what it was at the beginning of the tear

In conclusion, you want to try and stay with the trend and analyzing stablecoin flows can be very helpful in identifying and staying on the right side of a market trend.

When smart money is in stables, you may want to consider being in stables and when they're shifting out of stables, you may want to consider doing the same. Being less in stablecoins would normally be considered bullish, however given the greater environment in the crypto space at the moment (FTX contagion), it can be reasoned that fear and uncertainty has contributed to the drop in stablecoin holdings.

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.

As regards “the balance of stablecoins on exchanges has plummeted” how could one tell folks are actually taking their stables off exchanges or buying assets?