Weekly Alpha Leak 🚰 A Stroll Down Memory Lane - The Ghosts of Crypto Narratives Past

Week of October 1-7, 2022

Not a ton of new and exciting things to talk about recently… So today we’re taking a stroll down crypto memory lane. Let’s relive some of the recent hottest narratives and see how they played out..

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Done? Now let's dive in!

TL;DR:

Where Are They Now? The Ghosts of Crypto Narratives Past: SoLunAvax, FOAN, Curve Wars, Metaverse/Gaming Coins, Meme Coins

Top Bullets: BNB Chain $100M cross-chain bridge exploit, Celsius’ top 3 executives withdrew $42.13M before crash and bankruptcy, Do Kwon rescinded passport and first Terra employee arrest, Tether commercial paper cut to less than $50M, BNB Chain accelerator 27 web3 startups winners and 7 investments, FTX Dollar Spot Index, EDX Markets to work with Paxos as its custodian, Mt. Gox disbursements will likely occur next year

Data Highlights: DeFi TVL: $55B. In the past month: Ethereum sales: $350M - down 20.89%, Solana sales: $110M - up 101.79%, OpenSea down 38.49% in volume, Magic Eden up 53.56% in volume. Largest Smart Money Inflows this month: Compound ETH, Compound USDC, Compound DAI, Wrapped BTC, stETH, Aave WETH and WBTC. Largest Smart Money Outflows this month: USDC, WETH, Rocket Pool and USDT. Highest Volume NFT collection of the past week: Renga: 5900 ETH

DeFi Highlights: Sushi DAO new Head Chef, GoldenTree $5M stake in SUSHI, Celsius provides users' names and trading history in legal filing, Lido Finance launching on Arbitrum and Optimism, How Aave v3, should be deployed, MakerDAO $500M for investing in U.S. short treasuries and corporate bonds, GMX backend contract code for synthetics complete, Launch of Ribbon Lend, AVAX on THORChain Mainnet, 1inch wallet Unstoppable Domains partnership, Frax Finance proposal to partner with The Tie

NFT/Metaverse Highlights: Gary Vaynerchuk’s VeeFriends plush toys and vinyl figurines in Macy’s and Toys”R”Us stores, 3AC’s Starry Night Capital's NFTs collection moved to liquidators, Mythical Games creates Mythos Foundation, Hugo Boss/Imaginary Ones 360-degree metaverse experience, Moonbirds DAO launch early 2023, Dapper Labs’ NFT platform LaLiga Golazos beta, NFT-related trademark applications in the U.S. tripled

Government, Regulatory and Legal Highlights: European Council passed MiCA, US SEC charges Kim Kardashian, U.S. unemployment rate reinforces the Fed’s hawkish stance, CFTC serves legal summons to Ooki DAO members through online forums, SWIFT framework for a global CBDC system, Nasdaq no immediate plans of launching a crypto exchange until better regulatory clarity, EU crypto prohibitions on Russia tightened, OpenSea employee accused of fraud defense strategy, CFTC action against Digitex Futures, SEC charges 4 men for pump-and-dump scheme worth $36.8M, NFT firm seeks US election commission’s approval to market campaign souvenirs, SEC emergency shutdown of scam targeting Latino community

⛓ Crypto Highlights of the Week ⛓

Where Are They Now? The Ghosts of Crypto Narratives Past

It’s been a long and crabby bear market, hasn’t it? Very few catalysts have led to any type of sustained pumps. What about the narratives of yonder past? Let’s take a little stroll down memory lane and review some of the past “narratives” we had just before things really went to hell. What we can see in hindsight is the rotatooors rotating from one hot thing to another as liquidity sloshed around and leaving behind a trail of broken hopes and dreams. Not to rub salt in anyone’s wounds, but at one point or another, these were the “in” coins and now they ain't doing too hot.. Which will come back and which are the new dino coins?

SoLunAvax - Battle of the Alt L1s

So this one started popping up last year among exorbitant ETH gas fees and everyone looking for the next “ETH killer” and it for sure ripped and outperformed during the last bull run. Solana, Luna and Avax - this power trio took turns leading rallies and hitting new highs during the last bull run. Where are they now?

Solana:

This bad boy absolutely destroyed it and ripped till November when the market started turning. It has since returned to Summar 2021 levels and given up all those gains. Many out there believe that it’s only a matter of time before Solana comes back and evidence of that can be seen in the Solana NFT market, which has maintained life during this bear. Another train of thought is that when new and shiny VC backed chains like Aptos and Sui come out, interest in the old toys will wane for the shiny and new chains. Crypto is a space that runs on hype and narrative, after all.

Luna:

Unlike Solana which fell off in November and wasn’t able to regain its former power, Luna absolutely re-ripped starting in February and managed to make new all time highs in April before the major crash and death spiral that effectively killed this project in May and had far reaching ripple effects in the crypto space. We have since seen financial games being played with Luna Classic and Luna 2.0 and now we of course have crazy legal battles ongoing with Terra and Do Kwon. Many people got burned here.. Wild ride. Hard to see this one coming back.

Avax:

Avalanche’s Avax followed a similar path to Solana, it had a crazy run until November where everyone on twitter had little red triangles in their names and then has slowly grinded and bled down since, being unable to regain the same hype despite the introduction of subnets and heavy ecosystem development funding. This one is poised to survive the bear just fine due to all that funding but the question remains of whether the market will return to last season’s winners or look for something shiny, new and exciting to hype up. Either way, Avax is currently maintaining above summer 2021 lows.

FOAN - Fantom, One, Atom, Near - Battle of the Alt L1s part deux

Fantom:

Fantom was another major ripper during the 2021 bull but life was first breathed into the “FOAN” trade at the end of December and for Fantom, the run was short, only managing to stay alive until mid January before crashing and bleeding all the way down to the pits of Tartarus. In the meantime, prominent founder Andre Cronje has since fallen from grace and exited the crypto space for the time being - all adding to the uncertainty of this project.

One:

Harmony One. This one was another strong performer which fell off hard in November, sprung back up with impressive resilience and then crashed straight to fucking hell. The most interesting thing to come from Harmony was the game DeFi Kingdoms and that has also basically died since. This one is trading well below the summer 2021 lows and has a questionable future ahead of it.

Atom:

Atom has recently received a bit of hype with their Atom 2.0 and interchain security announcements however it wasn’t enough to move the price considerably. This one has a bit of a reputation for being cursed and you can see evidence of that in how compared to some of the other coins being compared here, this one struggled to make the same type of massive gains. It double topped in September and January and has bled since with the recent little bounce being linked to the recent announcements. Despite the unimpressive past performance, with the recent support of Delphi and others who believe in the future of appchains, this one has a potential future ahead of it.

Near:

The time frame for this one saw it survive the November crypto crash relatively well and successfully rip to new highs until early January before selling off and then finding some resurgence in March and April. It has since crashed hard and been grinding above the summer 2021 lows. This one is heavily VC backed but has very weak marketing power and name recognition in comparison to the massive brand recognition Luna and Avax had.

Curve Wars

The Curve wars narrative started blowing up in November and December before promptly dying in early January. The story for this one was interesting - phrased as DeFi’s fight for liquidity. It sure captured the imagination of market participants during a time when it seemed there were few narratives to rotate into. Overall, DeFi has been relatively dead however many have high hopes for upcoming narratives such as real yield to breathe some life back into this sector. Will the hype around amassing governance voting power to control that vital liquidity resurface?

Metaverse/Gaming: Gala, Mana, Sand, Defi Kingdoms

Each of these had a very similar playbook. They were super hot until November, upon which time they bled straight to hell. Jewel in particular sticks out as this was shilled heavily by CT influencers and has since died horribly with little chance of coming back due to problems with their team and how they’ve managed the project. Let’s not also mention the disgustingly overinflated fully diluted values of each of these projects and high emissions. It’s fascinating to look back in hindsight at how everything played out. What goes up, must come down.

Mana:

Sand:

Jewel:

Honorable mentions - Meme Coins:

Doge:

The mania for this one peaked in early May - when Elon Musk got on Saturday Night Live and shilled it. It has been decimated ever since.

Shiba Inu:

This one may look the same but this timeframe was pushed back a bit once the dog coin mania was established. This one ran all the way until the end of October before slow bleeding to death.

For Another Time:

Prominent Figures: Do Kwon, Su Zhu, Andre Cronje, Daniele Sesta, etc

Would you like to read about where some of these prominent figures are today?

💊This Week’s Top Daily Bullets 💊

BNB Chain $100M cross-chain bridge exploit. Hackers attempted to drain $560M in BNB tokens from the blockchain’s bridge, with more than $100M successfully siphoned to other chains. BNB Chain will adopt on-chain governance votes to determine future actions, including whether to freeze hacked funds. Since July 2021, 11 large cross-chain bridge attacks have occurred, involving more than $2B

Crypto lender Celsius’ top three executives, Ex-CEO Alex Mashinsky, ex-CSO Daniel Leon and CTO Nuke Goldstein, withdrew $42.13M in crypto between May and June, right before the company suspended withdrawals and filed for bankruptcy. Celsius’ co-founder Daniel Leon resigns following Mashinsky’s leaving. Leon is at least the eighth crypto sector executive who has resigned in recent months. The final bid deadline for Celsius’s asset auction will be Oct. 17

South Korea has ordered Terra founder Do Kwon to return his local passport in 14 days or risk losing the passport, and re-applications may be rejected. The first arrest in the ongoing investigation also reportedly took place with the arrest warrant being rescinded since - Yu, head of general business operations at Terraform Labs - allegedly used bot programming to inflate and manipulate the market price. South Korean prosecutors frozen $39.6M of crypto assets, including BTC, owned by Do Kwon through two exchanges however Do claims the funds are not his

Stablecoin issuer Tether has cut its commercial paper holding to less than $50M and plans to bring its commercial paper holdings to zero by the end of the year

BNB Chain accelerator announces 27 web3 startups as winners and seven projects will receive investment from Binance Labs

FTX has listed FTX Dollar Spot Index $FTXDXY perpetual futures

Citadel and Fidelity-backed exchange EDX Markets will work with Paxos as its custodian. Paxos is regulated by the New York Department of Financial Services and will hold all EDXM customer assets in a bankruptcy-remote trust, in fully segregated U.S. accounts

Mt. Gox Bitcoin exchange creditors can now register to select a repayment method. Not clear when the disbursements will happen, but will likely occur next year

These are just our top bullets, want more? Check out our daily newsletter:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

💰 Fundraising Highlights of the Week 💰

📊 Crypto Market Data Highlights of the Week 📊

DeFi TVL: $55B

In the past month:

Ethereum sales: $350M - down 20.89%, Solana sales: $110M - up 101.79%

OpenSea down 38.49% in volume, Magic Eden up 53.56% in volume

Highest Volume NFT collection of the past week: Renga: 5900 ETH

Nansen Smart Money:

A gauge of how risky or risk adverse smart money is feeling. We’re near the June bottom levels but also slowly ticking downward? Too early to tell but they are considerably more stabled up than they were all of the bull run and the early stages of the bear.

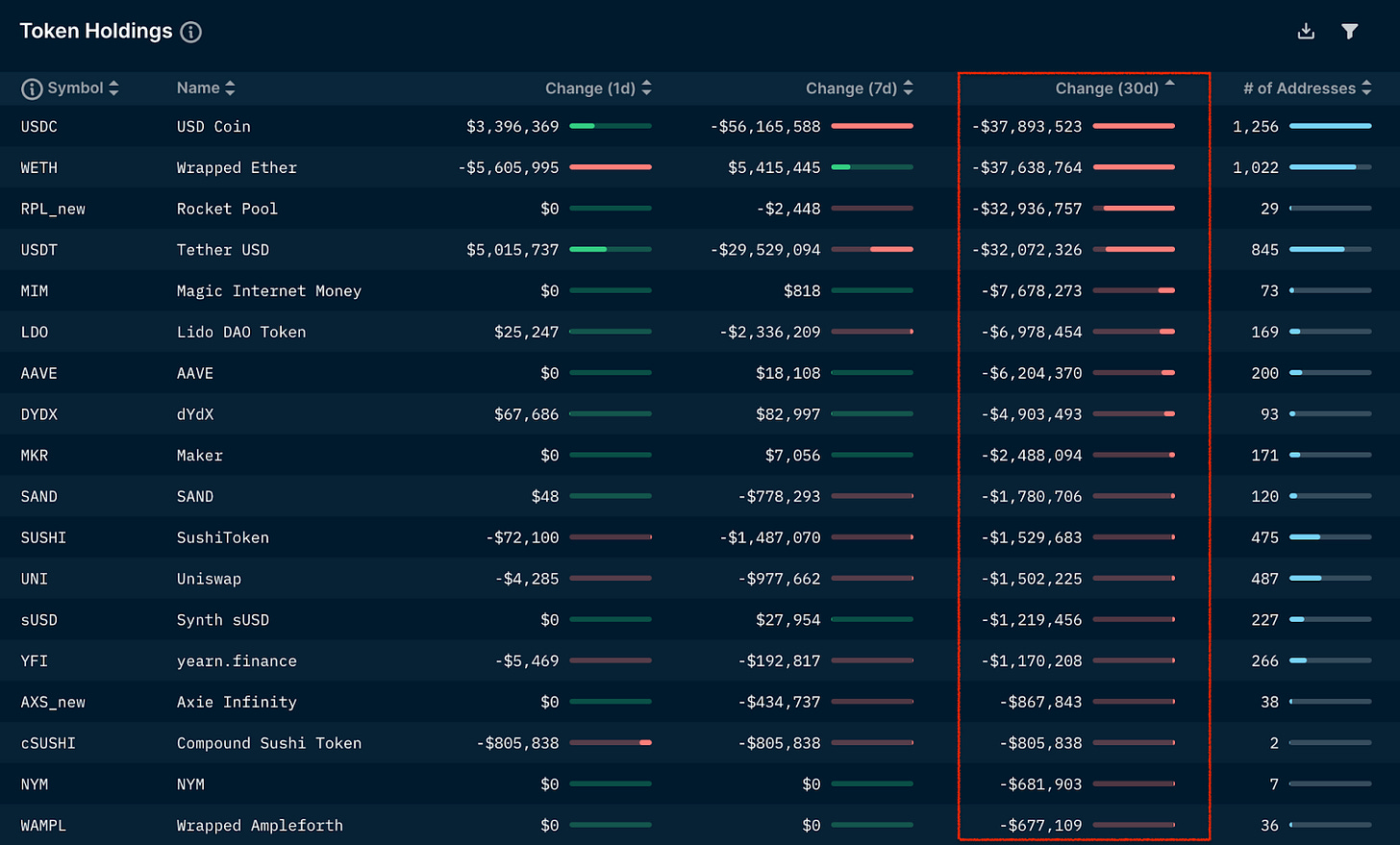

Largest Smart Money Inflows this month: Compound ETH, Compound USDC, Compound DAI, Wrapped BTC, stETH, Aave WETH and WBTC. Interesting to see that instead of holding the actual coins, smart money is choosing to move their crypto in Compound, Aave, Lido derivatives

Largest Smart Money Outflows this month: USDC, WETH, Rocket Pool and USDT. So basically moving out of stables, ETH and ETH staking

Nansen Hot NFT Contracts:

Highest Volume NFT collections of the past week:

Renga: 5900 ETH

LUSDBondNFT: 3933 ETH

CryptoPunks: 2897 ETH

Kitaro: 2104 ETH

BAYC: 2082 ETH

🏦 DeFi Highlights of the Week 🏦

Sushi DAO voted to elect former Eons Finance CEO Jared Grey as new Head Chef. Asset management firm GoldenTree, with about $47B in assets under management, has taken a $5M stake in SushiSwap’s governance token SUSHI

Celsius provides users' names and trading history in legal filing as part of its bankruptcy proceedings which may identify many anonymous crypto users’ wallets

Lido Finance has launched on two layer-2 networks - Arbitrum and Optimism

The Aave community is currently voting on how the latest update, Aave v3, should be deployed - the majority of the votes support creating a standalone new version rather than upgrading the previous one

MakerDAO has allocated $500M for investing in U.S. short treasuries and corporate bonds - initiated by DeFi asset advisor Monetalis and lead by digital asset bank Sygnum

GMX update - the backend contract code for synthetics is complete

Launch of Ribbon Lend - expansion into the credit market

Avalanche C-Chain integration completed - native AVAX is now on THORChain Mainnet

1inch wallet users get domain names with Unstoppable Domains partnership

Frax Finance proposal - partner with The Tie to increase institutional understanding, data access, and contact points for the FRAX ecosystem

🏢 NFT/Metaverse Highlights of the Week 🏢

Gary Vaynerchuk’s NFT project VeeFriends will launch plush toys and vinyl figurines later this month through Macy’s and its Toys”R”Us in-store brand

Three Arrows Capital's liquidators have taken control of Starry Night Capital's NFTs collection and moved to a Gnosis Safe wallet. Collection now valued at $840,000, a fraction of the $21M spent on it

Mythical Games creates Mythos Foundation to decentralize web3 gaming and enlists Ubisoft, Animoca and others to launch Mythos DAO and the MYTH governance token

Hugo Boss has teamed up with the NFT collection Imaginary Ones to launch a 360-degree metaverse experience

An official Moonbirds DAO is planned to launch in early 2023, with creator Proof planning to seed the DAO with $2.6M worth of ETH and NFTs

Dapper Labs’ NFT platform, LaLiga Golazos, based on the LaLiga Spanish soccer league will launch in closed beta later this month

The number of NFT-related trademark applications in the U.S. has tripled since 2021. NFT trademark filings peaked in march and have fallen in every month since

👨⚖️ Government, Regulatory and Legal Highlights of the Week 👨⚖️

The European Council has passed MiCA, the EU’s comprehensive crypto regulation and if approved, laws will be in place at the start of 2024

US SEC charges Kim Kardashian for promoting EthereumMax and Kardashian has agreed to pay $1.26M in penalties, disgorgement and interest

The U.S. reported that the unemployment rate in September was 3.5%, below expectations and the previous reading of 3.7%. This will reinforce the Fed’s hawkish stance

A judge in the Northern District of California will let the Commodity Futures Trading Commission serve summons and complaint to Ooki DAO members through online forums

SWIFT, the interbank messaging system facilitating cross-border payments, has presented a framework for a global central bank digital currency system, claiming to have solved the challenge of interoperability between different networks

US stock exchange, Nasdaq, has no immediate plans of launching a crypto exchange until there’s better regulatory clarity from policymakers

EU existing prohibitions on crypto assets have been tightened by banning all crypto-asset wallets, accounts, or custody services to Russia, irrespective of the amount of the wallet (previously up to €10,000 was allowed)

OpenSea employee accused of fraud, Chastain, is claiming the FBI violated his rights in the lead-up to his arrest, seeking to subpoena his former employer and trying to throw out any use of the term “insider trading” in the case

The CFTC is bringing action against Digitex Futures and its founder for failing to register and attempting to pump its token

The SEC filed charges against four men behind Bermudan company Arbitrade Ltd., Canadian firm Cryptobontix Inc., and U.A.E.-based Sion Trading for allegedly running a pump-and-dump cryptocurrency token scheme worth $36.8M from 2017 until 2019

NFT firm, Data Vault Holdings, seeks US election commission’s approval to market campaign souvenirs such as digital tokens to political committees

The U.S. SEC ordered the emergency shutdown of an ongoing fraudulent crypto offering targeting the country’s Latino community that has raised $12M

The crypto space is a wild and fast paced, evolving landscape - however one filled with recurring themes and trends. The point of this newsletter is to highlight the story of crypto - as it's told over time. The board, the players, and the game itself. Follow along as we catalog and organize the chaos.

Subscribe to receive our daily brief and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.