Will we, won’t we? The crypto markets are floating in limbo. With the upcoming ETH Merge and a heavy macroeconomic environment looming, the question is - at what stage in the market cycle are we currently? Let’s explore.

TL;DR:

The expectation is that the Fed will continue to hike interest rates until inflation lowers to its goal of 2% resulting in likely further pain for risk on assets

Ethereum Merge tentative date of September 15-16

Sudoswap has been growing in users and volume despite facing technical issues

Data Highlights by @Dynamo_Patrick: Dogechain, a new EVM chain that uses wrapped DOGE as currency, captivated the attention of DeFi enthusiasts, growing its TVL to $9M in a few days after launch

TradFi Highlights by @RNR_0: Massive long liquidations. $2T stock-options deadline is a make-or-break moment for bulls. For equity markets, option expiration Friday with Negative gamma

DeFi Highlights: AAVE, Lido, Yearn Tether, Iron Bank, 1Inch, Synthetix making positive developments

Upcoming Crypto Projects Offerings by @_TokenHunter

Before we get started...Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox.

Done? Now let's dive in!

⛓ Crypto Highlights of the Week ⛓

Elephant in the Room: Bull Trap? Macro Considerations to Keep in Mind!

The sentiment and narratives have fizzled this week and the market is looking meh. As the bullishness we’ve seen in recent weeks has softened, many are left wondering what stage of the market we’re currently in. Crypto is undoubtedly considered a risk-on asset and therefore beholden to the greater macroeconomic landscape. Let’s explore the state of where we currently are and some observations we should keep in mind going forward.

According to the Fed’s meeting minutes released this week, The U.S. Federal Reserve governors have signaled that they anticipate more interest rate increases in the coming months, however the pace of the hikes is likely to slow if the inflation rate starts to come down. Inflation is still too high.. despite the labor market being strong and unemployment very low, there was no evidence it would subside just yet. Language used in the minutes is very important to pay attention to as it indicates that they would need to slow the pace of rate increases “at some point” but that would depend on future data. The expectation is that the Fed will continue to hike interest rates until inflation lowers to its goal of 2%. Recall that the U.S. central bank has raised interest rates four times this year, including increments of 75 basis points – a historically large increase – at its last two meetings.

So how does that affect us here in the Crypto world?

In the past couple of months, we saw a huge liquidation cascade brought on by Terra, Celsius (stETH), Three Arrows Capital insolvency and all the fallout from all entities affected such as Voyager, Vauld, Babel Finance, Genesis, Galaxy Digital, and others - overall $3.5B owed to over 32 companies. What we saw was a lot of Forced Selling and Capitulation by large entities. This resulted in sub $20k BTC and ~ sub $1000 ETH which ended up being the turning point for the current rally we’ve seen in recent weeks. Are we seeing a dead cat bounce? Bear market rally? Bull trap? Let’s explore further.

What we’ve seen is the market painfully grinding upwards in an ETH led rally. ETH rose ~ 2x off the lows with Bitcoin and most altcoins underperforming all the while. Meanwhile, mini narratives have popped off surrounding things like Sudoswap NFT plays, Dogechain shitcoins, real yield protocols, Merge related plays, and others. It’s been uninspiring that basically no bullish momentum has been sustained this entire year. We’ve just meekly grinded and crabbed either up or down. Causing max pain and uncertainty for both bears and bulls.

On the horizon, we’ve got the highly anticipated upcoming Ethereum Merge with a tentative date of September 15-16. Will it be a sell the news event? Some people seem to envision a huge rally with fireworks and a parade when the Merge is successful that leads to us being off to new ATHs. There’s decent bullcases surrounding ETH moving towards becoming a deflationary asset and why this will result as a positive price catalyst. Arthur Hayes is a popular proponent that ETH will flip bullish with a successful merge due to the following reasons:

Ethereum will undergo a 90% cut in daily emissions

Yearly inflation will go down from 4.3% to 0.43%, equivalent to three Bitcoin Halvenings occurring at once

Proof of Stake Validator rewards will go up from 4.5% to 10-15% in the months after the Merge

Energy Consumption will drop by 99.9%.

Is that how things will play out, though? Due to several recent successful testnet merges, probability favors a successful merge but with the macro still so heavy... the chance that this highly publicized event turns into a sell event is a serious one to keep in mind.

As for why investors and market participants might be hesitant to regain risk-on mode any time soon, and why this could be bearish for the overall markets, let’s take a closer look at this inflation number everyone keeps talking about. As a reminder, the U.S recently saw a 9.1% inflation print followed by a lowered 8.5%. Still the highest since the 1980s! The Fed has been raising interest rates and the fact that inflation slowed down indicates that the efforts are working, which is why we therefore recently saw market participants switching risk on and liquidity begin to flow back into the market. However inflation is still historically high and rates need to in theory keep getting raised to get inflation under control which takes TIME. We’ve just barely started getting a handle on inflation and lot’s of people think that means it’s time to go full balls to the wall again. Imagine being obese, losing 5 pounds and thinking it was now ok to go back to your old ways.

More things to keep in mind, this entire year we’ve seen lots of market focus on events like CPI, FOMC, FED minutes, etc - market participants have been waiting with bated breath for the return of risk on conditions. Evident with all the volatility around these dates.

So what can we expect going forward? Are we seeing the beginning of a new bull run? Are we seeing a dead cat bounce or bear market rally? Has the past few weeks been one big bull trap? The Merge will probably proceed successfully and business will go on as usual on the development side followed by disappointment for market participants and speculators afterwards. The macro is still too heavy. Due to the fact that the crypto markets are still nascent and correlated to traditional legacy markets and that the macro hasn’t convincingly signaled a switch to return to risk on, the case that the Merge ends up being a sell the news event with new lows to be seen later this year or next year is a serious one to keep in mind until inflation gets under control and we can start seeing meaningful signals of reversals.

Bringing this fan favorite Psychology of a Market Cycle graphic back out, we definitely saw capitulation with all the forced selling and forced liquidations but it doesn’t quite feel like we’ve seen true depression, at least yet...

Of course markets, humans and reality are often not sensible or adhere to “what should happen” and we could pump out of here despite all the sensible reasons not to. The market could “price everything in” and the crazy casino games could continue while the Fed plays games. It’ll be important to observe how price behaves moving into the next month.

Worth noting that the overall long term picture is still bullish! Mainstream, VC interest and pop culture is obsessed with NFTs, metaverse, gaming and blockchain. The future of crypto is promising. So much interest and money is pumping into this sector. The next 5 years will most likely bring opportunities but as for the question of when will we actually bottom? Unfortunately, until the macroeconomic conditions start easing more meaningfully, we might have to wait a bit longer.

This Week’s Top Daily Bullets 💊

Dogechain was undoubtedly where most apes and degens were playing this week by bridging their doge to wrapped doge and gambling on this week’s new casino of choice. Time to bridge off takes between 30 hours - 7 days. Many scams, rugpulls and low liquidity plays.

Sudoswap has continued to be hyped up this week with an average 733 daily ETH volume however many users have faced issues with the interface. Seeing lots of copycats spring up as well (Sudo Loot, SudoPepes, and Sudo Inu)

BendDAO, an “NFTfi” project that allows users to borrow ETH against NFTs posted as collateral, presents liquidation risk for Bluechip NFTs. BAYC in particular are drawing attention

A16z investing $350M in Flow, Adam Neumann’s new real estate startup. The largest individual check Andreesen Horowitz has ever written. Values Flow at more than $1B before it even officially opens its doors

Polkadot DeFi platform Acala’s native stablecoin, aUSD, depegged, plummeting 99% after hackers exploited a bug in a newly-deployed liquidity pool to minted 1.28B tokens. Required burning the 1.2B tokens that were minted to regain peg

IRS takes out John Doe summons on crypto prime dealer SFOX to find tax cheat customers - same tactic to gain information from Circle, Coinbase and Kraken in recent years

These are just our top six bullets, want more? Check out our daily newsletter:

Scammy Sh*t 💩

Velodrome DEX identified a team member, well-known CT account Gabagool, as being responsible for a $350,000 theft. Gabagool confessed and returned funds

Do Kwon, the disgraced co-founder of the Terra blockchain, gave his first public interview since UST blew up

YouTube influencer Ben Armstrong, aka ‘BitBoy Crypto,’ sued a fellow social media personality over defamatory claims that he scammed his audience

Celsius CEO Alex Mashinsky had personally taken charge of the firm’s trading strategy in the months before it filed for bankruptcy

Martin Shkreli claims porn virus hack cost $450K in Crypto tokens

📊 Crypto Market Data Highlights of the Week 📊

✍️ From our special guest contributor: Patrick Scott from Dynamo DeFi

Polygon stood alone as the only major chain to grow its TVL this week. Polygon’s TVL increased 22.3% week-over-week.

Polygon’s TVL growth was driven by the launch of MM Finance, one of the leading DeFi products on Cronos, on Polygon. MM Finance has already attracted $500M in TVL in its first week on Polygon.

GMX, an on-chain perpetual exchange on Arbitrum, continued to grow its revenue this week. GMX’s revenue increased week-over-week by 34.5% for a total increase 75.4% month-over-month.

Dogechain, a new EVM chain that uses wrapped DOGE as currency, captivated the attention of DeFi enthusiasts, growing its TVL to $9M in a few days after launch.

🏢 TradFi Highlights of the Week 🏢

✍️ From our special guest contributor: Romano - @RNR_0

Overall the market (right now) looks like shit and looking at how BTC will react if SPX500 does go down hard. The effect of liquidations seems to be a bit more "permanent" in bitcoin because bitcoin is itself the project. Unlike ie Apple (if liquidations happen), people will buy because it might still trade at a discount due to earnings

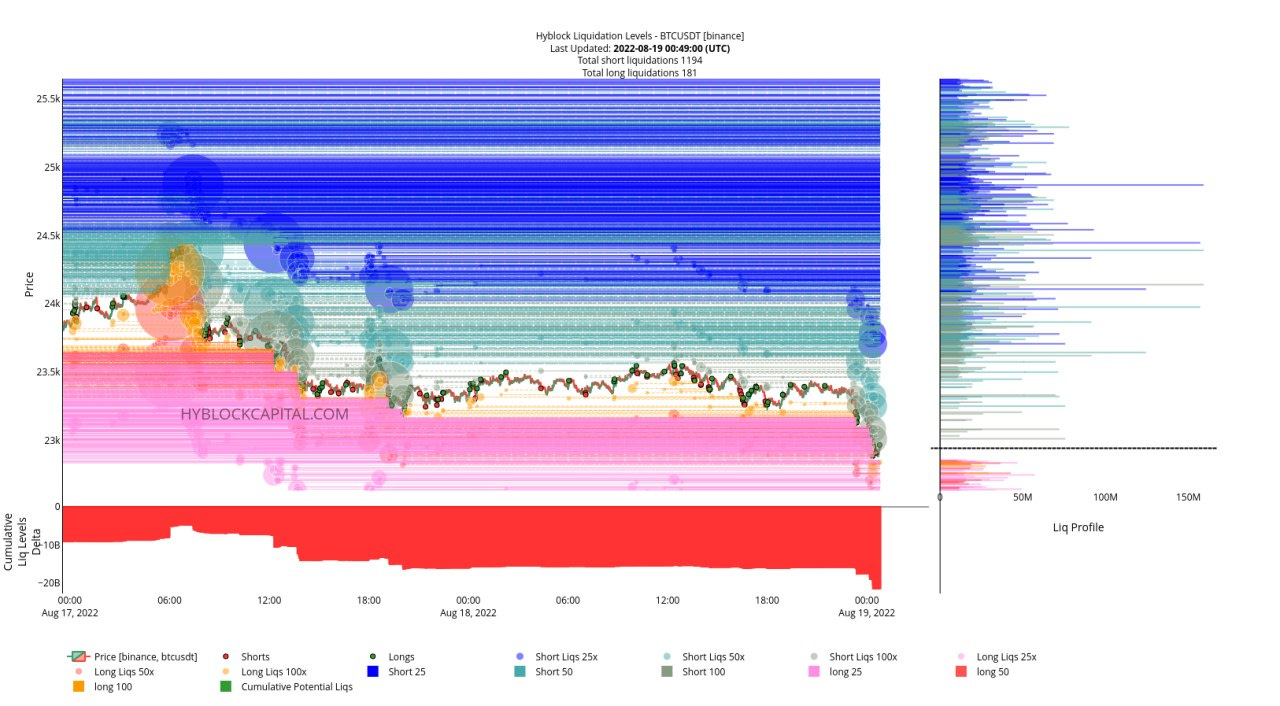

Liquidation heatmap of BTC Binance. Lot of longs got liquidated

Massive liquidations again, most longs got liquidated

$2 trillion stock-options deadline is a make-or-break moment for bulls. For equity markets, option expiration Friday with Negative gamma. So any move up or down will be violent as dealers chase delta to stay delta neutral

Something is brewing in Forex, again JPY and 10y yield

More market thoughts:

🏦 DeFi Highlight of the Week 🏦

Latest Tether disclosures show $28.9B in US Treasury bills

Lido Finance L2 expansion plan, first step is bridging Ethereum staking derivatives on Arbitrum and Optimism

Ethereum-based lending and borrowing platforms Iron Bank, Yearn Finance and Homora joined layer 2 network Optimism

Aave DAO Governance Proposal to commit to selecting the Ethereum Mainnet running under the PoS consensus over any Ethereum fork running an alternative consensus (such as Proof of Work)

1inch now fully integrated with Synthetix Atomic Swaps

🗓 Upcoming Crypto Projects Offering 🗓

✍️ From our special guest contributor: TokenHunter

The crypto space is a wild and fast paced, evolving landscape - however one filled with recurring themes and trends. The point of this newsletter is to highlight the story of crypto - as it's told over time. The board, the players, and the game itself. Follow along as we catalog and organize the chaos.

Subscribe to receive our daily brief and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.

Hello Team! Thx for great newsletter. Would it be possible to include weekly Nansen data inflow/outflow (sorted by 7d) in your weekly newsletter similar like you do for the daily?