Fed Hope Amongst the Luna, 3AC, FTX/Alameda Fallout and Carnage?

November 26 - December 2, 2022

Another week come and gone in our crazy little crypto bubble. This week we’re exploring the time based element of the market bottom. As for goings-on this week, we saw that ConsenSys is collecting our IP addresses, we had WBTC depeg issues and WETH FUD jokes gone too far, BlockFi filed for Chapter 11 bankruptcy, Solana-based DEX Serum is now defunct, Kraken intends to cut staff by 30%, SBF keeps doing bad interviews, NFT trading went live on Uniswap with an airdrop, The Fed is likely to slow its rate increases to 50 bps, Coinbase Wallet says Apple requested 30% of all NFT transfer gas fees, Genesis creditors organized in bid to forestall bankruptcy, and Blur's second airdrop is arriving December 5th. Never a dull moment around here.

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Done? Now let's dive in!

Market Ruminations - The Time Based Element of the Market Bottom

Could there be hope amongst the fallout and carnage of not just the FTX/Alameda implosion but also Luna, 3AC, Celsius, BlockFi, Voyager and all the other entities and players hurt throughout the past tumultuous and disaster-filled year? It’s definitely been a tough year for anyone in the crypto space, one catastrophe after another that could’ve blown out even the carefullest of participants. This week, a glimmer of hopium may have been delivered unto investors from the Federal Reserve. Let’s explore that glimmer and put it into context with what’s happening on the ground in our own crypto native waters.

The language delivered by Federal Reserve Chair Jerome Powell indicates that smaller interest rate hikes are on the way which more or less confirmed what has been speculated for weeks already by the market- that this month would begin to slow the pace of interest rate hikes from 75 basis points to 50 basis points - essentially scaling back hawkish monetary policy. It’s important to remember that The Fed has been consistent in stating their goal of reaching 2% inflation. It’s also crucial to note that the Fed has stressed that monetary policy is likely to stay restrictive for “some time” until we see real progress on inflation. So how does this tie into everything on the crypto side? When we take into consideration all the damage this industry has taken over the past year, it’s reasonable to assume that market participants will need more time to lick their wounds. Plus when you factor in all of the regulation that is bound to come our way due to all the ammunition and cause lawmakers and regulators have received this year, all of it further highlights that trust will take time to be regained. Trust is hard won and easily lost. Both retail and institutional players got burned this year badly. Not the sort of thing you easily brush off.

This therefore is confluent with what the Fed is saying, that there needs to be a further time element before monetary policy is eased and markets can fully begin to turn around. So, this focus on a time element can be viewed both from a macroeconomic level and a crypto native level. It’s promising that interest rates may soon begin to slow down, however there will most likely still need to be months of lower interest rate hikes before we start reaching our target goal of less restrictive monetary policy. With less restrictive monetary policy, comes a return of risk-on sentiment from investors. That’s when people will begin to fully shift bullish again and we’ll see capital and market participants begin to return en masse to the crypto space. Risk-on sentiment will reign and we can enter the next stage of the market cycle - which many believe still holds much promise and potential for crypto. The name of the game until then is to survive. Pay attention, do research and focus on those who are building and active. There are surprisingly many of those types of teams and projects during this bear market.

So let’s cover some bases - what are some bear scenarios to be aware of? One familiar FUD piece would be Tether loans, since stablecoins are an important part of the crypto world and if one of the major ones breaks, that will send Bitcoin and ETH to new lows. We could also not yet have fully digested the extent of the damage from all the blown up players yet, further bankruptcies and insolvencies that will result in forced selling to push prices lower. Then of course there’s the possibility that other large exchanges like Binance or Coinbase could experience their own crises - don’t fall into the trap of thinking anyone or anything is too big to fall - this year should be testament enough that anyone and anything can fail.

So, while it’s always difficult to ascribe a price bottom to a market cycle, we can instead turn our attention to the time based element and on that front, we may have a glimpse of the promised land on the horizon. How long could it take? The Fed says “some time” before inflation is under control - how much of 2023 could that eat into? Could it eat into 2024 as well? All of these options have to be on the table. Many market participants try to put a price bottom on the market and we’ve seen that with calls for things like $10k Bitcoin and sub $800 ETH - could we get there? Sure anything is possible but the point of this thought exploration is to shift your mindset away from a price bottom and instead to a time based bottom. Due to the current macro and micro environment that we find ourselves in, the time based bottom most likely is still not yet here.

Crypto Highlights of the Week

Monday, November 28th - Long Holiday Weekend Recap:

ConsenSys collects IP addresses and wallet addresses

Binance officially launched the Industry Recovery Initiative with a $1B commitment

Crypto Twitter influencers converged on the Bahamas in search of SBF

WBTC/WETH FUD - WETH is a meme gone too far

BlockFi will file for Chapter 11 bankruptcy protection and lay off a large portion of its staff

Fantom blockchain is cash-flow positive, earning more than $10M in annual revenue

Amazon Prime Video working on an 8 episode TV series on SBF and the FTX Saga

1inch new feature to prevent MetaMask users from getting hit by sandwich attack frontrunning

WBTC DAO moved to a new smart contract multisig, replacing signers that are no longer active

Aave temporarily freezes lending for 17 tokens after last week’s massive short left bad debt

Deadmau5’s Pixelynx unveils augmented reality music metaverse NFT scavenger hunt

Tuesday, November 29th

BlockFi sues SBF over Robinhood shares he allegedly pledged as collateral

Silvergate Capital has “minimal” exposure to lender BlockFi - less than $20M

Solana-based crypto wallet Phantom is expanding to Ethereum and Polygon

Binance Proof of Reserves with a 3rd party auditor resulting in large wallet movements

BNB Chain is officially live on OpenSea

Mastercard filed another crypto/web3 trademark application

Fidelity started opening retail crypto trading accounts

Kraken $362,000 settlement with the U.S. Treasury for violating U.S. sanctions against Iran

The Reserve Bank of India to launch a retail CBDC pilot in December

The National Bank of Ukraine draft concept for a CBDC digital hryvnia, or e-hryvnia

Kaiko launches a product tracking market data for Aave, Compound and MakerDAO

MakerDAO is voting to increase the amount of interest it pays on Dai deposits

Compound will enforce loan limits on 10 crypto tokens to adjust the risk parameters

Solana-based DEX Serum now defunct and replaced by a community fork called OpenBook

Sony’s latest invention for the metaverse, a wearable motion-tracking system called Mocopi

Wednesday, November 30th

NFT trading goes live on Uniswap with a $5M airdrop to past users of Genie NFT aggregator

South Korean prosecutors requested arrest warrants for 8 people related to Terraform Labs

BlockFi has $355M frozen on FTX

Genesis creditors organize in bid to forestall bankruptcy

London's High Court ordered six crypto exchanges to disclose client information to trace hack

Kraken intends to cut staff by 30% - amounting to 1,100 people

SBF called to a Feb. 2 hearing to answer claims from a Texas regulator

BlackRock invested $24M in FTX before its collapse

Creators selling NFTs on OpenSea collectively earned $1.1B in royalties this year

FTX Group’s solvent unit LedgerX to allocate $175M for the group’s bankruptcy proceedings

Animoca Brands to debut a fund of up to $2B to invest in metaverse companies

GMX surpassing Uniswap's in daily trading fees for the first time on record

Jack Dorsey's project TBD backed out of plan to trademark “Web5”

Secret Network resolved a security issue

Huobi will form a "strategic partnership" with Poloniex

Thursday, December 1st

The Fed is likely to slow its rate increases. CME's FedWatch tool says 77% of a 50 bp increase

SBF interview at the New York Times' DealBook Summit

Coinbase Wallet says Apple requested 30% of all NFT transfer gas fees

Telegram has sold more than $50M in usernames via Fragment. Plans wallets and DEXs

Russia's Sber bank integrates Metamask into its blockchain platform

Ethereum Ropsten testnet winding down, with a full shutdown sometime between Dec. 15-31

The Graph will soon add support for the Polygon blockchain

Near Foundation loyalty points program for one of Latam’s largest processed food companies

Italy’s proposed 2023 budget plans to extend a 26% levy on capital gains to digital assets

Binance completes the Hooked Protocol subscription launchpad and will open trading

Chainlink Staking v0.1 launching on Ethereum mainnet on December 6th

Blur's second airdrop is arriving December 5th and is 10x bigger than Airdrop 1

MoonPay is rolling out a "soulbound" NFT loyalty program Dubbed the "Web3 Passport"

Timex will make 500 watches for Bored Ape Yacht Club and Mutant Ape Yacht Club holders

Friday, December 2nd

Stripe to integrate its fiat-to-crypto onramp solution with partners: Magic Eden, Audius, Argent

Flipkart, one of India’s leading digital commerce entities partners with Polygon

Co-founders of Three Arrows Capital have one week to provide key financial documents

Crypto fraudster "Coin Signals" to pay $2.8M in restitution to victims + 42 months jail time

Thai VC fund, V Ventures to purchase a 90% stake in Zipmex crypto exchange for $100M

The Japanese subsidiary of FTX came out with a roadmap to resume customer withdrawals

MakerDAO vote concluded: The Dai Savings Rate (DSR) will be increased to 1.00%

Trader Joe DEX is launching on the Ethereum scaling chain Arbitrum

Fantom dApp Gas Monetization Program - proposes slashing token burn rate from 20% to 5%

Introducing the Theta Metachain

Ankr and stablecoin issuer Helio Protocol exploited for $20M

Magic Eden launches Solana NFT tool to enforce creator royalties in a similar move to OpenSea

These are just our top bullets, want more? Check out the rest of our daily newsletter editions:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Data Highlights of the Week

Nansen Smart Money % holdings in stablecoins gives an idea of how risk on or risk off smart money is feeling. We saw a local top on November 9th and since then, smart money has been slowing moving out of stables.

DefiLlama DeFi TVL: $42.5B

Big spike in November DEX volume that resulted from people fleeing centralized exchanges due to FTX concerns

Uniswap capturing the bulk of DEX volume. They just recently launched NFT trading as well

BTC, ETH and DeFi haven’t had the strongest of years with DeFi struggling the most

As for the alt L1s, it’s once again been a tough year but Polygon has ever so slightly been outperforming. Aptos is there because it’s new.

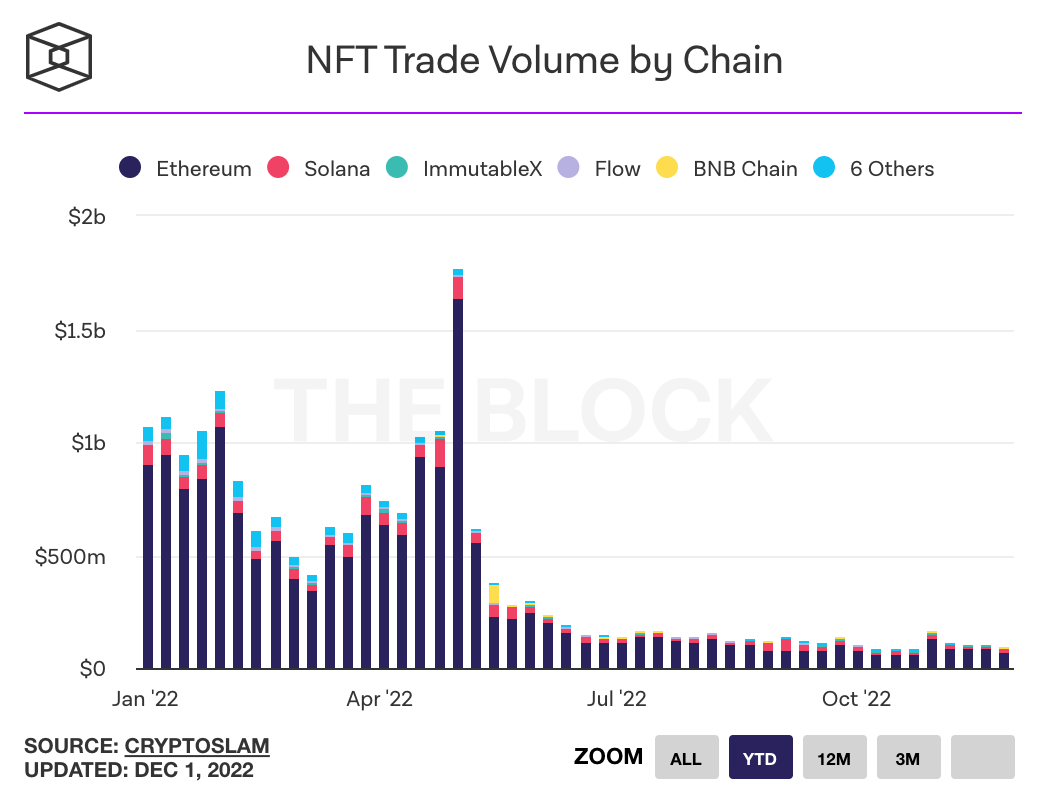

NFT trade volume has been disappointingly low

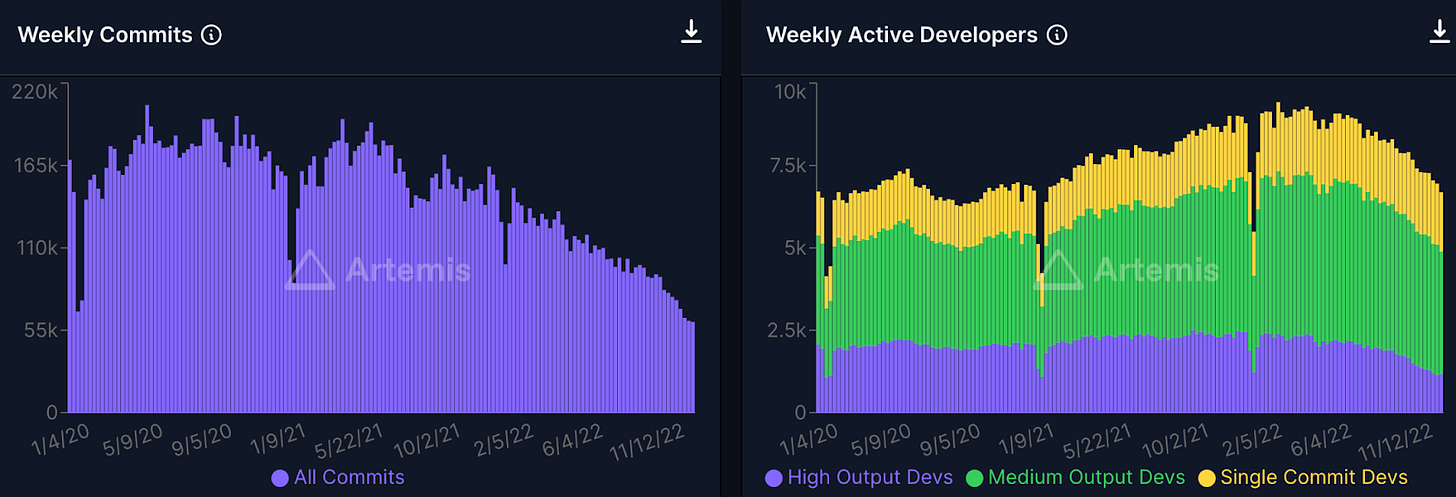

Weekly commits and weekly active developers have been slumping implying less active developers

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.