Weekly Alpha Leak 🚰 Hey, Kid - We’re Calling Them “Digital Collectibles” Now

Week of October 22-28, 2022

Everyone and their grandmother has been talking about Reddit NFTs this week and you know what? There’s something deeper there about the next potential iteration of crypto. Let’s explore - Narratives in Motion.

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Done? Now let's dive in!

TL;DR:

💭Narratives in Motion - Rebranding NFTS, Reddit Digital Collectibles and Web2.5

💊 Top Bullets: Elon Musk Twitter deal, a16z's fund lost 40% in first half of 2022, Pantera down 71%, Meta’s Reality Labs lost $3.7B in Q3, Binance launched native oracle service on BNB Chain, Bitcoin miner Core Scientific may seek bankruptcy protection, Google cloud-based node engine service for ETH devs, Circle partnered with Axelar for USDC cross-chain applications, Metavertu Web3 smartphone, Mastercard partnership with BitOasis for MENA region crypto cards, CashApp adds support for Bitcoin Lightning Network, Visa and Western Union crypto trademarks

📊 Data Highlights: Total Crypto Market Cap just shy of $1B, DeFi TVL ~ $54B, Nansen Smart Money did not follow the recent crypto pump - seems they sold into the pump. Stablecoins on exchanges going down, Green week for Top Protocols by DeFi TVL, Top Blockchains by TVL Spotlight: Algorand TVL near ATH ~ $300M, Optimism TVL near ATH ~ $975B. Arbitrum near lows ~ $1B, Tokemak explosion in revenue, In the past month: Ethereum: down 3% in NFT sales volume, Solana: down 43% in NFT sales volume

🏦 DeFi Highlights: Merit Circle to burn 20% of token supply, NEAR’s stablecoin USN shutting down, MakerDAO to custody $1.6B with Coinbase Prime, MakerDAO to break up into smaller MetaDAOs, BNB Chain $10M gas fee incentive, SushiSwap restructures to be managed by 3 organizations, PancakeSwap deploying on Aptos, Aave stETH earn strategy through Oasis.app, Compound to prevent users from being able to lend illiquid assets, Frax Finance liquid staking Frax Ether

🖼 NFT/Metaverse/Gaming Highlights: Apple to restrict apps from using NFTs to avoid 30% App Store fees, Reddit NFTs surge, X2Y2 blocks NFT aggregator Blur, LooksRare optional NFT creator royalties, Twitter users to buy/sell/display NFTs through tweets, Metaplex new NFT asset class enforces on-chain creator royalties, Azuki $2.5M auction for 8 Golden Skateboard NFTs, Otherside metaverse to launch in 2023, NFTrade integrates with Immutable X, Singapore court rules NFTs are property

💸 Exchange Highlights: FTX could launch its own stablecoin, FTX API keys connected to 3Commas exploited, Binance $500M commitment to Elon/Twitter deal, South Korean city deal with Crypto.com and Gate.io to grow blockchain ecosystem, Bitmex CEO departs, FTX lists Japanese Yen perpetual futures, Blockchain.com may raise money at a significant discount, Huobi to to delist HUSD and convert to USDT

👨⚖️ Economic/Government/Regulatory Highlights: 63% of ETH block transactions compliant with OFAC sanctions, Judge denied a motion to dismiss the wire fraud charges against former OpenSea employee, Bithumb owner faces 8 years in prison on charges of $70M fraud, UK's next prime minister is crypto friendly, Tel Aviv Stock Exchange blockchain-based digital asset trading platform, Singapore proposed restricting leveraged crypto trading, Hong Kong plans to allow retail investors to trade crypto, Hong Kong/Japan/UAE/Turkey CBDC developments

⛓ Crypto Highlights of the Week ⛓

Narratives in Motion - Rebranding NFTS, Reddit Digital Collectibles and Web2.5

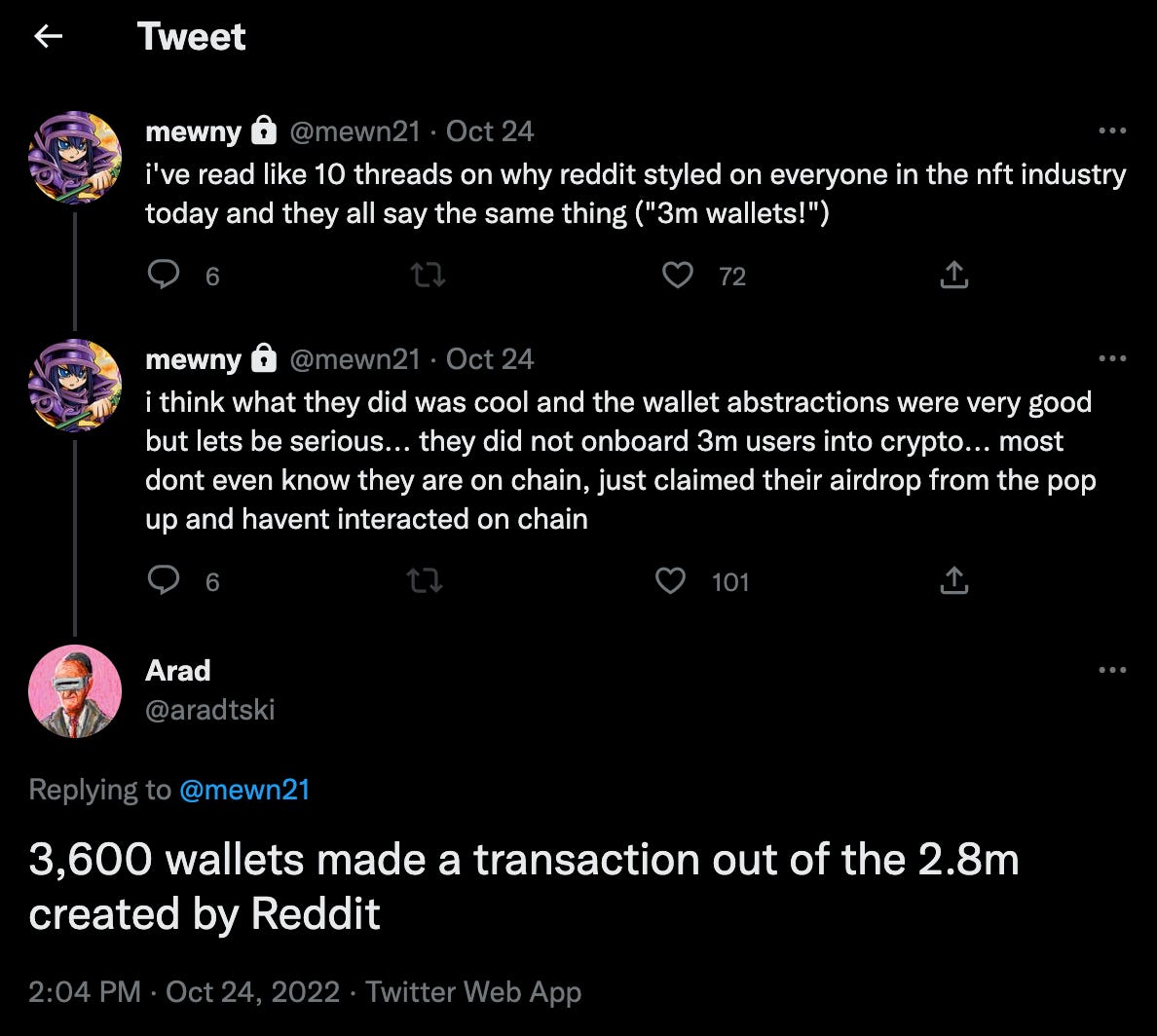

Reddit NFTs received a lot of attention this week, spawning a flurry of threads, memes, shitposts and articles about their success with everyone primarily focusing on the “3 million” wallets figure. It’s important to note that only a very tiny fraction (~3600) of those wallets made a secondary transaction but that’s not the point here. We’re looking at something broader and overreaching for all of crypto. Out of all the potential sectors in crypto - the gaming, NFT and metaverse sector stands out as being one of the most brimming with potential. As of April 2022, there were more than 5 billion internet users worldwide, which is 63.1% of the global population, and the goal is to one day onboard them to blockchain, innit? Everyone constantly mentions onboarding billions of new users in their theses of why crypto will one day revolutionize the world - but how exactly is that supposed to happen, because we haven’t seen anything close to this - yet.

Crypto in its current form is built on speculation, narratives, stories, marketing, and hype. People are sold an idea and buy into the story of what crypto may one day be. In actuality, the masses have not rushed in in any meaningful or sustainable way to signal that crypto adoption has taken place - not that efforts haven’t been made. While many grassroots communities have sprung up, we’re looking at the attempts by big and established companies to onboard new users. After all, they have the money, resources and manpower required to get things done. We’ve seen plenty of attempts but most of them have been duds so far. Coinbase, one of the largest and most recognizable crypto exchanges in the world, spent a ton of money building an NFT marketplace and it has so far flopped - seeing only 15k total lifetime users. The recently introduced GameStop NFT marketplace has barely seen 23.6k traders since its creation. That’s disappointingly low since OpenSea can currently see that many traders in a single day during the deep of a bear market. GameStop was once a behemoth of entertainment and gaming and there was hope that its newfound meme resurgence from the Wall Street Bets/ hedge fund short squeeze incident might be able to catapult the once giant into the world of crypto and web3. Unfortunately that hasn’t happened yet. The numbers haven’t been impressive. If the goal is to make money and invest in things that stand the most potential of going up in price, then it makes logical sense to look for instances of success.

Instances of what might be considered actual adoption or at the very least usage can help define investment theses. We want to see more than spinning fancy stories and promises of what crypto may one day be. In order to do that, it may take adjusting the angle, or approach in which people are first introduced to crypto. Yes, this may require some rebranding. A meme that circulated this week was how Reddit is rebranding NFTs to “digital collectibles” and while it made for some funny shitposts, there are some very interesting layers underneath that seemingly innocuous statement. “Non-fungible token” is such a mouthful and can be a turnoff for normies. It’s currently very sticky and cumbersome to introduce someone to the concept of fungibility, decentralization, blockchain, bridging and all the complicated parts of working on-chain, but a collectible that you own that’s digital? That’s easy and natural to understand. You have a digital wallet of some type and in it you can store all your favorite digital collectibles, many of which incentivize you by being able to use them in new and interesting ways (interoperability and utility). Users value simplicity and convenience - the easier we make things to use, the better. Now there have already been previous attempts at rebranding to something more catchphrasey such as “nifty” - a phonetic play on the word NFT, but that doesn’t feel like it’ll work quite as well.

Reddit attempting to rebrand NFTs as “digital collectibles” does stand out as an interesting vertical through which normies could get onboarded into crypto. It’ll take these types of little slick innovations to the game to attract the next generation of users. Is anything really changing for the user at the end of the day? They’d still be using blockchain based technology, you would simply obfuscate the complicated and undesirable parts of blockchain away from them and replace it with a clean and efficient user experience. This also isn’t about Reddit specifically, it’s much more broad - it’s about large brands and companies with established user bases. It’ll be easier to onboard them than create something new out of thin air. This also means that a high potential avenue will be for users to not even realize they’re interacting with crypto - just make it work and make it work well. No one cares how their iPhone works, they just care that it does work and makes their lives easier and convenient. So therefore, one of the best routes to look at for onboarding the next generation of users is a Web2.5 approach as it blends a bit of the old world with the new. Web3 is uncharted and unexplored territory - but Web2 has decades of experience under its belt. There’s a role to be played by this “bridge” from the old to the new. Established entities like Reddit, Disney, Gamestop, social media companies, sports teams, gaming, musical artists, shows, entertainment, etc - all of these have established brands and communities ready to be converted, and the question is how to convert them.

Narratives organically shift over time and strategic rebranding could definitely help towards that end goal of bringing in that next generation. Take a look at something like Bitcoin which has changed its own narrative during its relatively short existence - went from being digital money to a store of value and hedge against inflation, and so on. Narratives are constantly in motion. So what else will it take to onboard the Marvel, Disney, Star Wars, Pokémon, sports, music and video game fans into one day actively engaging with “digital collectibles” and crypto? Rebranding and shifting away from all the complexities of crypto for the end user as well as shifting to more sustainable models such as from play-to-earn to play-and-earn as well as play-to-own are decent first steps. While we’re at it, DeFi could stand to benefit from these types of rebranding as well - things can get pretty convoluted over there. Keep it simple, stupid.

Now, let’s tie everything together into the important part. The part where we make money. First we keep our eyes open to how certain products are received by users (Reddit), observe metrics and data for signs of success or failure, and then we can pay attention to what everything is being built on. That’s right, we’re talking about the classic approach of attempting to sell the picks and shovels to all the miners rushing to strike it rich during a goldrush. Which blockchains, infrastructure, tools, and related protocols will they be using to power their platforms? That’s where opportunity is. Reddit is taking a promising step in the right direction. Let’s keep paying attention to see if this and other attempts by large companies to mix the world of Web2 and Web3 are able to bear fruit.

💊This Week’s Top Daily Bullets 💊

a16z's largest crypto fund loses 40% value in first half of 2022. Pantera Capital's early-stage token fund is down 71% this year but has still returned 372% to investors since 2017

Meta’s Reality Labs business, the division in charge of producing metaverse-related technology, lost $3.7B during the third quarter. Follows losses of $2.9B and $2.8B in the first and second quarter

Binance launched its native oracle service to enable smart contracts to run on real-world inputs and outputs, starting with the BNB Chain ecosystem

Core Scientific Inc., one of the world’s largest miners of Bitcoin, warned that it may run out of cash by the end of the year and could seek relief through bankruptcy protection

Google is launching a cloud-based node engine service for Ethereum developers and projects

Circle partnered with Axelar focused on the use of USDC and cross-chain applications. Avalanche, Cosmos, Ethereum, Polygon, and Sui will be the first chains integrated with Axelar's General Message Passing (GMP)

Smartphone manufacturer Vertu revealed its latest device, Metavertu - a Web3 phone that can run its own blockchain node and turn photos and videos into NFTs with a single click

Mastercard signed a partnership with BitOasis to offer cryptocurrency-linked cards for customers in the MENA region

CashApp adds support for Bitcoin Lightning Network with a limit of $999 every seven days for BTC transactions on the Lightning Network

Western Union may be preparing to offer crypto-related services, based on trademark applications recently filed hinting at an asset and commodities exchange, insurance, and token. Visa filed 2 trademark applications claiming plans for: Managing Digital, Virtual, and Cryptocurrency transactions; Digital currency + Cryptocurrency wallets; NFTs + Virtual goods; Providing virtual environments and more

These are just our top bullets, want more? Check out our daily newsletter:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

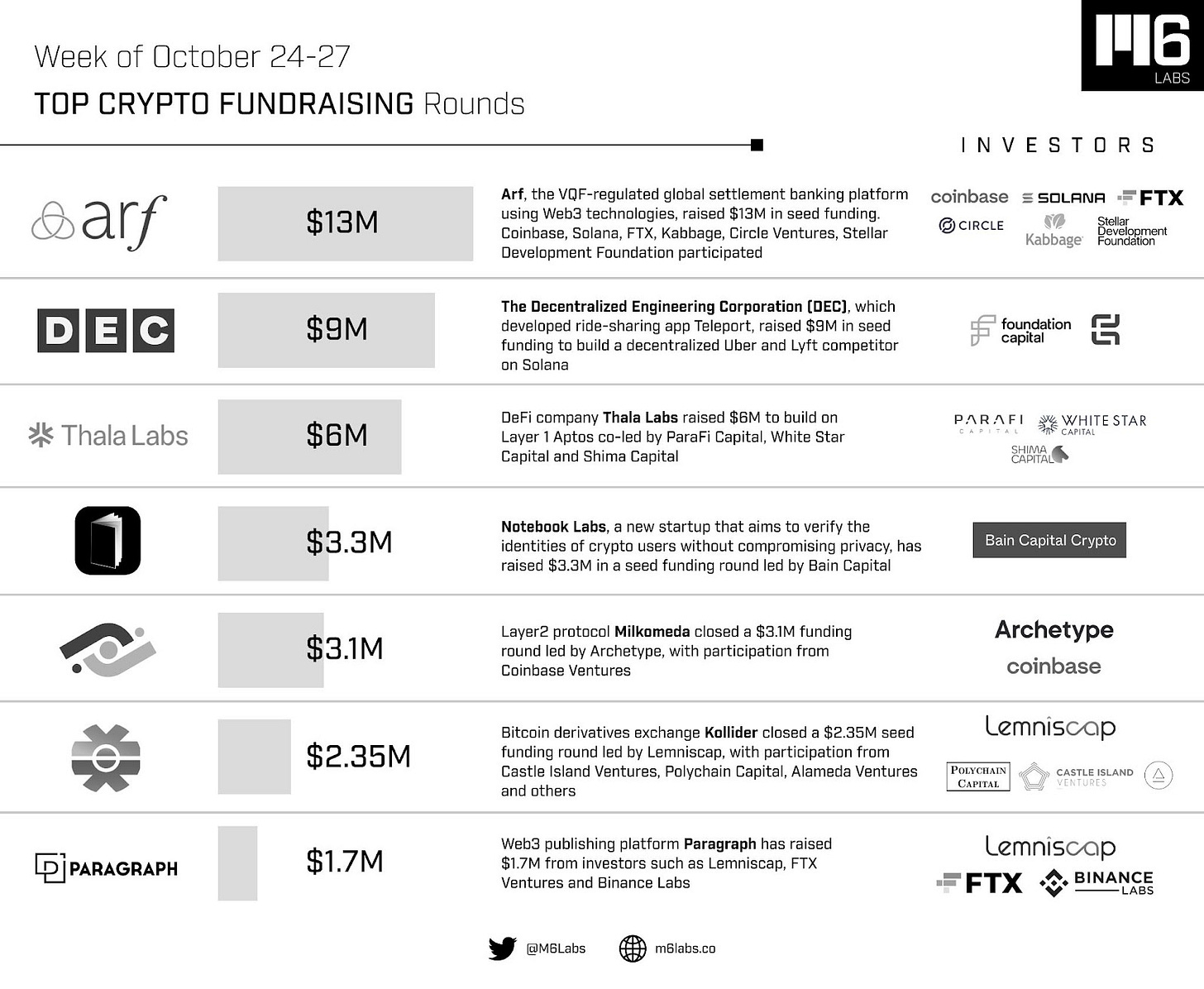

💰 Fundraising Highlights of the Week 💰

📊 Crypto Market Data Highlights of the Week 📊

Total Crypto Market Cap just shy of $1B

DeFi TVL ~ $54B

Nansen Smart Money did not follow the recent crypto pump. Seems they sold into the pump. Stablecoins on exchanges going down

Green week for Top Protocols by DeFi TVL

Top Blockchains TVL Spotlight: Algorand TVL near ATH ~ $300M

Optimism TVL near ATH ~ $975B. Arbitrum near lows ~ $1B. Similar TVLs but different paths

Tokemak explosion in revenue ~ up 36000%

In the past month: Ethereum: down 3% in NFT sales volume, Solana: down 43% in NFT sales volume

Nansen Smart Money Token Inflow and Outflows:

Largest Smart Money Inflows this week: Despite the recent crypto pump this week, Smart Money did not meaningfully move into either Bitcoin or ETH. Biggest inflow this week was into stETH, Aave USDC and FTM and only sparse amounts

Largest Smart Money Outflows this week: What we saw instead was a move out of stables, WETH and WBTC. The move out of stables is interesting because that didn’t flow into other tokens and it seems that smart money sold WETH and WBTC into the most recent pump

Largest Smart Money Inflows this month: Monthly inflows are fairly light - mainly into DAI and stETH and other odd coins. Nothing definitive

Largest Smart Money Outflows this month: Outflows again outweigh inflows and are leaving stables, ETH and WBTC. Where are the stables flowing? Smart Money not yet jumping back into the market

Stablecoins on Exchanges:

The amount of stablecoins on exchanges has been going down. You want to see this increasing if sustained buying were to be occurring.

Meanwhile the ETH on exchanges has sort of just stalled after dropping from that post-Merge spike.

Nansen Hot NFT Contracts:

Highest Volume NFT collections of the past week: LUSDBondNFT came out as the clear winner with over 9500ETH while other top collection volumes remain very low

🏦 DeFi Highlights of the Week 🏦

P2E gaming DAO Merit Circle has voted to burn nearly $170M worth of its native MC tokens with 99.7% voting in favor. 200M of Merit Circle's total supply of 1B tokens will be taken out of circulation

NEAR Protocol’s stablecoin, USN, is being shut down after it began to exhibit risky characteristics similar to those observed with TerraUSD. The Near Foundation opened up a $40M fund to protect investors and help them cash out of USN with equal amounts of wrapped Tether (USDT.e)

MakerDAO community approves proposal to place up to $1.6B in Coinbase's custody platform, Coinbase Prime, where it will earn a 1.5% reward

Community members of MakerDAO voted to move forward with founder Rune Christensen’s plan to overhaul how the protocol works and make it more decentralized by breaking up into smaller, allegedly more decentralized units called MetaDAOs

BNB Chain launches $10M gas fee incentive to support growth of web3 dapps

SushiSwap approves restructuring - the development of the DAO will be managed by three organizations, which would be based in Panama and the Cayman Islands

PancakeSwap and the CAKE token will be deploying on Aptos

Aave has launched a Lido Staked Ethereum, or stETH, earn strategy through Oasis.app

Compound Finance has approved “proposal-131,” which will prevent users from being able to lend relatively illiquid assets on the protocol - 4 protocols: 0x (ZRX), Basic Attention Token (BAT), Maker (MKR), and Yearn Finance (YFI)

Stablecoin issuer Frax Finance has entered the ether liquid staking war with a unique two-token model called Frax Ether

🖼 NFT/Metaverse/Gaming Highlights of the Week 🖼

Apple updated its App Store policy to restrict apps from using NFTs to incentivize users to purchase items or features to avoid 30% App Store fees. NFTs are allowed to exist within apps on the App Store but they can’t unlock additional features or content

Reddit NFTs - Polygon-based avatars trading volume hits all-time high - last week that over 3 million Polygon wallets created by users to collect the NFTs

NFT marketplace X2Y2 blocked NFT aggregator Blur for violating their Terms (by applying for 10+ keys to access their API). X2Y2 replied that when a marketplace has its own aggregator it creates a conflict of interest

LooksRare becomes latest NFT marketplace to switch to optional royalties for NFT creators, however will allocate 0.5% of trading fees to creators

Social media platform Twitter will let users buy, sell, and display NFTs directly through tweets with an integration called NFT Tweet Tiles in partnership with four marketplaces - Magic Eden, Rarible, Dapper Labs, and Jump.trade

Solana NFT standard maker Metaplex plans to launch a new NFT asset class that can enforce on-chain creator royalties

Azuki completed a $2.5M auction for eight Golden Skateboard NFTs which will be redeemable for physical golden skateboards setting record for eight most expensive skateboards ever sold

Otherside metaverse The Persistent World is expected to launch in 2023, and players will be able to access the beta game starting next year, similar to Web3 Roblox

NFTrade integrates with gaming-focused ETH Layer 2 Immutable X

The Singapore High Court has ruled that NFTs can be considered a form of property - the first injunction issued in Asia to protect an NFT

💸 Exchange Highlights of the Week 💸

FTX could launch its own stablecoin, CEO SBF said in an interview but would prefer launching a stablecoin via partnerships

FTX API keys connected to 3Commas confirmed to have been exploited. FTX will provide $6M in compensation to victims this one time but not setting a precedent if victims continue falling for phishing scams

Binance backed Elon Musk’s $44B acquisition with a $500M commitment to take a share of equity. Musk fired Twitter's current CEO, CFO and legal chief

South Korean city Busan has signed a business agreement with two international cryptocurrency exchanges, Crypto.com and Gate.io, to grow its blockchain ecosystem

Alexander Höptner is departing from his role as CEO of crypto exchange Bitmex. Stephan Lutz has been appointed as Interim CEO

FTX will list Japanese Yen (JPY) perpetual futures

Blockchain.com may raise money at a significant discount to previous valuation. Valued at $14B in a funding round earlier this year, but may only fetch $3B to $4B

Huobi Global to delist stablecoin HUSD and convert HUSD assets to USDT assets

👨⚖️ Government, Regulatory and Legal Highlights of the Week 👨⚖️

63% of all transaction blocks on the Ethereum blockchain are compliant with OFAC sanctions

A judge has denied a motion to dismiss the wire fraud charges against former OpenSea employee Nathaniel Chastain

South Korean prosecutors are asking the court to sentence Lee Jung-hoon, the owner of South Korean crypto exchange Bithumb, to eight years in prison on charges of fraud worth about $70M

Rishi Sunak's coronation as the UK's next prime minister could mean that plans to make the country friendlier to crypto could be possible

The Tel Aviv Stock Exchange (TASE), Israel's sole public trading platform for equity and debt, is looking to set up a blockchain-based digital asset trading platform

Singapore’s financial watchdog has proposed restrictions on the use of credit or leverage when trading cryptocurrencies

Hong Kong's government plans to allow retail investors to trade crypto on locally licensed exchanges as part of a wider effort to position the city as a center for virtual asset service providers

Hong Kong unveils completed retail CBDC project that has a CBDC-backed stablecoin

Japan Credit Bureau (JCB), a Japanese analog to international payments systems like Visa or Mastercard, announced the start of its central bank digital currency (CBDC) infrastructure testing

The Central Bank of the United Arab Emirates has completed the world's largest pilot of central bank digital currencies (CBDC) transactions, with other regulators including the People's Bank of China's Digital Currency Institute

Turkey to launch a central bank digital currency (CBDC) next year. The responsible institution is Turkey’s central bank, with the cooperation of the local Ministry of Finance and Scientific and Technological Research Institution

💩Scammy Shit 💩

$3.5M total has been stolen by phishing scammer known as Monkey Drainer according to ZachXBT

Crypto investment platform Freeway announced a halt to services amid market volatility. Freeway claims to offer up to 43% annual rewards on "Superchargers" denominated in crypto and fiat currencies. Team list has been deleted from website and allegations of a rugpull exceeding $100M. Claims it will “take time” before the firm will resume partial or full trading

Two Solana-based DeFi protocols, Tulip and UXD, have reopened after recovering tokens from Mango Markets following the $114M hack

Team Finance, a crypto token launchpad, suffered a $14.5M exploit in relation to a smart contract bug in its migration feature

Multi-chain crypto wallet UvToken hacked for 5,011 BNB tokens ($1.45M) and moved to Tornado Cash

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.