Weekly Alpha Leak 🚰 Le Merde - We’re in the Endgame Now!

Week of August 27 - September 2, 2022

After what feels like a lifetime, we’re finally entering the endgame for the long anticipated Merge! The first upgrade part which will begin on September 6 - in the background several developments are setting the stage for post-Merge narratives. Are you ready?

TL;DR:

Ethereum Merge part 1 - Bellatrix upgrade begins Sept. 6

Avalanche Dramarama, Mt. Gox misinformation, DigiDaigaku/airdrop/free-to-own hype

Top Daily Bullets: Ticketmaster adopting Flow blockchain, Arbitrum One upgraded to Nitro, African Sango Coin unconstitutional, Nexo $50M token buyback, Smooth Love Potion mystery solved, Moonbeam integrates LayerZero, Aptos: Incentivized Testnet, OpenSea adds Polygon support, Helium devs proposed migrating to Solana

Scammy Shit: Michael Saylor tax fraud, Solana brothers who inflated TVL no longer with firm, Crypto mining malware mines Monero, Turkish crypto exchange founder arrested, Crypto.com accidentally transfers $10.5M, executive of Thai exchange insider trading

Data Highlights: On the weekly, money is still flowing into ETH and BTC primarily while it’s flowing out of USDT, LDO, DAI, AAVE and COMP. On the monthly, the clear inflow is into ETH and other ETH derivatives while it’s mostly flowing out of stables USDC and DAI

DeFi Highlights: Curve’s new native stablecoin crvUSD, dYdX backlash for biometric checks, BNB Chain liquid staking, SushiSwap reduces proposed salary for 'Head Chef', Compound Finance coding error temporarily locks funds, 1inch 300,000 OP token airdrop, Bybit partnered with stablecoin issuer Circle, Ethermine new ETH staking service

NFTs/Metaverse Highlights: OpenSea trading volume 99% from May, Sudoswap announced governance token SUDO airdrop for XMON token holders, Meta brings NFTs and other digital collectibles to Facebook, Veve partners with Marvel, R3al Metaverse web series based on avatars from popular NFT projects, Swiss crypto bank opens hub in Decentraland, Luxury brand Hermès NFT trademarks, get married in Decentraland ft. Taco Bell

Before we get started...Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox.

Done? Now let's dive in!

⛓ Crypto Highlights of the Week ⛓

Le Merde

So, let’s obviously start with the most direct, in your face, elephant in the room story currently going on in Crypto, and that is obviously the Ethereum Merge. We did it… it’s finally almost here… It’s been a long road but this highly anticipated event is finally upon us. We’re in the endgame now. If you need a reprimer on the timeline, it’ll look something like this:

- First – the Bellatrix Hard Fork - September 6th

- Second – reaching Total Terminal Difficulty (TTD)

- Third – the Paris Hard Fork ~ will aim for September 15

- Finally – the Difficulty Bomb

Some interesting points to keep in mind, the Ethereum miner balance has reached a four-year high just weeks before the Merge, which could potentially mean hoarding more ETH in anticipation of price surges and forked PoW tokens. It’s clear that one way or another, market participants have been and are still positioning themselves for the next big move. Recall that post-Merge will result in two different chains - the current deprecated PoW chain and the new PoS chain. Most serious entities will only support PoS ETH and only speculators and traders will attempt to extract value from the PoW work fork.

Finally, even though it’s already been talked about to death, it’s crucial to keep in mind the bigger picture. It’s important to seriously consider that the Merge might be bearish and a sell the news event. Let’s not forget that the macroeconomic environment is still tense, inflation is still out of control and the recent hawkish Jackson Hole conference indicated that the Fed is buckling down with raising interest rates to reach that 2% inflation target. Risk assets are not yet ready to shift on. We’ll need more time and the Merge might not be able to overcome all this heaviness.

Avalanche Dramarama

There is literally never a shortage of shady and dodgy shit in the Crypto space. At the beginning of the week, we saw a drama storm swirl around Avalanche after a self-described "whistleblower" website accused Ava Labs of paying lawyers to hurt competitors via lawsuits and keep regulators at bay and away from Avalanche. It was a pretty bad look complete with undercover footage of Attorney Kyle Roche apparently admitting to shady business practices.

Ava Labs rejected the accusation as "conspiracy theory nonsense" and the whistleblower himself replied calling it unsourced false statements and illegally obtained, highly edited video clips that are not presented with accurate context. Ava Labs founder, Emin Gün Sirer, also released a statement refuting the crypto leaks “lies”. Kyle Roche ended up withdrawing from several class action suits including Tether, Bitfinex, TRON and BitMEX in the wake of this recent scandal. Tether later requested the entire firm remove themselves due to possible implications.

The entire story feels like it has holes in it and it’s one big “he said, she said” and so for now we just wait to see if more details eventually come to light. And if you’re wondering if this little dramarama affected the price of AVAX, well when you zoom out, it doesn’t look that bad in comparison to the mountain slope journey it’s already taken this year along with several other alts.

Mt. Gox Misinfo

It’s truly fascinating how FUD and misinformation can circulate in this space. This week it started with some prominent crypto twitter accounts circulating incorrect information regarding MtGox repayments hitting the market. The repayment system isn’t live yet and as it currently stands, you can’t even register where (which exchange) you want your BTC & BCH sent yet.

Mt. Gox trustee did release a repayment procedures update after all the messy news and stated creditors have until September 15 to submit claims regarding funds lost but a timeline of repayments has not been finalized yet. We’ll be keeping an eye out to let you know about this when it finally does happen.

DigiDaigaku and Free-to-Own

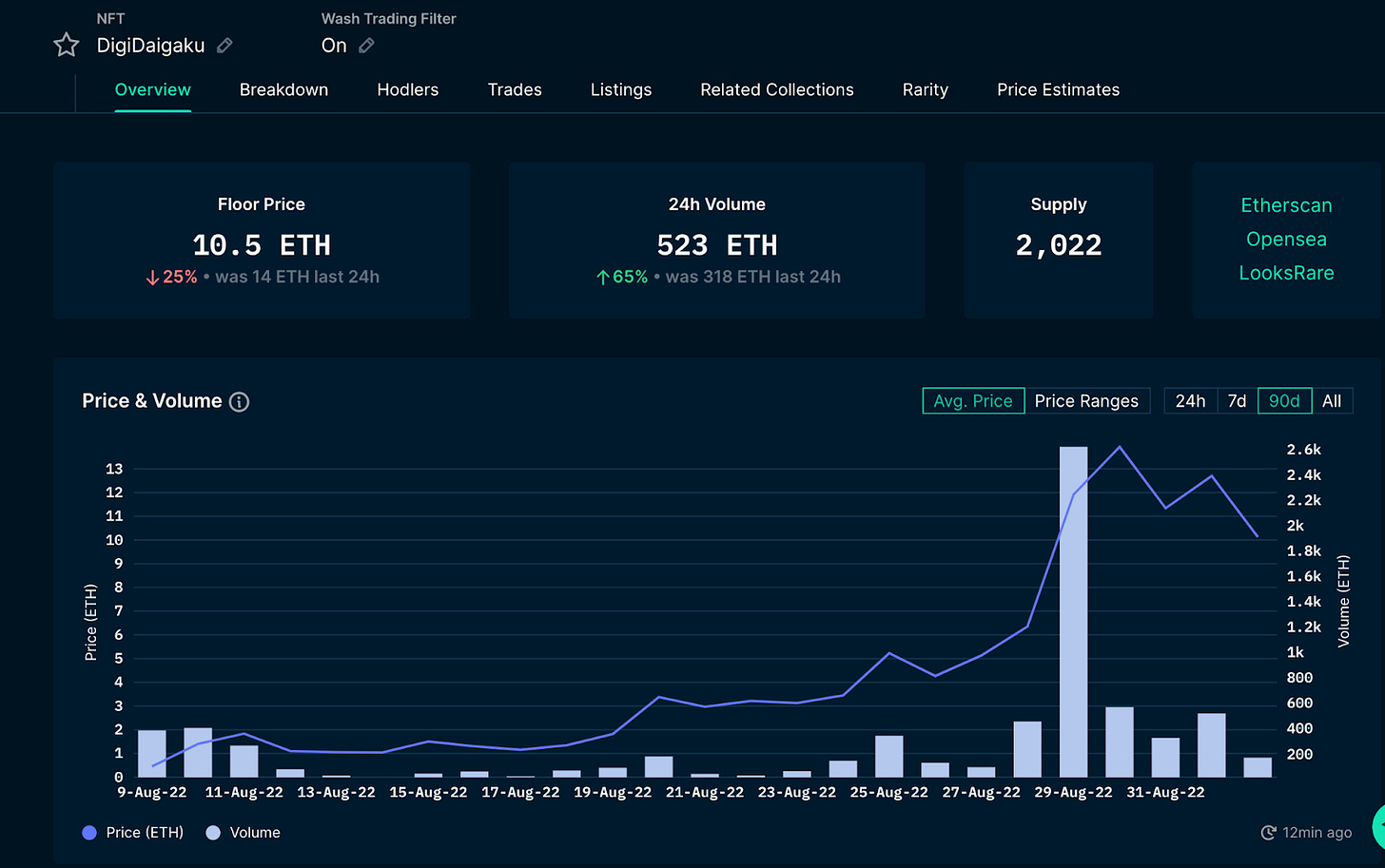

You might have noticed that the NFT project DigiDaigaku has been blowing up, running from roughly 1ETH floor up to 14 ETH recently with an anticipated airdrop coming on Friday, September 2 for DigiDaigaku holders. Some interesting points contributing to the buzz include, Limit Break, the company behind Digis announcing a $200M raise from Paradigm and other prominent VCs as well as the hype around this new “Free-to-Own” mechanism.

It works like this: the initial community receives NFTs for free and then those NFTs generate new NFTs (for gameplay, cosmetics). It is being predominantly pushed by Gabe Leydon, who was a pioneer of free-to-play mobile games at Machine Zone, which was sold for $300 million in 2020 to AppLovin. You can read more about him and why people are so interested here. Like everything in this space, people have been quick to criticize the free-to-own model.

This Week’s Top Daily Bullets 💊

Despite the fact that all the main attention is currently on the Ethereum Merge and most other things are currently taking a backseat, you know - bear market things - there are still plenty of interesting developments going on that will become important down the line. We’re making sure to keep up to date with them for the inevitable time when the rotations start up again.

Event ticketing behemoth Ticketmaster will adopt the Flow blockchain from Dapper Labs for minting tickets as NFTs for select events. In a pilot program, five million Ticketmaster NFTs were minted in six months. Despite abysmal performance for the native token, this is just the latest interesting development that we’ve seen coming from Flow. Worth keeping an eye on

Arbitrum One upgraded to Nitro, a major upgrade to Arbitrum, improving over "classic" Arbitrum in several ways. Depending on the market conditions, many are speculating that Arbitrum is due for a reason of its own when its eventual token drops.

Remember Sango Coin? Well the Central African Republic's Constitutional Court ruled that the purchase of citizenship, "e-residency" and land using the cryptocurrency, Sango Coin, the government launched last month was unconstitutional. Ruh roh.

Cryptocurrency lending platform Nexo has allocated an additional $50M to its token buyback initiative. Nexo managed to avoid the troubles experienced by rivals due to the grueling market downturn this year

For nearly a year now, a mysterious Axie Infinity whale has been quietly amassing billions of Smooth Love Potion, and now holds a little over 22 billion SLP — more than 50% of the total circulating supply. Originally, no one knew who it belonged to but the mystery was solved this week, with the wallet having been identified as an address belonging to Binance

Polkadot Parachain Moonbeam integrates cross-chain messaging protocol LayerZero

Aptos: Incentivized Testnet 3 - August 30 to September 9 is the last incentivized testnet before mainnet launch. This Alt L1 has been gaining a lot of chatter lately and for better or worse - we’ll be seeing more of Aptos in the months to come

OpenSea adds Polygon support to its Seaport protocol implementation to expand features and is will be accepting MATIC - another win the Polygon business development team which has been killing it with partnerships all bear market long

The core developers at Helium have proposed to migrate the project to Solana in a move that aims to achieve additional scalability. This is a bit of a sticky issue when your core devs are interested in abandoning your own chain..

These are just our top bullets, want more? Check out our daily newsletter:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Scammy Sh*t 💩

District of Columbia suing MicroStrategy founder Michael Saylor for tax fraud. D.C. alleges Saylor, MicroStrategy evaded over $25M in taxes

Ian and Dylan Macalinao, who used a web of secret identities to inflate the TVL of a Solana DeFi project, are “no longer affiliated with” Protagonist VC, said the firm they started

Crypto mining malware has been sneakily invading hundreds of thousands of computers around the world since 2019 forcing them to unknowingly mine Monero, often masquerading as legitimate programs such as Google Translate

Albanian authorities have Turkish crypto exchange founder, Faruk Fatih Özer, in custody, waiting for questioning and cooperation with the Turkish government

PSA - Chromium Based Browsers like Chrome, Brave, Edge allow websites to MODIFY clipboard WITHOUT the user's permission

Crypto.com accidentally transfers $10.5M to a woman instead of $100 who then bought a house. Now she’s being sued, must sell house and return the money

An executive of Thai cryptocurrency exchange group Bitkub has been fined $235K for insider trading related to a failed acquisition by the country's oldest bank

📊 Crypto Market Data Highlights of the Week 📊

Nansen Smart Money Token Inflow and Outflows:

TL;DR: On the weekly, money is still flowing into ETH and BTC primarily while it’s flowing out of USDT, LDO, DAI, AAVE and COMP. On the Monthly, the clear inflow is into ETH and other ETH derivatives while it’s mostly flowing out of stables USDC and DAI

Largest Smart Money Inflows this week:

Largest Smart Money Outflows this week:

Largest Smart Money Inflows this month:

Largest Smart Money Outflows this month:

This shows how much “smart money” is stabled up. The lower the number, the more risk on people are feeling. You can see we peaked on June 18th and have been falling since with a recent spike upwards. For reference, smart money was 4-5% stabled up back during November

🏦 DeFi Highlights of the Week 🏦

DeFi has had a rough year - along with most every other crypto asset - having fallen hard since November. That doesn’t mean that the sector isn’t busy with developments. So let’s take a gander and what’s new so we can be ready when the time is right to make moves:

The Stablecoin Wars are getting a new combatant. Curve founder Michael Egorov has said that Curve’s native stablecoin crvUSD is likely to be launched next month and is currently in the alpha stage - so many stablecoins at this point!

dYdX is just having the hardest time lately and it is on the defensive - defending the fact that they’re currently blocking less than 0.1% of the wallets connected to the exchange after Tornado Cash sanctions and they also raised hell this week regarding their “liveness checks” which scans your image using your webcam and compares if your image has been used with another account on dYdX - this is very not decentralized of them. All of this was done for a $25 promo offer which they’ve seen rescinded

BNB Chain has introduced liquid staking with three leading Web3 protocols: Ankr, Stader and pStake - who doesn’t like maximizing capital efficiency?

SushiSwap reduces proposed salary for its 'Head Chef' role after community pushback. This has been a contentious issue recently with many unhappy about the excessive compensation packages. It raises a larger issue of incentives and retaining the proper talent in the crypto space

Compound Finance executed a governance proposal updating its Chainlink price feeds that contained a code error, freezing the cETH borrowing and lending markets for 7 days - whoops!

1inch announces 300,000 OP token airdrop for users who made swaps via the 1inch wallet on Optimism - sounds nice for 1inch users - people tend to love their airdrops but won’t people just dump the token?

Crypto derivatives exchange Bybit has partnered with stablecoin issuer Circle Internet Financial to expand its suite of spot trading pairs denominated in USDC - The war for stablecoin supremacy rages with USDC gaining ground on current leader USDT

Largest Ether mining pool Ethermine opens new ETH staking service, offering 4.43% interest and as little as 0.1 ETH ($159) required to enter - making it easier for the plebs to get in

🖼 NFT and Metaverse Highlights of the Week 🖼

Oh the metaverse, everyone’s favorite or least favorite buzzword. Like it or not - the Metaverse is gaining traction so let’s see what new interesting developments this week had for us:

Highest Volume NFT collections of the past week: No surprise to see DigiDaigaku leading the NFT market this week. Running hot off the back of that $200M raise and airdrop

Let’s start with the less than great news - the NFT trading volume of OpenSea has shown a decrease of almost 99% from its record high of $405M on May 1 to $5M on Aug. 28 - bear markets really hit different, don’t they?

Sudoswap announced the launch of a native governance token, SUDO, with the majority earmarked for XMON token holders - 41.9% via a lockdrop event

Meta now lets you post NFTs and other digital collectibles to Facebook, while it previously only allowed users to post their digital collectibles on Instagram. Even if you don’t like Meta - they have over 2.9 billion users

The digital collectibles company Veve partners with Marvel to drop limited edition NFT covers featuring Spider-Man, Black Panther. Veve has also previously collaborated with Marvel’s competitor DC Comics and the entertainment giant Walt Disney - interdasting

The R3al Metaverse is a new web series starring characters based on avatars from popular NFT projects, including the Bored Ape Yacht Club, Cool Cats, Doodles, World of Women or Robotos. We’re seeing original works popping up around the silly jpegs - it’ll be interesting to see how this plays out

Swiss crypto bank and asset manager Sygnum will open a hub in Decentraland complete with a CryptoPunk receptionist, NFT gallery and event space. It’s silly when you think about it, isn’t it? Imagine one day checking in with a CryptoPunk receptionist and it's considered normal..

Luxury brand Hermès is laying the groundwork for its entrance to Web3 after filing a trademark application covering NFTs, cryptocurrencies and the Metaverse. Just another one of the countless big brands filing patents and trademarks to carve out their piece of the pie. Literally everyone wants to try and capitalize on the hype

Taco Bell and metaverse platform Decentraland are teaming up to offer United States-based couples a chance to get married in the Metaverse. Married in the metaverse at Taco Bell - every girl’s dream, amirite?

NFT project Art Blocks launches engine for generative asset creation - The intersection of art and artificial intelligence will be an interesting sector to keep an eye on

a16z wants to standardize NFTs by giving you a license for your token to fix NFT copyright confusion through new “Can’t Be Evil” licenses that make it explicit what an NFT holder can and can't do with their NFT

The crypto space is a wild and fast paced, evolving landscape - however one filled with recurring themes and trends. The point of this newsletter is to highlight the story of crypto - as it's told over time. The board, the players, and the game itself. Follow along as we catalog and organize the chaos.

Subscribe to receive our daily brief and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!