Weekly Alpha Leak - Market Pulse and Narratives

Genesis Bankruptcy, CT Fallen Heroes, Optimism Surpasses Arbitrum, Solana NFT Volume Goes Bananas

January 14-20, 2023

QCP Capital recently wrote about the game of chicken currently being played by the Fed and the market. We analyze their commentary on the state of the market and do a checkup on recent hot narratives.

How’s that “echo bubble” of ours doing? Where will we go from here?

DCG on the way down? Will 3AC co-founders get their redemption arc? What’s causing Optimism to overtake Arbitrum? Did you notice Solana’s price has doubled off the bottom and its NFT volume is blowing up?

In this issue:

Market Pulse - Commentary on QCP’s Commentary

Narratives Checkup

CT Disgraced Fallen Heroes - Redemption Arcs?

L2s: Optimism surpasses Arbitrum

Solana NFT Volume Going Bananas

Market Pulse - Commentary on QCP’s Commentary

Bitcoin and ETH are both up over 25% in the past 30 days. Are we experiencing an echo bubble, bear market rally or the real thing? To get insight we look to the broader macro. QCP Capital, a Singapore-based crypto options trading firm, offers solid crypto market insight and in their most recent article, they explore the current game of chicken being played - where the market has begun “fighting the Fed.” There are currently two situations to be aware of in relation to the macro and what that means for us here in crypto land.

The bull case: The Fed is bluffing in its fight against inflation and will in the coming months give up and ease their monetary policy resulting in up only for markets.

The bear case: The Fed is serious and will not back down. They will continue with hawkish monetary policy throughout this year and the bear market will have another leg down.

It’s important to be aware of both cases. Their view is that the recent risk revival in traditional markets and crypto may not sustain because the U.S. central bank is still intent in their fight against inflation. They don’t believe the Fed will back down. QCP comments on a Fed pushback, stating that "What will raise the FOMC's ire is how quickly financial conditions have loosened in this period which, together with the rally of meme stocks and crypto, risks severely derailing their inflation fight." They expect that the Fed will push back strongly against this pricing in their next meeting on February 1, but the March 22 meeting will be the moment of truth, when updated rate forecasts will be released. If there is no adjustment to the median 2023 dot plot, they expect markets will be in for a rude shock.

This coincides with their view that many crypto institutions who need to liquidate assets have chosen to buy time by preserving cash and cutting expenses instead. That’s the hidden sell pressure we’ve got hovering over our heads we need to stay aware of (DCG/Genesis, etc). Potential forced sellers. We have now officially seen that Genesis, owned by DCG, has filed for bankruptcy protection and owes more than $3.6B to top 50 creditors. There are market fears that the repercussions of the Genesis bankruptcy could lead to the liquidation of GBTC's holdings of 600,000+ Bitcoin.

Who will ultimately win? Is the market correct in calling the Fed’s bluff or will the Fed show some spine and hold their ground and will forced liquidations by the crypto entities limping along push crypto lower?

Narratives Checkup:

Checking in on how some of the recent narratives have been holding up. To recap some of the current narratives include: LSD tokens, AI coins, Metaverse coins and Meme coins.

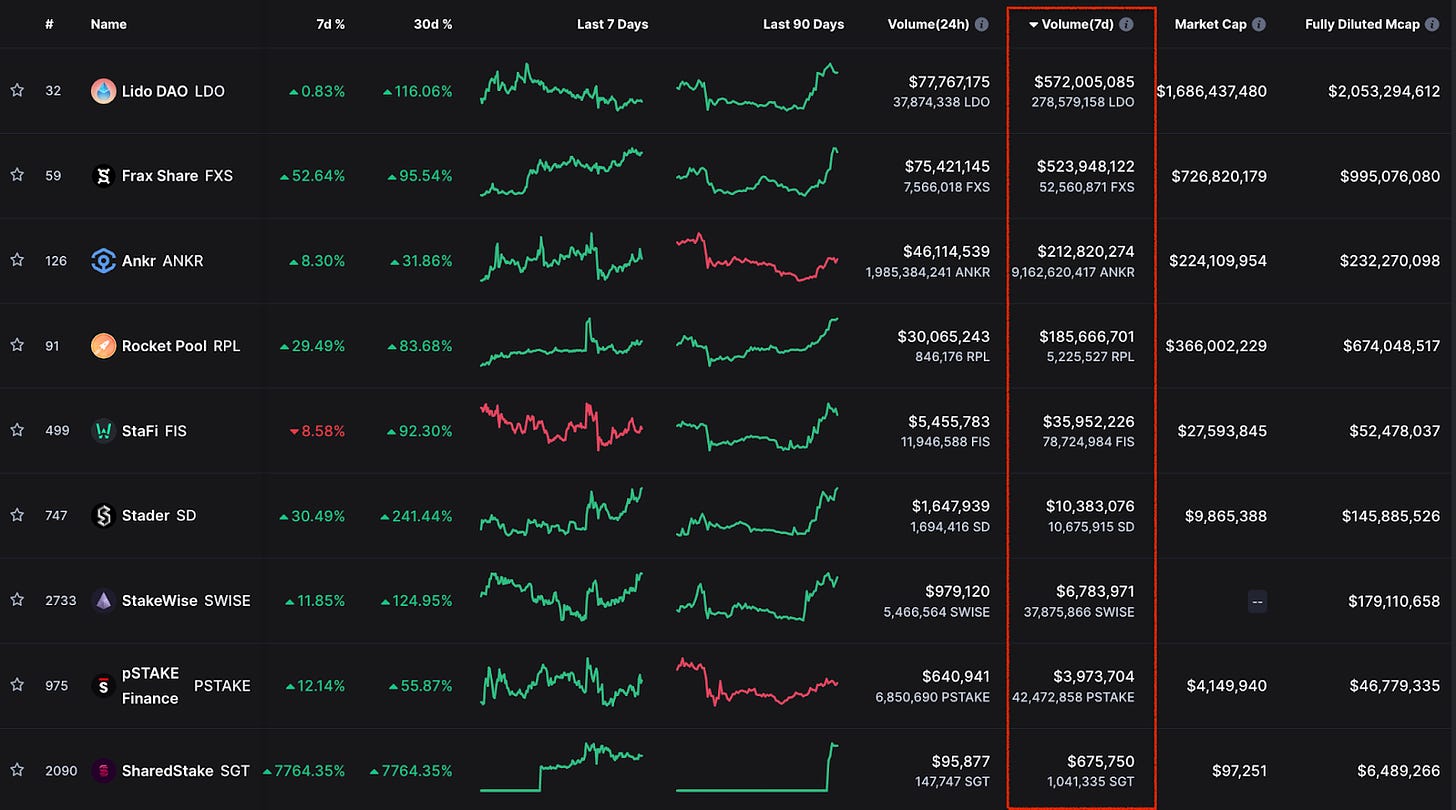

Liquid Staking Derivative coins: Most of last week’s hot runners have now begun to take a breather with the exception of FXS which spent the past week leading the pack. The Shanghai upgrade in March and ETH staking debate is still a solid narrative on the table. One thing to keep in mind: will it be another sell the news event when it hits like the Merge was and so many other events in the past year?

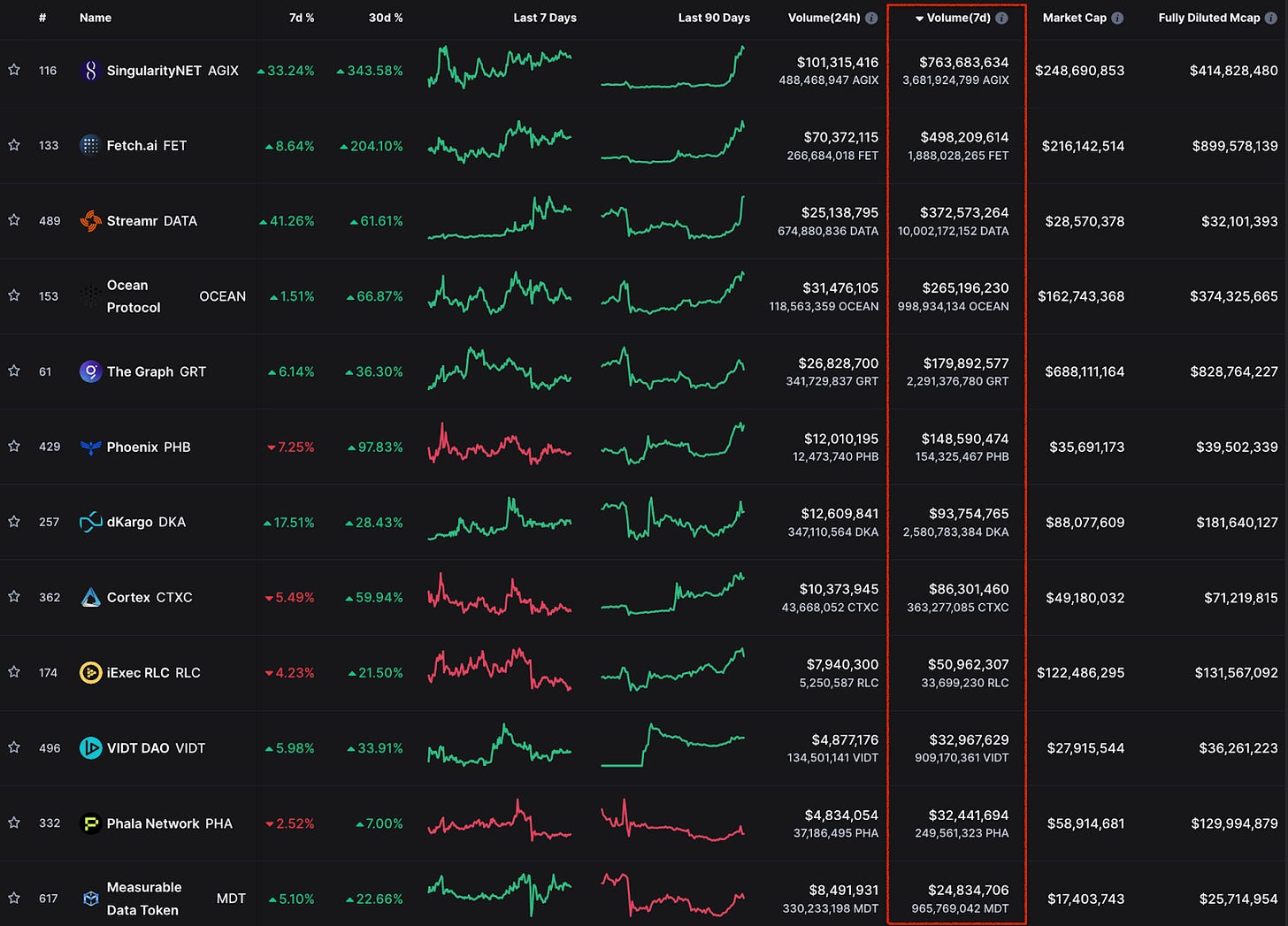

AI coins: Lots of green and solid performance over the past week. The thing about AI coins is that they give off similar vibes to metaverse tokens during the last bull run. The fundamentals are probably still too underdeveloped at this point in time but the narrative is powerful in capturing the imagination of users. Of what the future may look like and how the technology will be utilized. All we have to look at is how everyone has recently been gushing about ChatGPT. The concept of promising the future is a hallmark of crypto. People thinking that the metaverse is the future heavily contributed to gaming tokens going vertical in 2021. Do you think AI is the future?

Metaverse coins: Mana, Sand, Enj have been doing well. The fascinating thing about these tokens is that most of them still have grossly inflated Fully Diluted Market Caps and unlocks coming up, however when the narrative picks up, the market runs whether you like it or not. Everyone knew about the inflated FDVs in 2021 and people still bought these coins en masse. Overall, GameFi seems to have fizzled as most have to come to accept that games are going to have to start becoming actually fun and well built instead of blatant cash grabs. For the time being though, gaming and metaverse coins have been catching a bid. Enjoy.

Dog/Meme coins: Shiba Inu has an upcoming layer 2 release that could act as a catalyst. There’s also another thing to be aware of. The real life dog behind the meme of Dogecoin is sick and could potentially pass away soon. Some wonder that that will do to the highly reactive meme coin? Either way, memes as part of the crypto space are just a part of life.

CT Disgraced Fallen Heroes - Redemption Arcs?

So, Su Zhu and Kyle Davies, the founders of 3AC, along with CoinFLEX co-founders are trying to raise $25M to start a new crypto exchange. GTX, because it comes after FTX… Anyways, will it work out for them? There’s this tendency in crypto to idolize personalities and influential people. Despite how far you may have fallen or what you did wrong, all it takes is a little time and with people’s goldfish-like memory, past sins are forgotten and redemption arcs are allowed to occur. It’s natural that there are those who want to make money and will associate themselves with anything that garners publicity and hype. This is the reason that MoonCarl or Bitboy will never have a shortage of people wanting to work with them. They’re in no way qualified to be such a prominent figure in crypto but that doesn’t matter because they have an audience. Any publicity is good publicity, eh? The question boils down to will any venture a disgraced former hero launches gain momentum? Likely, yes. Driven by traders, investors and speculators looking to capitalize on their infamy and headline grabbing status as well. The point here is that it comes down to everyone as a market participant to decide whether this type of behavior will be allowed to continue. Stop supporting bad actors.

For those keeping score, what are the odds that any of the following could mount a successful redemption arc? SBF, Do Kwon, Alex Machinsky?

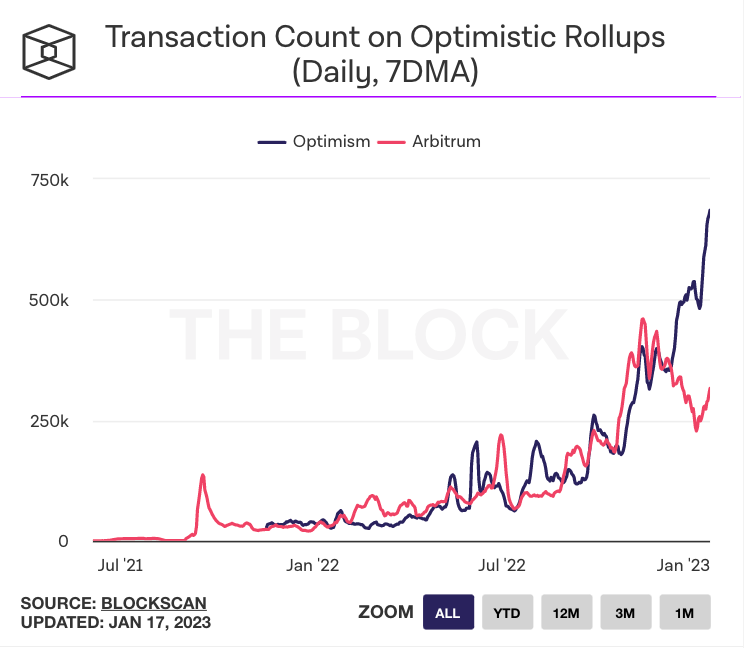

L2s: Optimism surpasses Arbitrum

In the race of the L2s, we’ve got some interesting developments happening. Transactions on Optimism have now surpassed Arbitrum which peaked in transaction count in November. The past weeks has seen a surge in activity.

What could this be signaling? Looking at TVL for both these we can see that Arbitrum has been stable and ranging around $1B since August 2022 and Optimism saw a drop from its $1B mark in November to its current ~$500M range. So more assets aren’t being locked in smart contracts on these chains but we’re seeing users actively participate on one chain more. Things to keep in mind, Arbitrum currently doesn’t have a token but plenty of participants have actively been gaming for an airdrop and Optimism does have a token and has upcoming token unlock pressure. Investors and Core contributors will receive their tokens starting in June.

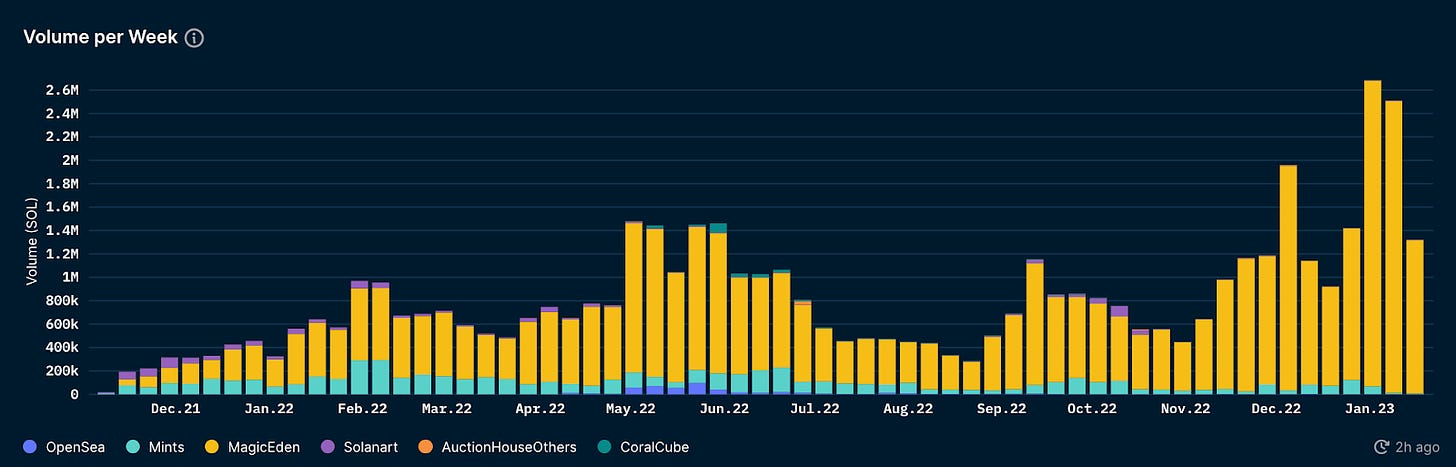

Solana NFT Volume Going Bananas

Solana NFT volumes have been going bananas lately! As well as price more than doubling off the local bottom. According to data from The Block, January (which isn’t even over yet) has already seen the second highest monthly volume ever after Oct 2021 and according to data from Nansen, this is the highest volume month ever for Solana. Everyone has their opinion on whether Solana is dead or not but no one seems to have mentioned that to the Solana NFT communities.

Top Crypto Highlights of the Week

News:

Su Zhu and Kyle Davies, the founders of 3AC, along with CoinFLEX co-founders aim to raise $25M to start a new crypto exchange called GTX

DCG halted its quarterly dividend payments to conserve cash and strengthen its balance sheet

DCG's Genesis Global files for bankruptcy protection and owes more than $3.6B to top 50 creditors

Cameron Winklevoss, co-founder of Gemini, threatened to file a lawsuit against DCG after bankruptcy unless they make a "fair offer" to Gemini's Earn customers

New FTX CEO says crypto exchange could be revived

Nexo to pay $45M to federal and state agencies after being charged by the SEC for its Earn Interest Product

Justin Sun considering buying up to $1B of Digital Currency Group’s assets

Binance Custody will allow institutional investors to keep their collateralized crypto used for leveraged positions, off the platform in cold storage

ConsenSys cuts 11% of the workforce which accounts for 96 employees

Coinbase paused its business in Japan and has advised customers to withdraw their assets from the platform

Circle taps Deloitte as new auditor and doubles down on Proof of Reserves

The founder of cryptocurrency exchange Bitzlato was arrested and charged with processing $700M in illicit funds

Project Updates:

Shiba Inu upcoming beta for Ethereum Layer 2 network called Shibarium with Bone tokens used for transaction fees

Visa listed Alchemy Pay as an Official Service Provider

Bitcoin data is live on Dune

New Avalanche app for Ledger devices and Ledger Live

Sushi's protocol's 2023 roadmap will focus on user experience, release its DEX aggregator in the first quarter, optimized tokenomics, launch decentralized incubator: Sushi Studios

BNB Chain completed the 22nd Quarterly BNB Burn via BNB Auto-Burn of over $500M worth of its native tokens

Polygon successfully completed a hard fork designed to reduce instances of spiking gas fees and disruptive chain reorganizations known as reorgs

Polygon zkEVM Mainnet launch teased by co-founder

Filecoin Foundation will deploy IPFS in space to test use cases for decentralized storage in space

Polkadot released version 3 of its cross-chain messaging format Cross-Consensus Messaging (XCM)

National Geographic NFT Launch met with anti-NFT backlash

Yuga Labs blacklisted addressed related to Blur, SudoSwap, LookRare and NFTX that don't mandate NFT royalties in Bored Ape's Sewer Pass mint

DEX aggregator 1inch Network has developed a hardware wallet

Aave V3.0.1 deployed across all testnets

National Australia Bank launching a fully backed stablecoin called AUDN on Ethereum and Algorand

Trader Joe DEX tokenomics revamp for native governance token JOE and expand to Arbitrum and BNB Chain

NFT marketplace Rarible is expanding its white-label marketplace building tool for Polygon-based collections

NFT marketplace Blur postpone token release date to February 14

Robinhood Wallet, smartphone app that allows users to swap, transfer crypto, NFTs on Ethereum and Polygon. It’s currently being slowly rolled out to over 1 million waitlisted

Fantom released a decentralized funding system to finance new projects, dubbed the “ecosystem vault”

Bonus - Tools and Resources

Do you have trouble following along with all the events and dates going on in crypto? Try checking out a calendar: