Weekly Alpha Leak 🚰 New Narratives Stirring Despite the Shitty Macro

Week of September 3-9, 2022

The macro is still shitty and likely won’t be improving for a hot minute - but that’s not deterring people from participating in our favorite 24/7 online internet casino. New narratives are emerging it seems - will it be different this time?

TL;DR:

What Should We Look for to Kickstart the Next Bull Run?

Binance Pushes Native BUSD over UCSD - Who’s Really Winning Here?

Gamestop and FTX Partnership - Appealing to the Normies - The Road to Adoption

Cosmos - Liftoff?

Top Bullets: Bellatrix upgrade activated, Voyager Digital to hold asset auction, Chainalysis helped U.S. government recover $30M stolen from Axie Infinity, Bank of Russia to allow cross-border payments, upcoming Cardano's Vasil upgrade, BNB Chain zkBNB, Binance Account Bound soul-bound token, Algorand upcoming upgrade

Scammy Shit: Influencer scam controversies, Celsius Ponzi-like scheme, flash loans recurring problem

Data Highlights: Nansen Smart Money paints two pictures. On the weekly, money is flowing out of ETH and into stables but on the monthly, it seems like most of the money is flowing into ETH and BTC. DeFi TVL is in the gutter and ETH NFT volumes are pretty flat - just like they’ve been all summer. Volume fell off hard in May. However recent uptick in Solana NFT market volume

DeFi: Highlights: Aave stopped loaning ETH ahead of Merge, GMX near ATH over Arbitrum hype, teasing Curve stablecoin, Frax Finance launches Fraxlend, Maker proposal to increase revenue by $24M, Binance introduced ETH staking

NFT/Metaverse Highlights: Sorare launching fantasy NBA platform, FIFA launches digital World Cup collectibles project on Algorand, TV maker LG Electronics launches NFT platform with Hedera blockchain, The Sandbox partners with Renault to offer digital automotive experiences in the metaverse, Meta aims to replicate the illusion of touch in virtual reality, Sony Music files trademarks for NFT-backed media, 4,200 US trademark applications filed for metaverse, virtual and web3 goods, Players in developing countries could work as NPCs in wealthier players’ worlds…exploiting poor people in the digital world?

Before we get started...Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox.

Done? Now let's dive in!

⛓ Crypto Highlights of the Week ⛓

What Should We Look for to Kickstart the Next Bull Run?

Everyone wants to know when the market will finally start to turn around. Wen bottom!? People are hungry to catch the next narrative and to know when we can go back to being risk on. For clues we look to the actions and verbiage of those in control of the ship. Several Federal Reserve officials recently signaled that the U.S. central bank will continue to raise interest rates until there are clear signs that inflation is coming down for multiple months. Long story short - we’ve still got pain ahead of us.

Fed Chairman Jerome Powell has stressed that upcoming decisions would be data-dependent, which means that all eyes will be on the CPI set to be released next week for the latest reading on inflation. Last week, the Labor Department’s jobs report for August showed that the labor market has started to cool slightly. The Bank of Canada raised its main interest rate by 75 basis points to 3.25%, the highest in 14 years. The European Central Bank (ECB) also raised interest rates by 75 basis points, the biggest single hike since it began setting monetary policy in 1999. The CME FedWatch Tool, which shows how traders of financial futures contracts are betting on the Fed’s next move, now suggests a 78% chance that the central bank will hike by 75 basis points - which would bring the federal-funds rate to a range of 3% to 3.25%.

As for clues to what we want to see: easing monetary policies, the decline of inflation, a change in Bitcoin's mining difficulty, and renewed confidence in DeFi and inflow of liquidity are good clues to watch out for - with a strong focus on easing monetary policies. We’ll be keeping an eye on these metrics so make sure to follow along with us as we stay the difficult course.

Binance Pushes Native BUSD over UCSD - Who’s Really Winning Here?

Binance controversially announced this week that it will be ending support for USDC, USDP and TUSD in favor of its own native BUSD stablecoin and will auto-convert USDC, USDP, TUSD to BUSD on September 29 “in order to enhance liquidity and capital-efficiency for users.” This originally seemed to scare people as the headline came off a bit misleading so it’s important to note that users will still be able to deposit and withdraw USDC, USDP or TUSD at a ratio of 1:1. In fact, The CEO of Circle actually came out saying that this move was a net positive for USDC. Binance is not “ending support or delisting USDC'' but the move signals a push by Binance to expand the market share for BUSD and may even raise antitrust law concerns. Is Binance strong-arming the market using its position as the world’s largest crypto exchange?

USDC is currently the second-most popular stablecoin in the world, accounting for 33.5% of transactions in the category and has been gaining in market share recently. USDT is currently the most widely-used stablecoin, with a market share of 50.3%. Meanwhile, BUSD sits in third place with 15.1%. Bank of America research concluded that the move may increase the supply of BUSD by as much as $908M.

Positive:

It will now be possible to deposit and withdraw USDC seamlessly in Binance due to the fact that before it was required to first convert USDC to BUSD or USDT and then use it to trade leveraged products. The idea here is that the overall liquidity of USDC should increase from the move.

Negative:

The automatic conversion could potentially result in greater redemption of USDC to mint more BUSD and anti-trust concerns regarding Binance. USDT, which was excluded, may end up taking a hit as exchange users may be more likely to convert BUSD into USDC than into USDT when withdrawing funds due to the added step of converting USDT causing friction.

Cosmos - Liftoff?

Cosmos has been getting quite a bit of attention and shilling lately on CT and recently Delphi, who got obliterated on their Luna investments, returned to the drawing board and decided that the Cosmos ecosystem was their best bet going forward. One way or another, there’s been a lot of buzz around the coin.

It’s super important to recall that pricewise, ATOM has a history of being a cursed coin! However, in the recent short term, we can clearly see that since mid-June, people have been selling their US american dollarinos, Bitcoin and ETH to buy ATOM. Will it be the next narrative rotation or has it run its course already?

ATOM/USD

ATOM/BTC

ATOM/ETH

Gamestop and FTX Partnership - Appealing to the Normies - The Road to Adoption

GameStop, which has earned its place in the popular culture lexicon and who has been busy entering the crypto space in the past year, will begin to carry FTX gift cards in its 2,970 stores as part of a new partnership to introduce more retail customers to FTX’s community and its marketplaces for digital assets. Basically the point is to get retail back and interested in NFTs and crypto gaming. GameStop has been interesting to pay attention to since back in 2021 when Reddit led a short squeeze against Wall St. hedge funds, costing them billions. It was a meme revolution and attracted many new speculators to financial markets.

GameStop was on the verge of being a forgotten about, dead brick and mortar store and then used the rejuvenated meme publicity from this catalyst to attempt to become a mainstream pillar of gaming and entertainment once again - just like they were in the 2000s. They’ve significantly ramped up their Web3 efforts this year after unveiling an NFT and Web3 gaming division in January, and launching an NFT marketplace in July in partnership with Layer 2 scaling solution Immutable X.

So why care about GameStop? The goal is to look for opportunities that have the best shot at actual adoption and mainstream usage. What’s more likely to attract and retain users? A brand that people recognize or some obscure DeFi protocol? GameStop was a part of many childhoods and if executed properly, could stand a real shot at helping to usher in the next generation of users - by leveraging its brand and name recognition. Could it once again be people’s first stop for games?

Looking at some data - since opening the GameStop NFT marketplace, 21,631 traders have generated $21.3M in volume. Compare that to OpenSea which has since a lifetime total of 2,174,812 traders and generated $32.2B in volume. Important to note that we have been in a brutal bear market since its opening and lots of retail have exited the NFT space but we’ll still be keeping an eye on performance to see how users feel about this. Is FTX correct in looking to GameStop as a means to onboard the next generation of users to crypto? We’ll have to wait and see!

This Week’s Top Daily Bullets 💊

Previously opposed to the idea of using crypto as a payment method, the Bank of Russia has reportedly agreed to allow cross-border payments in crypto due to geopolitical changes

Why this matters: Interesting to see the change in tone but important to emphasize that this doesn’t mean legalization of cryptocurrency as a means of payment domestically in the country. Sanctions have hit them tough.

The Bellatrix upgrade was activated at epoch 144896 on the Beacon Chain at 11:34 AM UTC on September 6. The activation of the Bellatrix upgrade on Ethereum triggers the final countdown of the Merge, which will likely be completed sometime around September 13-16

Why this matters: If you’re a long term person this will probably pass you by without too much noise but if you’re more active in markets, it’s important to pay attention to dates. We’ll be paying close attention to what the price of ETH and BTC are doing during the final Merge event. Exciting tmes!

Bankrupt Voyager Digital to hold asset auction on September 13

Why this matters: This is a continuation in the 3AC insolvency saga and all the fallout. Interestingly enough, VGX token has been performing well lately.

Crypto analytics firm Chainalysis announced that it helped the U.S. government recover about $30M stolen from Axie Infinity earlier this year

Why this matters: Slowly but surely, the U.S. government, with proper help and tools, is learning to navigate the on-chain realm. What more can we expect to see from their abilities in tracking individuals?

Cardano's Vasil upgrade, now has a firm date of Sept. 22, 3 months after target date. The most significant Cardano upgrade to date, bringing increased network capacity and lower cost transactions

Why this matters: This has been delayed for a while and Cardano is a polarizing topic in the crypto world. Some love it, some hate it. Waiting to see see if Cardano ever does anything interesting

Binance’s layer 1 BNB Chain has announced the launch of its zero-knowledge proof scaling technology, zkBNB

Why this matters: Binance is leveraging their name to enter the zk race. We’ve got several other participants such as Polygon zkEVM, zkSync 2.0 and Scroll. Who will win?

Binance is launching the Binance Account Bound token, a soul-bound token used as proof of identity for Binance users who have completed KYC

Why this matters: we’re starting to see some real world applications of soul bound tokens. Interdasting

Algorand announced a new upgrade that could boost its transactions per second (TPS) and cross-chain communication security via state proofs

Why this matters: Algorand recently launched a $20M incentive program to boost Ethereum compatibility and has been popping up quite often in the news over the past year. Worth keeping an eye on projects that stay busy with developments

These are just our top bullets, want more? Check out our daily newsletter:

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Scammy Sh*t 💩

Crypto researcher’s fake Ponzi raises $100K in hours. Crypto Twitter user FatManTerra explained the fake investment scheme was used to teach people a lesson about investing blindly in crypto schemes shilled by influencers and said he was inspired by the controversial pitch from CT influencer LadyofCrypto

Why this matters: Sigh. Such a common sense lesson here. Many influencers build up large accounts so that they may eventually sell you something or profit off you. Never forget

Celsius was using a Ponzi-like scheme to pay yields, the Vermont Department of Financial regulation alleged

Why this matters: Yikes. This was one of the more “traditional” businesses that a lot of normies saw as safe. It’s things like this that set the space back

One crypto arbitrageur was able to gain $370k from a $51M flash loan exploit on the Avalanche-based DeFi platform Nereus Finance

Why this matters: Flash loan exploits continue to be a major pain point for DeFi protocols and it seems like nothing is changing anytime soon

📊 Crypto Market Data Highlights of the Week 📊

Data from Nansen

Tl;DR: Nansen Smart Money paints two pictures. On the weekly, money is flowing out of ETH and into stables but on the monthly, it seems like most of the money is flowing into ETH and BTC. DeFi TVL is in the gutter and ETH NFT volumes are pretty flat - just like they’ve been all summer. Volume fell off hard in May. However recent uptick in Solana NFT market Volume

Percentage of Smart Money currently in Stables:

Let’s start by taking a look at how stabled up Nansen Smart Money is currently. A lower percentage means they’re feeling nice and risky and a higher percentage means they’re feeling risk averse. We seem to be in a little zone of indecision. Are we going up or down from here?

Weekly:

Largest Smart Money Inflows this week: Money is flowing into USDC, Aave ETH, stETH, WBTC, Aave USDC and Compound USDC. Money Flowing into stables makes sense if people are derisking before the Merge but the derivatives products inflow is curious. Seems to imply people aren’t interested in playing the ETHPOW airdrop which requires holding ETH during the Merge event

Largest Smart Money Outflows this week: Most of the money is flowing out of Compound ETH and WETH. This implies smart money is derisking ahead of the Merge

Monthly

Largest Smart Money Inflows this month: This paints a different picture. On the monthly level, it looks like most of the money is flowing into ETH, Aave ETH, WBTC.

Largest Smart Money Outflows this month: Similarly here, the most money flowing out is of USDT.

Nansen Hot NFT Contracts:

Highest Volume NFT collections of the past week: RTFKT beat out other major bluechips like ENS, Otherdeed and BAYC.

Highest Volume NFT collections of the past month: It’s interesting that despite all the buzz and hype a couple weeks ago, DigiDaigaku wasn’t able to generate higher volume. Suppose the buzz was rather niche

NFT Market Volume:

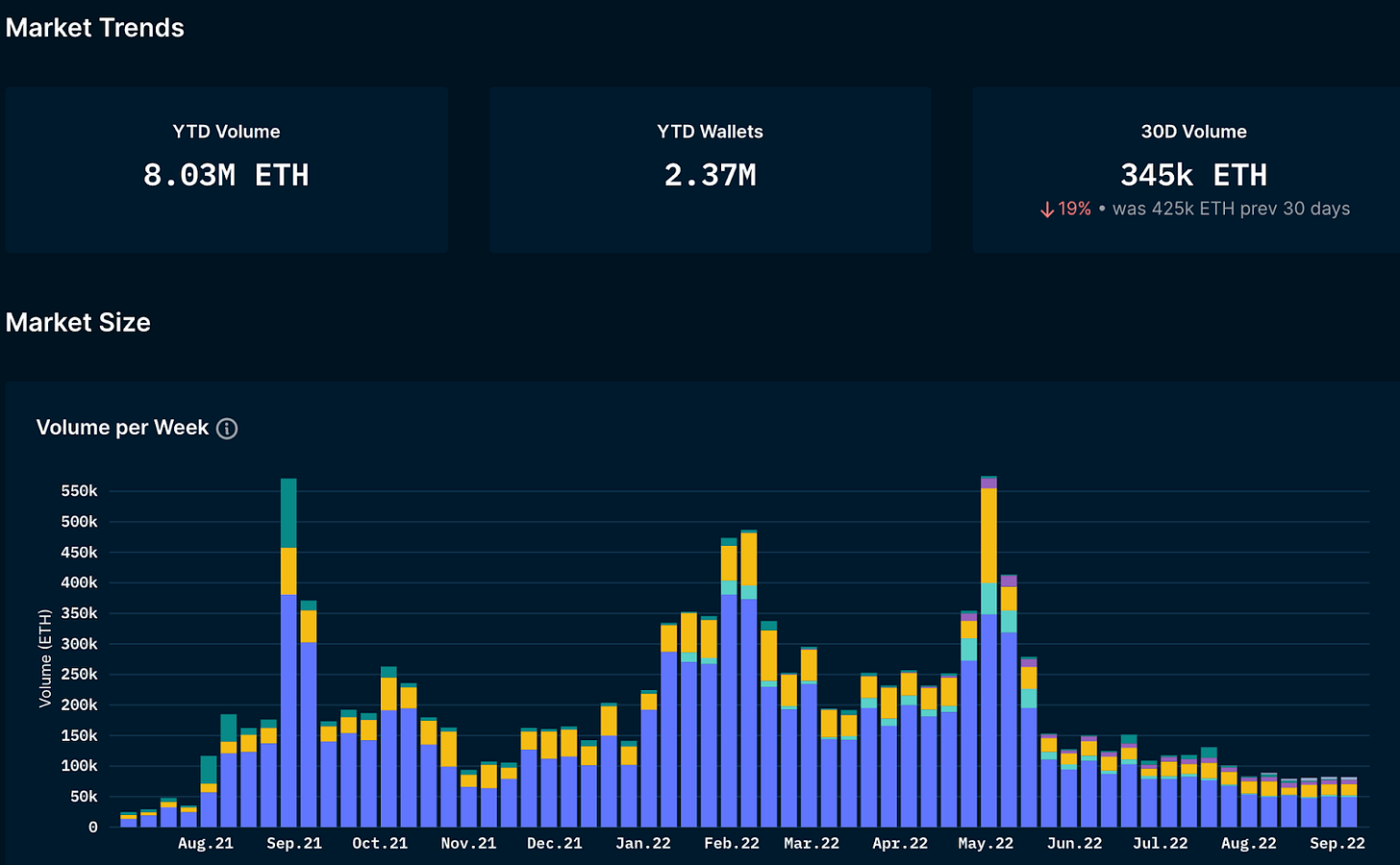

ETH NFT volumes are pretty flat - just like they’ve been all summer basically. Volume fell off hard in May

Checking in with the Solana NFT market, we can see a spike in volume. Interdasting! Are the degens busy playing over in NFT Solana world?

🏦 DeFi Highlights of the Week 🏦

Aave stopped loaning ETH ahead of Merge over concerns that users may increasingly borrow ETH, exposing the protocol to liquidity issues and injecting volatility into Lido's staked ether market

Why this matters: On one hand, this goes against free market principles and on the other, a spike in the utilization rate would mean most ETH has been loaned out, making liquidations challenging.

GMX surged to a record high this week amid rising interest from traders betting on the growth of Arbitrum

Why this matters: GMX has been a CT favorite for a while, for it’s genuine “real yield” narrative and combined with the prospect of upcoming Arbitrum season, it’s natural that this is near ATH

New upcoming Curve stablecoin github repo released

Why this matters: A new entrant into the stablecoin wars. Joining a slew of other protocols such as Aave, Gno, etc who are eager to step into the game.

Frax Finance launches Fraxlend, its own borrowing and lending market

Why this matters: FXS is another CT favorite and another cursed coin. It’s curious that that important protocol developments aren’t doing much for price

Coinbase proposal on MakerDAO’s governance forum that would transfer 33% of Maker’s $1.6B Peg Stability Module (PSM) into a Coinbase Prime custody account, increasing Maker’s revenue by roughly $24M

Why this matters: Major bluechip. An important place in the DeFi landscape - Attempts to improve their long term sustainability are worth keeping an eye on

Binance is introducing ETH staking in the U.S. ahead of the Ethereum Merge with a 6% APY for as low as 0.001 ETH ($1.51) staked

Why this matters: Binance is just one of many that introduced ETH staking just before the Merge. Will be important to keep an eye on how much ETH gets staked as this relates directly to how deflationary it will become

🖼 NFT and Metaverse Highlights of the Week 🖼

Sorare, the Web3 startup behind NFT-based fantasy sports games, will launch an officially-licensed fantasy NBA platform

Why this matters: It’s the National Basketball Association. We’re paying attention to these established brands and if they are able to bridge over their powerful fanbase in an attempt to gain mainstream adoption. The NBA also has Dapper Labs’ well-known NBA Top Shot, as well as the NBA’s own The Association project. Will this approach work?

FIFA launches digital World Cup collectibles project on Algorand

Why this matters: FIFA secured a partnership with Algorand in May and this project is akin to NFT sports collectibles like the basketball-focused NBA Top Shot and same reason as the previous point, we’re looking to see if this approach of appealing to the massive sports fan demographic yields results.

TV maker LG Electronics launches NFT platform with Hedera blockchain

Why this matters: This approach will give users a way to trade and display NFTs on their TVs with transactions being processed by Wallypto, a crypto wallet developed by LG. This is another approach attempting to gain adoption - by simplifying the barrier normie users have to onboard and interact with crypto. Big question as always - will it work?

The Sandbox partners with Renault Korea to offer digital automotive experiences in the metaverse

Why this matters: The following Cobie tweet is funny and brings up a valid point. Why would anyone want to interact with luxury items in the metaverse when you can do any variety of things that the imagination can come up with? Are these luxury brands crazy or are we?

Meta has acquired Lofelt, a startup whose technology aims to replicate the illusion of touch in virtual reality

Why this matters: Virtual reality and augmented reality are two interesting areas to pay attention to in the crypto space - add in that Meta is playing with this technology. The question is the same as always - will this approach work?

Sony Music, whose Columbia Records label represents several world famous artists files trademarks for NFT-backed media

Why this matters: This is another attempt at adoption to bring NFT authentication for the music industry somewhat mainstream. By leveraging their already massive brand influence - these approaches are interesting to observe. Will NFTs be able to successfully find real world use cases?

Almost 4,200 US trademark applications were filed for metaverse, virtual and web3 goods and services from January to August. The same period saw over 5,800 NFT-related patents filed

Why this matters: If you’re not currently paying attention, then it’s time to open your eyes. Huge brands are dying to get into the metaverse, web3, gaming, NFT space. No one really knows that they’re doing or if it’ll work but they’re doing it anyway. Are we early?

Players in developing countries could work as NPCs in wealthier players’ worlds…, according to one game consultant

Why this matters: Ok, this honestly come off as extremely dystopian. WTF. Treating poor people as NPCs in video games. It just rubs the wrong way. There’s been lots of chatter about “jobs in the metaverse” and it raises lots of questions - are we going to find new ways to exploit poor people?

The crypto space is a wild and fast paced, evolving landscape - however one filled with recurring themes and trends. The point of this newsletter is to highlight the story of crypto - as it's told over time. The board, the players, and the game itself. Follow along as we catalog and organize the chaos.

Subscribe to receive our daily brief and extended weekly newsletter along with in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.

Did we miss anything or is there anything you want to discuss? We’d Love to hear your feedback and engage with the community! Feel free to leave a comment and let us know your thoughts on the Crypto market!