State of the Market, Goldman Sachs & Blood in the Streets

December 3rd-9th, 2022

The end of the year is fast approaching! What a year it’s been. Goldman Sachs plans to invest in crypto firms whose valuations have recently been decimated this year. Are you so bold?

According to them, they see some really interesting opportunities which are priced much more sensibly now. Seems they plan to buy while there’s blood in the streets.

How about you? Are you willing to buy when there's blood in the streets even if the blood is your own?

In this week's alpha leak, we revisit some of the conditions that have large institutional players’ curiosity piqued. Things don't particularly look so hot but opportunity is found when things look bleakest.

Before we get started… Sharing is caring and knowledge is power! Do you find this newsletter helpful? Then be a Chad or Chadette and share this newsletter with your friends and colleagues

Done? Now let's dive in!

State of the Market - The Blood

The crypto space has undoubtedly been through some tests over the past year. So much happens in such a relatively short period of time that it can be hard to make sense of it all. If you follow this newsletter regularly, we seek to provide a comprehensive overview of the current state of the crypto market, exploring the key developments and trends that are shaping the industry. We look at the news, events, catalysts, narratives, major players, their strategies, and the potential impact of regulatory developments. So what’s the state of things? Why is a financial giant like Goldman Sachs sniffing around for bargains?

Well, unless you’ve been living under a rock, you’ll know that we’re in the depths of a bear market - have been for a year now. We’ve had multiple entities blow up such as Three Arrows Capital, Terra Luna, Celsius, FTX, Alameda and potentially more limping along still. Everyday normal people lost their money and savings in normie friendly companies such as Anchor Protocol, Celsius, and FTX. Once heroes of the crypto space such as Do Kwon, Daniele Sesta, Su Zhu, Kyle Davies and SBF have fallen from grace. Multimillion dollar hacks and exploits are routine. Regulators and politicians are eying the crypto space hungrily. VC funding has finally begun to slow down and the once routine large investment announcements are slowly dwindling. GameFi tokens and NFT floors have been pummeled into the ground. Alt Layer 1 blockchains that previously rocked the top of the charts such as Solana, Avalanche, Near, Fantom, Harmony, Cosmos, Polkadot have finally been humbled back down to earth. DeFi TVL has fallen off a cliff and tumbled down to the pits of Tartarus. Developer activity has slowed down considerably. CT people actually care and talk about things like the macro, CPI, FOMC and interest rates. Governments all around the world are piloting their CBDC programs. Shares of the world’s largest bitcoin fund, Grayscale Bitcoin Trust (GBTC), hit a record-high discount rate of nearly 50% relative to the price of bitcoin. Even the threadooors have chilled down.

So where does that leave us? It all sounds so bad and scary, should we pack up our bags and find something new to be interested in? Move on with our lives? No. It leaves us in a very opportunistic position. For example, financial giant Goldman Sachs plans to spend "tens of millions of dollars" to buy or invest in crypto firms whose valuations have been hit by the demise of crypto exchange FTX. According to them, they see some really interesting opportunities which are priced much more sensibly now. Valuations have certainly been hit hard and that is where the opportunity lies. Now of course, tens of millions of dollars is not comparatively a lot of money for the Wall Street giant, which earned $21.6B last year - but it still highlights that they are thinking more long term and the mentality behind which one should be thinking. Buy low, sell higher. The quote "Buy when there's blood in the streets, even if the blood is your own,” comes to mind. Just make sure you’re aware of and comfortable with the time factor of how long it may take to see improvement in the market. When the time comes to buy, action and conviction will be needed. May the odds be ever in your favor.

ChainLink and ApeCoin Staking - Sell the News Event? Again?

This week, we saw ChainLink and ApeCoin introduce staking and it so far appears that what we got was a classic case of a "sell the news" event. While there was much speculation and anticipation in the lead-up to the event, the reality of the situation was that the event failed to live up to the expectations of the market.

Many had hoped that the event would bring about a new wave of adoption, a surge in prices, and a renewed sense of optimism for the protocols. Unfortunately, that was not the case. LINK and APE have both fallen in price since the event hit. This should be routine to traders and investors by now as this has been the playbook we’ve seen for many events and launches this year. Buy the rumor, sell the news.

Of course, it may also still be too early to call as the price dips were not too significant yet but if it’s anything like other events and catalysts that went live this year, we might end up seeing a slower bleed in price. Traders will inevitably find some new catalyst and narrative to be interested in and move on. Will it be different this time?

Remember DeFi Kingdoms? Blast From the Past

This week we saw one of last year’s most notorious CT projects pop back into the news cycle. DeFi Kingdoms. Everyone on the timeline was shilling this last year during this exact time. Now that Serendale has launched on Klaytn, it felt like a good time to revisit this old “gem” and see where they are now. It was announced that DFK would move from Harmony to Klaytn in August and the revamped game will feature a new utility token, JADE. Crystalvale realm will remain on DFK Chain, an Avalanche subnet.

Price absolutely plummeted. From a high of $22 down to .20-30 cents. Rough. Literally anyone that bought last year and didn’t sell lost money. This is a cautionary tale for the future. From hero to zero.

We can also see that volume has practically evaporated, unique active wallets have slowly dwindled to barely anything, however transactions had curiously enough been on a rebound since the summer until recently. DeFi Kingdoms has also been plagued by team issues and overall - you can add this to the list of things that have fallen from grace. Will something like this ever resurrect? Hard to say. When so many people get burned on a project, it tends to leave a bad taste in your mouth. Maybe old ghosts from the past will rise again during the next cycle but it’s more likely that new, fresh and innovative projects will rise to take their place.

Revelo Intel collects, organizes, creates, & presents valuable information aimed at helping investors track & research projects & chains more efficiently.

With coverage of over 100 projects across DeFi, they produce notes & deep dive project breakdowns to help you research faster and more efficiently.

Get the FREE daily newsletter & early access to the platform.

Crypto Highlights of the Week

Monday, December 5th

Genesis owes its creditors at least $1.8B with $900M to Gemini customers

Maple Finance severed ties with the parent Orthogonal Trading who defaulted on $36M in loans

A court in Seoul denied attempt to have 8 people held during Terraform Labs proceedings

Teneo, overseeing the liquidation of 3AC, has taken control of $35.6M worth of assets

Code extracted from Twitter shows a potential new ‘Twitter Coin’ and “tipping feature”

Circle terminated its agreement with SPAC Concord, stepping back on its plan to go public

Nexo will phase out its U.S. products and services due to clashes with regulators

Launch of Chainlink Staking v0.1 on December 6th

DeFi Kingdoms: Serendale launching on Klaytn on December 7th

Bitcoin miner shows off oldest mined signature from a week after Bitcoin came into existence

Solana Foundation is adding a new incentive program called Tour De Sun ‘22

Bankless acquired Earnifi, a tool that’s helped users claim over $150M in airdrops

Bybit is reducing its workforce as a direct result of the deepening bear market

LedgerX is for sale, with Blockchain.com and Gemini interested in acquiring the firm

1INCH large token unlock coming up on December 30. 14.813% of the total supply

Tuesday, December 6th

Amber Group says it is “business as usual” after laying off hundreds of employees

Silvergate open letter seeks to reassure investors and customers

ConsenSys only plans to store and retain user IP addresses and wallet data for up to seven days

Goldman Sachs plans to spend "tens of millions of dollars" to buy or invest in crypto firms

Blur Airdrop 2 is officially live - have 14 days to claim by placing a bid on Blur

APE staking live. Rewards start accruing the 12th. North Americans have been geoblocked

GameStop laid off additional employees, including engineers from its crypto wallet team

Ledger partnered with iPod creator and co-creator of the iPhone, to create its Ledger Stax hardware wallet

Polygon and Warner Music Group partner on a music virtual vinyl platform

Gate established a $100M industry liquidity support fund

Nexus Mutual expects a $3M loss from exposure to Orthogonal Trading’s $36M default on Maple Finance

SushiSwap new proposal to direct all of the fees paid to xSushi holders into its treasury wallet for a year

Alchemy rolling out a dApp store to streamline access to decentralized applications for users and developers

Wednesday, December 7th

Fir Tree Capital Management is suing crypto investment fund Grayscale Investments

Polygon strategic token sale of 2021 distribution in a three-year unlock period started from late Nov. 2022

Judge authorized subpoenas to 3AC co-founders to turn over any recorded property or finances information

Mazars concluded that Binance’s Bitcoin reserves are fully collateralized with a collateralization ratio of 101%

SBF hired prominent attorney Mark S. Cohen - who recently defended socialite sex offender Ghislaine Maxwell

Crypto tax startup Koinly cut 14% of its staff

Microsoft and cybersecurity firm Volexity warn of new version of AppleJeus malware

Binance.US eliminated fees on spot ETH trading

DEX platform Hashflow partnered with crypto bridge service Wormhole

Activation of the Aave <> StarkNet Bridge

ConstitutionDAO will once again participate in Sotheby's auction of a copy of the United States Constitution

Decentranland will allow users who own virtual LAND to officially rent out their property

Old-school media player from the ‘90s Winamp now supports Ethereum and Polygon-based music NFTs

Use Telegram accounts without a SIM card using blockchain-powered anon numbers on the Fragment platform

Zodia Custody new service, Interchange, to protect client assets from exchange insolvency

Nigeria reduced cash withdrawals to $225 a week to attempt to push CBDC

Thursday, December 8th

Nomad to relaunch and partially reimburse users from $190M hack in August. Users must go through KYC

The U.S. Senate Banking Committee wants SBF to testify

U.S. prosecutors are probing into whether SBF could have manipulated the prices of TerraUSD and Luna

GBTC, hit a record high discount rate of nearly 50% relative to the price of bitcoin

Celsius Network must return around $44M worth of crypto back to customers

Ethereum next hard fork, Shanghai, coming March 2023 - will allow Beacon Chain staked ETH withdrawals

Ren 1.0 network is shutting down, holders of Ren assets should bridge back to native chains or risk losing them

Blur offers some NFT traders 50% refund after ETH losses from UI bug

Cosmos-based DEX Osmosis launched a stableswap

Polygon-based Starbucks NFTs are now available to beta testers

Bitmex added a derivative tied to Ethereum staking yield (ETHYLD) with up to 2x leverage

Bybit integrated decentralized exchange ApeX to achieve 2-in-1 platform

ImmutableX and MoonPay FT Checkout. Enables users to mint and own an asset using a credit or debit card

Nouns DAO will donate 100 ETH ($123,000) to ZachXBT

Lawsuit against EthereumMax founders, Kim Kardashian and boxer Floyd Mayweather Jr dismissed

Coinbase’s revenue this year will likely be cut in half

Friday, December 9th

SBF to testify before congressional committee on the 13th

Kevin O’Leary was paid $15M to promote the FTX brand and has since lost it all

3AC co-founder Kyle Davies blames downfall on being liquidated by FTX

Amber Group cuts 40% of jobs, ending a $25M sponsorship deal with Chelsea FC, owes $130M to Vauld's CEO

GameStop says it will no longer focus any efforts on cryptocurrencies

The U.S. SEC wants companies to publicly disclose if they have exposure to crypto assets

Coinbase introduces zero-fee USDT to USDC stablecoin conversion as the stablecoin wars rage on

Bybit will require updated KYC verification checks for various products from Dec. 15

Gnosis chain merged successfully

Metaplex accused Magic Eden of attempting to take over the NFT protocol in ongoing creator royalty drama

OpenSea extended the deadline to have royalties fully enforced after community backlash

OpenSea will transfer ownership of the Operator Filter Registry to a multi-sig controlled by a collective

Aptos Lab lawsuit claiming investor had been cheated out of of an equity stake is now resolved

Crypto.com released proof-of-reserves data from auditing firm Mazars Group

These are just our top bullets, want more? Check out our daily newsletter:

Crypto Market Data Highlights of the Week

Prices:

Bitcoin continues trading in the $17k region and ETH in the $1200 region. Tight range continues.

DeFi has been underperforming both Bitcoin and ETH over the past month.

Crypto Market Cap: ~ $850B

DeFi TVL: ~ $43B

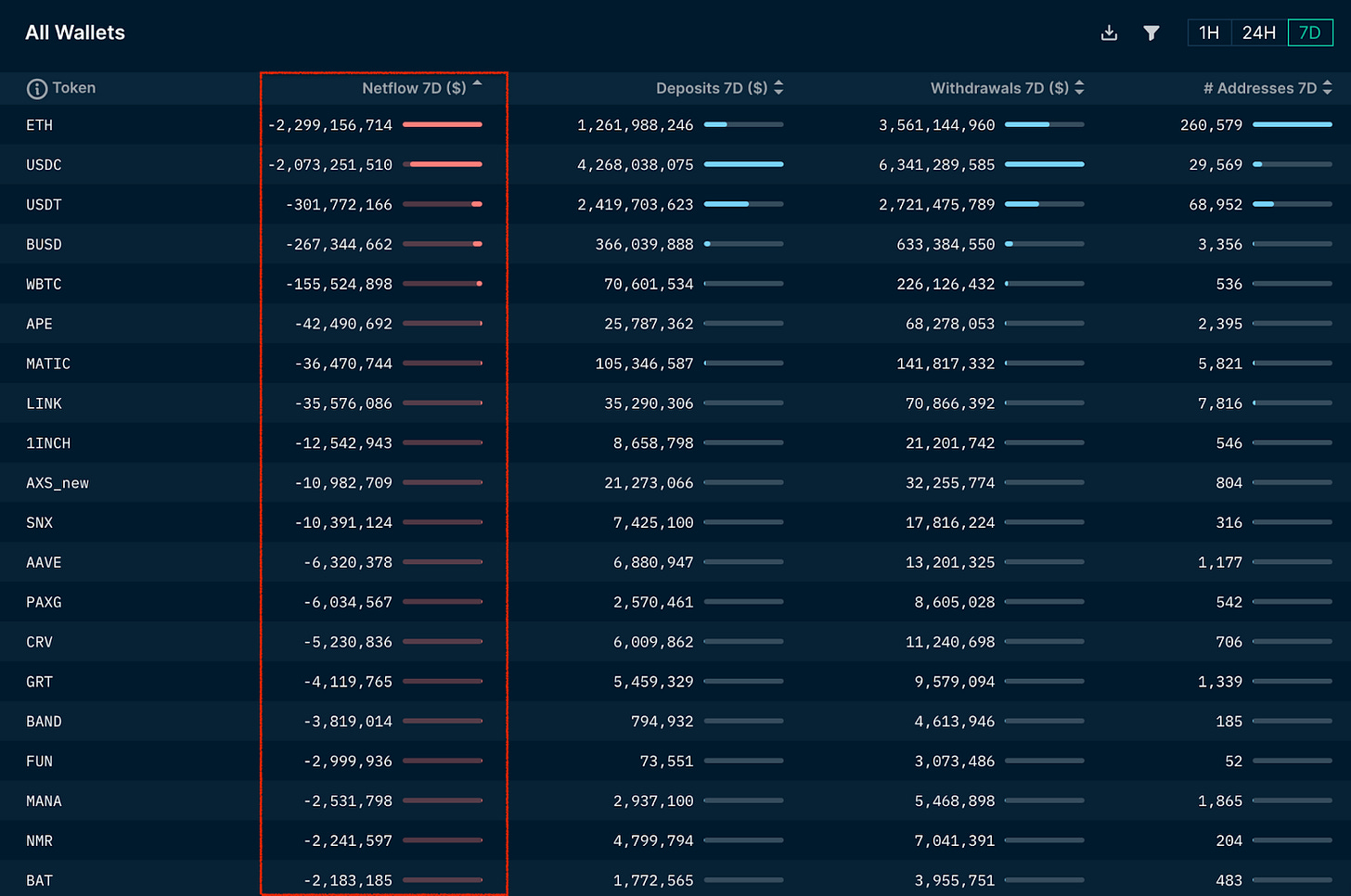

Nansen Exchange Flows:

Top 5 coins that flowed onto exchanges in the past week:

GMT, ENS, cbETH, ANKR, SHIB. The amounts are comparatively low however with the highest inflow being only $30M.

Top 5 coins that flowed off exchanges in the past week:

ETH, USDC, USDT, BUSD and WBTC. Amounts are also more considerable. ETH and USDC coming in at about $2B each.

NFT Volumes:

NFT volume continues to be in an ongoing slump since the summer.

Stablecoins:

Daily stablecoin transfer volume has cooled down since the FTX crash. When this starts moving again, we can expect some market moves.

Revenue & Fees:

Top protocols that took in more in revenue than they’ve put out through token incentives in the past week:

OpenSea, ENS, MakerDAO, Convex, Tokenlon

Top protocols that emitted more in incentives than they’ve took in in revenue in the past week:

Bitcoin, Dogecoin, Pancakeswap, BSC, Polygon

Subscribe to receive our brief daily and extended weekly newsletter along with in-house research content!

What’s your take on this week’s news? Anything interesting that you have to say about these stories? Did we miss anything that should’ve been included?

Please Share, Leave Feedback, and Follow us on Twitter, Telegram, and LinkedIn to stay connected with us.