Why We Invested in Persistence

A liquid staking hub building an economy around PoS assets

One of the original and most popular uses of the DeFi ecosystem is to generate passive income through staking. Since the introduction of the consensus mechanism based on the Proof-of-Stake (PoS) algorithm, the possibilities of participating in staking have increased significantly, becoming an industry sector valued at billions of dollars.

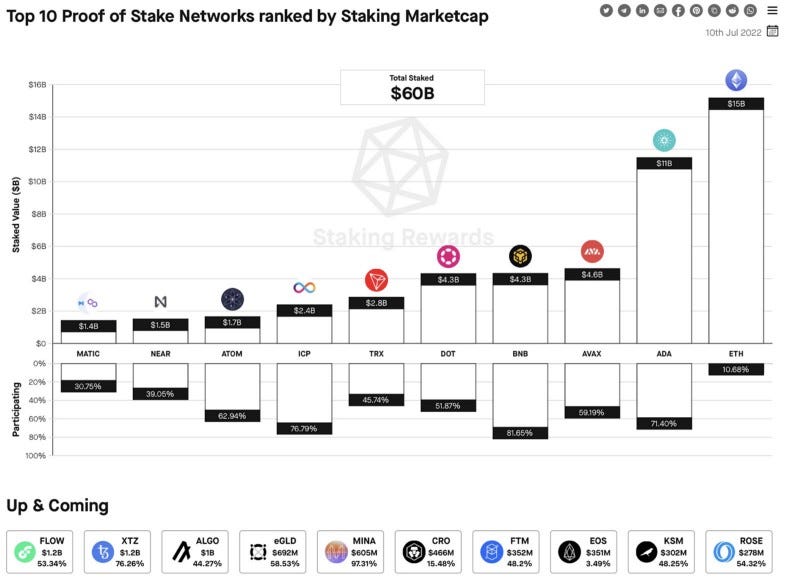

According to data from the latest report by The State of Staking, the Market Cap of the Top 35 PoS Assets is around $206 billion, representing 22% of the total crypto market cap.

Among these assets, Cosmos stands out with its $ATOM token, representing a stake rate of 64.4%.

Before we get started... Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox:

Done? Now let's dive in!

Even more interesting are the growth expectations forecast by JP Morgan to 2025, quintupling the current size of this market to about $40 billion.

Liquid Assets: Liquid Staking

Despite the staking sector’s promise, some challenges must be resolved, primarily related to the lack of liquidity when assets are locked for a certain period to generate passive income.

And for this reason, Liquid Staking has gained relevance and more popularity with the improvement of Ethereum 2.0 as a simple way to solve the lack of liquidity by locking ETH in the smart contract of this scaling solution.

As it grows in importance as a liquidity vehicle, Liquid Staking and the platforms that support it are on the rise, offering a variety of assets that have managed to reach a market cap of over $5B, according to data from Coingecko — one-third of the PoS staking market cap of $15B on Ethereum.

And within this conglomerate of tokens that make up the Liquid Staking sub-sector are tokens associated with the Persistence platform, a Tendermint-based specialized Layer 1 powering an ecosystem of DeFi dApps focused on unlocking the liquidity of staked assets.

Persistence: Liquid Staking Hub

Persistence is an ecosystem of financial products designed to serve institutional and crypto-native users. Persistence’s technology stack provides the infrastructure to effectively bridge the decentralized and traditional finance arenas in various areas, including Liquid Staking through pSTAKE.

Persistence has emerged as one of the most active contributors to the Cosmos ecosystem and developed a strong presence among the blockchain community as part of its goal of becoming the PoS industry’s Liquid Staking hub, driving the utility and adoption of pSTAKE’s stkASSETs (liquid staked assets).

The platform facilitates the issuance and deployment of liquid staking, (stkASSETs) whose value increases over time with staking rewards. Furthermore, these assets (stkASSET) can simultaneously be used in DeFi without the need to dispose of the underlying assets.

Persistence Ecosystem products are designed to stimulate global liquidity and enable continuous value exchange.

The Persistence mainnet is a proof-of-stake chain powered by the Tendermint BFT consensus engine. Its multi-chain technology stack (currently supporting Cosmos, Ethereum, and other Tendermint-based chains) abstracts developers’ complexities so they can easily build DEXs, marketplaces, loan/lending platforms, and other financial services products.

pSTAKE is a key component of the Persistence ecosystem, enabling liquid participation for users and the issuance of stkASSET on the Persistence core chain.

What benefits does pSTAKE offer crypto asset staking?

pSTAKE is the leading liquid staking solution for $ATOM and $XPRT, the native Persistence token.

Born as an experiment in Q4 2020 after witnessing excellent results for Persistence’s $XPRT StakeDrop, pSTAKE is a liquid staking protocol that unlocks the true potential of staked PoS assets (e.g., ATOM).

pSTAKE allows its users to utilize stkTOKENs in various DeFi protocols to earn an additional yield on top of their staking rewards.

This simple yet powerful process provides users:

Quick access to funds with no ‘unlink’ process

Yield optimization through DeFi practices such as Yield Farming or a DEX supporting stkASSETS that generate yield

Exposure to cryptocurrency-backed loans with auto-repayment against stkASSETS, whereby staking rewards are used to pay interest rates on the loan (still under development)

A further incentive to support the overall strength of the network by incentivizing users to lock up their assets without losing the benefits of using liquid assets in other DeFi protocols

stkASSETS indices, allowing users to gain exposure to multi-asset PoS staking rewards directly through the various stkASSETS index products (still under development)

Borrowing with stkASSETS indices as collateral (still under development)

Key features of pSTAKE

pSTAKE is one of the fundamental building blocks of the Persistence ecosystem. It is currently being built on top of the Core-1 chain in a modular fashion, enabling support for the issuance of liquid staked representative tokens (e.g., stkATOM and stkXPRT) on the Persistence Core-1 chain.

Users will deposit their native assets (such as ATOM, LUNA, JUNO) on the Persistence Core-1 chain (via the pSTAKE liquid staking module) to issue IBC-enabled stkASSETs against their staked assets.

Issuance of stkASSETs will help grow the total value locked (TVL) on the Persistence Core-1 chain, an essential metric for quantifying the ecosystem’s growth.

To use these stkASSETs on the Persistence ecosystem chain, users will pay gas fees in the form of XPRT. stkASSETs will also be integrated with apps outside the Persistence ecosystem, using the Core-1 chain as a hub to route the flow of stkASSETs.

An interconnected protocol to be governed by the community

The pSTAKE platform operates using two fundamental components: pBridge and PSTAKE token.

PSTAKE is a bridge between several blockchains. Through this component, the transfer of value between various blockchains such as Ethereum, Cosmos, Persistence, among others, is supported.

In addition, holders of PSTAKE, the governance and incentivization token of the pSTAKE protocol, are provided with incentives to participate in the protocol's governance to ensure its long-term success and security by staking PSTAKE on the pSTAKE staking contract.

PSTAKE will also be used as a disincentivization token if stakeholders staking the token act maliciously or cannot perform their duties appropriately.

Continued high growth for a leading PoS network

Persistence is now among the leading PoS networks in terms of Staking Ratio (84%+) and Staked Value (Top 50), demonstrating solid roots in the PoS community.

Since 2019, the developer team of pSTAKE and related solutions such as AUDTI.one (its validator arm) has actively participated in several liquid staking groups, demonstrating its experience and background in projects of this type.

The current pSTAKE product issues stkATOM and stkXPRT assets as ERC20 assets. This design choice is attributed to the absence of IBC and sufficient DeFi opportunities within the Cosmos ecosystem. But now given the thriving Defi ecosystem within Cosmos, and based on community feedback, the pSTAKE team is building a new solution for stkATOM, issuing the asset directly on the Persistence Core chain, and will be migrating the current product onto the new version post-launch.