zkLend - Money-Market Protocol of the Future

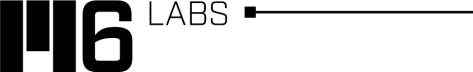

The protocol provides a dual solution without sacrificing decentralization: a permissioned and compliance-focused solution for institutional customers and a permissionless service for DeFi users

The increasing adoption of cryptocurrencies has led to sharp price increases and a rise in the number of dApps. On networks like Ethereum, higher transaction volumes have also highlighted several issues. Whether you have any experience with it or not, you have probably heard countless times that scalability is a prevalent concern among these challenges and that it directly impacts how well the blockchain functions. Transactions now cost more and take longer to perform on the most well-known, secured, decentralized smart contract network. Before we continue, you should be aware that there are two primary types of rollups: optimistic and the one we're discussing today, the zero-knowledge or validity rollups (in general, commonly referred to as zero-knowledge rollups or ZK-rollups).

zkLend is a Layer 2 money-market protocol—better referred to as the leading StarkNet native money-market protocol that combines Ethereum's security with ZK-rollup scalability, more incredible transaction speed, and cost savings. The protocol provides a dual solution without sacrificing decentralization: a permissioned and compliance-focused solution for institutional customers (“Apollo”) and a permissionless service for DeFi users (“Artemis”).

Before we get started... Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox:

Done? Now let's dive in!

It is important to note that zkLend is built on StarkNet, a permissionless decentralized ZK-rollup that operates as a Layer 2 network on Ethereum to enable dApps to scale. StarkNet’s gas fees are 100x+ lower than transactions on the main chain, making it ideal for increasing the affordability of transaction-heavy dApps.

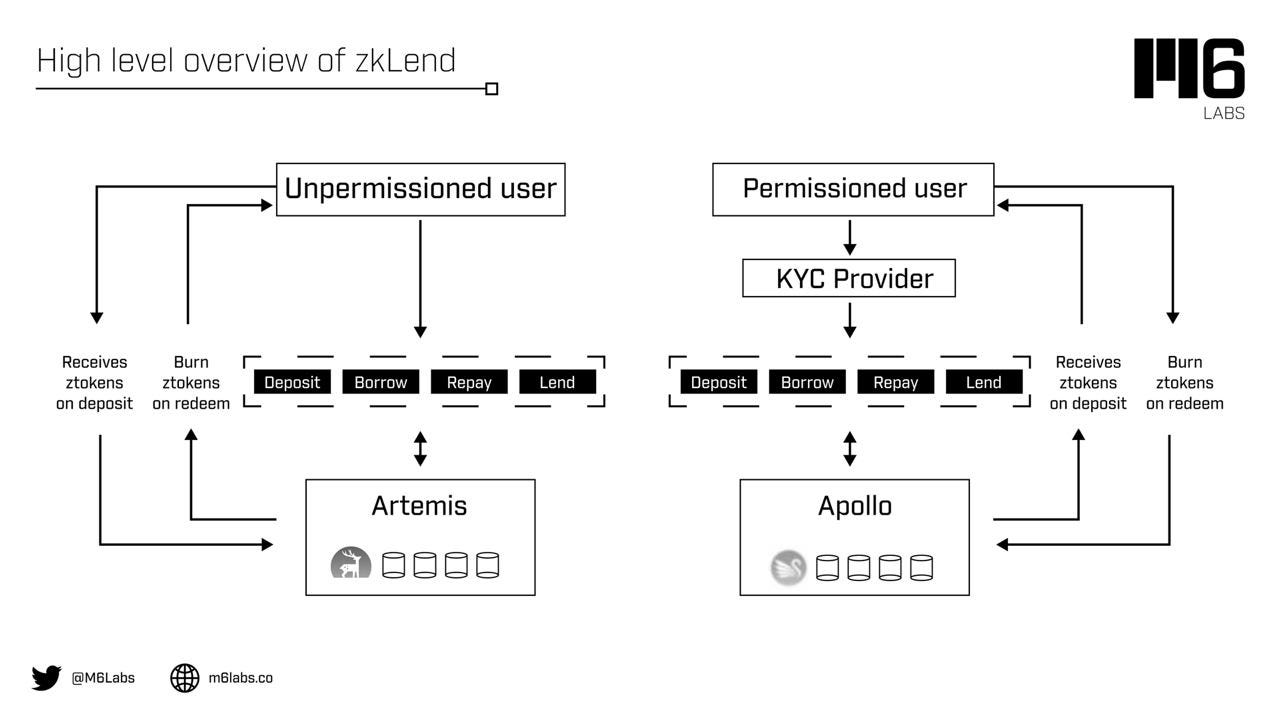

With Artemis and Apollo, zkLend is constructing the future generation of finance inspired by both tradition and innovation. Users can deposit assets with Artemis to earn a yield while using some assets as collateral for loans. Using Artemis, you can deposit, borrow, and lend money on StarkNet in a decentralized and cost-effective manner while still preserving the security offered by Ethereum Layer 1!

We'll talk more in-depth about Artemis, which will be able to lend/borrow, tokenize debt, offer flash loans to customers, and divide assets into different tiers.

Lending: Users may borrow assets deposited into money markets using their zTokens as collateral. The borrowers’ financing rate will depend on market demand and liquidity pool utilization. Users’ borrowing capacity, calculated based on their collateral value and the intended borrowing asset’s borrow factor, determines the maximum borrowing amount. If the users’ total loan exceeds their borrowing capacity, their position may be liquidated to protect the protocol against systemic risk.

Tokenized Debt: ERC20-compliant zTokens are used to tokenize debt on the protocol. The depositor receives a corresponding amount of zTokens upon deposit, which has a 1:1 ratio to the underlying asset. The depositor's zTokens holdings will increase over time, which reflects their accrued interest. The zTokens are claims on deposit pools and the collateral used to determine borrowing capacities. In additional build-ons, zTokens may be used to construct derivative products such as vault strategies, debt obligations, and other credit derivatives.

Flash Loans: Borrowers can leverage reserve pool liquidity without collateral to take advantage of market arbitrage opportunities because the loan is paid back within the same block. This means that borrowers will pay a fee for their flash loan, with the proceeds distributed evenly to all liquidity providers in the pool from which they borrowed.

The second zkLend tool, Apollo, works similarly but is only available to permissioned users who go through a KYC/KYB process approved by the protocol. As a result, the two protocols will operate separately, with their own capital pools and subdivided governance.

To understand Apollo, we must know more about whitelisting layers and whitelisters.

The whitelisting layer ensures that only authorized participants may create their own pools and borrow funds undercollateralized. On the other side, lenders may be other institutions or retail users.

Legal and credit checks (KYC, KYB, AML, and CFT), administrative onboarding procedures (understanding terms and conditions, fiat-to-crypto on-ramping, due diligence), and technical courses (providing permissions for the selected Ethereum wallet addresses) are typically included in the whitelisting process for borrowers. External parties will conduct compliance checks, while governance will set the standards and qualifications for borrowers to participate in Apollo. The robust KYB on borrowers and the approval process determined by governance are in place to ensure maximum transparency and protection to lenders.

As Apollo is developed, the team will reveal more details about the responsibilities and duties of whitelisters and the zkLend protocol to ensure that additional risk control, adequate compliance standards, and oversight are implemented. It is important to note that zkLend will collaborate closely with financial and legal counsel.

Institutional Onboarding: The on-chain and off-chain components of the institutional onboarding process are both present. Working with industry-recognized service providers for background, credit, and reference checks constitutes the off-chain component. Cooperating with service providers on the blockchain to handle whitelisting, custodial and wallets tracking analytics services is part of the on-chain component. Apollo will take a 'high-touch' and client-focused approach. Before onboarding, a dedicated institution and compliance team will engage with institutions to understand their product needs and compliance requirements, provide onboarding guidance, and liaise with KYC/KYB service providers, custodians, and whitelisters to streamline the process.

Deposit / Lend: The key difference between an unpermissioned and permissioned pool on Apollo is that the former allows deposits from retail users whereas the latter would be restricted to vetted lenders only. In both cases, the borrower would have to be KYB’d and approved by governance. Depositors in the pools (Participants) will receive corresponding zTokens representing their share of the pool and overtime, and their balance would increase based on interest earned.

Borrow: Only KYB’d institutions and/or participants can become borrowers. Each borrower is able to create their own pool or participate in an open pool. Each pool will have different borrowing terms, including duration, optionality, and collateralization ratio, all of which would contribute to different interest rates offered in the various pools.

Now that we've covered the essential features of both tools that zkLend provides, let's look at the main differences between Artemis and Apollo, as represented in the image below:

What should we know about zkLend’s token?

ZEND is the native utility and governance token that will also provide economic incentives to encourage users to contribute to and participate in the ecosystem on zkLend, thereby creating a mutually beneficial system in which every participant is fairly compensated for their efforts. ZEND is an integral and necessary component of zkLend because there would be no incentive for users to expend resources to participate in activities or provide services for the benefit of the entire ecosystem on zkLend without ZEND.

Before you start working with zkLend, you should know several differences between zkLend and other money market protocols, one of the reasons why we picked exactly this ZK-rollup project to inform you about today:

Offers a dual solution for permissioned and permissionless service without sacrificing decentralization

The two protocols can leverage one another to maximize capital efficiency at scale

UX: making it intuitive to use MM protocols

Building with institutions in mind, hands-on approach to onboarding institutional users

Why it matters?

ZK-rollups are one of the most highly praised solutions to Ethereum's scalability issues, providing efficient solutions. Even though the ZK-rollup solution is still in its early stages, it significantly improves Ethereum's scalability by lowering gas fees and reducing the amount of data contained in each transaction.

Keep an eye on several important dates regarding the zkLend roadmap. There are 4 phases, each bringing significant updates to the project:

Phase 1: Artemis MVP (Q3 2022) - Reliability of core functionalities established, and the testnet is now live and deployed!

Phase 2: Artemis Mainnet (Q4 2022/Q1 2023) - Refined Artemis mainnet product launched

Phase 3: Apollo MVP (Q2 2023) - Apollo testnet launch. First institutional clients onboarded.

Phase 4: Apollo 1.0 (Q3 2023) - Apollo mainnet launch. Preparation of DAO governance transition

As you may see, zkLend will continue product development, optimizing flow and features on both Artemis and Apollo. During this time, they will be working on new but important features we believe the next generation of money markets should have, both in terms of the backend contracts and front-end UI/UX, to build the best native money market protocol out there (reminder: keep an eye on this because there will be more revealed very soon!). As features roll out, they will keep the community in the loop with monthly updates.

Remember that while scalability provides significant value in modern blockchain networks, you must go deeper and learn more about scaling solutions to determine the best option for you right now. ZK-rollups and other applications leveraging ZK-proof technology are still in the nascent stages. More technological advances in this field are expected; buckle up your seat belts, and the best is yet to come.

You can access zkLend using the links below:

Telegram | Twitter | Discord | Website

Subscribe to receive our daily brief, extended weekly newsletter, and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.