Next Fallout Casualty: DCG Confirmed?

FTX Possible Revival, Sewer Pass Blacklists Marketplaces, DOJ Ridiculed, 1inch Network Hardware Wallet

Daily Bullets - Thursday, January 19th

Market has lost some of the oomph it previously had while today is another day heavy in fundraising announcements. Interesting question to consider: the new FTX CEO floated the idea of restarting FTX, stating customers like the platform’s tech and there could be value in restarting the platform. Has trust been destroyed in the brand or can a redemption arc be pulled off?

Daily Bullet Highlights

The crypto lending unit of DCG could file for bankruptcy as soon as this week

New FTX CEO says crypto exchange could be revived

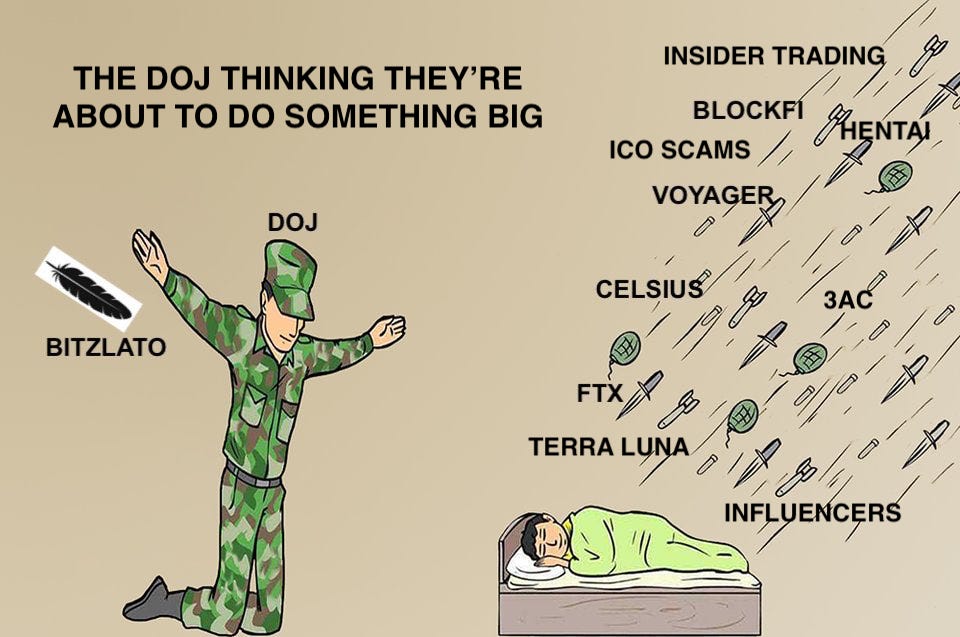

The founder of cryptocurrency exchange Bitzlato was arrested and charged with processing $700M in illicit funds. China-based money laundering engine that fueled a high-tech axis of cryptocrime

Yuga Labs has blacklisted addressed related to Blur, SudoSwap, LookRare and NFTX that don't mandate NFT royalties in Bored Ape's Sewer Pass mint

DEX aggregator 1inch Network has developed a hardware wallet

Aave V3.0.1 deployed across all testnets

National Australia Bank is launching a fully backed stablecoin called AUDN on the Ethereum network and Algorand blockchain

Trader Joe DEX plans to bolster the utility of its native governance token JOE and expand to Arbitrum and BNB Chain

NFT marketplace Rarible is expanding its white-label marketplace building tool for Polygon-based collections. Co-founder is bullish on Polygon

Flashbots, an Ethereum infrastructure service, is in discussions with potential backers about raising up to $50M at a billion-dollar valuation

Analysis

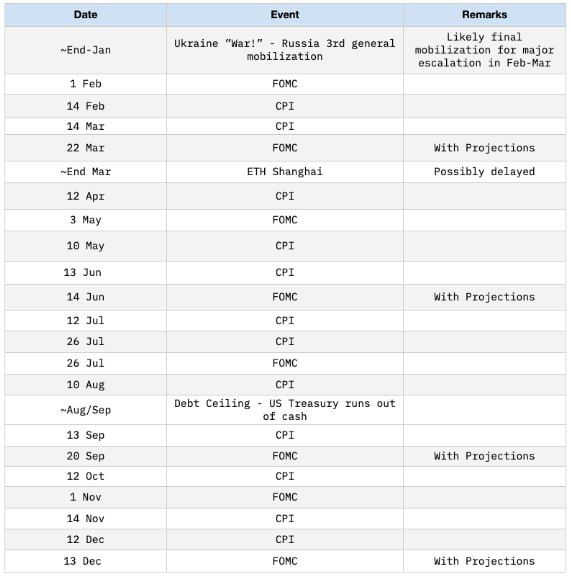

Despite the market conditions seemingly improving for now, we still can’t forget the macro and the Fed tackling inflation. That entire situation will be the theme of 2023 until we have definitive closure or reason to think otherwise. Here are some macro Fed dates to keep aware of.

Crypto News

Founders Fund, the venture capital firm co-founded by billionaire Peter Thiel, closed almost all of its eight-year position in crypto shortly before the market began to crash last year, generating about $1.8B in returns

CoinDesk, whose parent company is Digital Currency Group, has retained investment bankers at Lazard Ltd. to help it explore options including a partial or full sale

Ethereum scaling platform zkSync partnering with Espresso Systems, a crypto infrastructure company, to enable private transactions on its network

Cross-chain bridge protocol Stargate integrated with the Layer 2 Ethereum scaling solution Metis in first blockchain expansion since it was launched

Fireblocks enlists crypto insurance firm Coincover for third-party key recovery service

Crypto infrastructure firm MoonPay acquired web3 creative agency Nightshift for an undisclosed amount

Crypto Exchanges

OKX published its third monthly Proof-of-Reserves report showing $7.2B held in BTC, ETH, and USDT

Binance Futures will launch USDⓈ-M FXS perpetual contracts with up to 20x leverage

Binance will delist BEAM. Rocket Pool (RPL) listed on KuCoin. Coinbase will add support for Kava on the Kava network

Binance Margin will delist NEXO, POLS, QUICK as Borrowable Assets From Cross Margin and ALCX, NEXO, POLS, TOMO Trading Pairs From Isolated Margin

DeFi

Multi-chain wallet BitKeep will issue full refunds to victims of a hacking incident in December, costing the project around $8M

MakerDAO’s community voted for keeping Gemini USD (GUSD) stablecoin as part of the protocol’s reserve system for DAI

The number of BTC bridged from the Bitcoin blockchain to Avalanche blockchain has surpassed the number of coins held in the Lightning Network

A governance proposal for ENS DAO, proposed liquidating 10,000 ETH to cover operating costs over the next two years

Raydium hacker funnels $2.7M through Tornado Cash mixer

NFTs/Gaming/Metaverse

Virtual land developer LandVault, which has worked with global brands like Mastercard, L’Oreal and Heineken, signed with top talent agency Creative Artists Agency

L'Oréal’s NYX makeup brand to launch DAO and Ethereum NFTs called the “FKWME Pass”

Early Stage Projects

Rage Trade official integration with Stargate Finance

Osmosis DEX will conduct its v14.0.0 upgrade, termed “Neon,” in line with a broader plan to expand product integrations and make cross-chain trading more lucrative

Economic/Government/Regulatory

The SEC charged SBF with orchestrating a scheme to defraud equity investors in FTX Trading Ltd

The Central African Republic has set up a committee to integrate Sango coin into its national economy

Fundraises

Sequoia Capital fifth dedicated $195M fund enables seed investments across the U.S. and Europe, and also includes investments made in future Arc cohorts -@sequoia

SSV DAO, the DAO behind the decentralized staking protocol SSV.network, is starting a $50M ecosystem fund to help mature Distributed Validator Technology (DVT) infrastructure. Type: New Fund. Sector: Infrastructure. Investors: SSV and Digital Currency Group - @ssv_network

ZK tech developer Nil Foundation raised $22M at a $220M valuation. Type: Undisclosed. Sector: ZK tech. Investors: Polychain Capital, Blockchain Capital, Starkware and Mina Protocol - @nil_foundation

Ulvetanna, a zero-knowledge-proof hardware firm, raised $15M at a $55M valuation. Type: Seed. Sector: Web3 infrastructure. Investors: Bain Capital Crypto, Paradigm, Jump Crypto - @UlvetannaHQ

Multichain web3 wallet Cypher raised $4.3M. Type: Seed. Sector: Wallet. Investor: Y Combinator, OrangeDAO, Samsung Next and former Coinbase CTO Balaji Srinivasan - @CypherWalletIO

Gateway, a web3 credential protocol, raised $4.2M. Type: Seed. Sector: Web3. Investors: Reciprocal Ventures, 6th Man Ventures, Spartan Group, Figment, Polygon's Sandeep Nailwal and Messari's Ryan Selkis - @Gateway_xyz

Obligate, a startup offering blockchain-based regulated debt securities, raised $4M. Type: Seed Extension Round. Sector: DeFi. Investors: Blockchange Ventures, Circle Ventures, Earlybird, SIX Fintech Ventures - @obligatecom

Neopets Metaverse raised $4M. Type: Undisclosed. Sector: Metaverse. Investors: Polygon Ventures, Blizzard Avalanche Ecosystem Fund, Hashkey Capital, IDG Capital, NetDragon Websoft - @NeopetsMeta

Blue, which offers KYC and AML identity verification products for traders on DeFi protocols, came out of stealth with $3.2M raised. Type: Seed. Sector: DeFi. Investors: Blockchange Ventures, Fenbushi Capital, DoraHacks, Knollwood Investment Advisory, Gate.io, Wave Financial @BIueFi

DeFi startup Davos raised $500k. Type: Pre-Seed. Sector: DeFi. Investors: Polygon co-founder Sandeep Nailwal, Polygon Ventures - @Davos_Protocol

Virtualtech Frontier (VTF), a metaverse development company raised an undisclosed amount. Type: Seed. Sector: Metaverse. Investors: Blockchain Founders Fund, 500 Global - @VTFrontier

Amsterdam-based Authic Labs, an NFT marketplace for creators built on the Ethereum raised an undisclosed amount. Type: Pre-Seed. Sector: NFT Marketplace. Investors: Rockstart, Graduate Entrepreneur - @authic_io

Research/Reads:

TokenUnlocks 2022 annual report - source

QCP Capital - The Crypto Circular #9: Frightful Fours - source

Arthur Hayes - Bouncy Castle - source

Digital Asset Funding Landscape presented by HashKey Capital - source

Visa - The Merge: What to expect from a new era of Ethereum - source

Bankless - State of Ethereum Report — Q4 2022 - source

Ape Metaverse's first game Dookey Dash - source

Next Gen Onchain Gaming with User-Generated Logic - source

Twitter

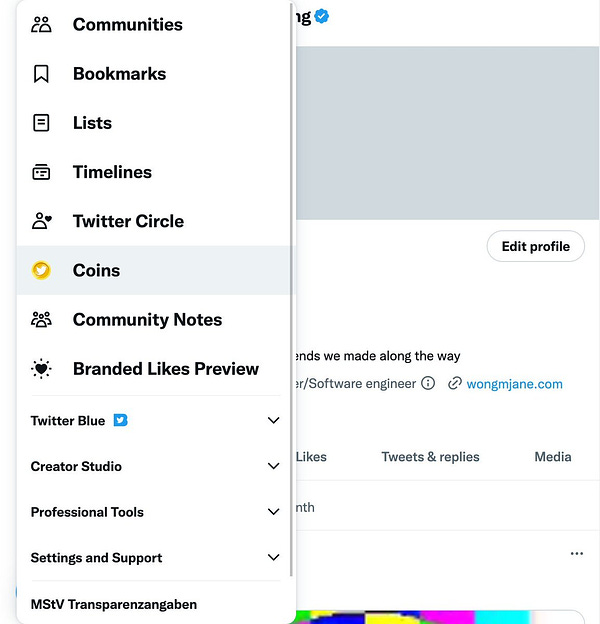

Twitter Coins:

268 Tweet Shill Thread - 2023 version: